Cosmos LSM: Catalyst for Cross-Chain DeFi, a Modular Solution for Liquid Staking

TechFlow Selected TechFlow Selected

Cosmos LSM: Catalyst for Cross-Chain DeFi, a Modular Solution for Liquid Staking

This article will explore the Cosmos Liquid Staking Module (LSM), the implications of its interactions, and expectations for the development of the modular ecosystem.

Author: New Order

Translation: TechFlow

Cosmos appchains represent a significant evolution over traditional application-specific chains, fundamentally transforming how decentralized applications are built, deployed, and used. Advanced applications like dYdX have already begun migrating to their own dedicated appchains. The benefits of transitioning to a single-application chain will be amplified by the surge in liquidity and innovation unlocked by the Cosmos Liquid Staking Module (LSM). This explosion of liquidity will make existing applications more efficient while rapidly expanding emerging ecosystems such as Sei, Berachain, and Canto.

In this article, we will explore the Cosmos Liquid Staking Module (LSM), its interaction effects, and the anticipated development of modular ecosystems.

Modular Solution for Liquid Staking

Consistent, available, and deep asset liquidity is critical for any decentralized network or application. While liquidity is often considered strictly in financial terms when analyzing popular DeFi protocols and apps,

its importance extends far beyond that. Securing consensus on networks like Ethereum requires assets representing trust (e.g., ETH) to be freely transferable and accessible. If Ethereum lacks sufficient liquidity, it would struggle to effectively decentralize and compensate participants for services such as block validation. Today, the Ethereum community benefits from a global liquid ETH market, directly fueling its growth as a network.

Liquid Staking Derivatives (LSDs) such as Lido and Rocket Pool are primary drivers of this liquidity.

The Cosmos ecosystem has grown rapidly over the past two years. Dozens of application chains are now interconnected via IBC, enabling scalable exchange of value and information across one another. Nevertheless, the Cosmos ecosystem has not experienced the same level of liquidity and LSD proliferation seen on Ethereum.

Current redemption requirements for unbonded tokens do not incentivize large liquidity providers to switch to liquid staking solutions. This limits the potential of financial applications and restricts innovative possibilities such as cross-chain shared security. This lack of LSD interoperability stems from the modular architecture and security guarantee processes.

The Cosmos Liquid Staking Module (LSM) aims to solve this problem.

LSM is designed as a modular component of the Cosmos SDK, meaning any Cosmos chain can implement LSM. With LSM, Cosmos ecosystem users will be able to stake their cross-chain assets without needing continuous unbonding, re-delegation, or transfers—ultimately making staked tokens truly liquid across connected zones. Through LSM, Cosmos can create a thriving LSD ecosystem that secures applications across multiple Cosmos zones and delivers a user experience comparable to LSDs on Ethereum and other L1 networks.

LSM Will Launch the Cosmos LSD Ecosystem

If LSM is implemented within the Cosmos SDK—as we expect this year—its impacts will be immediate. For LSD providers and validators, implementation will unlock improvements in governance and staking mechanics. Applications on Cosmos will be able to convert staked assets into liquid ones without requiring unbonding. Using the Interchain Accounts standard and IBC, governance rights associated with these stakes will become transferable to any chain or validator. What does this mean?

-

New Governance Markets and Primitives: Multi-zone governance delegation via IA/IBC creates highly interoperable governance/voting markets, potentially surpassing the capabilities of single-chain setups across application chains.

-

New Types of LSDs: LSDs on Cosmos chains (and supported validators) will be able to use or generate validation services in real-time (block-by-block) and dynamically allocate their stakes to the most valuable opportunities. This could usher in a new era of validators and LSDs, returning maximized rewards to users.

-

New Asset Flexibility: When LSM launches, bonded staked assets will suddenly gain a true path to liquidity. These assets will retain their role as stake-based governance instruments but inherit the full interoperability features intended for assets via IBC. This shift will generate deeper liquidity throughout the Cosmos ecosystem.

-

LSD Proliferation: Existing LSD providers—including Quicksilver, Stride, and Persistence—will significantly expand the capabilities of their tokens/LSDs. With IA/IBC staking delegation, Cosmos LSD operations become much more efficient. For example, Quicksilver’s qAsset system promises multi-zone delegation that is more attractive to users than current implementations. Once LSM goes live, LSD adoption is expected to increase substantially.

-

Step-Change Liquidity Gains: True LSDs enabled by LSM will effectively "unlock" billions of dollars worth of staked assets currently idle across the Cosmos ecosystem. This influx of liquidity will spark a new wave of rapid protocol bootstrapping and innovation.

-

Enhanced Security: Deeper liquidity and broader distribution of governance rights through LSDs will strengthen the overall security of Cosmos. Governance markets will become more efficient, increasing confidence in the direction of the entire ecosystem.

Currently, over $3.2 billion worth of Cosmos assets are staked but have never been truly liquid. These assets have never reached cross-chain DeFi—but that will change with LSM. With this upgrade, the staking environment will become significantly more favorable for IBC chains aiming to build innovative validation and governance applications compared to monolithic systems.

Technical Interactions with LSM

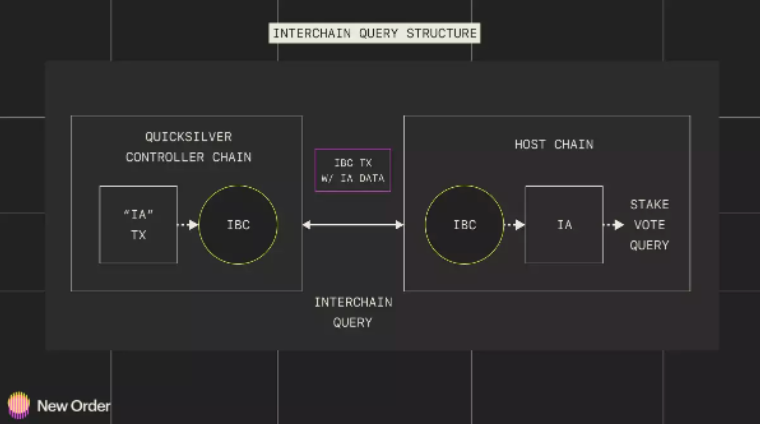

Due to how LSD providers currently operate within the Interchain ecosystem, LSM will primarily interact with Interchain Accounts (IA) and Interchain Queries (ICQ). Providers will use Interchain Queries to query the staking and bank modules of the Cosmos SDK to obtain necessary data for liquid staking, then communicate with Interchain Accounts controlled by the LSD provider located on the target blockchain.

IA (ICS-27) enables composability by allowing data and state exchange between smart contracts on different chains. Unlike simple interoperability that only allows data transfer, interchain accounts enable the transfer of smart contract states. This eliminates the need for users to navigate separate interfaces when moving assets or messages across chains. Chains supporting ICS-27 can create and control accounts on other ICS-27-compatible chains using IBC transactions. Interchain accounts resemble regular accounts but are operated via IBC by another chain or end-user, while full control remains with the owner on the source chain.

To initiate an Interchain Account transaction, IBC is used to send non-IBC transactions inside an IBC packet—akin to a "letter inside an envelope inside a box." The process follows the ICS specification (the IBC transaction framework), enabling application-agnostic transactions and achieving true composability across different networks.

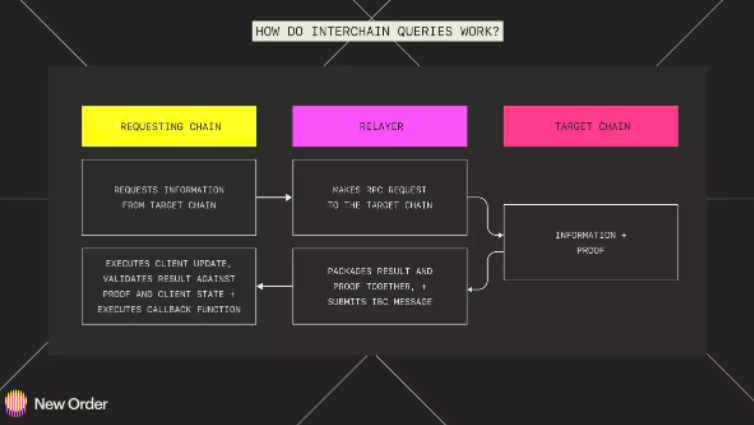

ICQ enables modules to query other application chains using Inter-Blockchain Communication (IBC) and Interchain Accounts (IA). With this framework, modules can access and interact with various application chains in a seamless and secure manner.

A key use case of this framework is querying assets on host chains (e.g., ATOM, OSMO, JUNO, etc.) corresponding to each user. This provides users with a unified view of their portfolios across different chains, making management easier.

Beyond asset queries, ICQ can also be used to allocate appropriate governance rights based on the number of tokens users hold on other chains. With the help of IBC and IA, users can easily participate in governance activities across different chains without holding multiple tokens or navigating complex interfaces. This simplifies the governance process and makes it more accessible to a wider range of users.

Overall, it offers developers and users a powerful tool to interact seamlessly and efficiently with multiple chains and their respective ecosystems.

The Liquid Staking Module will transform the Cosmos ecosystem by unlocking billions of staked tokens, enabling them to be used in DeFi across the interchain ecosystem.

In our view, this will be one of the biggest catalysts for fostering a flourishing cross-chain DeFi landscape, alongside new DeFi-focused chains such as Sei, Berachain, and Canto.

New Order is actively seeking teams building for the future of cross-chain DeFi. If you're building on Cosmos or developing next-generation LSDs, we’d love to hear from you.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News