Uncovering the Development of On-Chain Treasury Bond Ecosystem Projects in RWA

TechFlow Selected TechFlow Selected

Uncovering the Development of On-Chain Treasury Bond Ecosystem Projects in RWA

As the macroeconomic environment changes, DeFi products are adapting and evolving.

Produced by: DODO Research

Author: Flamie

Background

As macroeconomic conditions evolve, DeFi products are adapting and transforming. In DeFi 1.0, sustainable stablecoin yields were a cornerstone, but now low-risk instruments offer lower returns than traditional financial markets. As a result, traditional financial products have become more attractive due to their lower risk profiles, leading to an interesting convergence between traditional finance and DeFi.

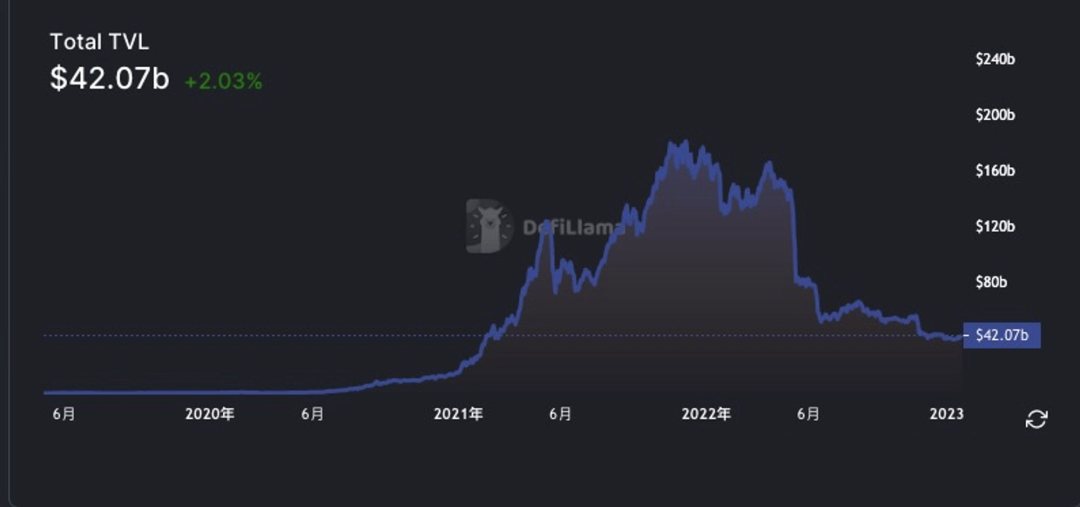

According to Defillama data, over the past year, the total value locked (TVL) in DeFi has dropped from over $180 billion at its peak to around $39 billion—a decline of more than 78%—due to significant declines in crypto assets, which pales in comparison to the scale of traditional asset markets.

Prior to this, several projects had already experimented with bringing real-world assets into DeFi. For example, JPMorgan Chase, DBS Bank, and SBI Digital Asset Holdings used Aave's protocol on Polygon to complete foreign exchange and government bond transactions on the Ethereum network. Banks swapped tokenized versions of Singapore Government Securities for Japanese Government Bonds, exchanging Japanese yen for Singapore dollars as part of a test.

Another example is MakerDAO issuing the world’s first DeFi-based loan backed by real-world assets, where Fix&Flip lending pool New Silver, launched on Tinlake—a platform built on the Centrifuge protocol—used MakerDAO as a credit facility to secure its first loan. Furthermore, in 2022, MakerDAO partnered with BlockTower Credit to launch a $220 million fund dedicated to financing real-world assets. In 2021, Aave collaborated with blockchain firm Centrifuge to launch the Real-World Assets Market (RWA Market), enabling businesses to allow users to invest in markets collateralized by real-world assets.

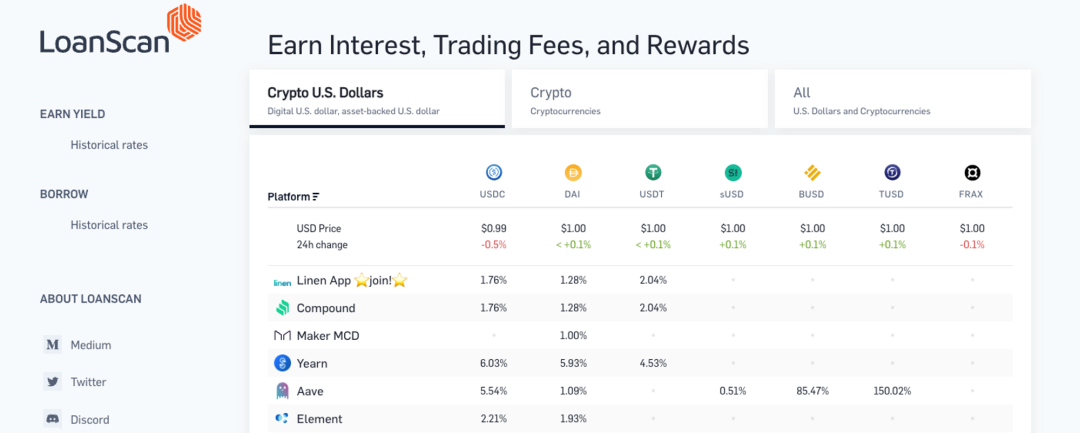

The onset of the 2022 crypto winter saw the collapse of high APR offerings, prompting investors to shift focus toward risk-free yields. Tokenized real-world assets (RWAs) are now fundamentally reshaping wealth management and investment. As a key financing tool and financial instrument, bonds represent low-risk safe-haven assets and fixed-income investments. In particular, U.S. Treasury yields are widely regarded as the benchmark risk-free rate. Meanwhile, investor confidence has been shaken by the implosion of high-yield products like UST that promised 20% returns during the last bull market, while DeFi protocols touting high returns have also underperformed. Take leading lending platforms Compound and Aave as examples: according to LoanScan data, as of May 8, USDC deposit rates on Compound and Aave fell to 1.76% and 5.54%, respectively—significantly below U.S. Treasury yields.

Next, let's explore this emerging segment of RWA—on-chain U.S. Treasuries—and examine the current state and development of key players in the on-chain treasury ecosystem.

Ondo Finance

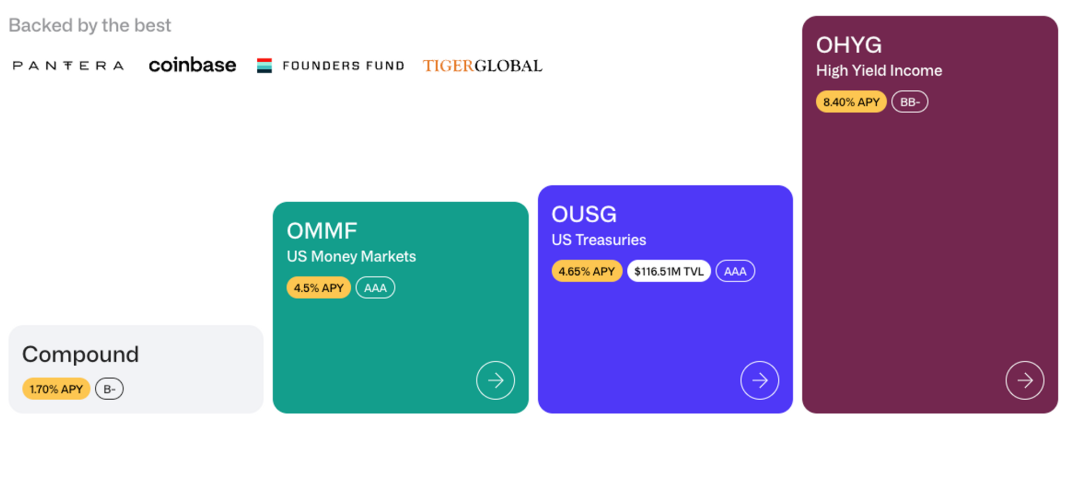

In January 2023, Ondo Finance announced the launch of tokenized funds, offering institutional investors access to U.S. Treasuries and investment-grade bonds.

Ondo Finance leverages large, highly liquid ETFs managed by major asset managers such as BlackRock and Pacific Investment Management Company (PIMCO), launching three tokenized U.S. Treasury and bond products: the U.S. Government Bond Fund (OUSG), Short-Term Investment Grade Bond Fund (OSTB), and High Yield Corporate Bond Fund (OHYG).

Among them, OUSG is pegged to the U.S. dollar via stablecoins and backed by short-term U.S. Treasuries, initially sourced through BlackRock’s Short-Term Treasury ETF (SHV), with an expected yield of 4.65%. OSTB invests in short-term investment-grade corporate bonds, initially accessed through PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT), yielding 5.45%. OHYG focuses on high-yield corporate bonds, initially using BlackRock iBoxx High Yield Corporate Bond ETF (HYG), offering a yield of 8.02%. Bondholders can transfer their tokenized fund equity values on-chain via smart contracts. Ondo Finance charges an annual management fee of 0.15%.

Given the failures of unregulated entities in the crypto space in 2022, Ondo Finance has opted to collaborate with strictly regulated third-party service providers, holding assets in bankruptcy-remote custodial institutions. Clear Street, a prime brokerage platform serving institutional investors, acts as the main broker and holds securities in the fund’s DTC (Depository Trust Company) account. Coinbase Custody safeguards any stablecoins held by the fund, while Coinbase Prime handles conversions between stablecoins and fiat currencies. Accounting and financial advisory firm Richey May serves as the fund’s tax advisor and auditor, having been repeatedly recognized as a top firm by Inside Public Accounting.

However, for compliance reasons, Ondo Finance operates a whitelist system: investors must pass KYC and AML checks before signing subscription documents, and may use either stablecoins or USD. The SEC defines “qualified purchasers” as individuals or entities investing at least $5 million.

Matrixdock

Matrixdock is a blockchain-based U.S. Treasury platform launched by Singapore-based asset management platform Matrixport. STBT is Matrixdock’s first product, introducing a risk-free interest rate backed by U.S. Treasuries.

At issuance, 1 STBT trades at a 1:1 ratio with USDC. STBT is underpinned by 6-month U.S. Treasury bills and reverse repurchase agreements collateralized by U.S. Treasuries. STBT is an ERC-1400-compliant token issued on Ethereum, minted and redeemed by Matrixdock, with transfers restricted only to authorized accounts via a contract-level whitelist mechanism.

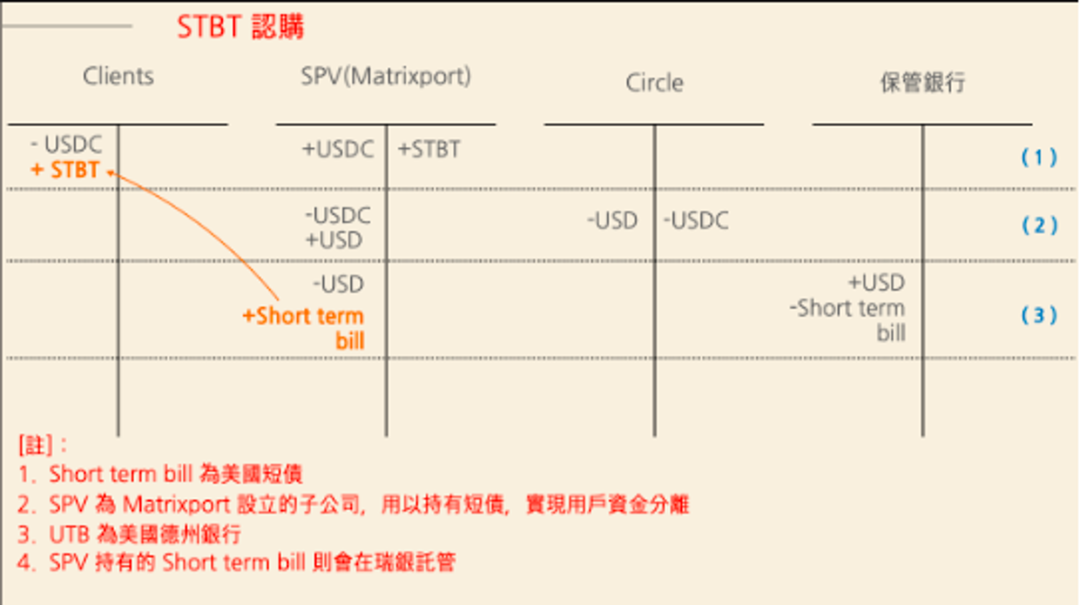

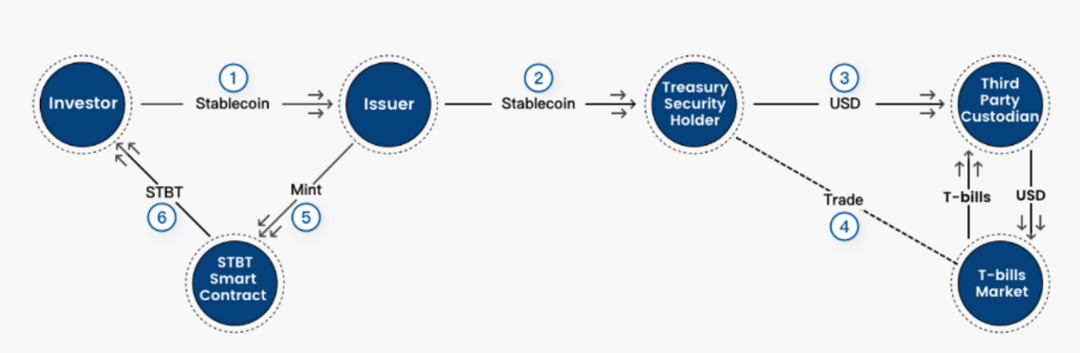

The STBT mechanism works as follows:

-

Investors send USDC or USDT to the issuer, who mints an equivalent amount of STBT via a smart contract;

-

The STBT issuer exchanges USDC for fiat currency via Circle;

-

Fiat is held by a third-party custodian, who purchases short-term U.S. Treasuries maturing within six months or participates in the Federal Reserve’s overnight reverse repo market through traditional financial channels;

-

After minting, STBT holders can transfer their tokens back to personal wallets, including cold wallets or third-party custodial platforms;

-

The STBT smart contract uses a rebase mechanism to automatically distribute daily interest from bonds or repos as additional STBT tokens to holder addresses;

-

As shown in the diagram below, the final outcome of these transactions results in STBT reserves consisting of U.S. government short-term debt (in orange).

After submitting a minting request, Matrixdock will issue the corresponding amount of STBT within up to four New York banking days, following a T+3 settlement cycle. Upon redemption request submission, Matrixdock will promptly redeem STBT tokens through the following process: deducting STBT tokens from your account, halting circulation or "burning" the tokens, transferring principal equivalent in USD-pegged digital assets (at a 1:1 ratio per STBT token) to your account, minus applicable fees, transaction losses reflecting the proportional value of underlying assets at redemption time, and any other transaction costs deemed necessary by affiliated entities to effectuate the sale of underlying assets.

Notably, the STBT issuer is a Special Purpose Vehicle (SPV) established by Matrixport. This SPV pledges U.S. Treasuries and cash to STBT holders, granting STBT holders first-priority claims over the physical asset pool. Even in extreme scenarios such as Matrixport’s bankruptcy, the value of STBT remains secured by the asset pool, allowing holders to redeem corresponding assets after liquidation of these securities.

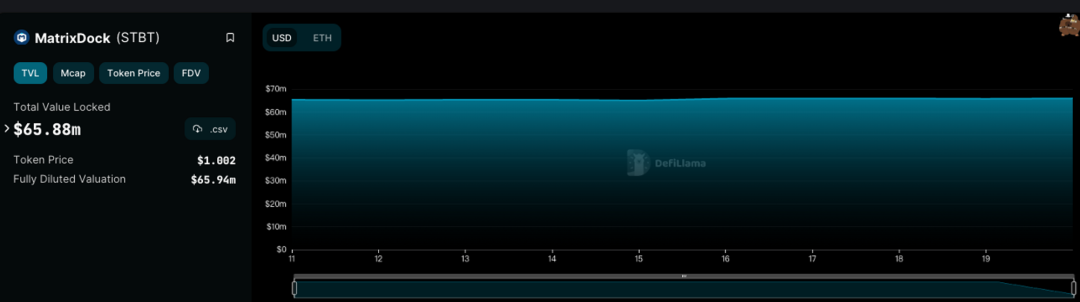

According to Defillama data, the current circulating supply of STBT is 65.88 million.

TProtocol

TProtocol is another new on-chain U.S. Treasury protocol, itself a fork of the stablecoin protocol Liquity, using Matrixdock as its underlying infrastructure. TProtocol introduces three tokens: TBT, sTBT, and wTBT:

-

sTBT: Issued by Matrixdock, rebases once daily at 6 PM Hong Kong time, maintaining a constant price of $1. Only accredited high-net-worth individuals or institutions who have passed KYC can purchase it.

-

TBT: A permissionless, rebase-enabled token accessible to retail users, fully equivalent to sTBT. Users can mint TBT with USDC at a constant rate of $1 (excluding fees). TBT can be redeemed for USDC at a constant price of $1.

-

wTBT: An interest-bearing token representing wrapped TBT, exchangeable for TBT. Its purpose is to enable integration of TProtocol into existing DeFi protocols, most of which do not support rebase tokens.

Additionally, the cost to mint TBT is 0.1%, and the redemption fee is 0.3%. The APR for TBT can be calculated using a specific formula. TProtocol emphasizes asset transparency. The value of TBT and wTBT is backed by three types of assets: MC_sTBT, IDLE_FUND, and PENDING_sTBT.

TBT is tradable on decentralized exchanges. TProtocol will launch a liquidity pool on Curve Finance to ensure minimal slippage. It also allows users to stake TBT-3CRV LP tokens to earn esTPS rewards, incentivizing DeFi users to adopt the TProtocol ecosystem and TBT, thereby significantly enhancing TBT liquidity and ensuring low trading costs when swapping TBT.

Currently, TProtocol has just launched on the Ethereum mainnet. Users can mint wTBT 1:1 with USDC to participate in early airdrop incentives, receiving TPS tokens as rewards each epoch. Additionally, TProtocol has gone live on Velodrome on Optimism, where users providing liquidity can earn both U.S. Treasury yields and bribe rewards.

OpenEden

OpenEden is a cryptocurrency startup founded in early 2022 by Jeremy Ng, former Head of Asia-Pacific at Gemini, and Eugene Ng, former Business Development Lead.

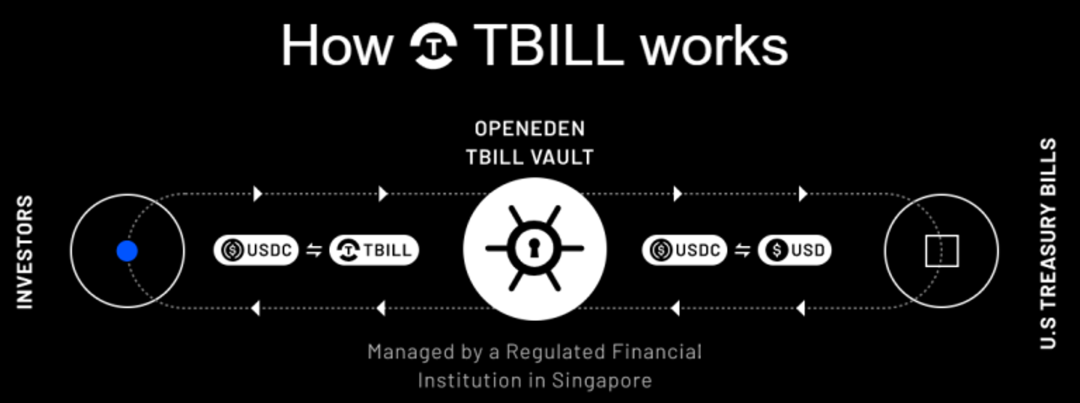

The OpenEden T-Bill Vault is an on-chain pool allowing stablecoin holders to earn yield from U.S. Treasury Bills, currently offering approximately 4.86%. Most of the pool’s assets are directly invested in short-duration U.S. Treasury bills, while a small portion of USDC remains on-chain to facilitate 24/7 instant withdrawals. Users can mint TBILL tokens from USDC in their wallets to enter the vault and earn yield, with redemptions processed entirely on-chain, benefiting from blockchain’s instant settlement—unlike traditional finance, which typically requires one to two business days.

Ribbon Finance

On April 17, Ribbon Finance announced the launch of Ribbon Earn USDC (V2), a capital-protected options product based on U.S. Treasuries developed in collaboration with another RWA protocol, BackedFi, offering a yield of about 2%, lower than other tokenized treasury products.

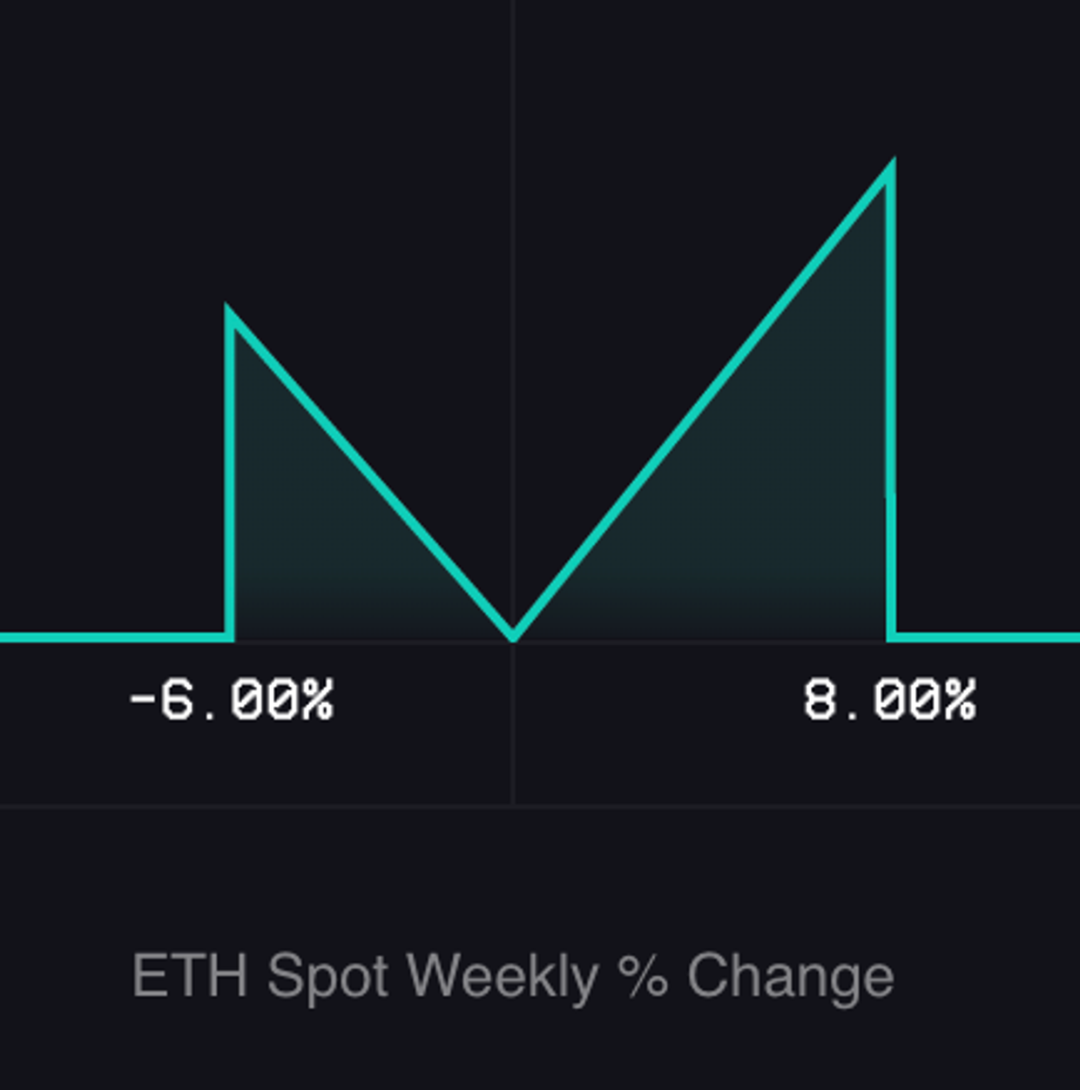

According to documentation, Ribbon Earn USDC V2 is an all-weather product that generates yield by purchasing Backed IB01 $ Treasury Bond 0-1yr tokens, which are backed by BlackRock certificates. As of April 10, its average projected yield was 4.64%. This is then enhanced by purchasing exotic ETH options to gain exposure to short-term market volatility, boosting overall returns. Depositors benefit from upside potential in the crypto market while maintaining full principal protection.

Conclusion

Currently, apart from TProtocol, which is truly a permissionless protocol open to all users, all other projects require KYC. Moreover, most treasury tokens do not support free transfers, limiting their usability—for instance, composability within DeFi, let alone cross-chain interoperability. Another critical aspect of on-chain treasuries lies in the qualifications of cooperating treasury dealers, posing significant and opaque counterparty risks, along with smart contract risks, oracle risks, and the well-known centralization issues inherent in CeDeFi models.

At present, the core objective of all RWA protocols is to enable seamless conversion between stablecoins and real-world assets. The high liquidity and low risk of U.S. Treasuries make them a relatively ideal choice. When an RWA treasury platform successfully launches a widely adopted yield-generating stablecoin, the resulting DeFi “money legos” could unlock exciting possibilities—such as Layer 1 blockchains built atop RWA platforms—though regulatory challenges would likely follow inevitably.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News