Which protocols will benefit from the upcoming Ethereum Shanghai upgrade?

TechFlow Selected TechFlow Selected

Which protocols will benefit from the upcoming Ethereum Shanghai upgrade?

The upcoming Ethereum upgrade will have a significant impact on liquid staking protocols.

Written by: The DeFi Investor

Compiled by: TechFlow

A new narrative is emerging in DeFi. The upcoming Ethereum upgrade will have a massive impact on liquid staking protocols. Here's why I believe liquid staking is a growing trend and the investment opportunities this shift presents.

First, what’s interesting about Ethereum’s Shanghai upgrade? (Expected to launch in March)

Once the upgrade completes, withdrawals of staked $ETH will be enabled. Because withdrawals are currently not possible, many remain hesitant to stake $ETH.

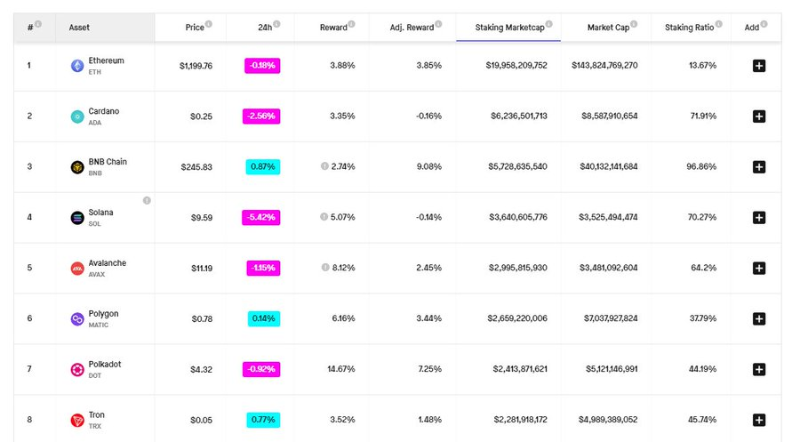

That’s why only 14% of the ETH supply is currently staked. In contrast, most other L1s have over 40% of their supply staked.

Here’s where it gets interesting: If more people begin staking ETH after the Shanghai upgrade—which is highly likely—most will probably opt for liquid staking derivatives.

Because liquid staking derivatives can be used across DeFi while still earning staking rewards. Once users can withdraw their staked $ETH, revenue for liquid staking providers could skyrocket.

Higher revenue → Their tokens stand to benefit as well.

Therefore, here are several tokens expected to benefit from the Shanghai upgrade:

$LDO

Lido is the largest $ETH liquid staking provider. It charges a 10% fee on staking rewards, with a portion of that fee going to the DAO treasury.

Pros:

-

Lido is the market leader in this segment.

-

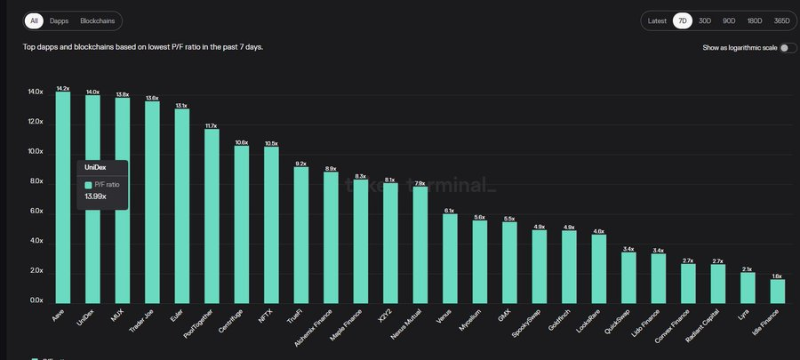

It ranks as the fifth most undervalued protocol based on price-to-fee ratio.

-

82% of the $LDO supply is already circulating (with minimal token inflation).

Cons:

- Does not share revenue with $LDO holders.

$RPL

The second-largest liquid staking protocol.

Pros:

-

Rocket Pool prioritizes decentralization (anyone can run a node).

-

Low $RPL inflation rate (5%).

-

Staking $ETH via Rocket Pool generates higher rewards.

Cons:

- Does not share revenue with $RPL holders.

$SWISE

Another liquid staking protocol.

Pros:

-

Stakewise V3 launching soon.

-

Anyone can stake $SWISE to earn a share of protocol revenue.

-

Open to anyone becoming a node operator (more decentralized).

Cons:

-

Not yet mainstream or widely adopted.

-

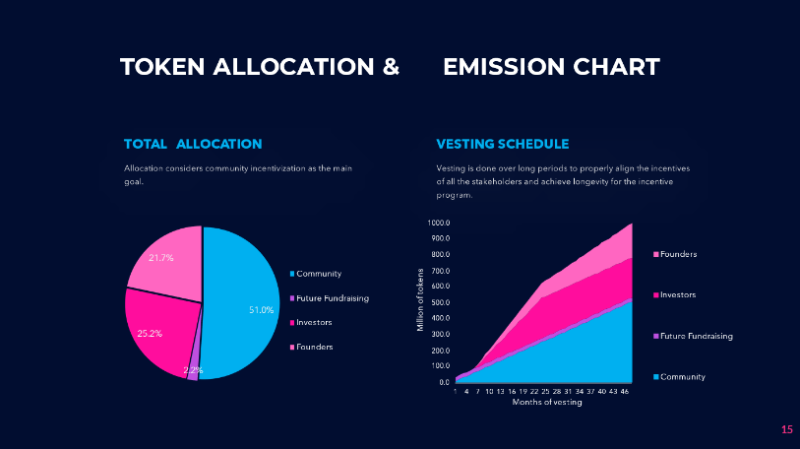

High $SWISE inflation rate.

$FXS

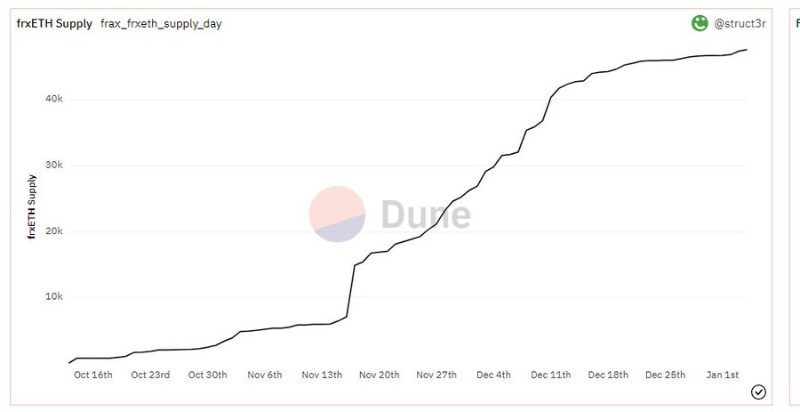

A protocol building a DeFi ecosystem around $FRAX and $FPI. $frxETH (FRAX’s liquid staked ETH derivative) launched a few months ago and has since experienced significant growth.

Pros:

-

$frxETH TVL has grown rapidly.

-

Attractive yields available for $frxETH on Curve.

-

8% of $ETH staking rewards are shared with $veFXS holders.

Cons:

-

$frxETH is relatively new and less popular than other liquid staking derivatives.

-

$FXS currently has a 24% inflation rate.

It’s still too early to predict which of these protocols will benefit the most from the Shanghai upgrade. However, if the upgrade proceeds as planned without further delays, a new narrative around liquid staking is likely to emerge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News