A Deep Dive into Arcadeum: How This Arbitrum-Based Casino Attracts Liquidity by Borrowing from GMX and Curve Designs

TechFlow Selected TechFlow Selected

A Deep Dive into Arcadeum: How This Arbitrum-Based Casino Attracts Liquidity by Borrowing from GMX and Curve Designs

One of the main challenges GambleFi protocols will face is incentivizing liquidity.

Written by: DeFi Candle

Compiled by: TechFlow

One of the main challenges facing GambleFi protocols is incentivizing liquidity. They need liquidity to attract more users and, in turn, offer attractive real yields. So how does Arcadeum plan to achieve this by drawing inspiration from GMX and Curve's tokenomics?

What is Arcadeum?

Arcadeum is a decentralized casino built on Arbitrum, offering low fees and competitive advantages. Users maintain full control over their funds, with all bets processed on-chain—no registration or KYC required.

It uses Quantum Random Number Generation (QRNG), allowing users to know exactly what the true odds or house edge are, making the system resistant to manipulation.

Each bet consists of two transactions:

-

The first transaction requests one or more random numbers from the chain’s QRNG provider node, initiated by the player.

-

The second transaction fulfills the random number requirement from the first transaction.

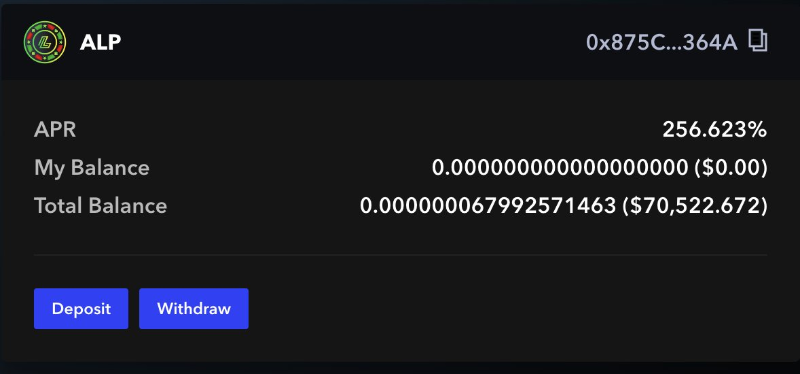

A liquidity pool called $ALP facilitates betting, with depositors receiving losses and paying out wins through this pool. Its composition is very similar to $GLP—entirely backed by USDT, so it has no volatility, and rewards are also paid in USDT.

Statistically speaking, over a long period, players tend to lose more than they win. This difference is where ALP generates its revenue—and why ALP maintains a positive APR.

-

More funds in ALP = higher maximum bet size.

-

Higher maximum bet size = increased betting volume.

-

Increased betting volume = higher ALP returns.

-

Higher ALP yields = more funds flowing into ALP.

This is known as the "ALP Flywheel."

Tokenomics

Arcadeum has four main tokens:

1. $ARC (the platform token), with a maximum supply of 10 million.

2. sARC, short for staked ARC.

3. xARC (burned ARC)—when ARC is converted to xARC, the underlying tokens are burned.

4. esARC (escrowed ARC), backed 1:1 by ARC but subject to vesting.

Revenue Sharing

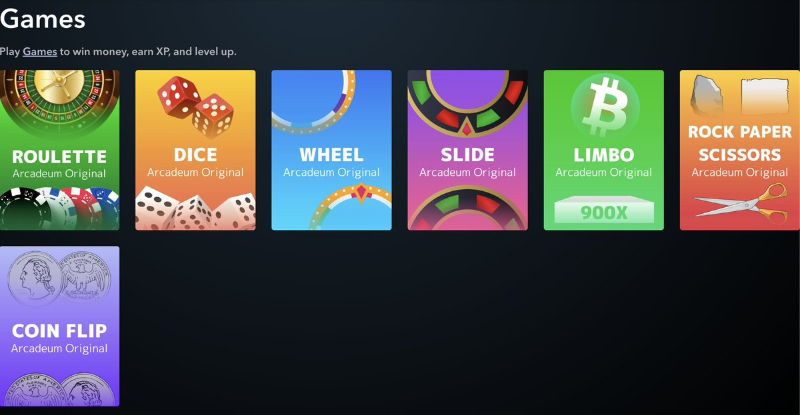

Arcadeum currently offers seven games:

1. Roulette

2. Dice

3. Wheel

4. Slide

5. Limbo

6. Rock Paper Scissors

7. Coin Flip

Each game generates revenue through fees.

These fees accumulate from multiple sources:

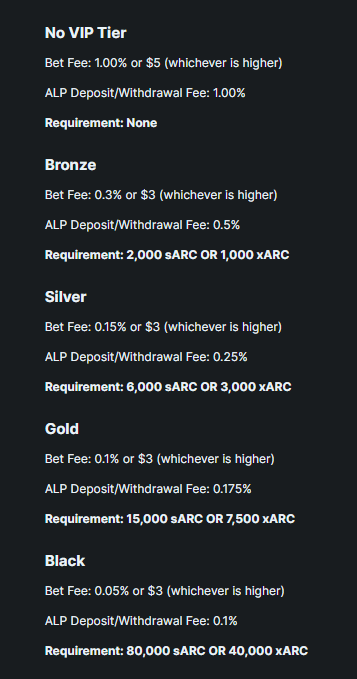

1. A betting fee charged on every wager

2. ALP deposit fees ranging from 0.1% to 1.00%

3. ALP withdrawal fees ranging from 0.1% to 1.00%

4. Uniswap V3 LP fees—all ARC fees are burned, while all wETH fees are distributed to stakers

5. Future fee additions aimed at increasing revenue

These fees are distributed to holders of the main tokens as follows:

✅ 70% of platform fees go to xARC holders.

✅ 15% go to sARC holders.

✅ 15% of fees go to esARC holders.

They also have a VIP system where users holding more sARC or xARC can reduce their betting fees and ALP deposit/withdrawal fees.

Upcoming Catalysts:

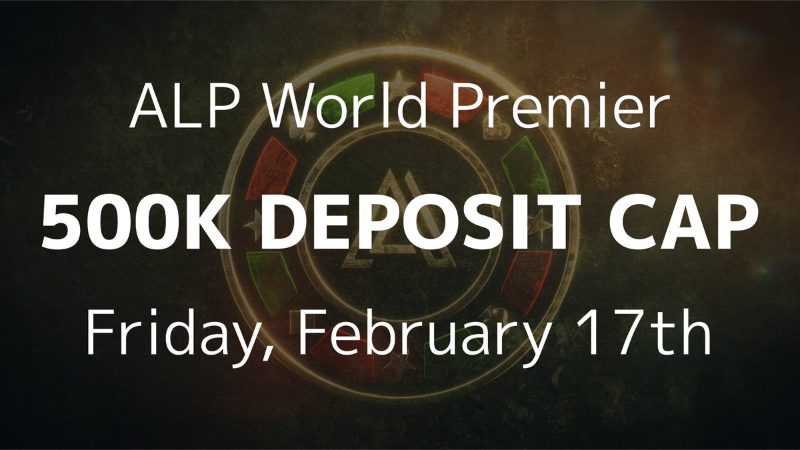

✅ Public launch of ALP

✅ Referral system rollout

✅ Expansion to cross-chain

✅ ALP will open to the public this Friday with an initial deposit cap of $500,000, which is expected to significantly boost the platform’s TVL.

Referral System: Referral commissions will be set at 20% of all betting fees generated by referred users. This feature is designed to encourage user acquisition and viral growth, accelerating platform expansion.

Going cross-chain will enable Arcadeum to generate more revenue, expand its user base, and become a dominant force in on-chain gambling.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News