Understanding DINERO: A New Stablecoin Launched by Redacted Cartel, Backed by ETH and pxETH

TechFlow Selected TechFlow Selected

Understanding DINERO: A New Stablecoin Launched by Redacted Cartel, Backed by ETH and pxETH

Redacted Cartel has launched a new stablecoin called Dinero, designed to address multiple issues within the Ethereum ecosystem.

Written by: Wajahat Mughal

Compiled by: TechFlow

Redacted Cartel has launched a new stablecoin called Dinero—an over-collateralized, Ethereum-backed stablecoin designed to address multiple challenges within the Ethereum ecosystem. Researcher Wajahat Mughal provides an analysis and breakdown of Dinero based on currently available information.

DINERO will be a stablecoin backed by ETH and pxETH (we’ll discuss pxETH in detail below). Dinero aims to solve the following issues:

-

Become a decentralized stablecoin;

-

Capture settlement-layer value from Ethereum;

-

Increase protocol revenue;

-

Access premium block space.

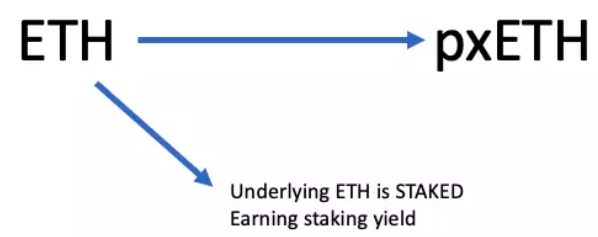

$ETH can be deposited into Pirex to create pxETH. The underlying ETH is staked. These stakes will be validated by Dinero protocol validators and ultimately support Redacted’s proprietary relayer and advanced RPC services.

There will be both an ETH vault and a pxETH vault for minting DINERO. The protocol will generate revenue from interest on DINERO. The pxETH vault will have stricter risk parameters due to its lower liquidity.

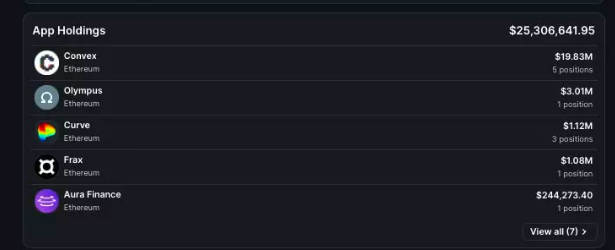

A peg-stabilization mechanism will keep the price anchored at $1, using USDC as collateral to alleviate upward price pressure. Liquidity will be boosted through Redacted’s substantial governance power (currently around $28.5 million).

To better understand other components of $DINERO, we first need to grasp the following:

1. When transactions are submitted to the Ethereum network, they enter the mempool to await confirmation.

2. Validators organize these transactions, along with those from all other nodes, into blocks.

3. Ethereum's block space is limited, making it highly valuable due to these constraints.

4. Users who require earlier transaction processing must pay higher fees.

5. This dynamic ultimately creates a premium block space market.

Why does this matter?

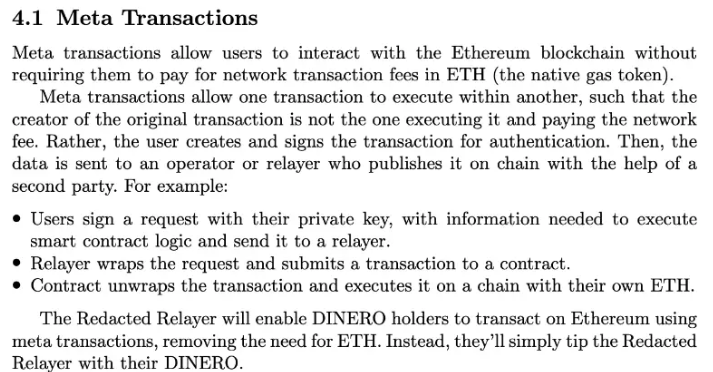

Redacted is building its own relayer, which will enable a range of new capabilities, including meta-transactions.

Meta-transactions allow users to pay gas fees using tokens other than ETH. Once scaled sufficiently, Dinero will be able to leverage pxETH-powered block space to enable private transactions and payment for order flow, among other features.

What benefits does this bring to BTRFLY holders?

Nothing confirmed yet—this is purely speculative—but rBTRFLY holders may earn additional revenue streams from:

-

Fees generated by pxETH;

-

Interest from DINERO;

-

Trading fees from premium DINERO markets;

-

Internal validation roles within Redacted.

In summary, Dinero is a stablecoin backed by ETH and pxETH, aiming to solve key issues around decentralized stablecoins, Ethereum settlement layer value capture, protocol revenue growth, and access to premium block space. The project also plans to build its own relayer and meta-transaction functionality, allowing users to pay gas fees in DINERO instead of ETH.

Dinero demonstrates how we can move beyond the application layer and build directly on the consensus layer. I’m excited to see what comes next, and look forward to further details revealing how Dinero will position itself within the Ethereum ecosystem.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News