iZUMi Research: Analysis of LP-Based On-Chain Hedging Strategies

TechFlow Selected TechFlow Selected

iZUMi Research: Analysis of LP-Based On-Chain Hedging Strategies

LP tokens are high-quality on-chain assets that provide liquidity for traders in the Web3 trading network and generate fee revenues for LP investors.

What is Liquidity Provision?

An LP Token (Liquidity Provider token) is a receipt awarded to liquidity providers who supply funds to decentralized exchanges (DEXs) operating on automated market maker (AMM) protocols. The provided liquidity typically consists of a combination of two or more assets, which act as counterparty to traders on these DEXs, generating fee income from trades.

Different DEXs have different types of LP models:

-

On DEXs such as Uniswap V2 and Curve, liquidity providers must deposit both tokens of a trading pair—acting simultaneously as buyer and seller—with the value of both sides usually balanced at a 1:1 ratio.

-

Balancer’s Liquidity Bootstrapping Pools require dual-token deposits but allow for customizable weight allocations.

-

Uniswap V3 LP positions are determined by the current price and the specified upper and lower price bounds within which liquidity is concentrated.

-

GMX's GLP consists of a basket of assets defined by protocol rules in fixed proportions, with arbitrage mechanisms working to maintain these target ratios.

Characteristics of LPs:

-

Passive liquidity – LPs function as passive market makers; they do not actively quote prices but instead wait for takers to trade against their pooled assets at the prevailing market price.

-

Value fluctuation / Impermanent loss – As users trade directly against the pool, algorithmic rebalancing changes the composition and quantity of tokens within the pool. When liquidity providers withdraw their share, the value of received assets may differ from simply holding the original tokens outside the pool. This discrepancy is known as impermanent loss.

-

Composite risk exposure – Since LPs represent baskets of multiple assets (typically two or more), holding an LP position equates to holding a diversified portfolio while being exposed to impermanent loss risks.

Web3 functions as a network for value exchange, where trading constitutes a fundamental layer. As enablers of trading liquidity, LPs generally earn substantial fee returns. After Uniswap V3 introduced concentrated liquidity, static fee income for LPs has reached APRs exceeding 100% in some cases.

LP tokens are high-quality yield-generating assets. Holding them gives investors exposure to a diversified basket of tokens, and due to impermanent loss, the volatility of LP token values tends to be lower than that of individual underlying tokens. Moreover, because LPs capture direct trading fees, so long as the DEX operates stably, LP tokens can deliver continuous returns. For these reasons, many investors hold LP tokens as part of long-term asset allocation strategies.

However, given the inherent volatility of LPs and investor preference for lower-risk yield products—combined with the relative simplicity of GLP compared to other LPs—a number of derivative financial products have emerged within the GMX ecosystem. This article examines four projects building chain-native, risk-neutral investment products using GLP as the base asset. We analyze their mechanisms and on-chain data to explore:

-

Dynamic composability of DeFi assets.

Hedging solutions are fully implemented on-chain with transparent operations, integrating multiple DeFi protocols such as GMX (with GLP as the yield-bearing base asset), Aave, Uniswap, and Mycelium (TracerDAO).

-

On-chain hedging strategies.

Technical implementation challenges of on-chain derivatives.

Efficiency of hedging mechanisms and capital utilization.

-

Long-term viability of LPs as foundational assets.

Yield levels and sustainability of derivative platform liquidity provision.

GMX/GLP Overview

GMX is a spot and perpetual exchange, where futures trading essentially enables leveraged trading. Similar to AMM-based DEXs like Uniswap, GMX employs a PMM (Proactive Market Making) mechanism inspired by AMMs. It uses Chainlink oracles to feed price data into the system and relies on the GLP liquidity pool to enable traders to execute up to 50x leveraged trades without slippage. Each trade has a maximum size determined by available pool liquidity, and the trading fee increases from 0.2% to 0.8% based on deviations in pool asset ratios and trading volume.

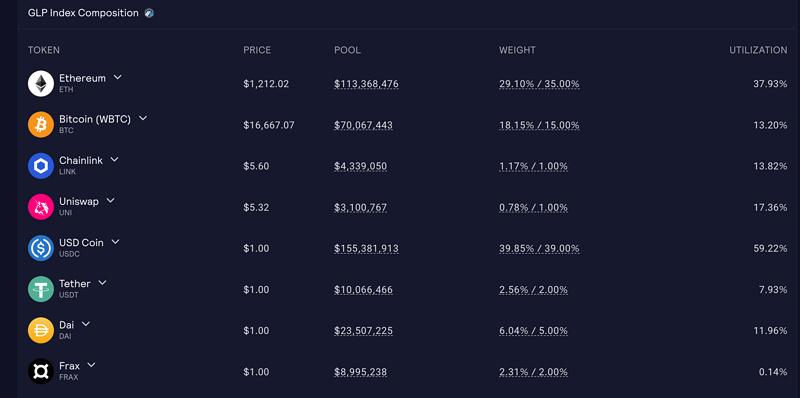

GLP is the liquidity provider token representing shares in the platform’s liquidity pool. GMX provides cross-asset leveraged and spot trading across multiple cryptocurrencies, so GLP comprises a basket of supported assets that can be minted or redeemed using any constituent token. Due to constant trading between users and the pool, the composition of GLP is dynamic. Fees collected during minting and redemption adjust the asset mix to maintain target weights and prevent significant deviations.

Compared to LPs on traditional AMM-based DEXs, GLP offers higher capital efficiency. Additionally, since traders collectively tend to lose money over time, GLP—acting as the counterparty—tends to profit overall. However, because GMX relies on Chainlink oracles for pricing, it lacks native price discovery capabilities, inherently capping its total liquidity potential.

Figure: Current composition of GLP on Arbitrum

GLP generates revenue from the GMX platform via: minting/burning fees, trading and position opening fees, liquidation income, and funding payments. Of this, 70% is distributed to GLP holders, while 30% goes to stakers of GMX tokens.

Figure: GLP fee income breakdown

GLP Hedging Solutions

Traditional market making is a high-barrier activity, accessible only to institutions authorized by exchanges, and typically offers high returns.

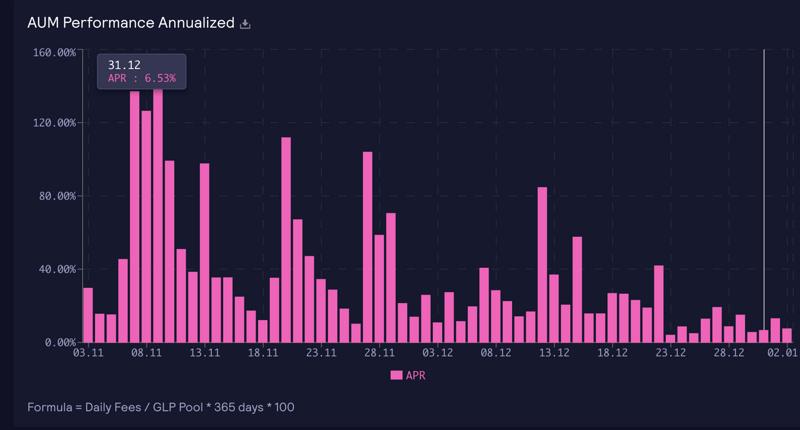

Currently, GMX implements various safeguards—including higher-than-average opening fees, transaction costs, and intentional delays—to protect LP interests. As a result, liquidity providers on GMX earn above-market-average yields. The daily platform revenue translates into GLP APRs shown below, maintaining approximately 15% annualized WETH yield even under current market conditions.

Figure: Daily GLP income expressed as APR

At present, GLP stands out as a strong yield-generating asset. While its multi-asset structure reduces volatility relative to single tokens, it remains non-stable and can experience significant valuation shifts during extreme one-sided market moves.

Compared to LPs on Uniswap and similar DEXs, GLP’s fixed composition makes multi-asset risk hedging easier to implement. Investors show growing interest in delta-neutral portfolios that offer high yields with minimal risk. Consequently, several projects in the GMX ecosystem aim to create delta-neutral strategies using on-chain asset combinations, offering dollar-denominated or BTC/ETH-denominated investment products. Notable examples include (some not yet launched):

-

Rage Trade

-

GMD Protocol

-

Umami Finance (Phase 1 product discontinued, Phase 2 not yet live)

-

Neutra Finance (not yet launched)

We will dissect each project’s approach to evaluate the feasibility and capital efficiency of on-chain hedging.

Rage Trade - Delta Neutral Vault

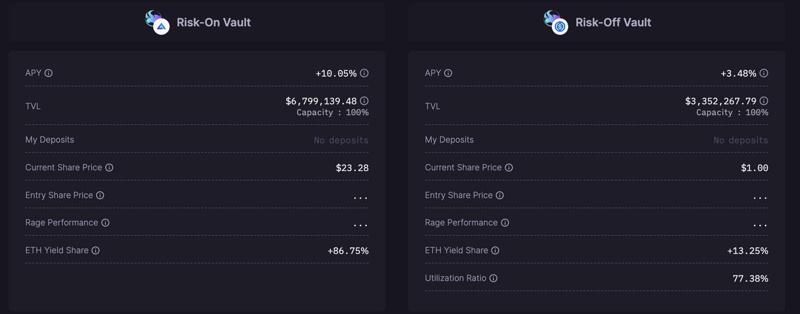

Rage Trade proposes a dynamic hedging model, splitting its product into two components: a risk-on vault for high-risk-tolerant users and a risk-off vault for conservative investors. These two vaults engage in an internal lending relationship (risk-on borrows from risk-off), creating an overall delta-neutral strategy.

Users deposit USDC into either vault. The risk-off vault is denominated in USDC, while the risk-on vault issues sGLP shares and carries some value fluctuation, though the design aims for long-term delta neutrality.

The risk-on vault uses a flash loan from Balancer to obtain BTC and ETH, swaps them for USDC on Uniswap, then borrows additional USDC from the risk-off vault. It deposits all USDC as collateral on Aave to borrow ETH/BTC, repaying the flash loan. This results in short positions on ETH/BTC, offsetting the price risk of those assets within GLP, sized according to GLP’s target allocation. The vault maintains a health factor of 1.5 on Aave (borrowing up to 2/3 of collateral value). The risk-on vault receives 86.6% of GLP fee earnings.

The risk-off vault earns yield by supplying USDC to Aave and additionally receives 13.4% of GLP fees for enabling the hedge.

Every 12 hours, the vaults automatically settle profits, update hedging positions based on price movements, and reinvest earned fees for compounding. Overall, the risk-on vault achieves an APY of 10.05%, while the risk-off vault reaches 3.48% APY.

Currently, Rage Trade’s two vaults hold TVLs of $6.79M (risk-on, measured by GLP holdings) and $3.35M (risk-off), respectively.

Umami Finance

Umami Finance previously launched a USDC Vault that used Mycelium leveraged tokens to hedge GLP’s risky asset exposures.

Mycelium constructs dual pools (long and short) with leveraged tokens representing shares. Every eight hours, a smart contract reallocates funds between pools based on the current price: when prices rise, capital flows from the short pool to the long pool, and vice versa. In theory, holding a leveraged token mimics holding a perpetual leveraged position. However, fund transfers rely on external arbitrage bots, leading to capital leakage, and the adjustment curve is only approximate.

Umami used Mycelium’s ETH/BTC leveraged tokens to hedge corresponding positions in GLP. During periods of high volatility, however, this method failed to accurately hedge the vault’s exposure.

Due to the imprecise hedging mechanism, the strategy incurred irrecoverable losses during volatile markets, prompting the team to shut down the product and pivot toward researching alternative approaches.

Umami’s new strategy has not yet launched, but its core also revolves around achieving delta neutrality using GMX’s GLP, closely resembling GMD Protocol’s design—splitting GLP into three separate vaults for USDC, BTC, and ETH. The strategy hinges on internal net asset value (NAV) accounting, with each vault acting as a natural hedge against the others. When GLP asset ratios deviate, inter-vault asset transfers occur. If necessary, Umami may also perform active hedging on GMX or similar platforms. The product is expected to launch mid-2023.

GMD Protocol

GMD’s main idea is to decompose GLP into single-asset vaults, catering to users averse to impermanent loss who prefer investing in individual BTC, ETH, or USDC positions. The GMD platform retains a portion of earnings as reserves to absorb risks arising from GLP asset ratio fluctuations, compensating vaults when losses occur. The protocol conducts weekly rebalancing adjustments including:

-

Minting fees: higher fees applied to oversubscribed pools.

-

APY: adjusted weekly based on GLP performance.

-

Caps on each of the three vaults.

Together, this forms a pseudo-delta-neutral strategy. The platform also allocates a portion of GLP earnings as protocol revenue to reward GMD token holders.

After depositing funds, users receive corresponding gmd tokens (e.g., gmdBTC) representing vault shares. The ratio of gmdBTC to WBTC gradually increases as GLP accrues fees, though it remains relatively stable. Users can provide liquidity on Uniswap V3 to earn additional yield, and once vault caps are reached, others can acquire shares through secondary market trading.

Currently, all three GMD vaults have reached their capacity limits, indicating strong user demand. Key metrics are as follows:

Pseudo-delta-neutral protocol $GLP

-

GLP TVL: $2.67M

-

BTC $455,866.62

Current GMD share: 14.98%

Current GLP share: 18.13%

GMX Target Rate: 15%

Current APY: 10%

-

USDC $1,500,482.09

Current GMD share: 58.30%

Current GLP share: 39.86%

GMX Target Rate: 39%

Current APY: 9%

-

ETH $980,470.98

Current GMD share: 26.63%

Current GLP share: 29.12%

GMX Target Rate: 35.00%

Current APY: 11%

Neutra Finance

Neutra Finance, after five months of testing, demonstrates the ability to deliver a stable ~10% annualized return to users who deposit stablecoins. The core of Neutra Finance’s approach combines off-chain strategy with on-chain execution, using a Tolerance Band–Volatility Model. User-deposited USDC is partially converted into GLP to generate yield, while another portion is used to open short positions on BTC/ETH via GMX, employing 5.5–6x leverage.

Unlike platforms that hedge at fixed intervals, Neutra Finance measures volatility in the risk-exposed half of GLP assets. As the name "Tolerance Band" suggests, hedging adjustments are triggered only when predicted price volatility (based on historical data) and GLP asset ratio deviation exceed predefined thresholds. This reduces hedging frequency and associated costs. Test results indicate robust performance, and the strategy is scheduled to launch in Q1 2023. Accounting for operational expenses, the final APR will be slightly below 10%.

Additionally, Neutra Finance is exploring hedging strategies for Sushiswap and Uniswap LPs, aiming to offer users more low-risk investment options.

Conclusion

LP tokens are high-quality native on-chain assets that provide liquidity to traders within the Web3 transaction ecosystem and generate fee income for investors. Compared to GMX’s GLP, which holds $317M in TVL, currently live GLP-based products like Rage Trade and GMD Protocol manage only $10M and $3M respectively—just 3% of total GLP value. The vast majority of GLP remains “naked,” with holders directly exposed to market risk.

Key reasons for this include:

-

Underdeveloped on-chain hedging tools.

Among existing hedging models, GMD uses decomposition and reserves part of GLP yield to buffer large impermanent losses—effectively sacrificing yield for risk mitigation, resulting in a “pseudo-delta-neutral” outcome.

Rage Trade uses Aave, but Aave’s limited leverage capacity reduces capital efficiency, forcing Rage Trade to split the strategy into high- and low-risk vaults.

Other unreleased strategies consider direct hedging on GMX, but GMX—as a perpetual futures platform—is ill-suited for long-term position holding. Annual holding costs are ~20%, plus additional fees per rebalance, significantly increasing protocol-level hedging expenses.

If more sophisticated on-chain hedging instruments—such as long-dated options—were available, LP-based hedged products would become far richer and more effective.

-

Early-stage constraints due to risk management and liquidity limitations.

Since the debut of Umami’s USDC Vault—the first GLP-based product—only about five months have passed, and that vault was quickly discontinued. The complex, multi-factor dynamics affecting GLP composition make hedging challenging, requiring sufficient time for testing before scaling.

-

Inherent instability of GMX itself.

GMX, having risen to prominence on Arbitrum within just a year, still carries notable risks. These include centralized oracle control—only the project team can write prices, introducing a central point of failure—and repeated design changes to GLP, such as routing improvements, which forced GMD Protocol to migrate its vaults.

Moreover, GMX’s reliance on external oracles imposes structural limitations. PMM-based LPs like GLP achieve high capital efficiency by using off-chain price feeds, but they operate on “second-hand” prices that lack true price discovery. Due to latency in oracle updates, Dodo—which uses a similar PMM model—sees its highest trading volumes on Ethereum in stablecoin pairs.

While GMX’s innovative design enables efficient LP usage and simple, hedge-friendly structures through targeted asset ratios and arbitrage incentives, it suffers from poor execution pricing (“stale” Chainlink quotes) and cannot support organic price discovery—limiting its long-term scalability.

Furthermore, on-chain trading is vulnerable to information asymmetry, where traders collude with nodes to front-run transactions—an issue researchers refer to as “toxic flow.” Passive LPs end up subsidizing informed traders, eroding market integrity. Whether in AMMs or traditional exchanges, takers inherently possess informational advantages over makers, as every trade reflects an expectation of future movement. In AMMs, where LPs provide lazy liquidity, this imbalance is especially pronounced.

Nonetheless, LPs remain among the most promising native on-chain assets today—best positioned to drive demand for derivatives and build widely accepted, stable-yield financial products. Thanks to its relative stability, GLP on GMX has already catalyzed a nascent ecosystem of LP-based derivatives faster than LPs on Uniswap or other AMM DEXs. Beyond resolving GMX-specific issues, advancing on-chain hedging will require broader innovation in derivatives and short-selling instruments. The solution lies not in isolated technologies, but in integrated systems. iZUMi continues to actively explore LP-based financial derivatives, and we look forward to further experimentation in on-chain finance.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News