A Quick Overview of Emerging Challengers in the DEX Derivatives Sector: Vela Exchange, Y2K, NFT Prep...

TechFlow Selected TechFlow Selected

A Quick Overview of Emerging Challengers in the DEX Derivatives Sector: Vela Exchange, Y2K, NFT Prep...

DEX derivatives exploded in 2022, with major players including $GMX, $PREP, $GNS, and $DYDX.

Written by: Viktor DeFi

Compiled by: TechFlow

DEX derivatives exploded in 2022, with major players including $GMX, $PREP, $GNS, and $DYDX. More importantly, new participants are emerging in 2023.

Overview

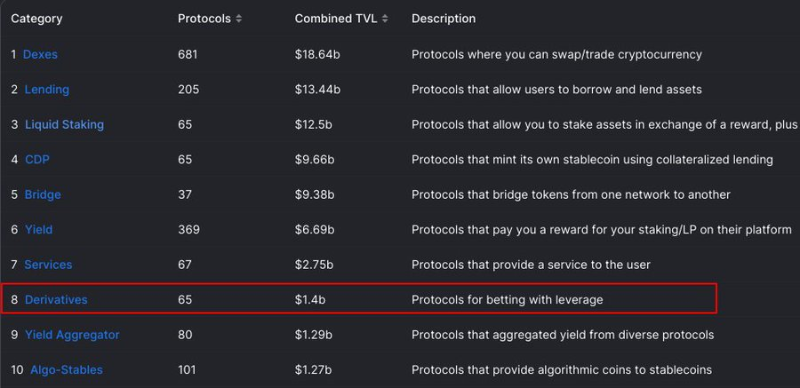

Derivatives are financial contracts that derive value from an underlying asset, group of assets, or benchmark. Some common derivatives include futures contracts, DOVs, and swaps.

Moreover, derivatives represent the world’s largest financial market, with an estimated notional value between $600 trillion and $1 quadrillion. Just imagine—if TradFi derivatives are this massive, then on-chain derivatives also hold enormous potential.

Since the 2021 bull run, crypto derivatives have steadily grown on both centralized and decentralized exchanges. However, due to FTX's collapse and the rising need for self-custody, there has been a clear recent shift toward DEX derivatives.

Users also prefer DEX derivatives for the following reasons:

-

They offer real yield;

-

To hedge against market risks;

-

Organic growth;

-

Capital efficiency.

Key Players

One of the easiest ways to quantify narrative growth is to examine its key players.

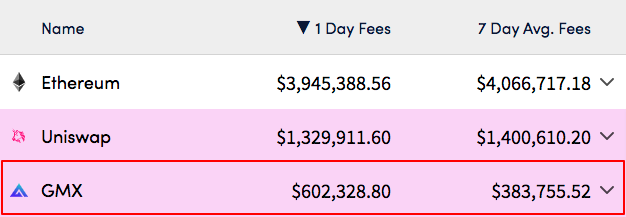

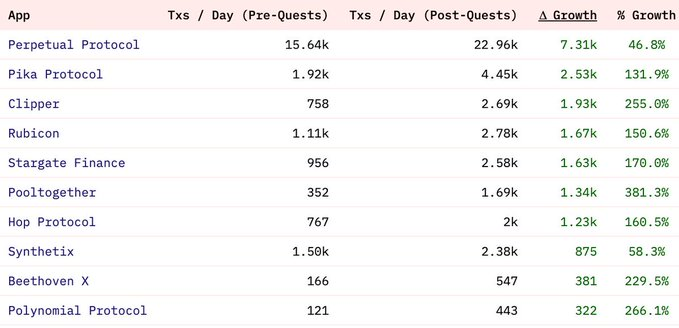

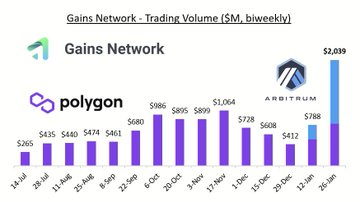

So far, top-tier DEX derivatives such as GMX, Gains Network, dYdX, and Perp have performed exceptionally well.

-

GMX ranks among the top three highest revenue-generating protocols.

-

Gains Network recently surpassed $1 billion in weekly trading volume.

-

Perp Protocol leads daily trading volume on Optimism.

New Entrants

Recently, several promising new DEX derivatives have emerged. They may carve out a space for themselves in the next wave of derivative growth and institutional adoption.

Let’s take a look at the following five (in no particular order).

1/ Vela Exchange

With Vela Exchange, users can create positions with up to 100x leverage on the performance of synthetic assets. The platform features an incredible reward structure and innovative technology.

2/ Prep88

Built on Polygon, Prep88 is a perpetual exchange offering up to 88x leverage and low trading fees.

Prep88 also stands strong in the real yield narrative: it currently offers approximately 15% APR.

3/ El Dorado Exchange

El Dorado is a decentralized spot and perpetuals exchange offering up to 50x leverage and low but real yields.

Trading on El Dorado is backed by three pools that earn LP fees from market makers, swap fees, and leveraged trades.

4/ Y2K

Y2K Finance, built on Arbitrum, allows users to hedge risks associated with pegged assets. Essentially, users can "sell" or "buy" insurance on pegged assets by depositing $ETH into various Y2K vaults.

5/ NFT Prep

NFT Prep is bringing innovation to the on-chain derivatives space. It is arguably the first perpetual futures DEX enabling users to go long and short on NFT trades.

Most importantly, users can trade with up to 5x leverage.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News