On How the Rise of Legal Status Can Lead DAOs Out of the Utopian Dilemma

TechFlow Selected TechFlow Selected

On How the Rise of Legal Status Can Lead DAOs Out of the Utopian Dilemma

After intense debate, the Utah State Legislature narrowly passed H.B. 357, the "Decentralized Autonomous Organization Amendments," granting DAOs recognition as independent legal entities in the United States.

Author: zf857.eth

On March 1st, local time in the United States, after intense debate, the Utah State Legislature narrowly passed H.B. 357 — the Decentralized Autonomous Organization Amendments Act.

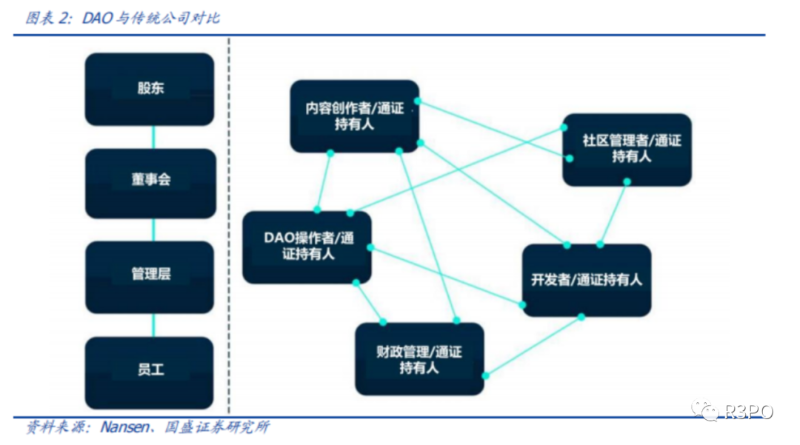

A DAO (Decentralized Autonomous Organization) is a governance structure or organizational form. Traditional organizations operate under a top-down hierarchical model—goals and tasks are cascaded down through layers, with members completing tasks for compensation, forming a pyramid-like system. In contrast, a DAO brings together individuals who share common beliefs, enabling them to participate in governance through proposals, voting, bounties, and other mechanisms, incentivized by token rewards. It emphasizes fair distribution of benefits and an egalitarian environment where power is decentralized and every member can exercise authority.

Before 2021, DAOs Lacked Clear Legal Entity Status

Prior to 2021, DAOs had very few viable options to establish themselves as legal entities. Even in jurisdictions that allowed DAO registration, excessive compromises were often required. For example, some demanded that DAOs maintain a full list of members’ names and addresses, appoint a board of directors or trustees with decision-making power over the organization, and keep written records of meeting decisions.

First, it's important to understand that in the U.S., if an organization isn't registered as a legal entity, it is essentially unrecognized by the government. Much of the modern economy depends on organizations having legal standing. Whether large or small, for-profit or nonprofit, traditional companies or associations typically begin by establishing a legal entity—usually in the form of a corporation, foundation, or limited liability company (LLC). This leads to a key issue: when a group operates a shared enterprise without formal legal status, U.S. law treats them as a general partnership. What problems arise when a DAO is treated as a general partnership?

In a general partnership, each individual is personally liable for the actions of the organization and of other partners. Thus, in cases of fraud, hacking, or accidents involving a DAO, innocent participants may be held legally accountable.

Legally, general partnerships lack independent legal personality. This means they cannot sign contracts, open bank accounts, own property, sue or be sued, or hire employees—critical limitations especially when most DAOs want to own intellectual property such as logos and trademarks.

Tax issues: profits from a general partnership are taxed at the individual level. If you hold a 10% stake in such a partnership, you must pay taxes on 10% of its profits. The same applies to DAOs operating under this structure.

After 2021, DAOs Were Incorporated into the LLC Framework

On April 21, 2021, the Governor of Wyoming signed Senate File 38, making Wyoming the first state in history to recognize DAOs as limited liability companies (LLCs), effective July 1, 2021.

In February 2022, the Republic of the Marshall Islands passed the 2022 DAO Act, allowing DAOs to register as LLCs and be officially recognized as DAO LLCs. The act also enables both for-profit and nonprofit DAOs to register, provides definitions and regulations regarding formation, protocols, and smart contract usage, and allows legal entities registered in the country to formally adopt DAO structures and governance tools.

On April 6, 2022, Tennessee followed suit by passing legislation recognizing and allowing LLCs to register as "DAOs," aiming to make "Tennessee the Delaware of DAOs." According to State Representative Jason Powell, “With this new business structure, Tennessee will become a beacon for blockchain investment and new jobs… just as Delaware became the hub for traditional LLCs or South Dakota for credit card companies.”

Since 2021, DAOs have been integrated into the LLC framework, giving them the option to engage formally with authorities and legal systems. Wyoming, Tennessee, and the Republic of the Marshall Islands have all enacted laws allowing DAOs to register as LLCs—highly flexible and powerful legal forms tailored specifically for DAOs while retaining all the benefits of traditional LLCs.

Additionally, some DAOs opt for alternative structures such as Colorado’s Limited Cooperative Associations (LCA), Unincorporated Nonprofit Associations (UNA), or establish foundations in Switzerland, the Cayman Islands, or the British Virgin Islands. Since 2021, hundreds of DAOs have incorporated in these jurisdictions, enabling access to banking services, protecting members from personal liability, and ensuring proper tax compliance.

However, these forms are not pure DAOs. Regardless of which legal wrapper is used, fundamentally they involve layering existing legal structures around a DAO. In essence, there was previously no standalone legal concept of a "DAO"—it was an LLC, a corporation, a cooperative, a foundation, or a trust, merely adopting DAO-style operations.

In 2023, Granting DAOs Independent Legal Personality

On March 1, 2023, Utah passed its DAO bill, officially recognizing decentralized autonomous organizations as legal persons. Now, blockchain-native organizations known as DAOs no longer need to wrap themselves within existing corporate structures—they can directly benefit from formal legal status. The Utah DAO Act grants DAOs legal recognition and limited liability protection, overcoming the limitations of earlier “LLC-wrapping” approaches.

This means DAOs no longer need to be structured as variants of LLCs; the DAO organizational form itself has now become an independently recognized legal entity under Utah law. According to R3P0 research, the following aspects of the bill are particularly noteworthy:

DAOs possess legal personhood, but with limited liability—their liability capped at the total assets of the DAO. Individual members bear no personal liability, except in special circumstances where responsibility may be allocated based on voting power.

Establishes clear and nuanced tax treatment aligned with current DAO functionalities, introducing new tax language that accommodates the complexity of DAO taxation.(Section 48-5-406(1): If a DAO recognized under this act qualifies to elect classification as a corporation for federal tax purposes and makes such an election, the DAO shall be subject to the provisions of Title 59, Chapter 7, Corporate Franchise and Income Tax Act. (2)(a) Unless the DAO makes the election described in subsection (1), a DAO recognized under this act shall be classified as a partnership for tax purposes and governed by the provisions of Title 59, Chapter 10, Part 14, Pass-Through Entities and Pass-Through Entity Taxpayer Act. (b) For tax purposes, the DAO shall allocate shares of income, gains, losses, deductions, and credits arising from DAO activities to each DAO member proportionate to their membership interest in the entity.)

No implied fiduciary duties apply to DAO participants, unless explicitly defined as applicable.

Uses "articles of organization" (instead of operating agreements) to protect anonymity and editorial rights of DAO owners/participants.

Includes technical gatekeeping mechanisms to ensure that only genuine DAOs qualify.

A DAO has no designated managers; all members are considered co-managers. All governance token holders are recognized as DAO members (with specific rules for delineation).

In short, Utah has introduced a more comprehensive and targeted compliance framework. An LLC is not a DAO, and a DAO is not an LLC. The Utah bill clearly distinguishes between the two, providing greater clarity and protection for DAO participants, enabling experimentation and innovation. The effective date of the law is set for 2024. According to the Utah Legislature, this compromise allows an additional year to refine, adjust, and ensure smooth implementation of the actual legislation.

Can DAOs Escape the Utopian Dilemma?

Will Formal Legal Recognition Make DAOs Less 'Decentralized'?

A common concern among many DAOs considering incorporation is whether legal compliance might undermine their decentralization, thus contradicting core Web3 values. However, in practice, the absence of regulation often allows actors to misuse “decentralization” as a shield for malicious behavior.

At the end of last year, in the CFTC’s lawsuit against Ooki DAO, bZeroX transferred control of the bZx protocol (now Ooki) to bZx DAO (now Ooki DAO) precisely to exploit its decentralized nature and evade regulatory enforcement. The founders of bZx attempted to use the DAO’s decentralized characteristics to avoid legal accountability.

The spirit of “decentralization” remains central to Web3 communities, but one must never underestimate human malice. With Utah’s passage of the DAO bill, DAOs now gain formal legal status. Regulation, rather than stifling innovation, actually protects DAO members. Notably, many details in the new law reflect deep respect for decentralization, imposing minimal constraints on internal coordination and decision-making mechanisms. This balanced approach—embracing innovation while rejecting uncontrolled growth—is commendable.

DAO Business Models May Finally Become Viable

Some specialized DAOs already operate in vertical sectors, offering professional and paid services. These function similarly to partnership firms: initiators with strong expertise and extensive networks form early core teams with trusted collaborators, then onboard community members to work collaboratively within the DAO’s consensus framework, delivering services and charging fees. Such DAOs typically have high entry barriers, remain relatively small in scale, yet foster strong community culture and execution capability. With Utah’s new DAO legislation, these types of DAOs are poised for explosive growth. They feature clear role divisions—contributors, consumers, investors—including examples like FWB, Water & Music, StoryDAO, IndexCoop, and LegalDAO.

Development of DAO Tools Fuels Ecosystem Formation

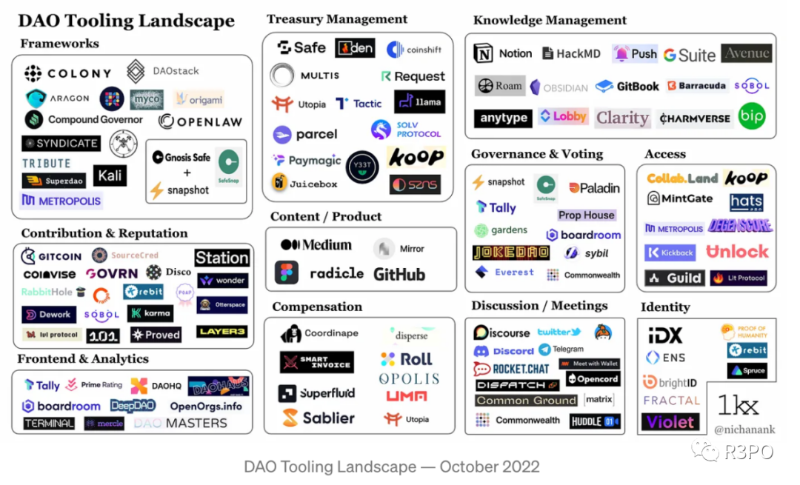

The past year—from Celsius Network to FTX’s collapse—has served as a wake-up call, highlighting the necessity of decentralized asset management and decision-making, which will inevitably drive a DAO renaissance. As blockchain technology continues to evolve, DAO tools will make future applications leaner and more efficient. Governance, proposal submission, and voting are essential components of DAOs, with nearly a million active voters and proposers requiring robust tools to ensure fairness and efficiency. Additionally, a DAO treasury is vital—it fuels the organization’s mission. To ensure secure and effective management, especially when interacting with DeFi protocols, high-quality tools are essential to prevent hacks and errors.

Today, a mature ecosystem of interwoven DAOs and DAO tools has emerged, addressing well-established needs with sophisticated solutions. Beyond protocol templates like Aragon, Tally, and Moloch, new L2 chains designed specifically for DAOs are appearing. Q.org, an EVM-compatible L2 chain, offers various template tools to attract DAO deployments and has already received investment from Hashkey. Other comprehensive DAO tool platforms such as DAOlens and Web3CRM demonstrate strong capabilities across UI design, application scenarios, and understanding of DAO governance principles—evolving into a new era of maturity.

In the near future, participating in a DAO could be as seamless as interacting on social media. Achieving this next level requires integration with existing legal frameworks. Simultaneously, continuous technological innovation will propel DAOs toward maturity and integration with the broader global production economy. Regulatory compliance provides the foundational soil for DAOs to take root in reality, while technological breakthroughs serve as nourishment. As DAO legislation improves and matures, achieving true legal compliance with clearly defined rights and responsibilities, transparent tax rules, and practical operational viability, concerns about DAOs being incompatible with real-world systems will gradually fade. Increasingly, people may soon adopt DAO structures as standard corporate models. The revival of DAOs will no longer be a mirage or mere theory—it will become tangible reality.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News