Gumball: How to drive NFTs with native tokens to maintain perpetual liquidity?

TechFlow Selected TechFlow Selected

Gumball: How to drive NFTs with native tokens to maintain perpetual liquidity?

Gumball is a new iteration of the NFT/ERC-20 pair that Sudoswap completely overhauled in the summer of 2022.

Author: Degen Sensei

Compiled by: TechFlow

The NFT season is back. It's exciting when NFT prices rise and there are always buyers willing to pay—but the game stops being fun when trading volume slows down and you can't find anyone to take your JPEG off your hands.

NFTs rarely go to zero; people just stop buying them because they’re illiquid assets.

Sudoswap was the first protocol to tackle this issue by creating NFT liquidity pools that pair NFTs with ETH via bonding curves.

The Gumball Protocol takes a slightly different approach to ensure NFTs on its platform always maintain liquidity.

What Is the Gumball Protocol?

Gumball is a platform facilitating NFT creation and asset trading. They aim to solve the lack of liquidity in NFTs by creating a unique ERC-20 token for each collection, enabling instant liquidity.

While some NFT collections may reach high valuations, there aren’t always buyers available, making it difficult to turn these valuations into liquid assets. This is precisely the problem Gumball aims to alleviate by defining how NFTs and ERC-20 tokens are exchanged through bonding curves.

How Does It Work?

The protocol architecture consists of three main components. The first is the Gumball Factory, which deploys new NFT collections by creating gNFTs (Gumball NFTs). When a collection is created, it interacts with an ERC-20 bonding curve—similar to Sudoswap, but using the native GBT token instead of just ETH. What makes this possible is the Gumball Factory, which enables seamless conversion between GBT and gNFTs at any time.

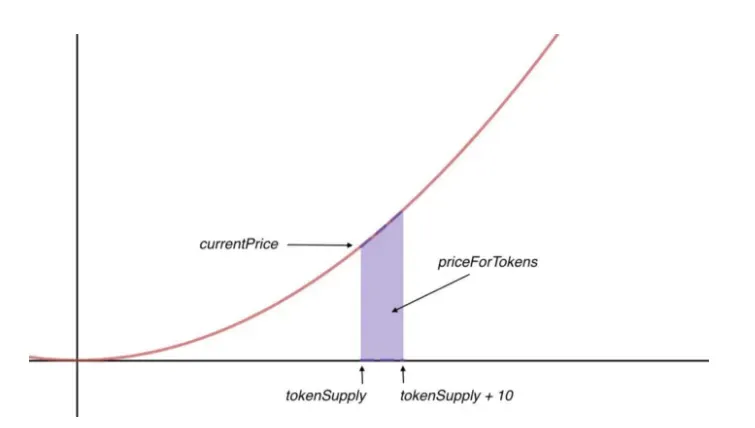

Bonding Curves

Prices are determined by the Gumball Token (GBT) paired with ETH, rather than setting NFT floor prices based on ETH trading activity. The price of GBT is controlled by a bonding curve: each purchase increases the GBT price, while each sale decreases it.

As buyers and sellers reach equilibrium on token value, high volatility at specific price points stabilizes over time. Transaction activity from users interacting with the bonding curve generates fees, which are retained within the protocol’s liquidity via Gumbar.

Gumbar

Gumbar allows users to earn trading fees generated from active pairs by staking GBT and gNFTs, thus benefiting from trading activity within NFT collections. This helps the protocol maintain liquidity—the most critical component of DeFi and a persistent challenge surrounding NFTs.

Protocol Value Accumulation

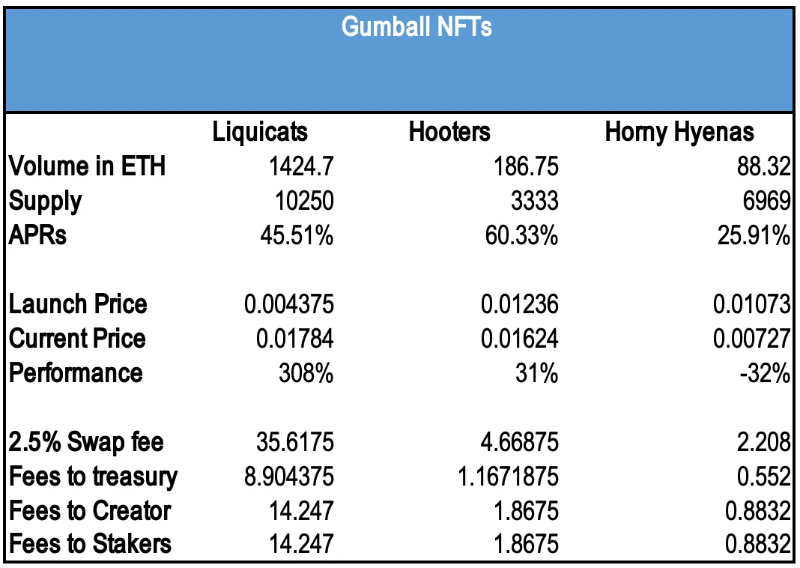

Although the Gumball Protocol has not yet announced any token launch, the protocol still has ways to accumulate value. Looking at the top three NFT series on the platform, we see the following figures:

These numbers are based on just three NFT collections currently added independently to the platform. We can expect fees to grow as Gumball launches more series, especially if marketing efforts increase. By helping creators promote their products to their communities, the protocol partially removes one of the biggest barriers creators face.

Based on a 2.5% fee generated from swaps, the distribution is as follows:

-

0.5% of the swap fee goes to the Gumball treasury.

-

1% of the swap fee goes to the creator.

-

1% of the swap fee goes to GBT/gNFT stakers who facilitate swaps and maintain liquidity within the protocol.

At the current ETH price (as of writing), the protocol has generated approximately $17,688.37 since January 10. Over the past 25 days since launch, daily revenue stands at $707.

On an annualized basis, the protocol generates $707.53 × 365 = $258,248.

While the protocol’s economics are well-structured to align creators, the protocol, and users appropriately, launching a token currently makes little sense—governance isn’t needed (unless adding whitelist barriers), and revenue hasn’t reached levels requiring fee-sharing mechanisms.

Opportunities and Drawbacks

Since gNFTs can freely exchange with their own GBT, successful tokens give creators greater control and allow usage outside the protocol—for over-collateralized loans and integrations with other protocols—enhancing further utility for NFT collections (likely only viable for blue-chip projects). However, compared to using ETH alone, this also weakens liquidity, as ETH is clearly the most liquid asset in the market after USDC.

Nevertheless, many NFT series eventually create their own ERC-20 tokens anyway.

Additionally, since NFTs created on the Gumball Protocol can also be listed on other exchanges like OpenSea, arbitrage opportunities and inefficiencies will emerge, causing discrepancies between the ETH value on Gumball and the GT value. The danger here is that if these NFTs gain traction on OpenSea, holders will flock to wherever liquidity is highest. This leaves stakers tied to the collection—and the protocol itself—without income.

Security

Gumball was audited in December 2022 by PeckShield, a Tier-A auditing firm. They concluded that although several issues were identified—including one medium-severity bug and two low-severity bugs—the smart contracts were generally well-designed by the team.

Prior to the PeckShield audit in December 2022, the protocol was also audited by Zokyo in June 2022 and passed initial review (though contract modifications afterward prompted a second audit).

Conclusion

Gumball represents a new iteration of the NFT/ERC-20 pair model revolutionized by Sudoswap in the summer of 2022. It’s an intriguing concept for creating instant liquidity for NFTs while ensuring users, creators, and the protocol are all aligned through properly tuned incentives.

It competes in a crowded NFT marketplace alongside other Ethereum-based exchanges, but if Arbitrum experiences an NFT boom, Gumball will be well-positioned. While they haven’t signaled any plans to launch a token, engaging with the platform early could prove rewarding in the long run.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News