X To Earn Sector Research Report: The Past, Present, and Future of GameFi

TechFlow Selected TechFlow Selected

X To Earn Sector Research Report: The Past, Present, and Future of GameFi

This report provides a comprehensive overview and summary of the GameFi sector's development trajectory, covering topics such as the definition of GameFi, the early history of blockchain games, the 1.0 and 2.0 phases of GameFi, and future trends in GameFi X.0 evolution.

Table of Contents

I. Introduction

II. Definition of GameFi

2.1 What is GameFi

2.2 How Does GameFi Work?

2.3 Types of GameFi

2.4 Development Stages of GameFi

III. Era of Blockchain Games

3.1 What Are Blockchain Games?

3.2 Types of Blockchain Games

3.3 Technical Solutions and Economic Models

3.4 Market Performance

3.5 Summary

IV. GameFi 1.0

4.1 What is GameFi 1.0?

4.2 Types of GameFi 1.0

4.3 Technical Solutions and Economic Models

4.4 Market Performance

4.5 Summary

V. GameFi 2.0

5.1 What is GameFi 2.0?

5.2 Types of GameFi 2.0

5.3 Technical Solutions and Economic Models

5.4 Market Performance

5.5 Summary

VI. Trends in GameFi X.0

6.1 Diversified X to Earn

6.2 Analysis of Technical Solutions and Economic Models

6.3 Traditional Game Developers Entering Web3

6.4 The Return of Gaming

6.5 Risks and Opportunities

I. Introduction

When does investment behavior become immersive and collective? Usually when investment logic is weakened and aligns with the livelihood needs of most people.

While most investment activities were still confined to primary and secondary markets, a door of miracles had already opened, unleashing tremendous potential in 2021. That door was GameFi.

As DeFi slowed down in growth and hype, GameFi expanded gaming into the financial realm. Players from all corners of the world gathered in this blockchain-powered new frontier driven by stronger property rights, entertainment desires, and profit motives. GameFi has already become an investment tool for some crypto users.

Meanwhile, a continuous stream of GameFi and NFT projects have become bright spots in the crypto market—a carnival for crypto enthusiasts. Investment institutions that participated during the sector’s explosive phase have yet to fully realize their gains in the market, so the momentum still lingers.

Current GameFi projects can integrate concepts from DeFi and NFTs, catering to various preferences among crypto investors and gamers. Blockchain gaming remains relatively niche compared to traditional games, which boast billions of players—indicating significant room for growth.

Therefore, this special research report will comprehensively review and summarize the development of the GameFi sector—from its definition, early history of blockchain games, the evolution through GameFi 1.0 and 2.0 stages, to future trends in GameFi X.0.

This report requires no deep prior knowledge of GameFi. Content and insights are compiled by professional researchers at AvatarDAO to help you further understand the past and present of GameFi.

II. Definition of GameFi

2.1 What Is GameFi

GameFi is visualized blockchain finance using games—simply put, monetizing money (finance) within games.

GameFi is the concept of "gamified finance," merging DeFi and NFTs by presenting decentralized financial products in game formats. It gamifies DeFi rules and tokenizes in-game items and derivatives as NFTs. The NFT nature of GameFi ensures uniqueness and collectibility of all in-game assets, props, and characters, allowing players full ownership within decentralized games due to integrated game mechanics.

In many ways, GameFi breaks the norm where game assets belong solely to developers, enabling players to generate wealth through gameplay. It enhances the entertainment and interactivity of blockchain finance and NFTs, offering rewards via combat, dungeons, social features, and more.

2.2 How Does GameFi Work?

Rewards in GameFi come in various forms, including cryptocurrencies and in-game assets such as virtual land, avatars, weapons, and clothing. Players earn these items through gameplay and can trade them on NFT markets for profit or convert them into cryptocurrencies. Each GameFi project has different models and game economies.

Most in-game assets are NFTs on blockchains and can be traded directly on NFT markets. In other cases, assets must first be converted into NFTs before they can be sold or traded. In-game assets typically create benefits for players, helping them earn more rewards.

Some avatars and skins only affect visual appearance without impacting gameplay or rewards. Depending on the game, players usually earn rewards by completing tasks, battling others, or building monetizable structures on owned plots. Some games allow players to stake or lend game assets to others, earning passive income without playing.

2.3 What Are the Types of GameFi?

2.3.1 Classification by Token Design:

Single-Token

-

Features: All economic output and consumption activities within the game are tied to one token, making it easy to regulate; however, it's prone to death spirals later on. It struggles under extreme market conditions—for example, large holders dumping tokens causing price crashes that cannot recover.

-

Representative game: Spaceship.

-

Key focus: Burn mechanism design, value anchoring choices.

Dual-Token

-

Features: Adopted by most games, featuring a main token (value token) and auxiliary token. Typically, the main token’s consumption and production are linked to the auxiliary token. Sometimes, main and auxiliary tokens are tied separately to PvP and PVE systems. Often, “diamonds” become the main token and “gold coins” the auxiliary token. The main token applies across most in-game scenarios.

-

Representative games: Axie and its clones.

-

Key focus: Ratio between main and auxiliary token supply; linkage design between their consumption methods; balance between consumption and production ratios; ongoing adjustments related to diversifying consumption channels.

Multi-Token

-

Features: Commonly used in games with abundant resources: SLG, open-world games.

-

Representative games: Farmers World; Star Sharks.

-

Key focus: Relationship between each token and corresponding activities; production and consumption relationships among different tokens.

2.3.2 Upstream and Downstream Classification of GameFi:

Engines: UE, Unity, Cocos, etc.

-

Currently, there's no need to develop engines from scratch for GameFi—or rather, a dedicated GameFi engine doesn't make much sense.

Lightweight game development tools: Primarily offered as SDKs providing blockchain integration solutions for lightweight games.

Rendering: Cloud rendering platforms

Game Application Chains: Ronin, Defi Kingdoms, etc.

-

Mainly suitable for games with large user bases, high DAU, and long lifecycles.

-

However, issues exist regarding cross-chain asset transfers and bridge security.

Game-Specific Chains: Immutable X, WAX, Klaytn, etc.

WAX operates very successfully, maintaining consistently high active users. Top games include Alien Worlds, R-PLANET, PROSPECTORS, Kolobok Adventures, and Farmers World.

Immutable X continues to innovate, collaborating with Starkware and experimenting more at the base layer. However, it still lacks actively played games with large user bases.

Decentralized Cloud Platforms:

-

Core involves setting up nodes to leverage decentralized computing power for computational support.

-

Currently, decentralized cloud platforms remain in early stages, facing high development costs and unresolved latency issues.

-

It represents a promising direction for the future.

Decentralized Computing: Fluence, LivePeer

Partially solves real-time computation challenges on-chain.

Content Distribution Platforms: Gala, Come2Us, P12

-

The operation model of content platforms differs significantly from traditional games, particularly in platform token utility and the relationship between platforms and CPs (content providers). Some platforms use their own tokens as gateways for CP access—requiring conversion from platform tokens to native CP tokens to enter games, and vice versa upon exit, effectively endorsing CP tokens; participation in CP investments occurs through exchange between platform and CP tokens;

-

Platform tokens maintain independent minting and burning mechanisms, enabling partial control over CP tokens.

IGO Platforms / Content Incubators:

-

Resource-driven.

-

Whether these will consolidate with content distribution platforms into oligopolistic upstream-downstream chains is worth watching.

Guilds: YGG, MC, GuildFi, etc.

-

Highly regional, lacking clear head concentration effects; low business barriers;

-

Mostly located in regions with high population dividends but low per capita incomes;

-

Starting September–October 2021, guild fundraising began increasing steadily;

-

Issues: Valuation logic resembles a profitable DAO model; “asset-heavy” projects command high valuations in primary markets but issue governance tokens in secondary markets, leading to weak value capture and limited premium.

2.4 Development Stages of GameFi

2.4.1 Era of Blockchain Games

As early as 2015, the first blockchain-based card mobile game, "Spells of Genesis," launched, marking the beginning of blockchain gaming.

In 2017, games like "CryptoKitties" introduced NFTs into gameplay, combining blockchain's "financial attributes" with NFTs.

On December 9, 2017, daily active users exceeded 14,000, temporarily clogging the Ethereum network due to skyrocketing gas fees. At that time, there was no token economic model—just simple, basic graphics and weak gameplay—but NFT assets emerged. Afterward, more blockchain games appeared with increasingly diverse content, ushering in the era of blockchain games.

Era of Blockchain Games: The market was dominated by innovative small-scale NFT games and nurturing mini-games with limited playability, but these opened the blockchain gaming market. Continuous innovation from native crypto projects also led to market chaos. At the same time, Ponzi schemes were widespread, creating artificial market illusions through aggressive pumping to cash out.

2.4.2 GameFi 1.0

Between 2019 and 2020, GameFi was first proposed, with NFT assets gaining prominence and improvements in visuals and gameplay. GameFi transformed the game economy from closed proprietary systems to open markets. Blockchain provided open trading and asset issuance protocols for chain games, forming a vast gaming economy composed of countless individual games, greatly expanding market depth. Especially with NFT integration, players could now gain both application value and financial value from games. However, GameFi 1.0 faced many problems—new players often needed to purchase in-game items or assets upfront, hoping to recoup costs later. But with increasing circulating tokens, poor gameplay, lack of durability, and unstable economic models, token prices would fall, making it hard for players to break even. Moreover, most GameFi 1.0 projects relied on constant inflows of new players to sustain operations, yet 1.0-era chain games mostly featured single scenarios and NFT items, insufficient to attract new players.

GameFi 1.0 Stage: Characterized by Play-to-Earn and NFT-focused PC and mobile games. These chain games possess certain game qualities but fall short compared to traditional games in terms of playability. With shorter development cycles and lower difficulty, they prioritize asset value over gameplay. Due to rapid development, numerous uneven-quality mini-games quickly captured market share. Enhancing application scenarios to extend lifecycle and ensure sustainable revenue models became key goals for GameFi 2.0.

2.4.3 GameFi 2.0

There is no unified definition of GameFi 2.0 yet, but conceptually, games will offer higher playability and incorporate metaverse elements, becoming true bridges between reality and the metaverse, enhancing player engagement. As entry points to the metaverse economy, GameFi 2.0 designs will closely integrate metaverse scenes with NFT assets, DAOs, and DeFi, differing from 1.0-era applications focused more on DeFi. GameFi 2.0 stands on the shoulders of the metaverse, perfectly solving lifecycle and sustainability issues faced by GameFi 1.0. If a game encounters financial mechanism problems, DAO plays a critical role—using its treasury to stabilize token prices on secondary markets or repurchasing tokens via bond mechanisms to maintain healthy liquidity.

GameFi 2.0: Building on previous stages, it resolves single-game economic limitations, avoiding circular economies within isolated games. Around the same time, higher-quality game products began development—led by independent teams primarily based on blockchain, though now including more AAA studio teams and members. Overall game quality improved significantly, attracting a few curious traditional gamers drawn by relatively high quality, gradually bringing chain games into public view. GameFi will become a standard feature of gaming.

2.4.4 GameFi X.0

Based on current GameFi developments, reaching the X.0 stage means deeper integration with the metaverse—an important step toward transitioning from physical to virtual worlds. Games serve as ideal tools to onboard users into the metaverse. The metaverse can empower GameFi in unexpected ways.

-

First, GameFi achieves interoperability within the metaverse—different games can interact seamlessly. Characters and items from one game can appear in another. For example, a League of Legends skin could be worn by a character in Honor of Kings.

-

Second, after achieving interoperability, GameFi’s liquidity issues will be resolved. Players won’t need to repurchase new characters and items when starting a new game—they can simply use existing NFT assets to join new games easily.

With metaverse development, universal NFTs will emerge. With these universal NFTs, players can enjoy most metaverse games freely. This means GameFi projects can instantly gain initial liquidity upon launch. If the game is high quality, sustained liquidity will follow.

Thus, more high-quality GameFi projects will appear in the metaverse, drawing increasing liquidity into it, creating a virtuous cycle.

III. Era of Blockchain Games

3.1 What Are Blockchain Games?

Blockchain games refer to gaming products built on blockchain technology. Their biggest difference from traditional games lies in blockchain’s decentralized nature, which naturally confirms ownership of player assets—so in-chain game assets belong to players personally. Compared to GameFi, blockchain games encompass a broader category—any game product with data stored on-chain qualifies as a blockchain game.

Additionally, another interpretation of the blockchain game era is governance tokens + gaming. Players deposit stablecoins or major cryptocurrencies to buy characters or buildings, earning project governance tokens within a set period for profit. Essentially similar to mining, but with complex membership systems, rebate conditions, and extremely high profit margins, giving strong incentives for user acquisition.

3.2 What Are the Types of Blockchain Games?

The blockchain game era marks early exploration of integrating blockchain with gaming. During this period, blockchain games were mainly represented by dApps and gambling games, with weak game attributes. There were four main types: card games (Spells of Genesis), lottery games (Fomo3D), nurturing games (CryptoKitties), and construction games (Jushang).

3.3 Technical Solutions and Economic Model Overview

3.3.1 Economic Model

CryptoKitties was an early work combining NFTs with games, initially issuing 50,000 smart contract-generated CryptoCat NFTs—known as Generation 0 cats—each with unique attributes. The core gameplay revolves around breeding: combining two NFTs generates a new NFT inheriting traits from parents while randomly generating new ones. The developer profits primarily by charging transaction fees for interactions between players and the game. Players can circulate their NFTs in the market through breeding and leasing functions to generate profits. Although the economic model isn’t complex, it fully leverages underlying blockchain characteristics.

Fomo3D was an early gambling-style game platform built on blockchain technology. Similar to CryptoKitties, the developer mainly profited by collecting transaction fees.

Compared to the above games, Spells of Genesis leaned more toward actual gameplay. Its economic model resembled web2 card games, except it used tokens for in-game economic circulation. Because Spells of Genesis emphasized gameplay more, it demonstrated greater longevity than the previously mentioned types.

Another type from that era—the game "Jushang"—used ETH for deposits and distributed governance token EGT for withdrawals. Jushang adopted a single-token governance model with EGT, requiring players to spend EGT to build structures and generate ongoing returns. Secondary markets drove EGT prices sharply upward, continuously providing confidence for participants to hold or add positions—creating an illusion of legitimacy. This economic model generated profits dependent on the surplus between incoming external funds and internal release volume. When incoming capital fell below internal yield generation, a downward spiral occurred. Fundamentally, Jushang was a Ponzi scheme disguised as a game, meaning there was no concept of "economic balance." In reality, later participants paid earlier ones—it was outright exploitation.

3.3.2 Technical Solutions

Regarding technical approaches and economic model considerations for GameFi, the general idea involves modifying internal game mechanics, extending and sustaining external value, and transforming irreconcilable conflicts among different stakeholders to prolong the lifecycle of blockchain games and escape Ponzi dynamics. This year alone, total funding in the gaming industry reached over $1.2 billion. In 2022, thousands of games exist in the market. Most blockchain games, amid crypto market volatility, choose to delay token launches and game releases to mitigate environmental impacts. Below is a detailed analysis:

-

Shift Between Playability and Economics:

① Regarding playability:

♢ Improve graphics and production quality—well-made games attract players far better than poorly made ones; this point needs no elaboration.

♢ Increase scenario diversity, raise difficulty levels in mission-based gameplay to enhance interest, satisfy gamers’ sense of achievement and fulfillment, differentiate experiences between free and paying players moderately, and increase payment motivation among free players.

♢ Cultivate player habits—use incentive measures like sign-in bonuses. Treat free and paying players equally. Like QQ Farm’s vegetable-stealing phenomenon—some people once set alarms for 3 AM just to steal crops. The common phrase back then was, “Did you steal vegetables today?” Build stickiness, retention, and daily active users. Try to retain customers.

② Regarding economics:

♢ Open free-to-play mode: This approach offers several benefits—first, it attracts more players, expands the player base, and makes the game more resilient and scalable. Second, it lowers barriers, allowing players to experience the game. Often, “free” ends up being the most expensive—draw players in, then convert them into paying users during gameplay.

♢ Define boundaries between free and paying players: Free-to-play is a way to expand player numbers. A larger player count enables richer gameplay and diverse mission scenarios. For free players, it's entertainment; for paying players, it's consumption. Avoid letting free players participate in the internal game economy to prevent disruption of the in-game tokenomics. Assign time-consuming, labor-intensive tasks to free players, which paying players can pay to bypass, creating cooperative synergy between free and paying players while opening pathways for free players to transition into paying users.

♢ Optimize economic model: A solid token economy significantly extends a game’s lifespan. Consider multi-token systems, token allocation ratios and unlock schedules, supply-demand balance, token utility, and incentive mechanisms like staking.

-

Extending External Value and Channels

① Real-world integration: Connect games with real-life interaction—examples include StepN, jump rope games, singing games, treasure-hunting games. Bridge games and real life so games aren’t seen as mere entertainment. Integrate daily life into gameplay—everywhere can be part of the game. Make game value tangible—e.g., free players completing tasks could earn real-world rewards like Starbucks loyalty points.

② Upgrade product attributes: Evolve games from single-purpose products into social platforms. Human social needs are lifelong and immense. In-game social activities like guilds and team battles. Out-of-game examples: Back then, conversations around QQ Farm were often, “Did you steal vegetables today?” Or friends gathering locations in Honor of Kings for team fights. These elevate the game’s utility.

③ Expand metaverse: As GameFi becomes part of the metaverse, advancements in VR/AR infrastructure and diversified use cases bring greater playability.

-

Transforming Conflicts

Balancing interests among investment institutions, project teams, and players (free vs. paying, new vs. old).

① Balance profit distribution between investors and project teams: Token allocations should be reasonable—too high a proportion harms investor enthusiasm. Also explore multiple avenues for value realization—e.g., investors might achieve returns through in-game advertising.

② Resolve tension between project teams and players: In past models, players constantly mined, withdrew, and sold tokens regardless of price, maximizing short-term profits—creating massive sell pressure. Players and project teams seemed locked in conflict. Shift this dynamic so players compete with each other—one player’s loss becomes another’s gain—increasing token utility and exchange value.

③ Transform player roles: Enable transitions from free to paying players and facilitate new player onboarding. Sustained game operation requires fresh blood. Lower the cost barrier for role transformation. Use tax mechanisms from the treasury to incentivize free and new users.

3.4 Market Performance

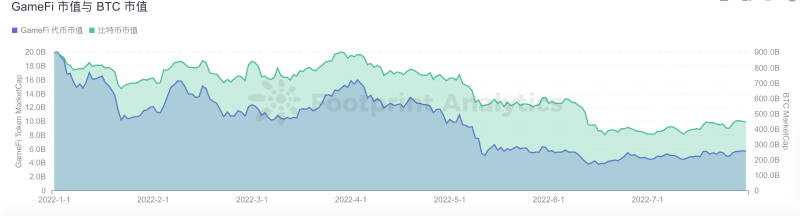

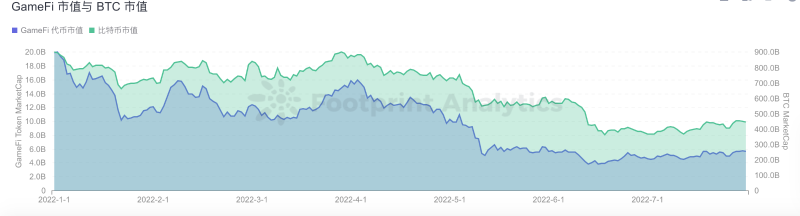

In 2022, alongside Federal Reserve rate hikes and balance sheet reductions aimed at curbing inflation, the strengthening dollar index led to liquidity shortages in the cryptocurrency market, plunging the entire market into a bear phase and pouring cold water on blockchain games. The chart below shows GameFi market cap versus Bitcoin market cap. Clearly, as the market deteriorated, blockchain game performance declined steadily.

3.4.1 Blockchain Game Market Size and Funding Situation:

Under worsening crypto market conditions, fundraising across sectors became abnormally difficult. In 2021, blockchain game funding accounted for 8.45% of the market, rising to 11.89% in 2022. Thanks to the metaverse boom, parts of the blockchain game market were indirectly boosted, positioning blockchain games as key players in the metaverse. Currently, over 1,400 blockchain games exist in the market. According to incomplete statistics, blockchain game funding reached $1.4 billion in 2021 and $1.36 billion in 2022 (as of now), expected to surpass 2021 levels soon after Q4. Many funded blockchain games delayed plans, pushing game launches to Q4 2022 or Q1 2023 to avoid negative impacts from unfavorable crypto market conditions and gain more time for development, optimization, and economic model refinement.

3.4.2 Impact on the Crypto Market and Investor Sentiment:

The emergence of blockchain games brought added fun to the crypto market, expanding investment channels and directions. Just as DeFi once brought traffic and capital to the crypto market, reviving stagnant markets with increased inflows and activity. Throughout blockchain games' development, obvious benefits flowed to the NFT market—rights-based NFTs represent blockchain game assets and serve as funding sources for game developers, enriching NFT market content.

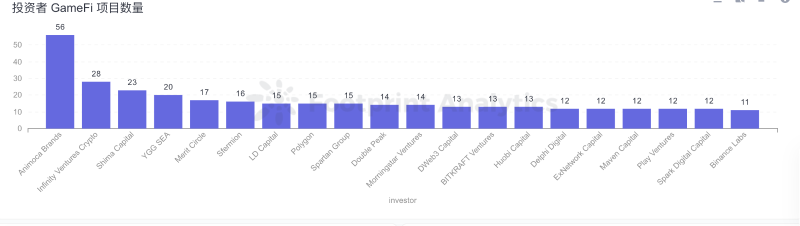

Moreover, blockchain games act as gateways to the metaverse, with large numbers of game users fueling metaverse development. The two go hand in hand. The charts below show institutional enthusiasm toward blockchain games, especially Animoca Brands, which invested in 56 blockchain games. Despite declining active user counts and scarcity of quality games, both players and institutions continue to pursue blockchain games, anticipating breakout hits. With capital, traffic, players, and institutions flowing in, market recovery will inevitably spawn high-quality blockchain games.

3.5 Summary

During the blockchain game era, P2E-mode games flourished, but few withstood the test of time. As the crypto market entered a bear phase, the blockchain game market cooled down. However, blockchain game concepts have gained popularity over time, drawing more capital and players into exploration. These concepts and models are becoming increasingly aligned with players and the market, destined to become essential components of the crypto world.

IV. GameFi 1.0

4.1 What Is GameFi 1.0?

There is currently no precise definition of GameFi 1.0. Generally, GameFi 1.0 is characterized as DeFi in disguise as games. Compared to traditional games, blockchain games developed over just a few years remain immature. Most exhibit P2E characteristics: low playability, with most players participating primarily to earn.

The P2E (Play-to-Earn) model, a new favorite driving traffic in this blockchain game wave, has become almost standard, pursued eagerly by both capital and giants. While the play-to-earn model brings tangible high returns that naturally attract followers, overall, these blockchain games still cannot match traditional games in playability. "Profitability" remains the main driving force.

Summary: Game experience leans more toward "manual labor," and GameFi 1.0 generally lacks sustainable development momentum and ecosystem extension—resembling massive Ponzi schemes.

4.2 What Are the Types of GameFi 1.0?

Although GameFi 1.0 lacks playability, it's undeniable that blockchain games absorbed the essence of traditional games and empowered them with unique blockchain advantages. Meanwhile, numerous attempts at game types emerged during the GameFi 1.0 era.

Card Games:

Alien World — Token;

ALCHEMY TOYS — Token;

GAT RPG Battle Games;

Cryptoblades — Token;

Pixel Adventure Games:

Crusaders Of Crypto — Token;

Pet Battle Games:

My Defi Pet — Token;

DPET Radio Caca — Token;

RACA Axie Infinity — Token;

Management Simulation Games:

Town Star — Token: GALA

4.3 Technical Solutions and Economic Model Overview

4.3.1 Technical Solutions

As a fusion of gaming and finance, ensuring user asset security is paramount in GameFi. Currently, crypto assets are stored in two typical ways: Onchain Wallets and Offchain Wallets—commonly known as hot wallets and cold wallets.

-

Offchain Wallet: Can be an idle electronic device running wallet software, disconnected from the internet—such as computers, phones, USB drives, hardware wallets, etc.

-

Offchain Wallet is a relatively secure storage method, protecting against malware and external hacker attacks.

Onchain Wallet works oppositely to Offchain Wallet—it stores assets online, offering convenient access but carrying higher risks and vulnerability to hacking.Project teams in the GameFi 1.0 era often adopt the more secure Offchain Wallet solution for storing crypto assets. For less technically capable teams, multi-chain asset management systems (e.g., Istring) may be used. These systems provide trusted technicians who build centralized hot wallet systems and manage private keys themselves.

4.3.2 Economic Model

At the heart of GameFi lies the Play-to-Earn economic model. Unlike the traditional gaming industry’s Free-to-Pay (F2P) model, blockchain game players can earn real money through crypto assets. Participants in the virtual economy earn rewards through their actions and then sell them on the market for profit.

So, what exactly is the core economic model of blockchain games?

Simply put, the economic model revolves around the supply and demand of in-game tokens—matching token production with token consumption. However, GameFi 1.0's economic model suffers from a critical flaw—it cannot escape the "death spiral." Basic economics tells us: oversupply leads to falling prices; undersupply leads to rising prices. The same applies to GameFi 1.0: only when Token consumption ≥ Token production can token prices remain stable or rise.

Ideally, new players diligently "work and level up" to become veterans. Once experienced and equipped, they require more resources to progress, prompting reinvestment ("re-staking") that sustains token demand, raising prices. Rising prices attract more players, stimulating further demand and creating a positive feedback loop.

But ideals are beautiful—human nature is realistic, and players aren’t naive. Most come chasing quick profits ("fast money"), rarely reinvesting. Instead, they "mine, withdraw, sell" late in the game. Veteran sell-offs are mostly absorbed by new entrants. Once new player growth slows, demand drops, and token prices fall. Falling prices trigger panic selling by more veterans and further reduce appeal to new players. Ultimately, a "death spiral" ensues. Below are some fundamental economic model types: We categorize all economic models into two groups: single-token and dual-token models.

-

Single-Token Economic Model

① Fixed Fiat Cost In, Variable Token Reward Out

Mining-based DeFi projects typically follow this model.

Characteristics: Fixed entry cost, variable returns depending on token price fluctuations.

Assessment: High initial price surges, short lifecycle. Recommend players focus on "mine, withdraw, sell"; once a downtrend appears, sell decisively.

Positive loops easily generate strong FOMO, but when the death spiral hits, it strikes swiftly and destructively.

② Fixed Fiat Cost In, Fixed Fiat Reward Out

Suppose daily earnings equal $100. Yesterday, the token price was $1, so the reward was 100 tokens; today, the price drops to $0.50, so the reward becomes 200 tokens.

During price increases, reduced output quantities keep breakeven periods stable; during price declines, players' daily fiat-denominated earnings remain unchanged in the short term.

Stable income, less prone to wild swings, longer lifecycle. Players can accumulate some tokens early, sell at higher prices later for potentially better returns; switch to "mine, withdraw, sell" once clear signs of slowing new user growth appear.

③ Variable Token Cost In, Variable Token Reward Out

Day 1: Token A priced at 1:1, entry threshold is 100 tokens—players spend $100 to enter, earning 10 tokens/day. Day 2: Price rises to $2. Veterans still earn 10 tokens ($20 value), but new player entry cost jumps to $200!

Prone to sharp spikes and crashes, short lifecycle unless foundational demand is massive. Recommend players rush for early mining rewards and clearly assess whether the team can keep attracting new users—if not, exit immediately.

Typical example: RACA

④ Variable Token Cost In, Fixed Fiat Reward Out

Currently, almost no games use this model.

This model stems from inexperienced teams, unless the project has exceptionally strong functionality required at launch.

-

Dual-Token Economic Model

Beyond the single-token model, AXIE innovatively introduced a dual-token model.

In the dual-token model, there are typically parent and child tokens.

Parent tokens are usually tied to long-term game development—often governance tokens—while child tokens are designed to absorb veteran sell pressure—typically economic tokens aiming to stabilize parent token prices or support long-term game growth.

When classifying dual-token models, we do so based on NFT minting.

① Reproduction Consumption Type

All NFTs originate from reproduction of genesis NFTs—officials won't sell additional NFTs. Minting new NFTs consumes specific tokens [this serves as the primary token burn mechanism].

For this game type, observe which token bears the sell pressure, ruthlessly burn that token, hoard the less pressured one, and sell opportunistically.

② Blind Box Sales Type

♢ USD Blind Boxes: Provides relatively free capital flow for project teams, potential for viral hits, but higher risk for players [higher chance of team rug pulls]. Most grassroots blockchain games adopt this method.

High risk, high reward—small bets for big wins.

♢ Parent Token Blind Boxes: Drives upward momentum for parent token prices and allows easier team control—when parent token prices get too high, discouraging new entrants, teams can sell some tokens to bring prices down.

Short-term speculation on parent tokens may outperform in-game grinding.

③ Child Token Blind Boxes: Heavily consumes child tokens—similar to reproduction-consumption models. Project teams aim to internally balance child token prices, extending game lifecycle by developing new mechanisms promoting internal circulation.

Grind safely, enjoy steady happiness until clear signs of declining new entrants.

4.4 Market Performance

4.4.1 Overall Market Performance of GameFi 1.0

During the GameFi 1.0 phase, numerous star projects emerged—e.g., AXIE, RACA, SANDBOX—among which Axie Infinity stood out as the trendsetter.

-

Overview of Star Projects

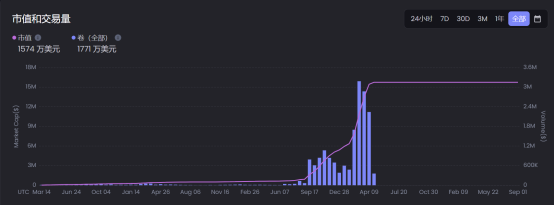

① During the GameFi 1.0 era, Axie Infinity’s native governance token AXS surged from $3 to $156 in just six months. This astonishing growth brought Axie’s total valuation close to $30 billion, making it one of the most valuable gaming companies worldwide.

② This figure may seem unbelievable, but many wonder why: In Axie Infinity, players can raise, breed, and trade digital pets called Axies, which exist as NFTs (non-fungible tokens). Players can also earn SLP tokens by battling other players. Breeding new Axies requires consuming SLP tokens.

③ Notably, to start playing Axie Infinity, users must first purchase at least three Axie pets from the Axie marketplace. These are NFTs generated via genetic algorithms with varying rarity and utility. Each Axie is an ERC721 token with unique traits affecting its rarity and in-game usefulness. An Axie’s traits depend on its parents’, combining probabilistically upon birth.

④ The game runs on a dual-token system: in-game currency (SLP) and governance token (AXS). The two tokens have clearly defined roles and work together coherently, avoiding systemic risks and rigidity inherent in single-token systems, offering greater elasticity in economic operation and governance.

-

Overall market cap situation, percentage contribution by star projects (dominated by Axie)

① Driven by Axie’s frenzy, GameFi’s market cap rose rapidly, drawing massive inflows.

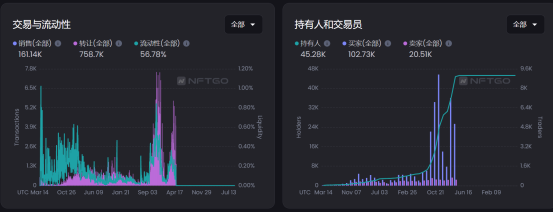

Data source – NFTgo

② Using the above data as an example, peak values were reached in July 2021. Axie Infinity’s 30-day cumulative trading volume exceeded $600 million (reaching $604 million), up 449.5% month-on-month. Historical cumulative volume reached $758 million. Many projects sprouted like mushrooms afterward, uneven in quality, fragmenting the market. Then, starting November, a death spiral channel emerged—rapid decline.

③ Most GameFi 1.0 models showed strong profitability early on, but performance declined as player numbers grew. Take BHB Hero as an example—initial profitability was impressive, but payoff periods stretched to 10 days, then two weeks, then three weeks, eventually resulting in total losses. Even well-funded projects from major studios exhibited death spiral tendencies within about three months.

④ Looking back at 2021, GameFi trading volumes peaked in early August and early November. Both weeks saw trading volumes reach around $220 million, over 90% of which came from Axie Infinity. Other top-trading games included Alien Worlds, Sorare, Aurory, Gods Unchained, and Crypto Kitties. Trading volumes for these games steadily declined after November, dropping to around $44 million in the first week of 2022—over 80% lower than peak levels. Axie Infinity’s trading volume dropped to around $35 million—about 16% of its peak.

4.4.2 Overall User Performance of GameFi 1.0

-

User Growth Data

Looking at blockchain game market data, despite a sharp drop in trading volume, active users have fluctuated upward—from 470,000 in late July last year to 1.53 million in early January this year. Active users tripled within half a year. This indicates that although trading volume plummeted after market cooling, new users continue joining GameFi.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News