Ethereum After the Shanghai Upgrade: Outlook on Staking and Potential Sell-Off

TechFlow Selected TechFlow Selected

Ethereum After the Shanghai Upgrade: Outlook on Staking and Potential Sell-Off

This article analyzes whether there will be a sell-off after the completion of the Shanghai upgrade, combining data such as Ethereum's price, deflation rate, staking rate trends, and supply rate trends.

Author: Darren, Everest Ventures Group

The Shanghai upgrade is tentatively scheduled for April 13, enabling validators to withdraw and withdraw funds from the Beacon Chain for the first time. With these expectations building up, market attention has once again turned to Ethereum liquidity.

After the Shanghai upgrade, will there be a sell-off? Will significant price volatility occur? What are the future prospects of the Ethereum staking landscape, and how will staking yields trend? This article analyzes and discusses these questions by combining data on Ethereum's price, deflation rate, staking rate, and supply trends. The key conclusions are as follows:

-

There may be some short-term selling pressure (partial withdrawals) immediately after the Shanghai upgrade, which could have an immediate impact on the market;

-

Only about 40% of Ethereum stakers (non-liquid stakers) have the intention to sell. These stakers generally have relatively low entry costs, creating some selling pressure, but this process will unfold gradually—under extreme conditions, it would take up to 125 days to fully withdraw all staked ETH;

-

Ethereum’s staking rate is expected to continue growing over the next few years, though its growth rate will eventually slow once reaching a critical threshold;

-

Excluding nested or leveraged positions, Ethereum’s staking yield will decline as the staking rate increases. However, with continued growth in the blockchain industry and new innovations emerging within liquid staking, overall staking yields—and thus staking rates—are likely to exceed current expectations.

1. Impact on Ethereum Price

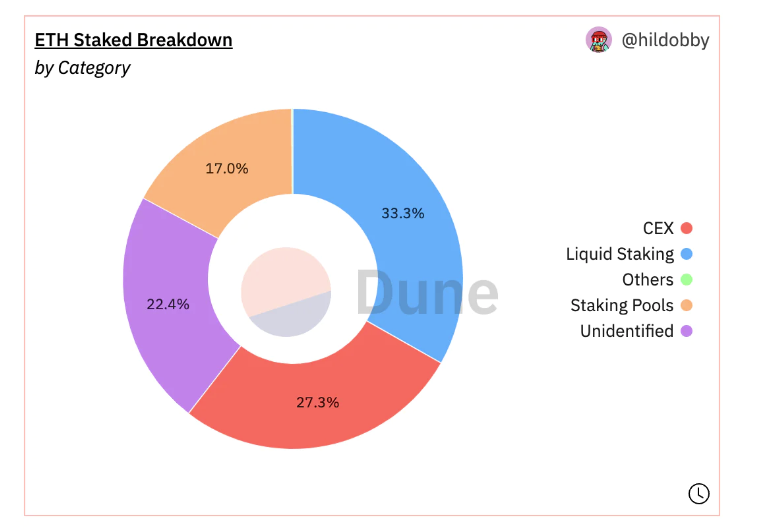

Source: https://dune.com/hildobby/eth2-staking

Currently, approximately 60% of staked Ethereum is held through services offering liquid staking derivatives, while only about 40% belongs to independent validators and staking pools. These two groups will be affected differently by the Shanghai upgrade.

1) Partial vs. Full Withdrawals

Withdrawals are categorized into partial and full withdrawals.

-

Partial withdrawal: Refers to the withdrawal of balances exceeding 32 ETH (i.e., accumulated rewards), which can be directly transferred to an Ethereum address and used immediately. The validator continues operating as part of the Beacon Chain and remains active;

-

Full withdrawal: Refers to a complete validator exit. The validator ceases participation in the Beacon Chain, and their entire balance (32 ETH plus any rewards) becomes unlocked and available after the exit process completes.

It should also be noted that each Beacon Chain validator contains a field called "withdrawal credentials." The first two bytes of this credential, known as the withdrawal prefix, are currently set to either 0x00 or 0x01, determined at the time of deposit via the deposit tool. Validators with 0x00 withdrawal credentials cannot initiate withdrawals immediately and must migrate to 0x01 to enable both partial and full withdrawals.

2) Potential Impact of Partial Withdrawals on Ethereum Price

The rate of partial withdrawals allows for 16 withdrawal requests per block. With one block produced every 12 seconds—5 blocks per minute, 300 per hour, and approximately 7,200 per day—if all validators had updated to 0x01, around 115,000 validators could undergo partial withdrawals daily.

According to beaconcha.in, there are currently 558,062 validators. Thus, it would take roughly 4–5 days to complete all eligible partial withdrawals. With an average validator balance of 34 ETH, stakers have earned approximately (34 - 32) × 558,062 = 1,116,124 ETH in staking rewards (estimated at 1.1 million ETH). At the current ETH price (~$1,800), this equates to about $1.98 billion worth of ETH being released over 4–5 days.

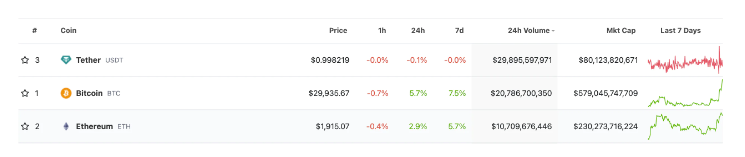

As shown below, CoinGecko data indicates that Ethereum’s daily spot trading volume is currently ~$10.4 billion. Therefore, the value of partial withdrawals represents about 19% of daily spot volume. Spread evenly over five days, the daily release amounts to roughly 3–4% of daily spot volume.

This constitutes a predictable source of selling pressure. Unlike full withdrawals, where liquid staking derivatives (e.g., stETH) allow users to reclaim ETH before Shanghai, reward earnings (eligible for partial withdrawal) cannot be accessed until after the upgrade. Hence, some portion of these rewards may be sold. However, this effect is short-term and unlikely to exert prolonged downward pressure on ETH’s price. Moreover, given current ETH prices and considering other on-chain behaviors of PoS participants (such as compounding), many long-term stakers are unlikely to sell at this stage.

Source: https://www.coingecko.com/

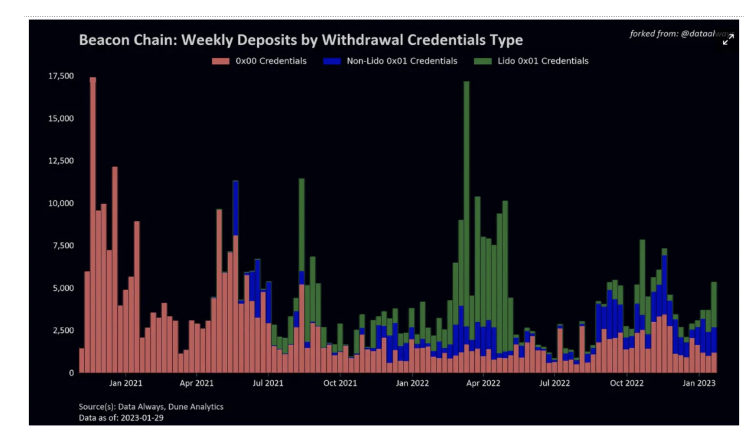

Furthermore, not all validators actually hold 0x01 credentials. As shown below, according to Data Always, as of January 29, 2023, approximately 20% of newer validators had not yet configured their withdrawal credentials to 0x01.

Source: https://dataalways.substack.com/p/partial-withdrawals-after-the-shanghai

Additionally, animations from Data Always' research suggest that the peak conversion from 0x00 to 0x01 will occur early on the second day after the Shanghai upgrade and last for about two days—not immediately upon activation. Therefore, under extreme assumptions, we might see around 110,000 ETH withdrawn partially on the first day (excluding Lido’s 0x01 validators).

3) Potential Impact of Full Withdrawals on Ethereum Price

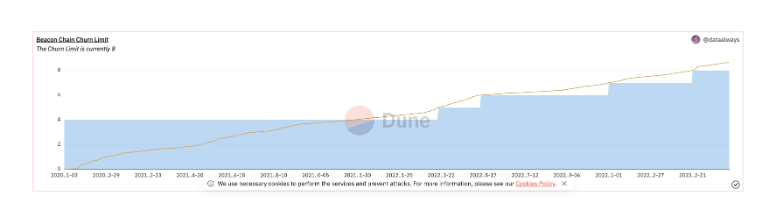

Full and partial withdrawals share the same priority queue. When a validator is marked as “exited,” both principal and rewards are unlocked together. However, full withdrawals face stricter limits. As shown in the charts below, the current outflow limit for full withdrawals is capped at 8 per epoch, allowing a maximum of 57,600 ETH to be withdrawn daily. Currently, around 18 million ETH are staked, with LSDs and CEXs accounting for 60% of this total.

Since most LSD and CEX participants already have secondary market exit options, we can reasonably assume that only the remaining 40% (~7.2 million ETH) may consider exiting post-Shanghai. Under an extreme scenario where no new deposits are made and daily withdrawals hit the maximum cap, it would take up to 125 days to fully withdraw all staked ETH.

Source: https://dune.com/queries/1924507/3173695

As previously mentioned, the 60% represented by LSDs and CEXs typically issue liquid staking derivatives such as stETH, cbETH, rETH, and bETH.

Take stETH as an example: the current stETH-to-ETH exchange rate is 0.9996, indicating minimal spread. Therefore, anyone wishing to sell can simply swap their liquid derivative tokens for ETH on the open market without waiting for Shanghai. Consequently, the effective cost basis of staked ETH is highly dispersed and constantly shifting—many stETH holders acquired them via secondary markets rather than direct staking. For this 60%, barring extreme sell-offs driven by market panic, the Shanghai upgrade itself will have limited direct impact.

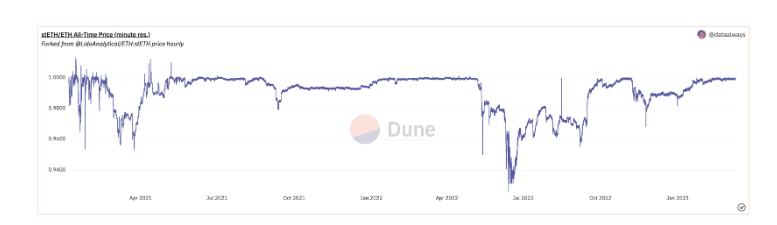

Some argue that large-scale stakers may avoid selling derivatives due to concerns over illiquidity and potential discounts, preferring instead to wait until after Shanghai to exit and sell directly. While plausible, historical ETH price data (shown below) reveals significant stETH de-pegging events in March 2021 and June 2022. In March 2021, elevated selling pressure coincided with broader market highs, primarily from users who staked at the end of 2020 cashing out. The June 2022 de-peg was triggered by institutional liquidations (e.g., 3AC, FTX), causing stETH to lose its peg. This demonstrates that large players do sell even amid liquidity constraints—driven more by macro conditions than structural fears. Thus, attributing potential ETH price declines solely to liquidity concerns is misleading.

Source: https://dune.com/skynet/lido-stetheth-monitor

4) Impact of Ethereum Staking Cost Basis on Post-Shanghai Price Volatility

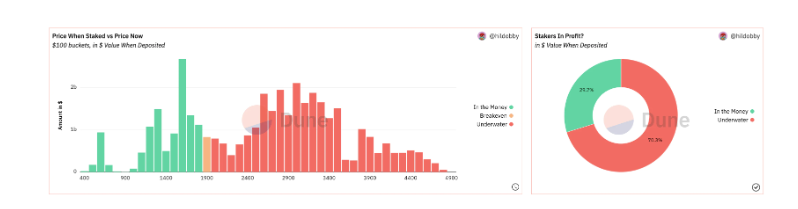

Source: https://dune.com/hildobby/eth2-staking

As illustrated above, more stakers are currently underwater than in profit. This leads to two opposing views: one suggesting underwater stakers may withdraw to cut losses; the other arguing they may hold due to loss aversion.

However, for the majority of stakers (60%), cost basis is irrelevant—since they can already trade stETH for ETH on secondary markets pre-Shanghai and sell if desired. Therefore, Shanghai does not materially affect this group.

For the remaining 40%, mostly early POS adopters, cost bases are significantly lower. The Beacon Chain’s deposit contract launched in November 2020 when ETH traded around $400–$500. It wasn’t until March 2021 that ETH reached today’s levels. It’s reasonable to assume that much of the “In the Money” cohort consists of these early stakers, whose holdings have appreciated 3–4x from entry prices (~$1,800 today). This group may contribute some selling pressure. Additionally, their actions could trigger FUD, potentially prompting panic selling among the 60%. However, as previously noted, withdrawal speeds are rate-limited, meaning any sell-off would unfold gradually rather than abruptly.

2. Impact on Ethereum Staking Rate and Staking Yield

The previous section discussed potential impacts of the Shanghai upgrade on Ethereum’s price. Beyond price, Shanghai will also influence Ethereum’s staking rate and staking yield.

1) Factors Influencing Ethereum Staking Rate and Yield

Our analysis suggests that Ethereum’s staking rate will rise post-Shanghai but is unlikely to reach the high levels (60–80%) seen on other blockchains. Furthermore, absent complex strategies like nesting or LSDFi, staking yields will decline as the staking rate increases.

Three factors could support higher staking adoption:

- i) As shown below, Ethereum’s current staking rate stands at only 15.52%, whereas other chains reach up to 73%. This indicates substantial room for growth.

Source: https://www.stakingrewards.com/

- ii) Prior to Shanghai, staked ETH was illiquid, locking up capital inflexibly and discouraging participation. With Shanghai enabling full withdrawal functionality, this liquidity risk is resolved. The loop from deposit to withdrawal is now closed, and liquid staking derivatives are expected to stabilize closer to a 1:1 peg with ETH. This may attract institutional capital. However, in today’s LSD-dominated environment, this factor may have less marginal impact.

- iii) Ethereum is already in a deflationary state, with a current inflation rate of -0.62%. According to supply-demand dynamics, this implies Ethereum’s intrinsic value is increasing over time. Other chains achieve high staking rates due to higher yields, funded by continuous token issuance and dilution. From a long-term perspective, Ethereum offers a more attractive proposition. Notably, this deflation occurs even during a bear market with low activity—during a bull market, higher gas consumption will accelerate deflation further.

Nevertheless, Ethereum’s staking rate will not grow indefinitely. We believe:

-

i) Ethereum cannot match the high staking yields offered by competing chains, making those networks more appealing to yield-seeking users.

-

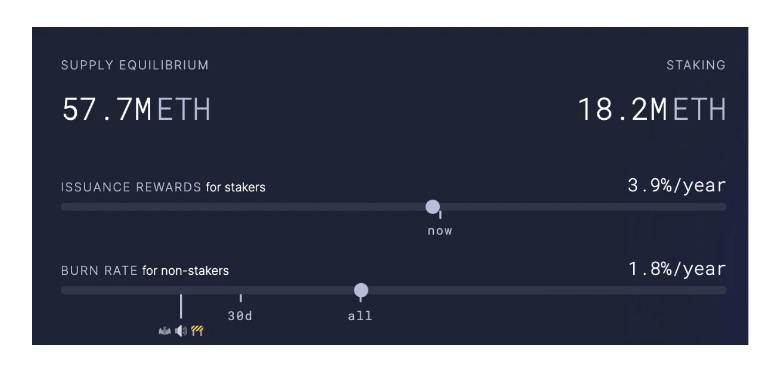

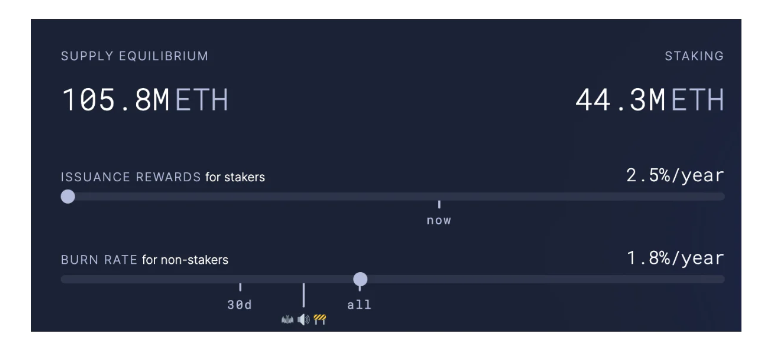

ii) Beyond lower relative yields, Ethereum’s native staking return decreases as more ETH is staked (excluding advanced strategies like nesting or LSDFi). As shown in the following charts, staking rate and yield reach dynamic equilibrium. At 44.3 million staked ETH, annual yield drops to just 2.5%—about 2.5x the current 18.2 million. Such low returns may fail to attract broad participation. Therefore, we expect Ethereum’s staking rate to double from current levels before growth slows.

Source: https://ultrasound.money/

2) Forecast: Ethereum Supply, Staking Rate, and Staking Yield

Ethereum supply and staking rate trends from February 2021 to March 2023

As shown above, since September 2022, Ethereum’s supply growth has flattened and begun declining. Since staking launched, the amount of staked ETH has consistently increased, with no signs of slowing down.

Based on this, we conclude:

During bear markets with low trading activity, Ethereum’s supply growth stabilizes or contracts. In a bull market, increased transaction volume and higher gas fees will accelerate deflation. Against this deflationary backdrop, the staking rate is likely to rise. However, as more ETH is staked, individual validator yields decline, eventually reaching a new equilibrium between staking rate and yield.

Nonetheless, we believe that as the blockchain ecosystem evolves, liquid staking—acting as a DeFi Lego component—will spawn innovative use cases such as leverage and recursive strategies. These developments will generate higher effective yields, driving the staking ecosystem toward a new, higher equilibrium. While models predict yields dropping to 2.5% at 44.3 million ETH staked, the emergence of LSD-based financial engineering will likely push both yields and staking rates beyond current projections.

References:

[1] Brace Yourselves, Shanghai Is Coming

[2] Partial withdrawals after the Shanghai fork

[3] The Future of ETH Liquid Staking

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News