Insights into Hot Tokens and Trading from Recent On-Chain Fund Movements of Whales and VCs

TechFlow Selected TechFlow Selected

Insights into Hot Tokens and Trading from Recent On-Chain Fund Movements of Whales and VCs

Cryptocurrency researcher Thor Hartvigsen summarized the activities of several prominent venture capital funds, investors, and traders in the cryptocurrency market over the past 30 days.

Written by: Thor Hartvigsen

Compiled by: TechFlow

Crypto researcher Thor Hartvigsen has summarized the activities of several well-known venture capital funds, investors, and traders in the cryptocurrency market over the past 30 days. These activities involve multiple digital assets including GNS, DYDX, GMX, RDNT, DPX, ARB, LDO, ETH, BTC, MATIC, and AAVE.

Notably, some of these investors used high leverage when making large trades. Additionally, some investors may have sold tokens after transferring them to centralized exchanges.

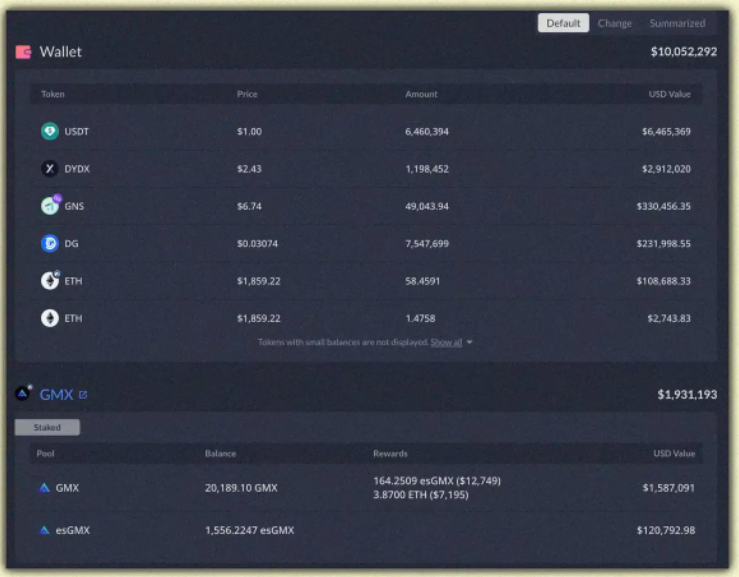

1. Arca (Venture Capital Fund)

Past 30 days:

• Purchased $350,000 worth of GNS | Entry price: $7.06;

• Purchased $4.1 million worth of DYDX | Entry price: $2.22;

• Sold $3.5 million worth of GMX at an average price of approximately $74.6.

Note: Arca still holds $1.6 million worth of GMX and previously bought heavily between $40–$70 in January/February.

• Sold $1 million worth of RDNT at an average price of $0.41. Previously purchased in February at an average price of $0.277.

• Sold $600,000 worth of DPX at an average price of $315. Previously purchased in February at an average price of $391.

Their largest current positions are USDT, DYDX, and GMX, in descending order.

2. Arthur Hayes (Whale)

Arthur appears to have acquired LDO tokens during 2022 at an average price of $2.53. However, he recently sold all 758,000 of his LDO tokens at $2.42, amounting to $1.9 million.

In the wallets we track, Arthur still holds:

• $17.5 million worth of ETH;

• $15.7 million worth of GMX;

• $3.2 million worth of ENS;

• $1 million worth of FXS;

• $750,000 worth of WILD;

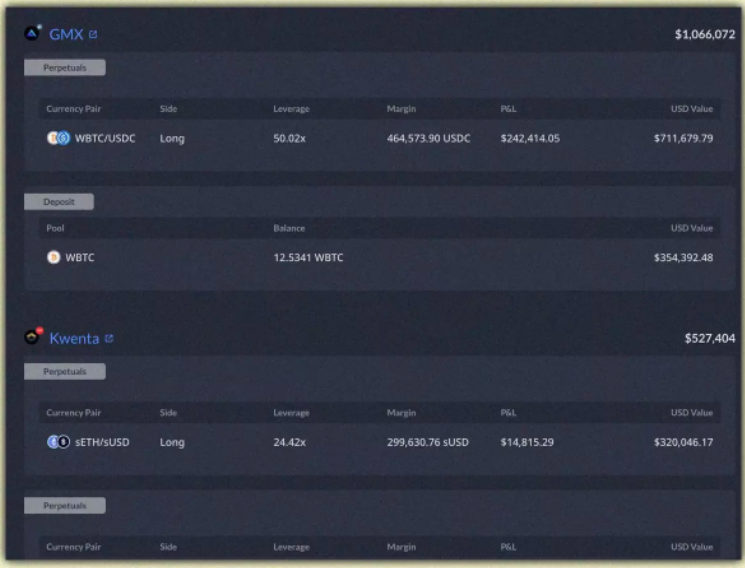

3. Andrew Kang (Whale)

Interestingly, ARB is the only significant spot investment across Kang’s three traceable wallets.

-

Purchased $800,000 worth of ARB tokens at $1.25 on April 4.

-

Purchased $1.51 million worth of ARB tokens at $1.23 on April 5.

Kang is also actively trading on GMX and Kwenta, having previously earned substantial profits but also suffered major losses. He is currently long on ETH and BTC with 25–50x leverage, totaling approximately $1.5 million.

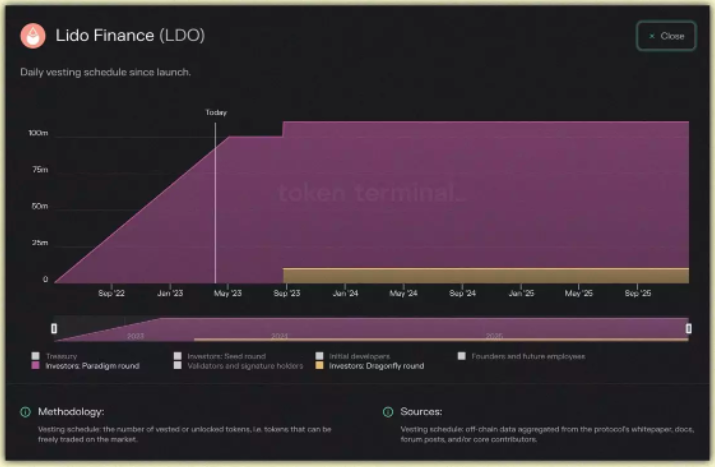

4. DragonFly Capital (Venture Capital Fund)

Dragonfly appears to have sold various assets in March:

• Received $12 million worth of LDO tokens in July 2022. The funds remained idle in a wallet until early March when they were transferred.

• Sold $5.7 million worth of LDO tokens on OKX on March 1 and March 21.

Dragonfly still holds 21.1 million LDO tokens ($56 million) and will receive another 10 million LDO tokens from investor round unlocks on August 25.

• Sold 8.3 million MATIC tokens ($10.2 million) on March 3.

• And 80,000 AAVE tokens ($5.9 million).

Note: Sending tokens to centralized exchanges does not necessarily mean they were sold (but often implies so).

5. GoldenTree (Venture Capital Fund)

• Acquired 5.9 million SUSHI tokens at an average price of $1.24 between September and October 2022.

• On March 23, 5 million SUSHI tokens were sent to Binance and likely sold at $1.04.

• The remaining 900,000 SUSHI tokens were transferred to an unlabelled wallet.

6. Other Notable Activities

Republic Capital transferred 24.5 million MATIC tokens ($27 million) to Coinbase on March 6 (likely for sale).

This transaction originated from a wallet that received funds in January for Polygon ecosystem growth.

Whale 0xSisyphus purchased 200,000 LDO tokens ($480,000) at $2.47.

Wintermute purchased 2.5 million LDO tokens ($6 million) in April, possibly for market-making, as this wallet frequently sends LDO tokens to various centralized exchanges.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News