GameFi 2022 Annual Report and 2023 Outlook

TechFlow Selected TechFlow Selected

GameFi 2022 Annual Report and 2023 Outlook

Over the past three years, the Web3 industry has witnessed the flourishing of the GameFi ecosystem, with rapid growth in both game categories and numbers.

Over the past three years, the Web3 industry has witnessed the flourishing of the GameFi ecosystem, with rapid growth in game categories and numbers. As a GameFi developer community, SparkX has long been closely monitoring the GameFi market together with practitioners and enthusiasts. This time, SparkX collaborates with Footprint Analytics, a leading Web3 data analytics platform, to release the "GameFi 2022 Annual Report and Outlook for 2023." The report reviews 2022 GameFi projects through various rankings and player voting, and provides analysis and outlook on the GameFi sector from 2022 to 2023 across project data, ecosystem development, and evolution of project models.

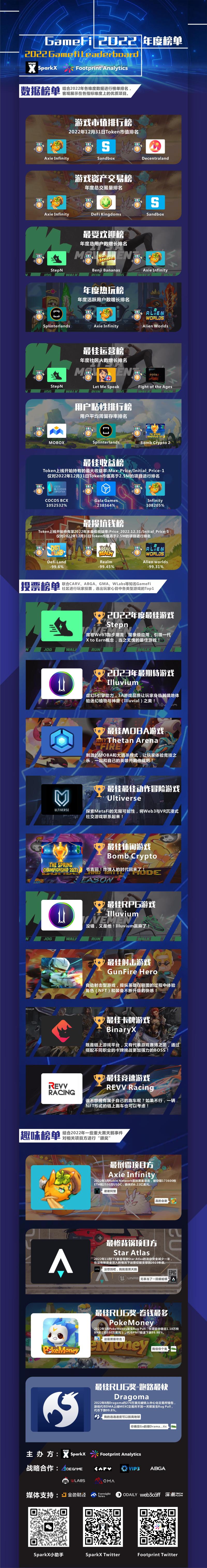

GameFi 2022 Annual Rankings

Detailed ranking data available at:Data Rankings

2022 GameFi Market Review and 2023 Outlook Report

I. Overall Review:

2022 was the darkest year for the GameFi sector. StepN went viral but could not withstand macroeconomic pressures. With black swan events including the collapse of Luna, bankruptcy of 3AC, FTX implosion, and DCG liquidation, GameFi entered its darkest period—token market cap dropped by 87% throughout the year, and most GameFi tokens fell over 90%. At the beginning of 2022, GameFi token market cap accounted for 0.9% of the entire crypto market; by year-end, it had declined to only 0.5%, underperforming the broader crypto market.

85% of GameFi projects have fewer than 1,000 users. In 2022, the number of GameFi protocols increased by 49% year-on-year to reach 2,171, yet the number of active protocols with DAU above 100 continued to decline. Only 14.5% of GameFi protocols attracted more than 1,000 users, and 98% failed to achieve an average weekly retention rate of 10%. During this bear market, declining ROI left most games without genuine gameplay stuck in stagnation, awaiting demise.

Some GameFi players remain resilient. By the end of 2022, DAU had dropped 57% from its peak but remained stable at over 750,000. Affected by falling token prices, GameFi’s average monthly trading volume declined by 98%, yet the number of monthly transactions stayed steady between 130 million and 185 million. Among top-performing protocols by DAU, many are Web2 games adapted onto blockchain, such as Splinterlands (Hearthstone), Galaxy Blocks (Tetris), and Benji Bananas—indicating that what keeps players engaged is primarily the fun and appeal of the games themselves, not just ROI from trading.

Increased capital interest and strong entry of Web2 gaming giants suggest 2023 may become a year of GameFi buildout. Within the crypto market, GameFi ranked first in funding share for both 2021 and 2022. Although its funding share decreased by 2% year-on-year, total funding amount rose 84% to $5.4 billion. Notably, 80% of the annual funding occurred in the first half of 2022, after which extreme market conditions shifted investor sentiment from proactive to cautious. Meanwhile, major Web2 gaming companies like Epic Games, Square Enix, and Ubisoft made aggressive moves into Web3. Epic Games raised $2 billion in April 2022 specifically for GameFi expansion—the largest single funding round of the year. The involvement of these Web2 giants will enhance the professionalism of GameFi projects and bring wider adoption among traditional Web2 users, signaling that poorly designed, unattractive "mining games" will gradually exit the stage.

For more 2022 data, read Footprint Analytics’ GameFi Annual Report.

II. Infrastructure Ecosystem Outlook:

General-purpose blockchains like BNB Chain and Polygon lead the GameFi market. In terms of total GameFi protocols, BNB Chain (747), Ethereum (599), and Polygon (305) rank top three, maintaining leadership in gaming ecosystems. However, when looking at active protocols with DAU > 100, Polygon ranks first and BNB Chain second. Nearly 77% of Ethereum’s games were launched in 2021, and by the end of 2022, only Gala Game remained active—indicating Ethereum L1 is no longer developers' preferred chain. In terms of new protocol growth, BNB Chain and Polygon still rank first and second, with WAX third. BNB Chain leads Polygon by about two times in both total and newly added protocols, yet Polygon surpassed BNB Chain in active protocols by the end of 2022—suggesting Polygon hosts higher-quality games. BNB Chain, Polygon, and Ethereum remain key chains to watch in 2023.

-

In 2022, Polygon Studios invested in over 30 GameFi games totaling $341 million. Beyond direct investment, Polygon Studios partnered with multiple Web2 brands for further growth, including Mastercard Incubation Plan, Starbucks Odyssey Program, Disney Accelerator Program, Adidas and Prada NFT Launch—expanding GameFi’s development pathways.

-

In June 2022, Binance Labs announced the successful fundraising of a $500 million fund dedicated to identifying promising projects in DeFi, NFT, and GameFi. That year, Binance Labs invested in nearly 20 GameFi projects totaling over $1.91 million. Its Web3 Accelerator Program and Incubation Program provided substantial support to selected games, including now-prominent names like Axie Infinity, StepN, Ultiverse, Alterverse, and Gameta.

-

Although high gas fees and low TPS make Ethereum less attractive for GameFi projects today, its robust ecosystem support, along with ongoing developments in Ethereum 2.0 and sharding technology, means it could still make a comeback. Upcoming Ethereum-based titles like Illuvium and Big Time are worth watching.

Vertical chains like WAX and Hive operate quietly but profitably, while Immutable X and Arbitrum emerge as rising stars. Compared to general-purpose chains, vertical gaming-focused chains WAX and Hive significantly outperform BNB Chain and Polygon in average active users and transaction volume. However, their game ecosystems remain relatively narrow—WAX relies heavily on Alien Worlds and Farmers World, while Hive centers around Splinterlands. Immutable X, a dedicated gaming chain, raised $200 million in March 2022 led by Temasek, gaining visibility through popular titles Gods Unchained and Guild of Guardians. In June, it partnered with investors like Animoca and BITKRAFT to establish a $500 million ecosystem fund to advance GameFi. On Arbitrum, GameFi growth has largely stemmed from Treasure DAO's continuous development. Driven by hit game The Beacon, Arbitrum emerged as a new trend in the GameFi space by the end of 2022.

For more insights into current public chain ecosystems and future outlooks, please refer to the following article.

III. Narrative Review and Outlook

1. P2E → X2E → F2O / PlayFi / R2E

Whether it was the P2E wave sparked by Axie Infinity in 2021 or the X2E craze driven by StepN in 2022, once the market cooled down, all earn-centric GameFi projects inevitably spiraled into collapse. DeFi projects disguised as games are inherently unsustainable. Many teams are now exploring new economic models from different angles—for example, the Free-to-Own model (Limit break), which initially distributes NFTs for free to targeted users to bootstrap community growth; the PlayFi model (Nor), which focuses on gameplay quality while building an NFT + token governance economy outside the core game; and the Risk-to-Earn model (Trident), where winners gain rewards from losers based on match outcomes, helping resolve inflation issues in the economic system. Thoughtful economic design supports long-term stability. Teams innovating in tokenomics and utility applications in 2023 remain highly值得关注.

2. AAA vs. Casual Games

After the 2022 market cooldown, users began prioritizing game quality and playability, bringing AAA games into the spotlight—titles like Illuvium, Ultiverse, Big Time, Alterverse, Delysium, and Metalcore gained traction. However, due to high production costs and long development cycles, few have successfully launched so far. While AAA games continue to generate strong expectations in 2023, during their development gap, casual games—offering quick-to-implement fun mechanics—may become new focal points, such as the blockchain version of match-3 game Umi'Friends or Merge Bird inspired by Angry Birds. Additionally, Casual GameFi platforms like GameSpace are taking shape. With fast blockchain integration and reliance on proven Web2 hits, they can rapidly build extensive product matrices offering rich entertainment value. Furthermore, combining multiple games strengthens the platform’s overall economic model, mitigating the short lifecycle risks common in the Play-to-Earn era.

3. GameFi → DeGame

Currently, almost all GameFi projects follow the Web2 game + token incentive model, with core game logic running on centralized servers, and only tokens and NFTs placed on-chain. Project teams retain unchecked power, leading to serious moral hazards in unregulated environments and resulting in numerous GameFi rug pulls. In contrast, On-Chain Games place both core game logic and assets fully on-chain, better aligning with blockchain’s core principles of decentralization, permissionless access, and composability. Developers cannot unilaterally alter game rules, giving players greater control. Players can create in-game items and assets within defined parameters, and characters or items from different fully on-chain games can interoperate and combine. However, on-chain games demand extremely high network performance. Current public chains face computational speed and cost limitations that hinder progress. As various Rollup solutions mature, these performance bottlenecks may gradually be overcome. Emerging on-chain game teams such as Dark Forest, Lattice, MatchboxDAO, and Topology are worth tracking in 2023.

4. Land → Metaverse

Blockchain has long been seen as a foundational protocol for the Metaverse. Even during the economically weakest second half of 2022, Metaverse-related projects continued to attract strong funding. In August 2022, metaverse avatar platform Ready Player Me secured $56 million led by a16z; in September, sports metaverse company LootMogul received a $200 million investment from GEM; in November, Animoca Brands announced a $2 billion fund to support metaverse ventures. However, Metaverse land sales dropped over 96% in 2022—not only due to bear market effects but also because the utility bubble around virtual land burst. Virtual worlds lacking meaningful gameplay experiences fail to retain users long-term. In 2023, greater focus should shift toward real utility and user experience, seeking products that deliver genuinely engaging gameplay and immersive experiences.

Click this article to read about the evolution of GameFi models.

Conclusion and Acknowledgments

From a data perspective, 2022 was a turbulent year for the crypto market. Yet, judging by the proportion of on-chain transactions and Web3 investment activity, GameFi remains a powerful driving force even in the depths of winter. Beyond surface-level metrics, encouraging signs include the entry of Web2 gaming giants and professional game developers, growing infrastructure dedicated to Web3 gaming, and increasing interoperability among GameFi projects. As public chain infrastructures improve, innovative gameplay mechanics and novel economic models are emerging. Highly anticipated AAA games focused on superior user experiences—developed quietly throughout 2021 and 2022—are beginning to launch. 2023 promises to be a year full of potential for the GameFi sector.

About the Organizers:

SparkX: A developer DAO based in mainland China, targeting overseas and Web3 developers. Core contributors come from Tier-1 internet companies and Web3 backgrounds, aiming to bridge Web2 and Web3 by empowering high-quality developers comprehensively.

Footprint Analytics: The first no-code analytics platform in the crypto space. It also offers a unified data API enabling users to quickly retrieve NFT, GameFi, and DeFi data across more than 24 blockchains.

Special Thanks:

We thank Degame, CARV, VIP3, ABGA, Wlabs, and GMA partners for supporting the voting rankings, and Jinse Finance, Foresight News, Odaily Planet Daily, Web3Caff, and TechFlow for promoting the rankings!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News