Gone are the days of passivity and moderation: A deep dive into MakerDAO's new proposal — Spark Protocol liquidity market

TechFlow Selected TechFlow Selected

Gone are the days of passivity and moderation: A deep dive into MakerDAO's new proposal — Spark Protocol liquidity market

Overall, this is a new Maker: more aggressive and determined, rather than the mild and passive Maker we've seen so far.

Written by: Ignas

Translated by: TechFlow

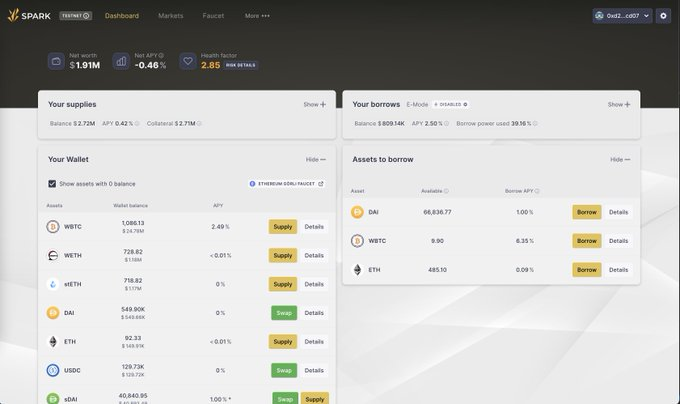

MakerDAO has just announced a new product called Spark Protocol, which can be seen as a competitor to Aave. Compared to Maker’s previous mild strategy of integrating $DAI into existing DeFi protocols, this marks a sharp turn—indicating that Maker wants to build its own DeFi ecosystem.

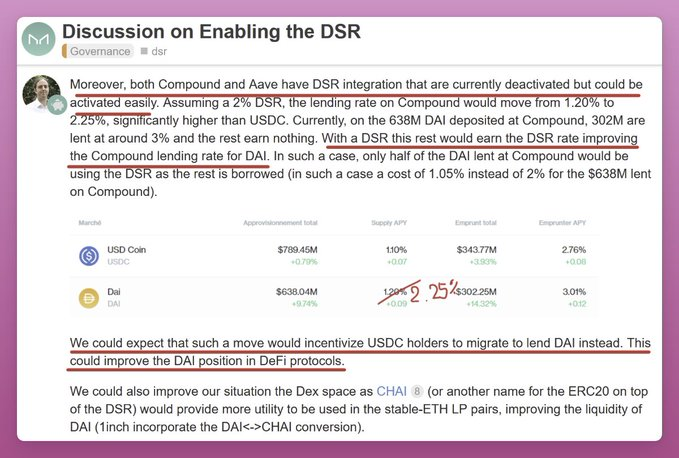

Maker's strategy has long focused on integrating $DAI into leading DeFi protocols. For example, Maker recently launched the Dai Savings Rate (DSR), offering 1% APY. The expectation was that Aave or Compound would integrate DSR, prompting USDC holders to shift to DAI.

But that hasn’t happened. Instead, Maker is now using DSR integration and centering an Aave v3 fork around EtherDAI. Sure, Aave could earn 10%, but the message is clear: thank you, we’re doing it ourselves now.

When you think about it, this isn’t surprising.

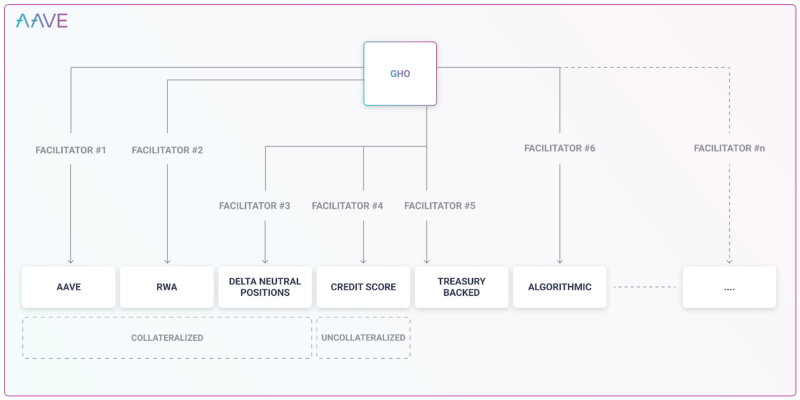

Aave is preparing to launch its own DeFi stablecoin, $GHO, clearly a competitor to $DAI. Curve is also launching its stablecoin crvUSD, and Curve is critical for DAI’s on-chain liquidity.

Compound’s V3 only supports USDC lending, while other crypto assets serve as collateral. I believe this new model poses a threat to DAI. Compound could have supported DAI, benefiting both protocols, but they chose not to.

Moreover, Maker is about to launch EtherDAI. Similar to Frax’s frxETH, EtherDAI is an ETH liquid staking derivative (LSD). This is a core component of Maker’s Endgame plan, positioning DAI as a neutral global currency.

At launch, EtherDAI will rely on Lido, as Maker currently lacks the infrastructure to run its own staking operations—but this may change in the future.

"This will help us capture market share in the fast-growing liquid staking derivatives (LSD) market."

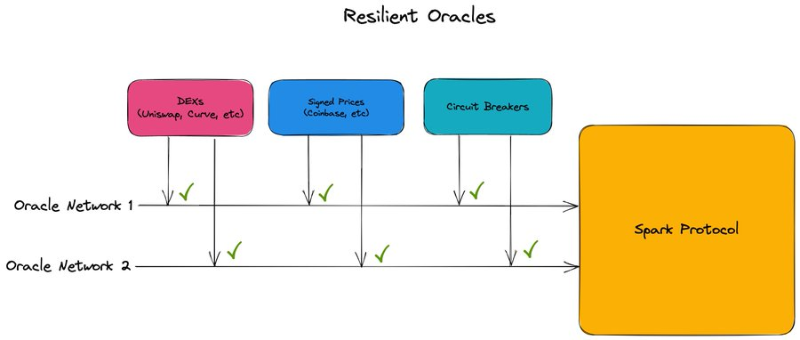

That’s not all. Maker’s Spark Protocol will support two oracles: Chronicle 3 (formerly Maker Oracles) and Chainlink.

This is an added security measure to prevent failure from a single oracle source. Spark Protocol will have its own token, but it will be fully owned by Maker’s $MKR. This part is confusing, so please wait for the team to clarify.

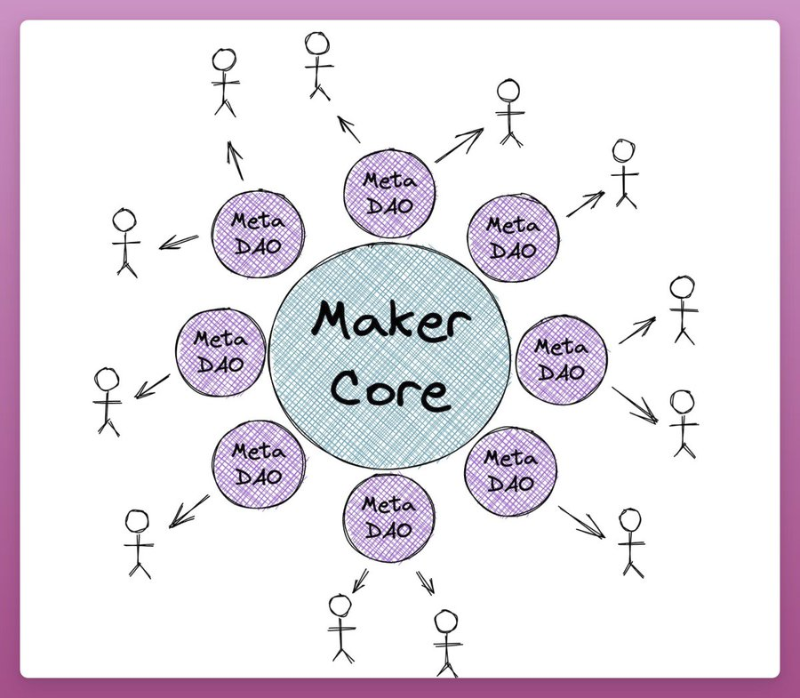

Maker’s Endgame plan involves creating MetaDAOs (or SubDAOs) to reduce governance complexity within Maker.

You can think of Maker Core as Ethereum L1: slow and expensive, but secure. The MetaDAOs are like L2 solutions: fast and flexible, deriving security from L1.

Each MetaDAO has a specific mission. Spark Protocol will serve as the foundational lending protocol for all current and future Maker services, such as DAI or EtherDAI.

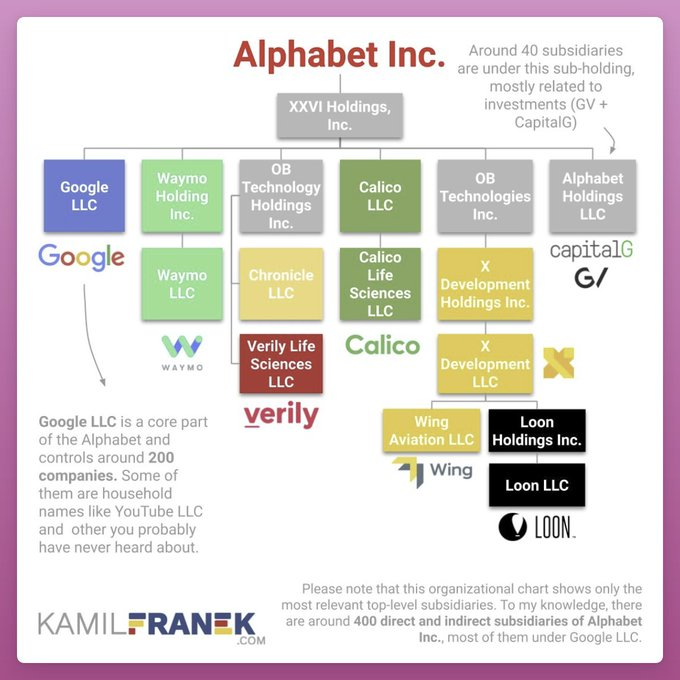

It’s like Google’s Alphabet: Maker Core is Google, and the MetaDAOs are the “Alpha Bets.” Each MetaDAO will launch a token through yield staking—this is how we’ll get the Spark Protocol token, with no presale or public sale.

MakerDAO’s Endgame plan anticipates potential major regulatory setbacks along with global economic and social downturns. To adapt, survive, and recover, Maker will operate under three states: Pigeon, Eagle, and Phoenix.

Maker is currently in the first state: Pigeon. The goal here isn’t to limit exposure to RWAs, but to keep DAI pegged 1:1 to the dollar. Maker can tolerate minor regulatory threats to maximize yield from RWAs as much as possible.

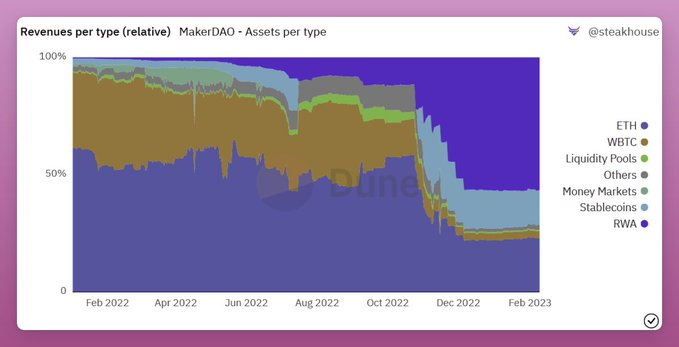

In practice, Maker has already derived 57% of its revenue from RWAs. Spark Protocol will help increase DAI supply, generating even more yield. It could also integrate Element Finance and Sense Finance, enabling fixed-rate lending and diversified income streams.

I bet Aave or Compound will soon support DSR. Overall, this is the new Maker: more aggressive and determined, rather than the mild and passive Maker we’ve seen so far.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News