The investment narratives throughout 2023: ETH/L2s, AI, app chains...

TechFlow Selected TechFlow Selected

The investment narratives throughout 2023: ETH/L2s, AI, app chains...

Take a long-term view of 2023.

Written by: Aylo, Alpha Please

Compiled by: TechFlow

In 2023, which project are you most confident in?

I asked this question on Twitter and received a large number of interesting responses from my followers. I’d like to highlight some replies that resonated with me and use them to elaborate on my own thoughts across different sectors.

I expect some of these ideas to generate solid returns in 2023, but undoubtedly many won’t pan out in the short term, and there will also be plenty of incorrect takes. This is absolutely not investment advice.

Overall Crypto Market in 2023

I personally believe Bitcoin and Ethereum have entered their cyclical bottoms, and expect both to end the year at higher valuations than where they started.

Although I anticipate market challenges in Q1 due to macroeconomic factors, I see this year being characterized by significant volatility. This presents a rare opportunity to acquire assets with strong multi-year growth potential. Take a long-term view on 2023.

ETH & L2s

Ethereum has The Merge and continues improving its tokenomics. Beacon chain withdrawals are imminent, and by year-end, the proportion of staked ETH will rise significantly. Ethereum is poised to outperform Bitcoin in the foreseeable future.

Relative to other parts of the market, liquid staking derivatives have performed quite well recently. LDO, RPL, and FXS are expected to grow their user bases and TVL. The safest choice remains the market leader—LDO.

The L2 market will continue maturing. All major rollup projects will offer ecosystem investment opportunities. I’ve been very bullish on Arbitrum and expect another strong year of growth. I also believe OP Stack will gain widespread adoption in 2023—it’s becoming the “ERC20 standard” for building L2s.

Many ZK-based L2s will launch in 2023, and we’re likely to see multiple L2 token launches. For many, one of the most profitable investments in 2023 may be capturing L2 airdrops.

Our space will make progress toward achieving interoperable gaming worlds. Betting on any single gaming token is quite risky, but one project allows you to invest in the broader growth of interoperable gaming tokens: MAGIC.

AI

Everyone knows artificial intelligence will accelerate throughout this decade, but (at least for me) it's still unclear how crypto investors can best capitalize on this trend. It's not an area where I have a competitive edge.

That said, I've been researching TAO for some time, and it appears to be a project capable of leading in this category.

With ChatGPT’s recent valuation reaching $29 billion, the AI narrative is heating up. I believe it could persist through 2023, but the largest gains might come years later.

Storage

We must have storage-centric blockchains—an appealing category for long-term investors.

Solana has already migrated all of its data to Arweave.

Appchains

ATOM should be the primary beneficiary of the appchain movement. Version 2.0 will eventually launch, and interchain security will add more value to the token.

dYdX’s migration to the Cosmos ecosystem signals developer trust in the platform.

Over the past six months, ATOM has also been one of the strongest-performing L1 tokens—a trend likely to continue into 2023.

I’ll also be watching the launch of Sei Network. Sei is an orderbook DEX chain built using the Cosmos SDK, specifically optimized for orderbook trading. This means Sei can deliver both the decentralization and permissionless nature of a DEX, along with the speed and capital efficiency of a CEX.

AVAX’s interoperable subnets could compete with ATOM in the appchain space. Last time I checked the testnet, there were over 600 subnets. I assume a significant portion will launch in 2023, driving increased activity.

Real-World Assets (RWAs)

For crypto and DeFi to go mainstream, tokenizing real-world assets is inevitable and necessary. We’ll see this process accelerate in 2023.

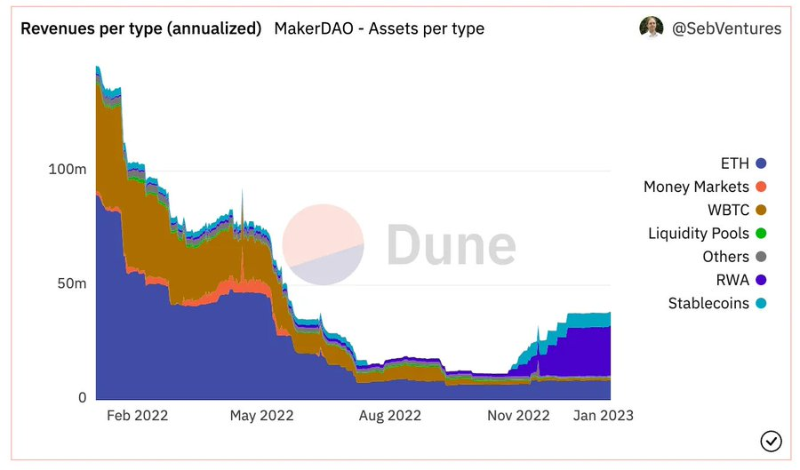

Currently, a large portion of Maker’s revenue comes from RWAs. This is essential for creating safer, more structured credit markets within DeFi.

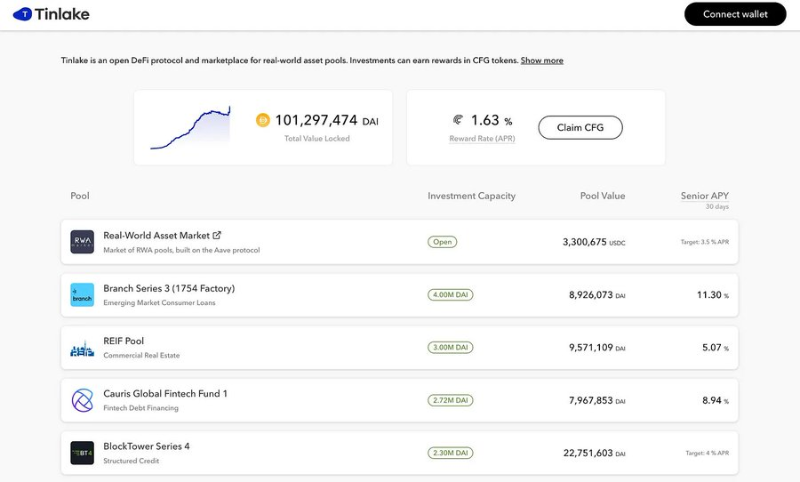

Centrifuge has also made solid progress in RWAs:

• Financed assets – $230 million

• TVL growth (YoY) +80%

UI/UX

I hope for a massive leap forward in crypto UI/UX overall in 2023. I agree with Issh that products emphasizing user experience will perform well.

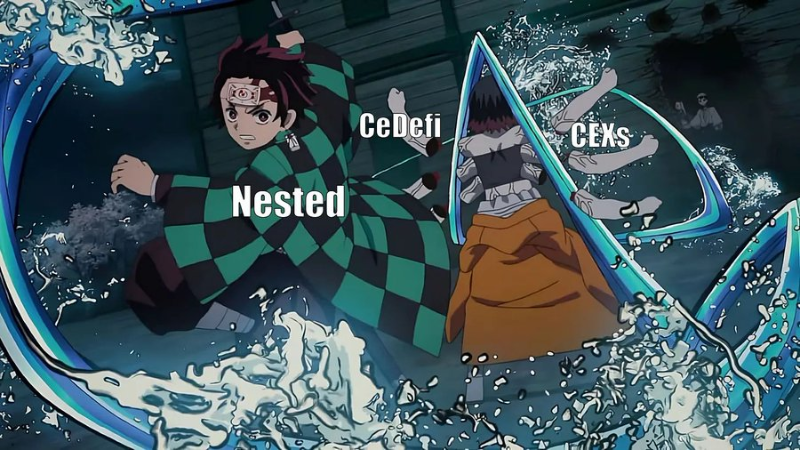

NestedFi aims to become the front-end for DeFi, abstracting away all complexity, focusing on retail user experience. It’s truly an elegant platform.

Account abstraction is also crucial for bringing more people into crypto.

StarkNet and zkSync support account abstraction. Argent wallet is the prime example of a secure, easy-to-use mobile wallet offering seamless access to DeFi.

EigenLayer and Celestia

Neither was mentioned in responses to my original question, but I believe both will have a major impact on the space this year.

Celestia launched three testnets in 2022, but in 2023 it will go live on mainnet. The Celestia token will likely debut with a multi-billion dollar FDV.

EigenLayer is a protocol modifying Ethereum at the base layer, allowing validators to re-stake their ETH and simultaneously validate other protocols in parallel. It enables validators to reuse their ETH—already securing Ethereum—to validate other systems such as oracles and data availability layers. Many are extremely excited about its potential.

Interestingly, EigenLayer could become a competitor to Celestia. One of EigenLayer’s flagship offerings is a data availability module.

EigenDA indeed holds advantages over Celestia. EigenDA doesn't need to bootstrap a large validator network—it only needs to convince existing ETH stakers to participate. Additionally, unlike Celestia, EigenDA isn’t a consensus layer, so it’s cheaper and offers higher throughput.

However, it’s still unclear whether EigenLayer will issue a token—we’ll have to wait and see.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News