Recap of Sequoia Capital's crypto investments in Q1 2023

TechFlow Selected TechFlow Selected

Recap of Sequoia Capital's crypto investments in Q1 2023

This article introduces Sequoia's top 5 cryptocurrency investments in the first quarter of 2023.

Written by: Surf

Compiled by: TechFlow

Sequoia Capital focuses on incubation and investments in private enterprises at the seed, startup, early, and growth stages. It has backed a series of successful companies including Apple, Google, Oracle, PayPal, Stripe, YouTube, Instagram, and Yahoo.

Recently, Sequoia announced the split of its regional firms (India and China). The Indian VC firm is now called Peak XV, while the Chinese VC firm is named Hongshan.

Their investment focus includes:

• High-growth tech startups across fintech, healthtech, consumer tech, and more.

• Cryptocurrency and blockchain technology.

• Diversified investments in companies led by underrepresented groups.

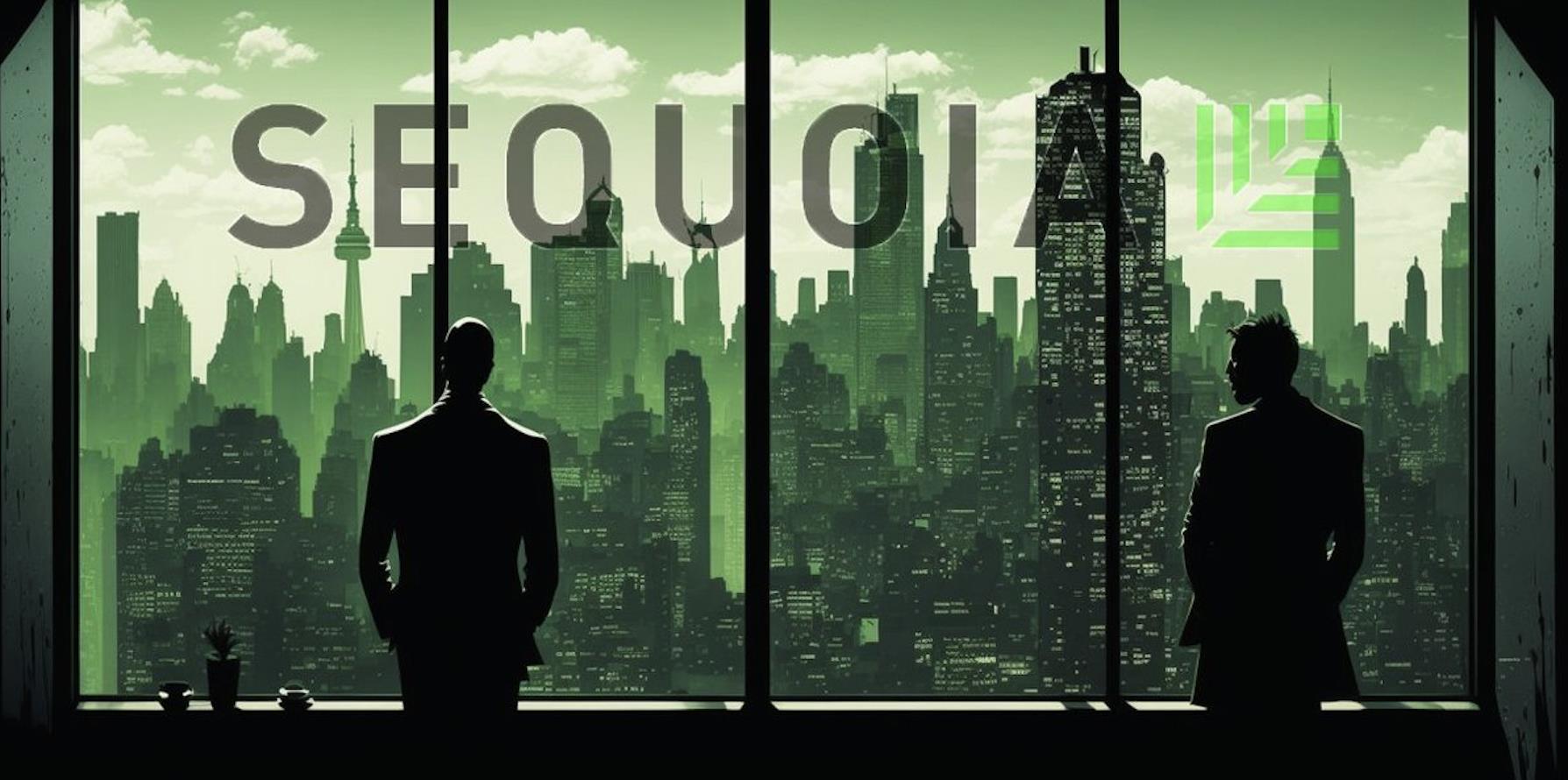

Now, let’s take a look at Sequoia’s top five cryptocurrency investments in Q1 2023:

LayerZero

Funding amount: $120 million in Series B;

Lead investor: a16z.

Other investors: Sequoia Capital, Christie's, Samsung Next, OpenSea, Circle Ventures.

LayerZero is a blockchain interoperability protocol serving as a foundational layer for data transfer and communication between different networks. It is used across various dApps such as Stargate, Aptos Bridge, and L2s like Arbitrum and zkSync.

Taiko

Taiko raised $22 million, with lead investors being Sequoia Capital China and Generative Ventures. Other investors include IOSG Ventures, GGV Capital, GSR Ventures, Patricio Worthalter, Tim Beiko, and Anthony Sassano.

Taiko is a Type 1 ZK-Rollup designed to achieve EVM equivalence and Ethereum equivalence, enabling its rollup to support all existing Ethereum smart contracts, dApps, developer tools, and infrastructure.

Tiny Tap

Tiny Tap raised $8.5 million in venture funding, with other investors including Sequoia China, Polygon, Liberty City Ventures, Kingsway Capital, and Shima Capital.

TinyTap is a platform for creating and selling mobile educational games for children, fostering a global community of creators. Creators can mint their games as NFTs, offering them a new way to monetize their creations.

TinyTap operates on a revenue-sharing model, allowing creators to earn from the income generated by their works sold on the platform.

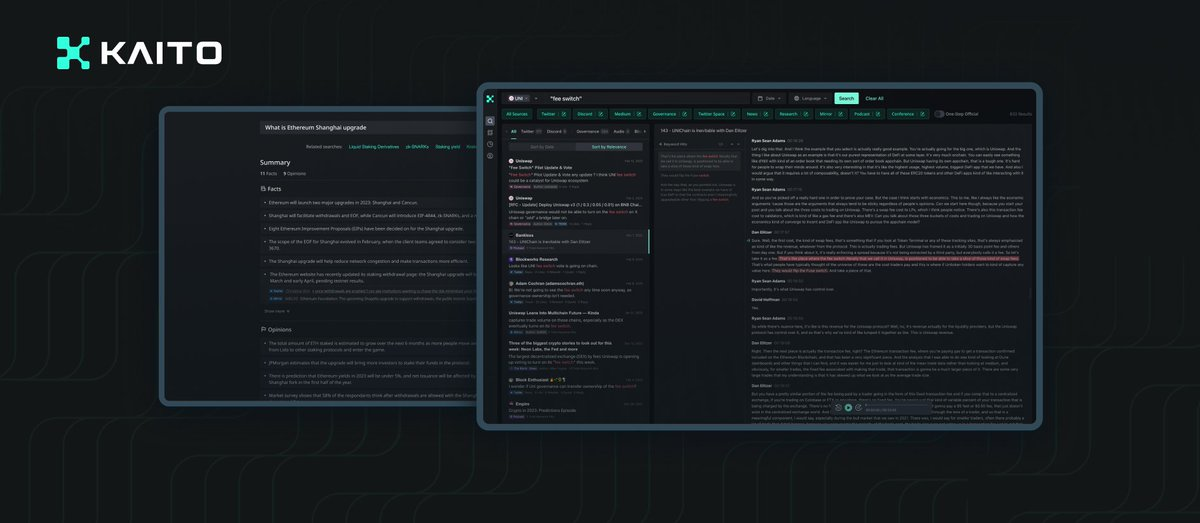

Kaito

Kaito raised $5.3 million in seed funding, led by Dragonfly Capital. Other investors include Sequoia Capital, Jane Street, Mirana Ventures, Folius Ventures, and Alpha Lab.

Kaito is an AI-powered crypto research intelligence database designed to solve fragmented crypto information. Essentially, it's a faster, more accurate, and deeper ChatGPT built specifically for crypto information.

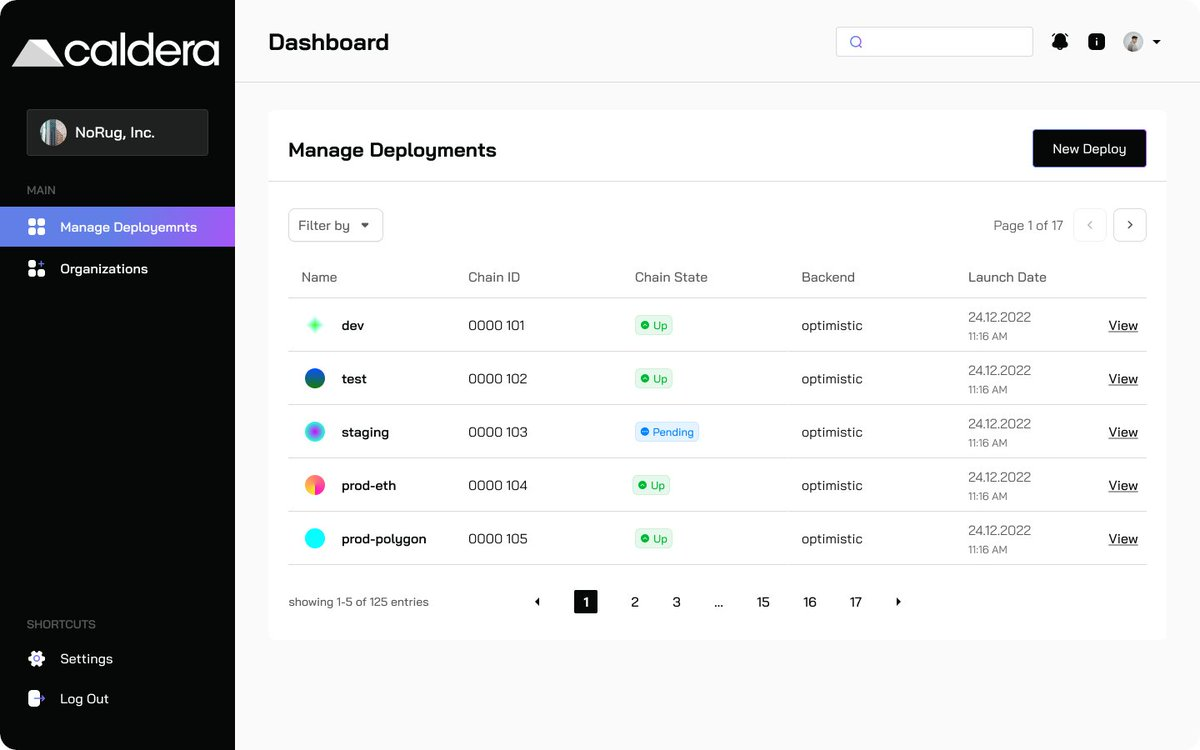

Caldera

Caldera raised $9 million, led by Sequoia and Dragonfly Capital. Other investors include NEO Foundation, 1kx, and Ethereal Ventures.

Caldera focuses on building high-performance, customizable, application-specific Layer 2 blockchains, known as Caldera Chains. These customized Optimistic Rollups are fast, handling hundreds of TPS with sub-second confirmations.

Caldera Chains are highly customizable—supporting features like address whitelisting or sustainable revenue generation—and are compatible with standard Ethereum smart contract code without modifications.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News