BitKeep X ParaSpace Research Report: Analysis of NFT Trading Sector Development in the First Half of 2023

TechFlow Selected TechFlow Selected

BitKeep X ParaSpace Research Report: Analysis of NFT Trading Sector Development in the First Half of 2023

This report primarily analyzes the development status of the NFT trading sector in the first half of 2023 and explores future trends.

Abstract

This report analyzes the development status and trends of the NFT trading sector in the first half of 2023, reaching the following conclusions:

-

The NFT market cap is highly volatile, but this also indicates that the NFT market still holds development potential.

-

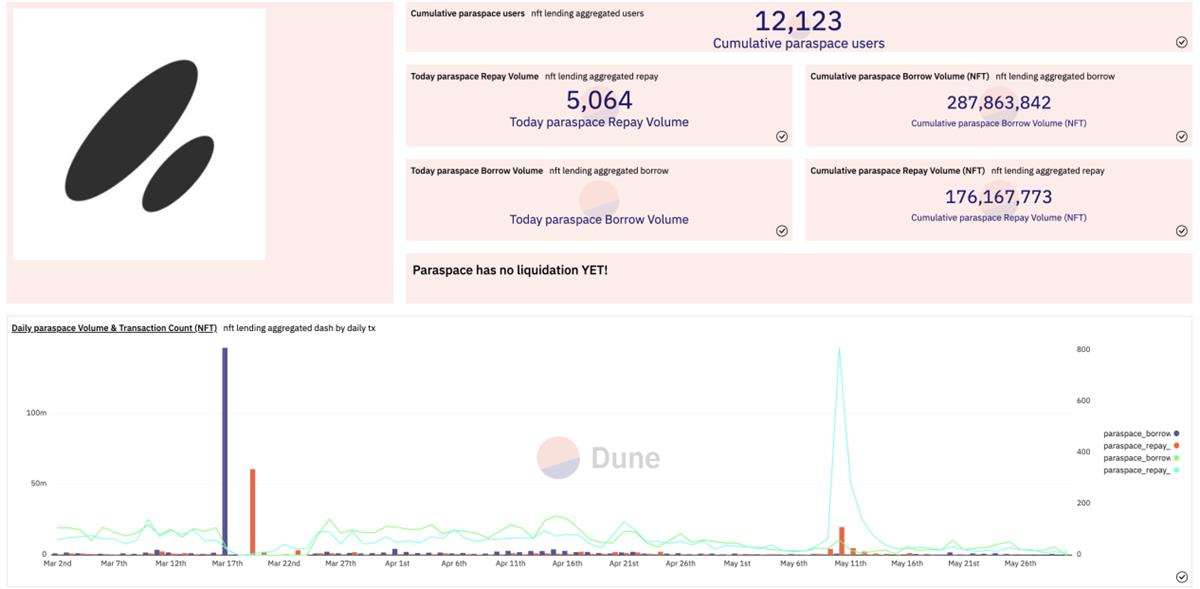

In Q1 alone, the total loan volume in the NFT market was substantial. ParaSpace, a leading project receiving significant attention, accumulated over $280 million in loans.

-

Liquidity remains the primary challenge in today’s NFT market. The active growth of NFTFi has greatly expanded NFT use cases.

-

Digital collectibles combined with brand IPs represent the first widely recognized NFT application that broke traditional boundaries.

What Happened in 2023

NFT projects began gaining visibility in early 2021, attracting widespread attention. Although the emergence of the Ordinals protocol in February reignited interest in NFTs, signs of market fatigue began appearing by late April.

NFT Market Recap: A Rollercoaster Ride

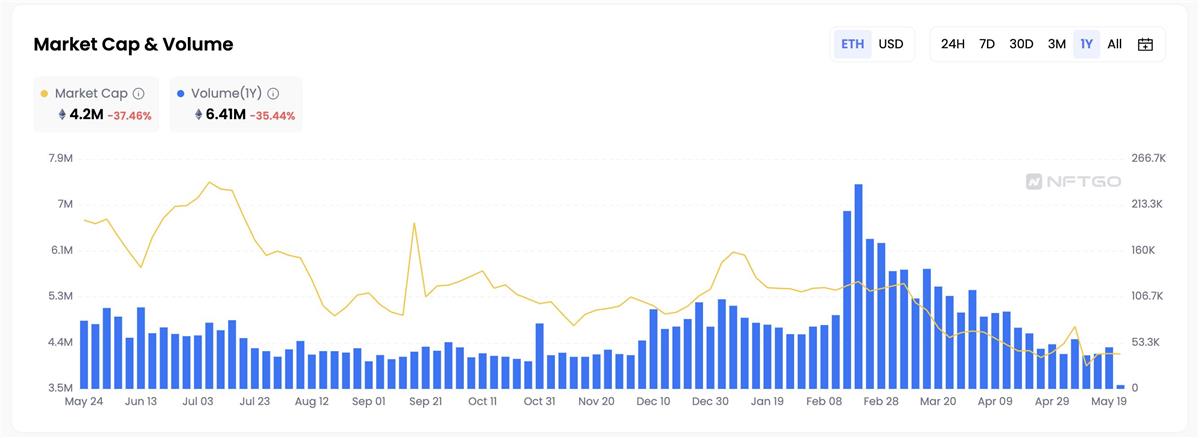

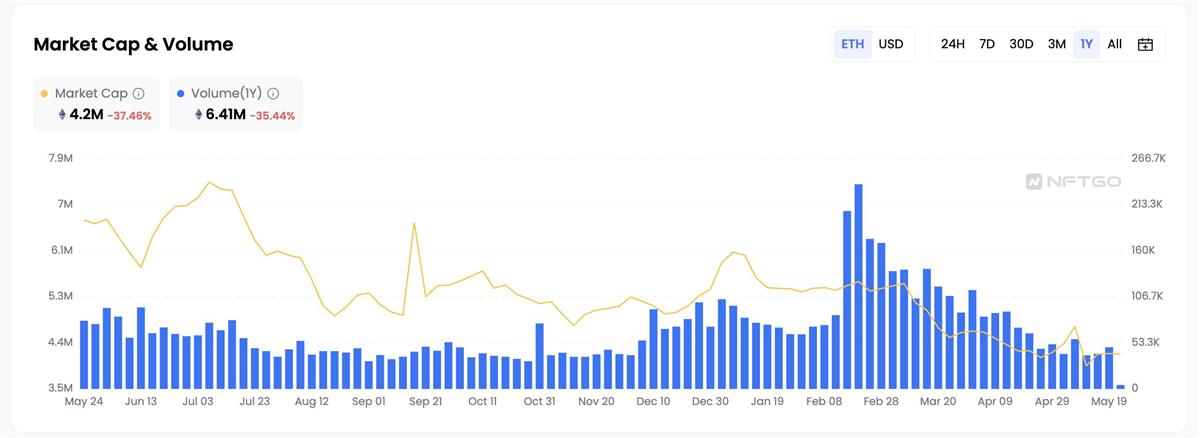

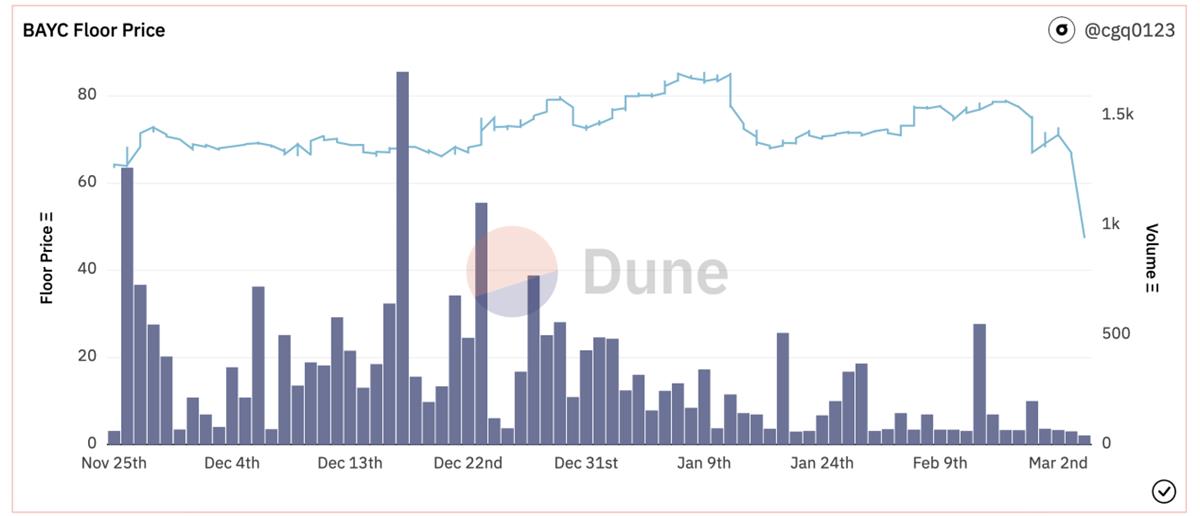

Since the beginning of 2023, the cryptocurrency market has experienced rapid recovery followed by volatility. In January 2023, the total NFT market transaction volume reached $941 million. Influenced by BTC Ordinals, the NFT market's transaction volume surged to $1.5 billion in March. However, by May, the transaction volume had dropped to $330 million.

Currently, the NFT market cap stands at $4.2 million, indicating continued investor interest in the NFT space this year.

Key NFT Events in 2023

-

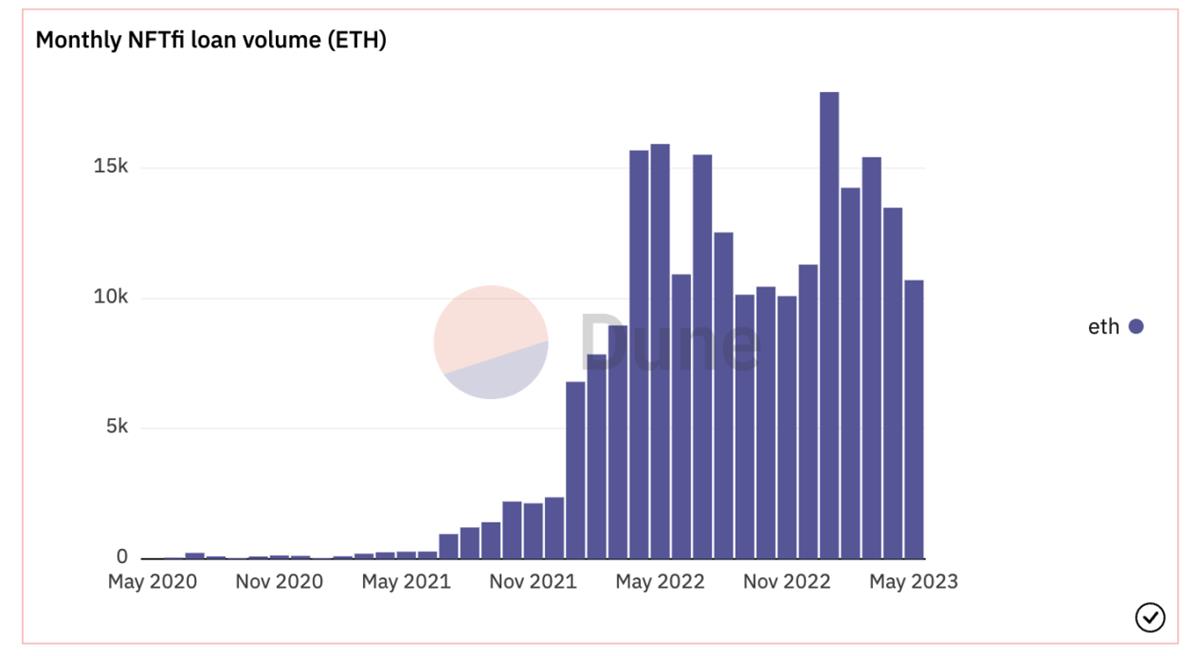

NFTFi lending market shows signs of recovery in Q1

From January to March this year, the total loan volume in the NFT market reached approximately $25 million. On May 2, BLUR launched Blend, a peer-to-peer perpetual lending protocol using NFTs as collateral, officially entering the NFT lending space. It has already attracted $30 million in deposits. Among lending platforms, ParaSpace holds the largest market share. The top three lending projects collectively account for over 65% of the entire lending market, with a loan volume of about $35 million and total deposits of $120 million. The NFT lending market shows immense potential, drawing increasing user participation.

-

BTC Ordinals Boom

Bitcoin Ordinals NFTs are NFTs on the Bitcoin blockchain, inscribed in satoshis (the smallest unit of BTC). However, due to being built on the BTC network, users face slower transaction speeds, high costs, and limited application scope. Although creating NFTs on Bitcoin is more complex than on Ethereum, second-layer protocols such as the Lightning Network and RSK can help overcome these limitations.

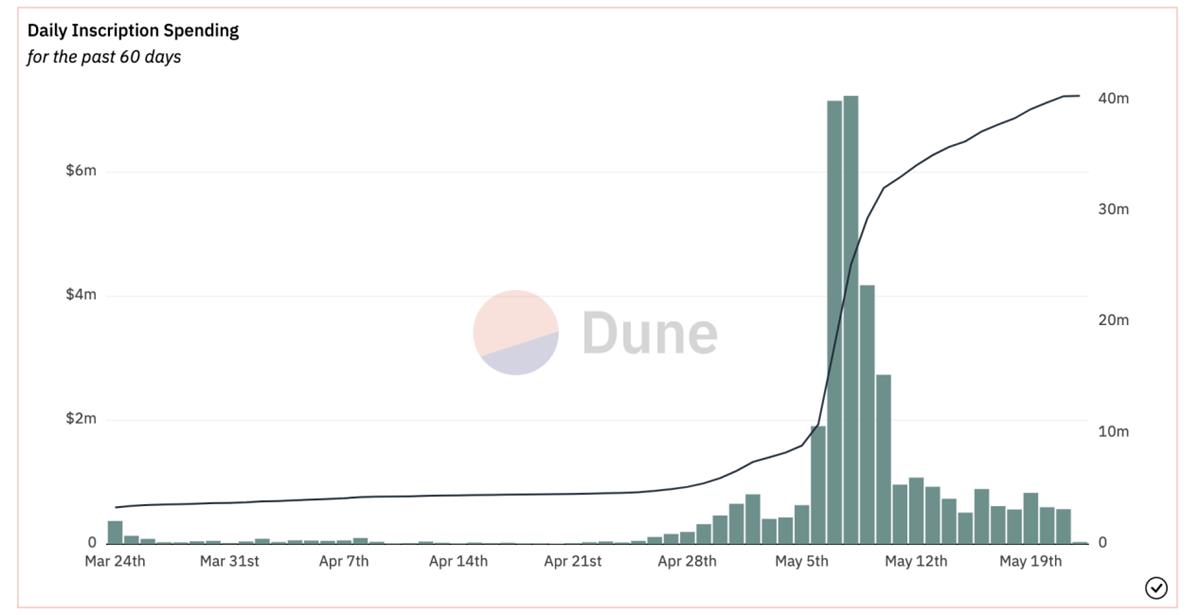

After the launch of the Ordinals protocol, numerous NFT projects were minted on-chain. According to data from Dune, Ordinals experienced rapid growth since March, sparking a wave of interest in BTC NFTs. Many NFT investors and community members actively participated. Currently, both trading volume and quantity in the BTC Ordinals market are on an upward trend. Within four months, a total of 1.19 million NFTs were minted, with trading volume reaching $20 million.

-

BLUR Launches Token Airdrop

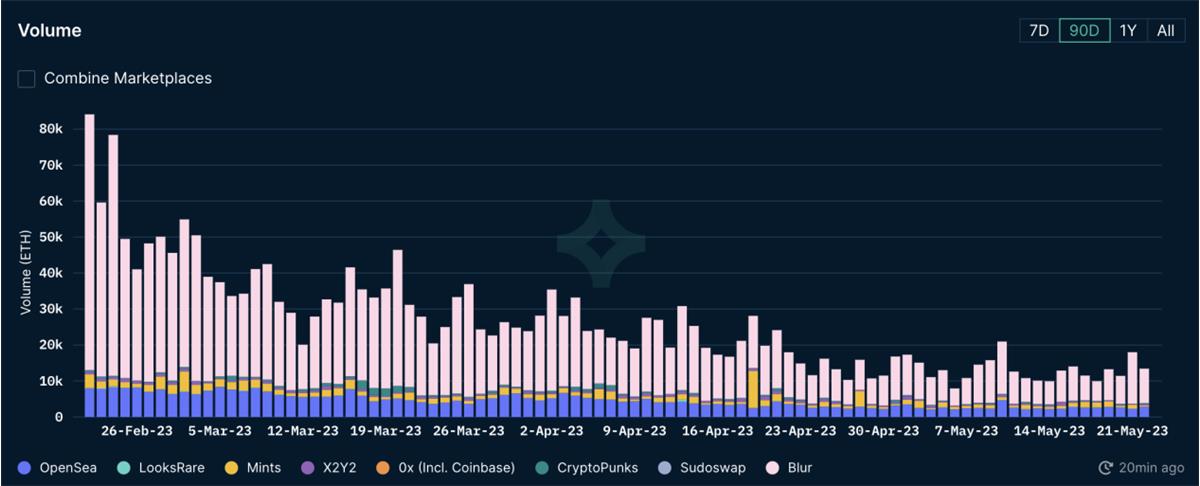

BLUR has become the largest NFT aggregation marketplace by on-chain trading volume, surpassing OpenSea, previously the dominant NFT trading platform, thanks to its zero-fee model and token airdrops.

NFT trading volume sharply increased in Q1 2023 but later declined, with BLUR’s incentives and airdrop mechanisms being the main drivers. After launching its native token, BLUR was quickly listed on major exchanges, further fueling the NFT boom.

BLUR surpassed OpenSea in royalty share by mid-February. Its optional royalty policy and zero-fee structure attracted many price-sensitive users, driving up trading volume. On February 22, daily trading volume peaked above 80k ETH. Although volume gradually decreased after March, BLUR continued to expand its lead, capturing 66% of the total NFT market trading volume.

-

OpenSea Pro Rebrands to Gem.xyz, Introduces "Gemesis" NFT

OpenSea Pro (formerly Gem V2) has been rebranded to Gem.xyz and introduced the "Gemesis" NFT. Users who used Gem.xyz before March 31, 2023, could claim a free "Gemesis" airdrop. The NFT could be claimed for free until May 4, with its floor price typically ranging between 0.03 ETH and 0.05 ETH. While the "Gemesis" NFT saw a rapid increase in trading volume upon release, there was a clear divergence in holding duration and purchase behavior—about 50% of users chose to hold their assets long-term, often possessing higher-value holdings, while the other 50% resold within 24 hours of purchase.

NFT Market Overview and Analysis

Current State of NFT Trading

-

The NFT market began attracting attention in February due to the popularity of Ordinals NFTs, further boosted by memecoins, which drove high market enthusiasm and capital inflow, resulting in a rapid rebound lasting until the end of April. This environment presents an interesting and promising market for NFT traders.

Although creating NFTs on Bitcoin is more complex than on Ethereum, Ordinals are still in early development. The current total value of Ordinals has reached tens of millions of dollars and has already gained market attention. Bitcoin’s market cap is 2.3 times that of Ethereum. If Ordinals aim to match Ethereum’s NFT market cap, they have a potential growth space of 1,000x. Therefore, in the long term, Ordinals NFTs remain in their infancy, and once the ecosystem and infrastructure mature, they will have enormous room for growth.

-

Lending, as a financial instrument, has vast development potential. At its core, it enables users to obtain loans by using NFTs as collateral, thereby expanding NFT use cases. To date, the cumulative NFTFi lending volume stands at $430,979,851, with 43,521 unique borrowers.

As a common financial tool, lending has broad applications in the blockchain space. Given the lack of liquidity in the NFT market, many users cannot immediately liquidate their NFT assets. NFT lending platforms allow users to deposit their NFTs as collateral and borrow corresponding cryptocurrencies or fiat money. Additionally, these platforms offer appropriate loan-to-value ratios based on collateral value. As the NFT market grows, the lending sector is expected to continue expanding.

-

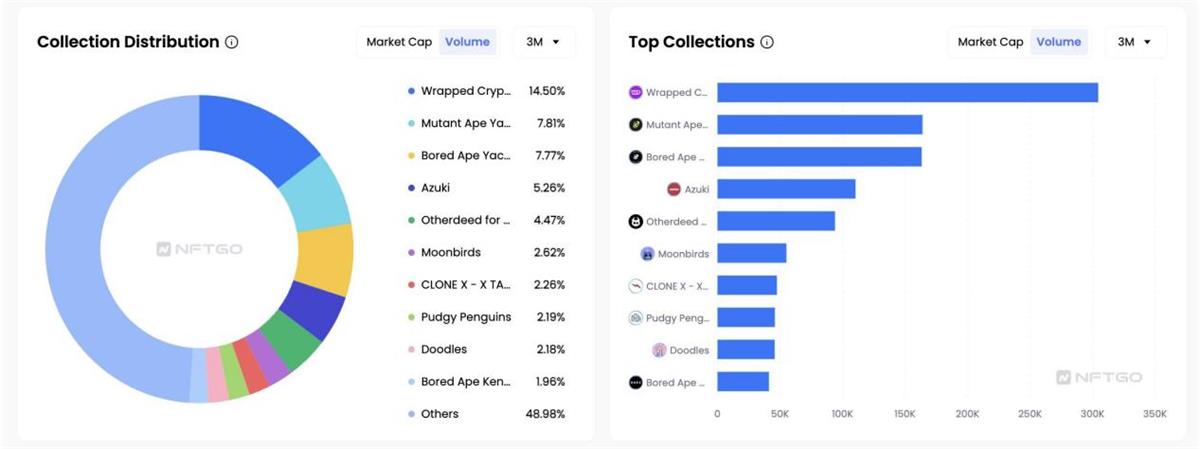

Over the past three months, Wrapped Cryptopunks ranked first in trading volume, accounting for 14.50% of the market, followed by MAYC and BAYC at 7.81% and 7.77%, respectively. Wrapped Cryptopunks contributed over 3M ETH in trading volume, outperforming others. NFT projects within YugaLabs’ ecosystem occupy one-quarter of the overall market share.

NFT Liquidity and Characteristics

Liquidity issues are critical not only for DeFi but also for NFTs. Insufficient NFT trading liquidity stems from limited user base, pricing difficulties, and high NFT prices. NFT liquidity is closely tied to market sentiment, resulting in two extreme scenarios: Top 10 NFT projects maintain consistent liquidity with minimal fluctuation, while many other NFTs must be discounted to facilitate sales.

The NFT market is nascent, lacking historical data and standardized valuation methods, making pricing difficult. Differences in perceived rarity and subjective preferences cause even NFTs within the same collection to vary significantly in price, lowering liquidity and capital efficiency. Additionally, high NFT prices deter many investors. Entry barriers for blue-chip NFTs are extremely high, with average prices ranging from $11K to $120K. Some NFT holders are unwilling to sell their assets for immediate liquidity, further exacerbating liquidity challenges.

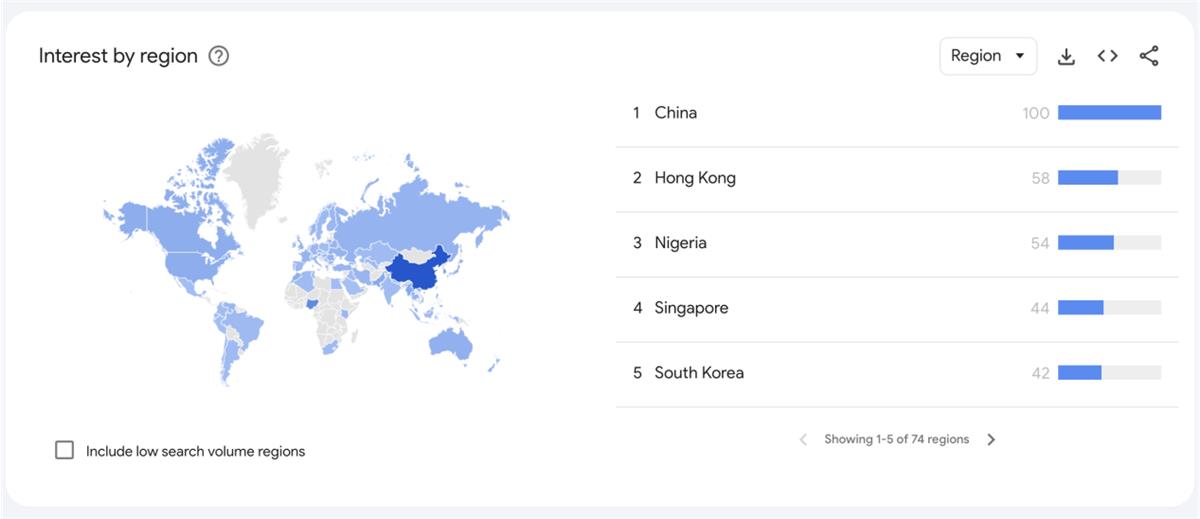

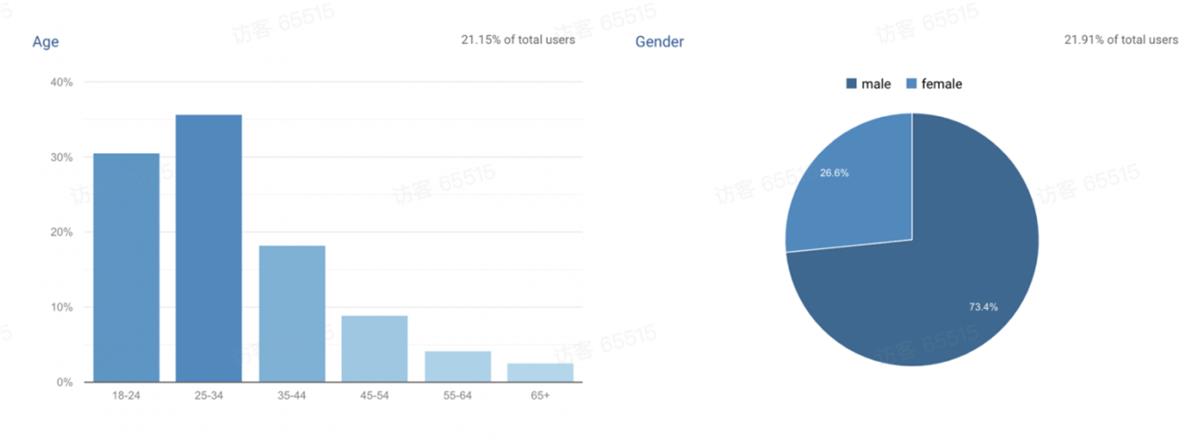

An interesting observation from NFT traffic distribution by country shows that Asian audiences generally exhibit greater enthusiasm for NFTs compared to Western counterparts.

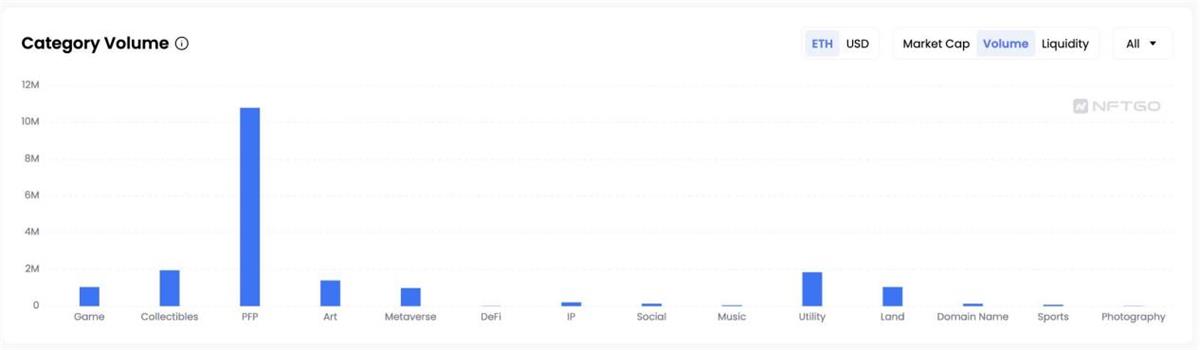

The most prominent and popular category in NFTs is “PFP (Profile Picture)” projects, with a total market cap of $1.3 billion and trading volume of $1.8 billion. However, Utility NFTs demonstrate the best liquidity performance.

NFT users are predominantly young males, comprising over 70% of the user base.

NFT Project Development and Future Trends

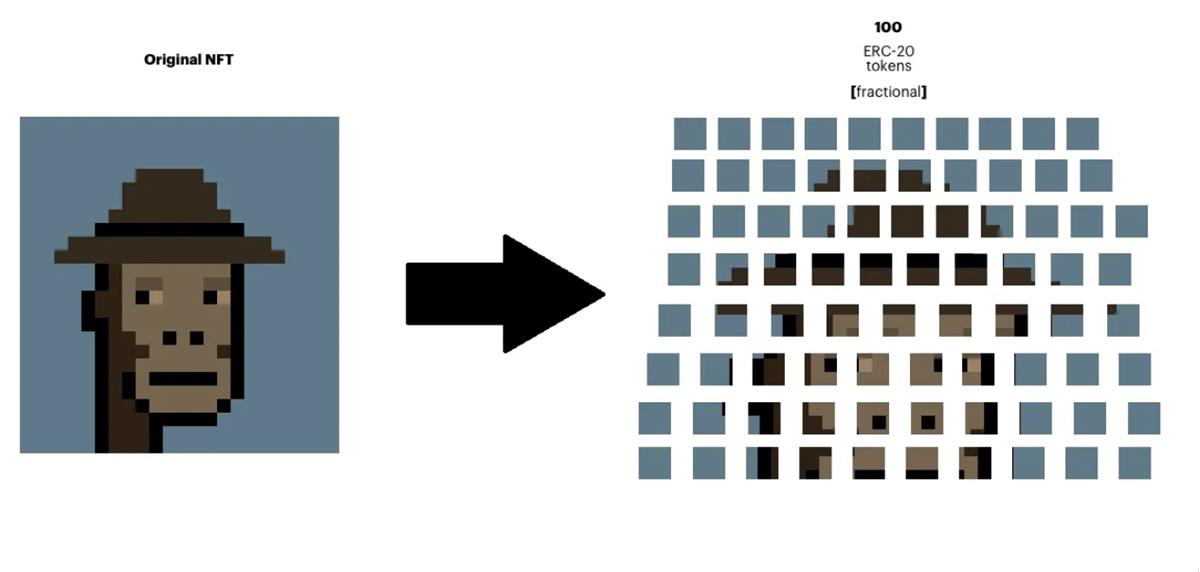

High-quality NFT projects typically feature strong community consensus, reputable teams, and distinctive artistic styles, making them attractive to institutional investors. For average users, however, the barrier to entry for blue-chip or trending NFTs continues to rise. Solutions such as NFT fractionalization, NFT staking, and NFT liquidity platforms have emerged to address this issue.

NFT Marketplaces

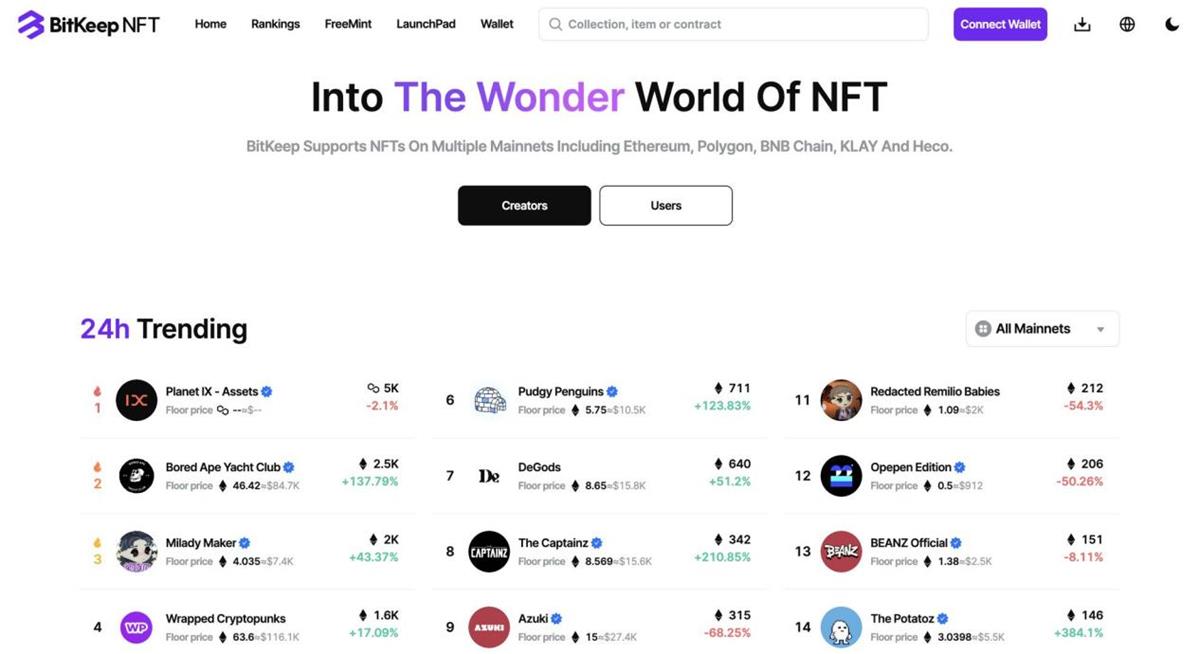

NFT marketplaces serve as gateways for buying and selling NFTs. Currently, the majority of NFT transactions occur through dedicated marketplace platforms. BitKeep, OpenSea, LooksRare, and Binance all operate specialized NFT trading sections.

BitKeep NFT Marketplace is the first platform globally supporting NFT purchases with any cryptocurrency. It currently supports two major NFT standards—ERC721 and ERC1155—and integrates NFT ecosystems across nine public chains: Ethereum, BNB Chain, Polygon, Arbitrum, KLAY, Optimism, and HECO, hosting over 1,000,000 NFT projects.

Due to the high barrier for BTC participation, Ordinal punks trades often rely on Google Docs, highlighting how early-stage the industry is and how lacking essential infrastructure for Ordinals remains. As foundational infrastructure for the NFT market, BitKeep Wallet has launched an Ordinals market dashboard and is preparing to integrate into the Bitcoin ecosystem, introducing a dedicated Bitcoin NFT trading zone that supports display, minting, transfer, and trading of BTC NFTs under the Ordinals protocol.

BitKeep Wallet will also support Taproot address formats, providing asset display, transfer, and trading services for BRC-20 tokens. Upon integration, BitKeep users will be able to use BTC Taproot addresses on both mobile and browser extension versions, managing deposits, withdrawals, transfers, and trades for BRC-20 tokens and Bitcoin NFTs.

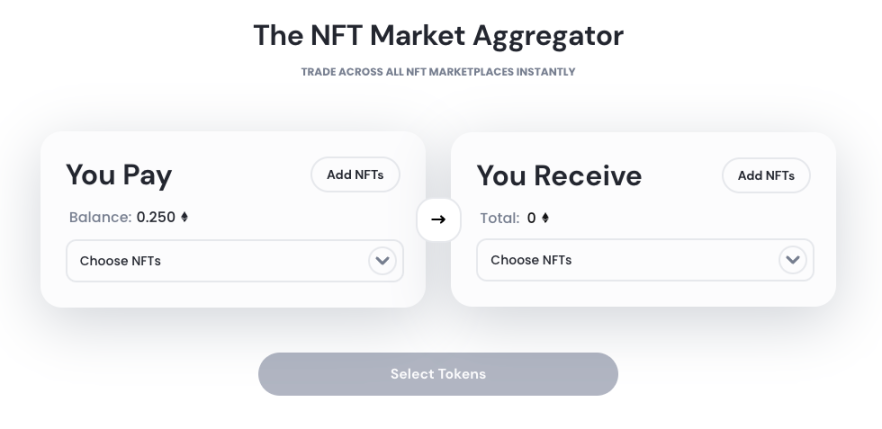

NFT Aggregators

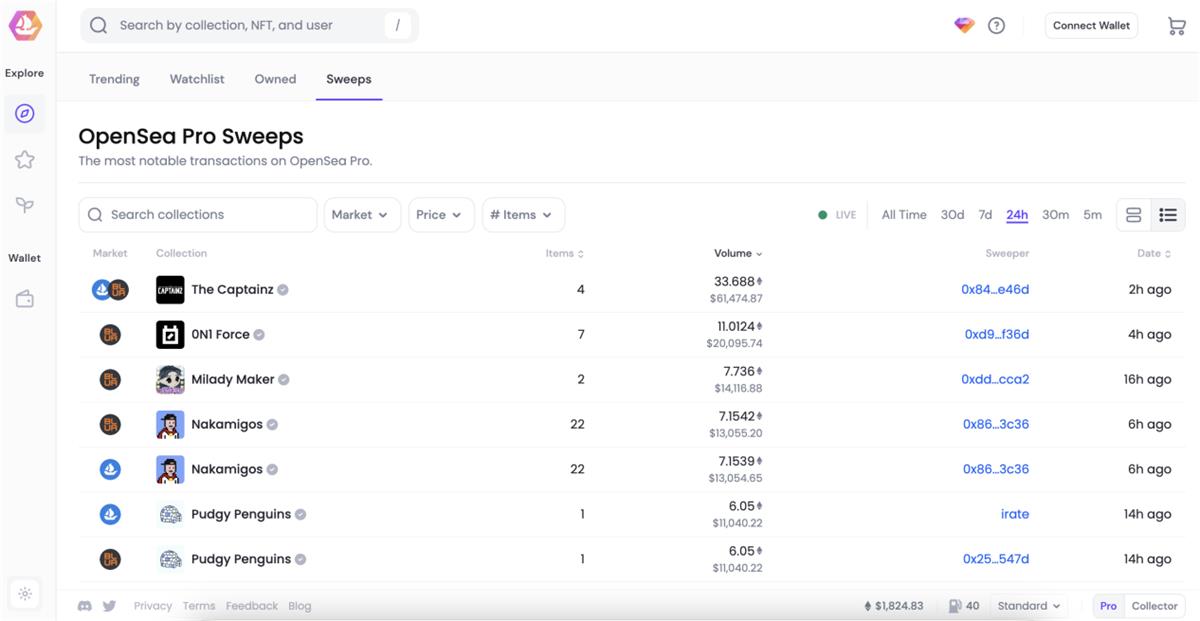

NFT aggregators are currently among the most compelling solutions for NFT liquidity. By enabling bulk purchases, they can save users up to 40% in gas fees. The top three aggregators—Gem (acquired by OpenSea), Genie (acquired by Uniswap Labs), and Flip—offer cross-platform NFT aggregation, with features like “bulk sniping” proving especially useful.

Gem V2 is now OpenSea Pro! Gem is the most powerful NFT aggregator, sourcing listings from over 170 markets to provide users with the best prices. It has integrated liquidity from LooksRare, offering enhanced features such as improved buying, collecting, trait filtering, and leaderboard tracking—all with zero fees. By aggregating listings from most NFT marketplaces, Gem provides investors with comprehensive data and tools. Its new rarity rankings and collection analytics are particularly valuable for users.

As NFTs grow in popularity, so does the market. NFT aggregators offer broader market access and better pricing by comparing offers across multiple platforms, presenting users with optimal deals. Their future prospects are highly promising.

Genie specializes in bulk NFT buying and selling, being the first NFT marketplace aggregator, primarily composed of Genie Swap and Genie List.

Genie Swap supports trading platforms including OpenSea, NFTX, NFT20, Rarible, and Larva Labs’ CryptoPunks, with no platform fees charged.

Genie List allows users to purchase up to 60 NFTs from multiple markets in a single transaction, reducing costs through aggregated trading.

NFT Projects

Top-tier NFT projects often benefit from strong team backgrounds and attract significant market attention. For example, BYAC gains popularity through celebrity endorsements, while domestic projects like Jay Chou’s Phantom Bear generate organic traffic and attract Web2 capital. Fan engagement and celebrity influence play crucial roles in the NFT space, where project success heavily depends on building momentum—something celebrities effectively deliver.

-

Bored Ape Yacht Club

Bored Ape Yacht Club (BAYC) is a classic PFP NFT series consisting of 10,000 "Bored Apes," launched on April 30, 2021. It was the first project released by the renowned Yuga Labs.

BAYC has actively expanded its ecosystem by launching its native token ApeCoin (APE), developing Otherside—the metaverse land—and monetizing IP rights to boost royalty revenue, thus enhancing the utility of its NFTs.

-

Azuki

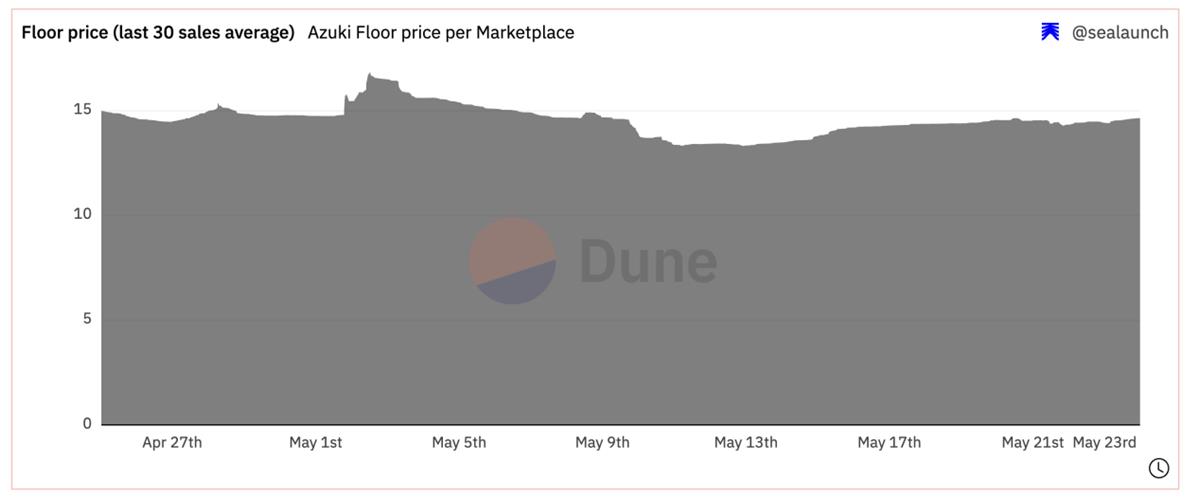

Azuki is an anime-styled PFP NFT and one of the hottest NFT projects in 2022. It gained market attention due to its three-tiered minting approach: Dutch auction, whitelist mint, and public sale. At one point, Azuki’s total sales even surpassed those of CryptoPunks and BAYC.

Azuki pioneered NFT fractionalization by splitting one of its IPs, #Bobu, into fungible tokens ($Bobu). The token holders formed a DAO to govern Bobu’s future development. This successful fragmentation lowered the entry barrier for new users into the Azuki ecosystem while rewarding existing holders. Despite significant price fluctuations in the NFT market during Q1, Azuki managed to overcome bearish trends, maintaining stability in floor price and market cap. While blue-chip NFTs broadly declined by up to 50%, Azuki moved counter-trend, with whale holdings increasing and supply concentrating.

-

ParaSpace

Given the current lack of liquidity in the NFT market, there is growing demand to expand NFT use cases. Platforms enabling users to lend NFTs for cash maximize capital efficiency. Additionally, allowing users to collateralize rather than sell NFTs helps alleviate oversupply concerns.

ParaSpace dominated the Q1 lending market with a cumulative market share of $134 million. Positioned as a Universal NFT Liquidity Platform, ParaSpace offers a full suite of products including Lending, Staking, and Trading. Its collateral pool includes various yield-bearing tokens, with WETH, cAPE, USDT, USDC, and stETH being the most lent. As the first lending platform supporting UniSwap v3 LP positions and the first to enable Universal NFT Lending, ParaSpace is particularly favored by experienced DeFi users for its thoughtful design and user-friendly features.

-

Fractional_art

Fractional is a decentralized protocol enabling NFT fractionalization—one solution to improve NFT liquidity—by splitting a single NFT into multiple tradable fragments.

Fractional leads the NFT fractionalization space. Once users own NFT shard tokens, they gain voting rights over the NFT’s floor price. Fractionalization unlocks new gameplay mechanics and lowers entry barriers, increasing overall asset liquidity. For high-priced blue-chip NFTs, it significantly reduces participation thresholds. As technology advances, NFT fractionalization will become more flexible and intelligent. If widely adopted by top-tier NFT projects, its application potential is enormous.

Opportunities and Development in the Second Half of 2023

The NFT market remains nascent and in its early stages. The 2021 NFT boom was largely driven by the broader crypto market surge and celebrity endorsements, triggering mass adoption. Due to relatively low awareness, the market faced prolonged oversupply in 2022. Although the Q1 2023 NFT market showed volatility, it demonstrated ongoing vitality. The hype around the Ordinals protocol generated strong metrics, but without new narratives or sustained trends, market momentum has waned.

NFTs are increasingly integrating with traditional sectors such as art, sports, entertainment, and social media, expanding their ecosystem and influence, and attracting new participants. “Everything can be an NFT”—NFTs are becoming viable representations for all kinds of assets, including metaverse worlds, collectibles, and gaming items. These assets can achieve economic ownership via NFTs. With the rapid evolution of NFT platforms and products, the ecosystem is thriving and forming a relatively complete industrial chain.

The persistent liquidity issue in the NFT market has spurred the rise of NFTFi, introducing derivatives to enhance capital fluidity and composability for future growth. To improve liquidity, broaden use cases, and lower entry barriers, NFTFi has emerged with solutions including NFT marketplaces, aggregators, lending, derivatives, and fractionalization—all continuously evolving. BitKeep NFT Marketplace, as a trading platform, significantly lowers entry barriers for beginners and supports purchasing NFTs with any native-chain asset. Supporting NFT transactions across nine chains—including BSC, Polygon, Arbitrum, and Klay—BitKeep Wallet accommodates over 250,000 token assets, delivering a seamless, user-friendly experience for all.

As digital products, NFTs exist as standardized software code executed on blockchains, heavily dependent on underlying blockchain protocol properties. Security remains a critical concern. Most NFTs are minted on Ethereum, and active Layer2 developments aim to solve scalability issues. While blockchain technology is advancing rapidly, security and privacy protections remain incomplete, leaving room for hackers to exploit vulnerabilities through theft, cyberattacks, or scam forks. These risks underscore the need for heightened security awareness to prevent fraud.

Conclusion:

The NFTFi ecosystem is experiencing explosive growth, with multiple niche projects turning ideas into reality and leveraging derivative NFT products to expand user bases and improve market liquidity. The NFT market evolves rapidly, with new developments emerging monthly. Although trading volume declined in May, such fluctuations confirm that the NFT market remains dynamic and promising. The era where everything can be an NFT may not be far off.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News