10 Projects That Have Completed Seed Funding Rounds: Startup Directions, Prospects, and Potential Airdrops

TechFlow Selected TechFlow Selected

10 Projects That Have Completed Seed Funding Rounds: Startup Directions, Prospects, and Potential Airdrops

The cryptocurrency space has always been a rapidly evolving and unpredictable industry. Early participation in new projects and airdrop opportunities, beyond methods like ICOs and IDOs, can also be significantly enhanced by exploring crypto seed funding rounds—an often overlooked avenue for gaining early access.

Written by: Minty

Compiled by: TechFlow

The crypto space has always been a fast-evolving and unpredictable industry. Early participation in new projects and potential airdrops—beyond traditional routes like ICOs and IDOs—can also be gained through tracking early-stage seed funding rounds, an often underappreciated opportunity.

After extensive research, here are 10 promising seed-funded projects worth your attention.

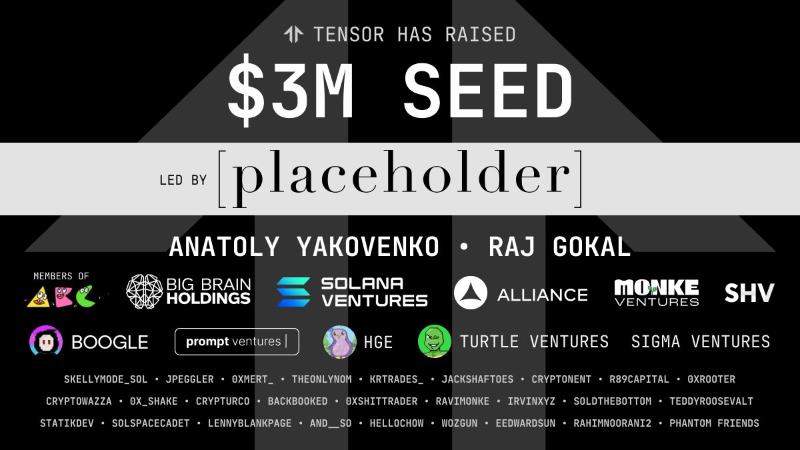

Tensor ($3 million)

Tensor is an NFT marketplace built on Solana, similar to Blur.

The project runs an airdrop points system akin to Blur’s, where users earn points toward future token distributions by using the platform.

If you're interested in Solana NFTs, this is a project to watch.

Mangrove ($7.4 million)

Mangrove is an order-book-based DEX on Polygon that does not require liquidity providers (LPs) to lock up their capital.

Instead, LPs list quotes on Mangrove’s order book as smart contracts.

This improves capital efficiency because LPs are only called upon when someone accepts their quote.

Mangrove is currently running a private testnet. You can contact them via their website, though access is not guaranteed.

Alkimiya ($7.2 million)

Alkimiya is building a permissionless blockspace marketplace. With Alkimiya, validators/miners can sell a certain amount of blockspace to regular users at a specified price.

This benefits both parties: regular users gain real yield without needing to own or manage the hardware required for block production.

Miners/validators can hedge against revenue volatility by locking in fixed amounts upfront. The platform is currently live on the Avalanche testnet. A token has not been confirmed yet, but if an airdrop occurs, I believe some tokens will go to protocol users.

Strider ($5.5 million)

Strider is a game studio behind the Smolverse games.

Beyond that, they appear to be building a platform enabling users to co-create narrative experiences. It sounds a bit vague, but it's worth monitoring.

Towns ($25.5 million)

Towns is an open-source group chat platform backed by a16z, allowing anyone to create their own town on-chain.

Towns can be transferred and sold on the blockchain. Anyone can build a town with full ownership and customizability.

Fungify ($6 million)

Fungify aims to create liquid markets for NFTs by launching NFT indices and lending protocols.

Eligible NFT holders can stake their NFTs into indices and earn additional yield. The product isn't available yet, but it appears to be launching soon.

A governance token seems likely, though no details on distribution have been released.

VestExchange (undisclosed amount)

Vest is a derivatives platform allowing users to create permissionless markets with isolated risk parameters.

Anyone can launch a market for a new asset as long as requirements are met, offering greater flexibility and choice. The protocol recently concluded its testnet competition, but further testing opportunities should emerge.

Etherfi ($5.3 million)

Etherfi is a new liquid staking protocol offering users exposure to ETH validator yields.

Backed by major players like Arthur Hayes, Etherfi is currently running an early-bird points program.

Monad ($1.9 million)

Monad is a new EVM-compatible L1 claiming to deliver 10,000 tps throughput.

If true, Monad could be 1,000x faster than Ethereum mainnet and 5x faster than Solana. Validator applications for the testnet are closed, but they recently announced a new community initiative on social channels through which users can earn POAPs.

Token distribution hasn’t been confirmed, but early contributors may receive benefits.

GammaSwapLabs ($1.7 million)

GammaSwap is a platform enabling volatility speculation and hedging against impermanent loss for liquidity providers.

The platform is currently live on testnet. No token has been confirmed, but if you're hunting for potential early opportunities, this is a good place to start.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News