Causes of DeFi protocol failures: poor protocol risk management, flawed token economics, and excessive use of leverage

TechFlow Selected TechFlow Selected

Causes of DeFi protocol failures: poor protocol risk management, flawed token economics, and excessive use of leverage

Three critical flaws that caused DeFi protocols to fail in this cycle.

Author: Cyril

Translation: TechFlow

After spending countless hours researching DeFi protocols and analyzing why most of them fail, I believe it's important to share with everyone the three critical flaws that have caused DeFi protocols to collapse in this cycle:

Poor risk management, insufficient revenue generation, and excessive use of leverage are at the core of DeFi’s collapse.

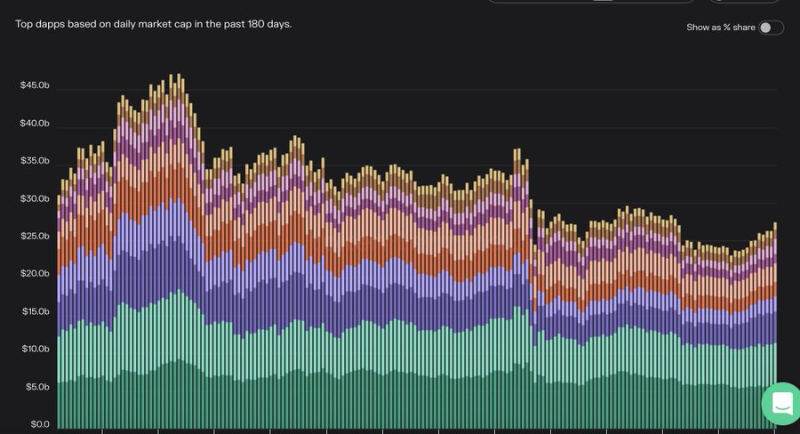

The dust has yet to settle, but a steady stream of details allows investors to piece together a picture highlighting systemic risks in decentralized finance stemming from poor risk management. One of the most commonly cited reasons for struggling DeFi protocols is their inability to generate sustainable revenue and create meaningful value within the platform’s ecosystem.

The second flaw lies in the fundamentally broken tokenomics designed by many DeFi protocols, which often feature extremely high inflation rates used to lure liquidity.

High incentives may seem attractive, but if the rewarded tokens lack real intrinsic value, users are essentially taking on significant risk—giving up control of their funds—for little return. This point must be kept in mind.

This is closely tied to DeFi’s revenue-generation challenges and the inability to build a sustainable treasury. High inflation increases token supply, and if token value cannot be maintained, liquidity will eventually exit the ecosystem.

The third issue is users who overuse leverage. Excessive leverage is another widespread problem in DeFi, which became glaringly evident last month as platforms like Celsius, 3AC, and other DeFi-focused investment firms began to unravel.

In this sense, during market downturns, without a solid contingency plan, the responsibility for over-leveraging ultimately falls on the users themselves. While this issue was overlooked during the peak of the bull market, it should always remain top of mind for traders, given this market’s notorious volatility.

So now you know what to watch out for when evaluating crypto projects in general. Any project exhibiting the above characteristics should be considered a major red flag.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News