Top 5 protocols to earn passive income with stablecoins last month

TechFlow Selected TechFlow Selected

Top 5 protocols to earn passive income with stablecoins last month

May 2023 was another bear market month for earning passive income through stablecoins.

Author: Wajahat Mughal

Compiled by: TechFlow

Welcome to May 2023, another bear market month for earning passive income with stablecoins. In this article, researcher Wajahat Mughal will introduce several top-performing stablecoin yield farming projects from last month and provide a brief analysis of their returns, risks, and other factors. However, please note that stablecoin liquidity provision is not risk-free. Please carefully consider all potential risks and make decisions prudently before taking any action.

1. Pendle Finance

Pendle Finance offers very high yields through $PENDLE incentives, though it's uncertain how long these yields will last. Recently, these yields have declined somewhat, but they remain attractive for a meme coin heavily promoted on Twitter.

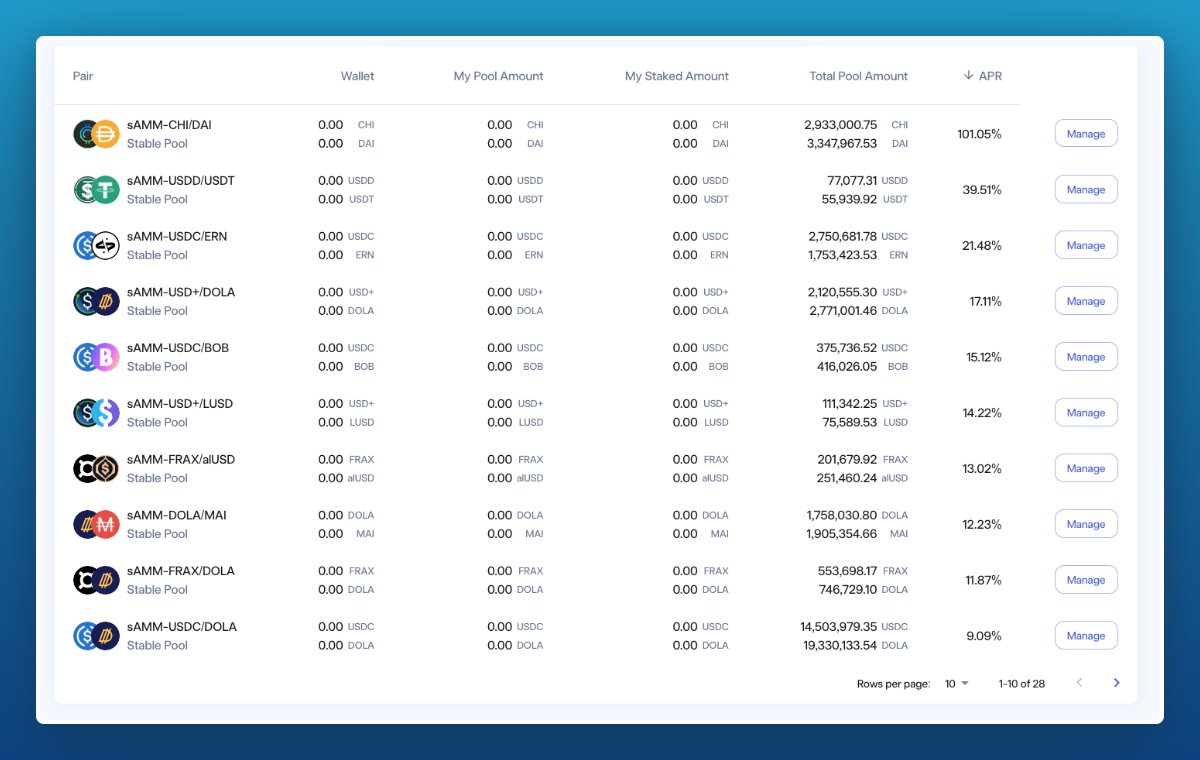

2. Velodrome

Velodrome appears to offer some of the best DeFi yields in the stablecoin space. Below are several liquidity mining options, although yields have slightly decreased compared to previous months.

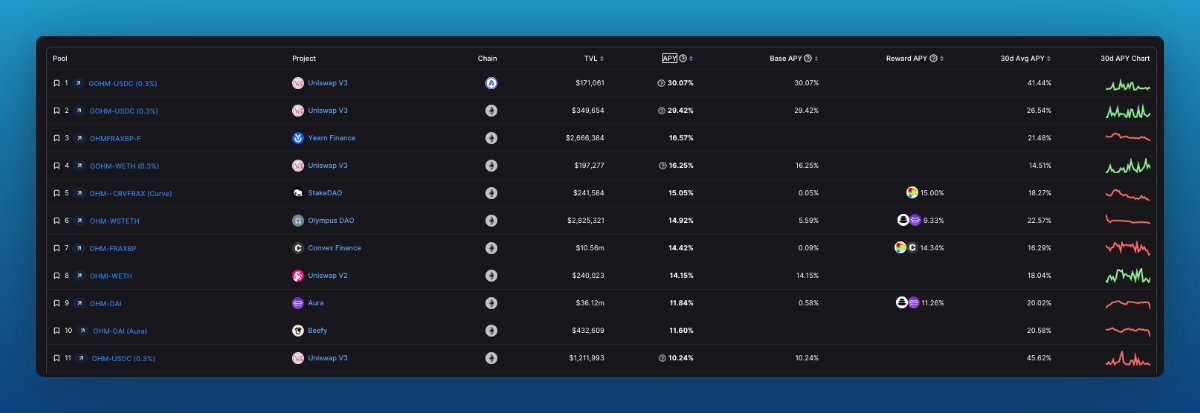

3. OHM Farms

During the bear market, Olympus has innovated, and $OHM is becoming an important asset in today's DeFi ecosystem. With the introduction of Boosted Farming, we can achieve higher yields on $OHM.

4. Convex

In my opinion, Convex remains the best long-term farming option in DeFi. Yields remain high, and accumulation of cash-flow-rich assets such as $CRV, $CVX, and $FXS continues to be strong. There are many LP opportunities here offering yields above 10%.

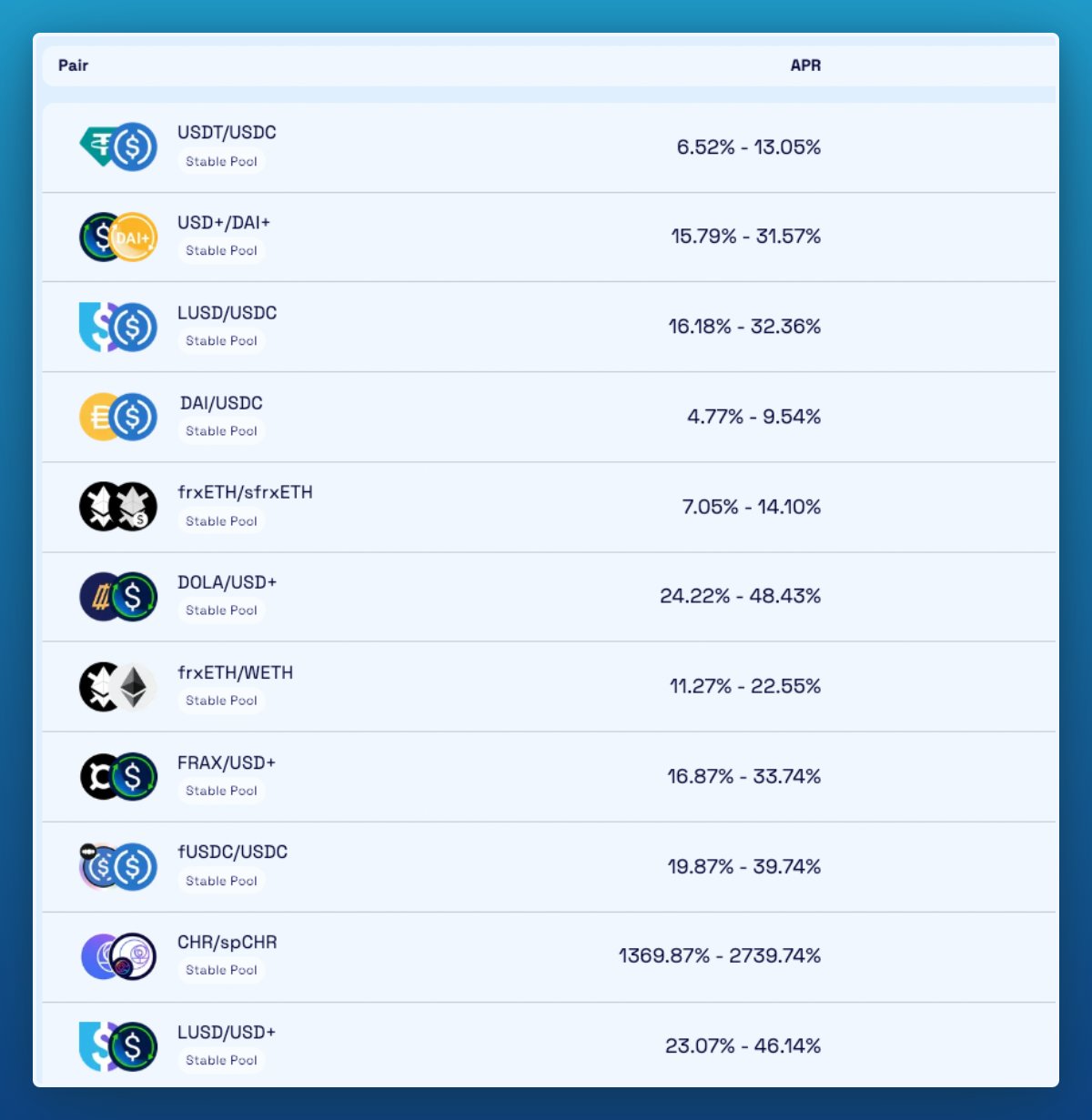

5. Chronos

Yes, another Solidly fork—but with a difference. The longer you keep your LP position, the greater your bonus. It already ranks third on Arbitrum’s TVL leaderboard, and the yields are quite decent.

The downside is the associated risk, including that this is a new project backed by a new team.

Of course, please be mindful of all risks related to LP positions. There will always come a time when one or more of the above projects may cease to exist, get hacked, or face other issues.

DeFi farming is not without risk—everyone needs to be aware of this.

Due to very high gas fees, it's wise to continue focusing on L2s or other L1s. Perhaps next month will bring better-yielding projects, especially with the potential launch of $crvUSD coming up.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News