Everything You Need to Know About Tetraguard: A Decentralized ETF and Real Yield Narrative Protocol

TechFlow Selected TechFlow Selected

Everything You Need to Know About Tetraguard: A Decentralized ETF and Real Yield Narrative Protocol

If the world doesn't give us a cryptocurrency ETF, DeFi will provide us with a decentralized ETF.

Written by: RiddlerDeFi

Compiled by: TechFlow

The collapse of FTX reminds us that cryptocurrency needs decentralization. If the world won't give us a crypto ETF, DeFi will build a decentralized ETF for us. This article dives deep into $TETRA and $QUAD.

TL;DR

Tetraguard is a decentralized ETF protocol on Ethereum, where major cryptocurrencies and $PAXG are collected in fixed percentages within the $TETRA token and algorithmically rebalanced. Meanwhile, $QUAD is a fee-sharing token.

$TETRA, composed of $ETH, $wBTC, and wrapped $PAXG, lost only 3% during the recent crash triggered by FTT. Its fee-sharing Quadron token $QUAD suffered no losses at all.

What exactly is this project?

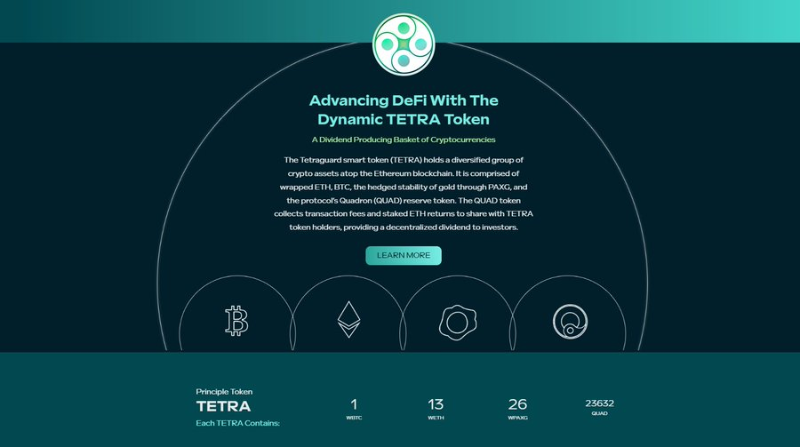

Tetraguard is a decentralized ETF built around the $TETRA token. With the recent inclusion of $PAXG, it has also become an excellent tool for hedging against crypto volatility.

To avoid common problems in crypto, $TETRA relies on DeFi mechanisms and smart contracts: an integrated AMM and an automated mechanism controlling the supply of $TETRA.

Thanks to blockchain technology, this ETF is fully decentralized and censorship-resistant.

How does it work?

$TETRA is the primary token, composed of major cryptocurrencies and $QUAD: 1 $WBTC, 13 $WETH, 26 $WPAXG, and 23,632 $QUAD.

$PAXG serves as a hedge against crypto volatility—so what is $QUAD?

$QUAD is a fee token that also captures $ETH staking rewards. Every buy/sell transaction on the $TETRA AMM incurs a 1% fee. Combined with $ETH staking rewards, this revenue is automatically distributed to all holders.

Since PAXG holds 51% in U.S. Treasuries, $TETRA offers its holders a safer exposure to BTC and ETH, while the $QUAD token acts as the growth engine of the ETF. Most $QUAD tokens are staked or locked within the $TETRA portfolio.

Here’s a deeper look at the mechanism:

-

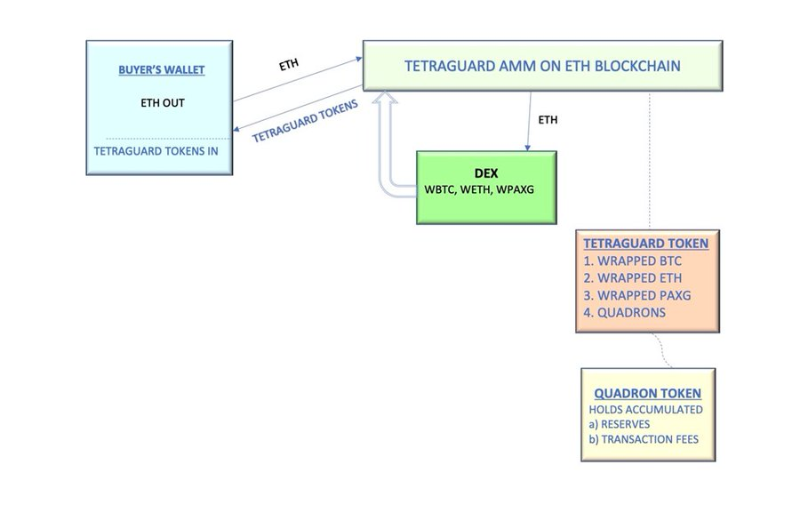

Buyers send their $ETH to Tetraguard’s built-in AMM.

-

The AMM swaps $ETH into $WETH, $BTC, $PAXG, and $QUAD.

-

It mints the corresponding $TETRA and sends it to the buyer’s wallet.

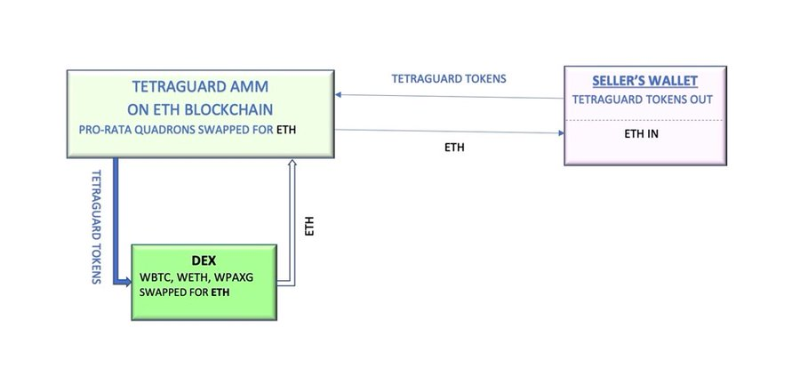

$TETRA holders can redeem their tokens for $ETH at any time. When they send $TETRA to the AMM, the contract automatically exchanges it back into the four component tokens, converts everything into $ETH, returns the $ETH to the seller, and burns the $TETRA.

Tokenomics

Although calling it a token basket might be more accurate, Tetraguard indeed operates a dual-token system.

$TETRA corresponds to a fixed percentage of the four component tokens, and early buyers receive $QUAD rewards.

A Tbit is the smallest unit of $TETRA, where 1 Tbit = 0.0000423 $TETRA.

$QUAD is the defining feature of this protocol, driving it toward the real yield narrative.

Due to the 1% fees and $ETH staking rewards, its growing liquidity enables holders to generate profits even during bear markets.

Thanks to this system, Tetraguard is one of the best-performing tokens currently available.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News