The Challenge of Ethereum Finality: Is the Beacon Chain Still Alive?

TechFlow Selected TechFlow Selected

The Challenge of Ethereum Finality: Is the Beacon Chain Still Alive?

The events of May 11 and 12, 2023, were pivotal moments in Ethereum's development journey. They provided tangible evidence of the Beacon Chain's resilience, even amid challenging circumstances.

Author: Yicheng

Translation: TechFlow

Introduction

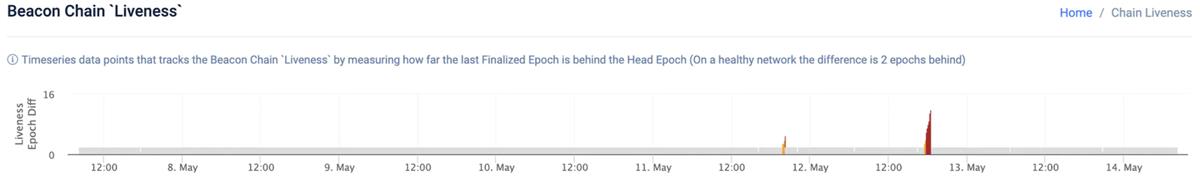

“The Beacon Chain has come to life.” On May 11 and 12, 2023, Ethereum faced two temporary finality loss events that tested its resilience. Despite these challenges, the network remained alive and autonomously recovered from both incidents. We will now delve into these notable events, examine their impacts, and review the subsequent enhancements implemented to prevent similar occurrences in the future.

Event Overview

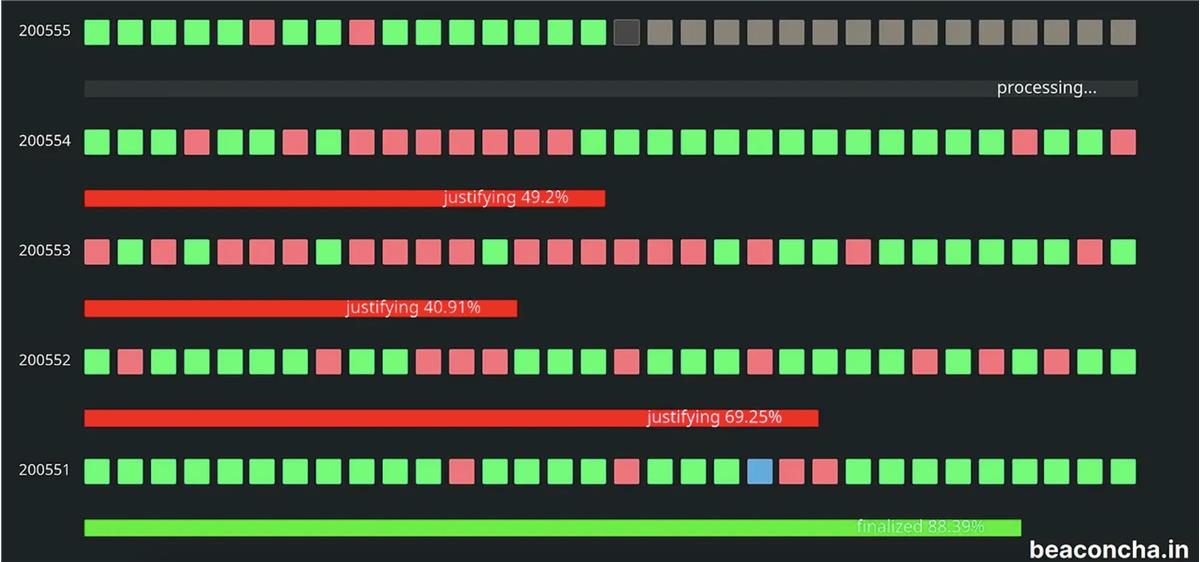

May 11 and 12, 2023, will stand as significant days in Ethereum’s history, as the network’s resilience was put to a severe test. On May 11, around 20:19 UTC, the Ethereum mainnet experienced a significant slowdown in block production, resulting in a four-epoch delay in finalization—the first such occurrence on Ethereum. The following day, a similar event occurred, extending the delay to nine epochs and triggering inactivity penalties.

During these events, a sharp decline in network participation was observed. The first drop occurred at epoch 200,551, causing finalization to temporarily stall until epoch 200,555. The second participation decline happened at epoch 200,750, pausing finalization again until epoch 200,759.

Despite initial concerns, the Ethereum network demonstrated its inherent robustness by autonomously recovering. These events not only confirmed the resilience of the Ethereum Beacon Chain but also highlighted areas for potential improvement.

Inactivity Leak

During periods of non-finality, the Ethereum network deployed a critical mechanism known as the "inactivity leak." This feature, built into Ethereum 2.0's PoS protocol, is designed to maintain network functionality during major disruptions—such as a world war or large-scale natural disaster—that could take many validators offline and hinder block finalization.

If the network fails to finalize blocks for four consecutive epochs (approximately 16 minutes), the inactivity leak mode is triggered. Under this mode, validators who do not attest to blocks begin losing portions of their staked ETH. This penalty grows quadratically over time until block finalization resumes.

This mechanism serves a dual deterrent purpose. First, it removes attestation rewards. Second, it imposes escalating penalties on inactive validators proportional to their downtime. This incentivizes validators to remain actively engaged, accelerating network recovery. It is a cornerstone feature for maintaining network integrity during major disruptions.

Impact

On Network Participants (Validators):

According to estimates provided by Ben Edgington, assuming 65% of validators were offline during an 8-epoch leak, the inactivity leak resulted in approximately 28 ETH being burned. This equates to about 0.0006 ETH lost per offline validator.

Additionally, attestation rewards dropped to zero during the disruption, leading to an extra loss of around 50 ETH that would otherwise have been issued. In total, the estimated losses for validators—including inactivity penalties and lost attestation rewards—amounted to roughly 78 ETH.

On Users:

Conversely, end users were minimally affected. Although reduced block space led to lower transaction throughput, gas prices did not spike dramatically and remained below daily peaks. More importantly, the network remained active throughout these events.

This meant Ethereum continued processing transactions without major interruption, demonstrating its resilience. As a result, users could maintain operations on the Ethereum network with minimal disruption, underscoring the system’s robustness even under stress.

Root Causes

At the core of the Prysm issue was the absence of a caching mechanism for block replay. This deficiency exacerbated system load, generated excessive go routines, and increased CPU pressure. In some cases, new replays began before previous ones had completed, further straining the system.

Another contributing factor was Prysm’s improper handling of attestations from prior epochs—data that should have been ignored was instead processed. This inefficiency, combined with suboptimal use of the head state, placed additional strain on the system, especially amid surges in deposits and growing validator registrations.

These events also revealed key differences in strategies adopted by various Ethereum clients. When facing execution client issues, Lighthouse chose to discard attestations to preserve network liveness, whereas Prysm and Teku defaulted to using old attestations to build blocks.

Despite the challenges, these incidents were crucial in providing insights into software inefficiencies, design choices, and network conditions, ultimately strengthening the Ethereum network. No permanent damage occurred; rather, the events reinforced the resilience and diversity inherent in Ethereum’s network design.

Recovery

During these events, the resilience of the Ethereum Beacon Chain was truly tested—and it performed exceptionally well. The Beacon Chain seemed to possess life, healing itself.

A key factor in the successful recovery was client diversity across the Ethereum network. The existence of multiple clients, each with unique approaches to handling the network, proved to be a blessing. For example, while Prysm and Teku struggled under the load of stale attestations, Lighthouse’s strategy of discarding them ensured part of the network remained active and functional.

In essence, Ethereum’s resilience stems from its client diversity—a critical factor that enabled the network to self-recover without requiring any manual intervention.

Lessons Learned

-

Testnets vs Mainnet: These events highlighted the differences between testnet environments and the mainnet. With over 600,000 validators and extensive withdrawal activity on mainnet, the complexity and unpredictability of real-world networks clearly surpass those of test environments. This underscores the need for more rigorous stress testing to better prepare for actual network conditions.

-

Effectiveness of Inactivity Penalties: The effectiveness of inactivity penalties on mainnet was reinforced during these events. These penalties play a vital role in encouraging validator participation, maintaining network liveness, and enabling recovery.

-

Importance of Liveness: These events emphasized the critical role of liveness in blockchain networks. Under the LMD Ghost protocol design, Ethereum maintained liveness throughout, minimizing user impact. Unlike some blockchains that may face downtime during network issues, Ethereum prioritizes liveness over throughput. This approach protects both users and network uptime, highlighting that without liveness, network functionality and user security are compromised regardless of throughput.

-

Value of Client Diversity: The recovery process underscored the value of having diverse clients. Different Ethereum clients responded uniquely to network events, contributing to overall network resilience and robustness.

-

Network Resilience: These events served as strong evidence of Ethereum’s network resilience. Despite significant challenges, the network self-recovered and emerged stronger, embodying the concept of anti-fragility in complex systems. This resilience sets a powerful precedent for the broader crypto ecosystem and demonstrates the soundness of Ethereum’s underlying architecture and design principles.

The events of May 11 and 12, 2023, were pivotal moments in Ethereum’s evolution. They provided tangible proof of the Beacon Chain’s vitality, even in challenging circumstances. As Ethereum continues to evolve, it builds upon these experiences, becoming not only more robust but also more anti-fragile—ready to advance steadily along the path of decentralization and beyond.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News