How do crypto products achieve product-market fit?

TechFlow Selected TechFlow Selected

How do crypto products achieve product-market fit?

Product-market fit means having a product that meets the needs of a good market.

Written by: Jack Niewold

Compiled by: TechFlow

Since the term "product-market fit" became popular, the startup world has gradually elevated this concept into something akin to a religion. If you haven't heard of it before, Mark Andreessen defined it best with the following statement:

"Product-market fit means being in a good market with a product that can satisfy that market."

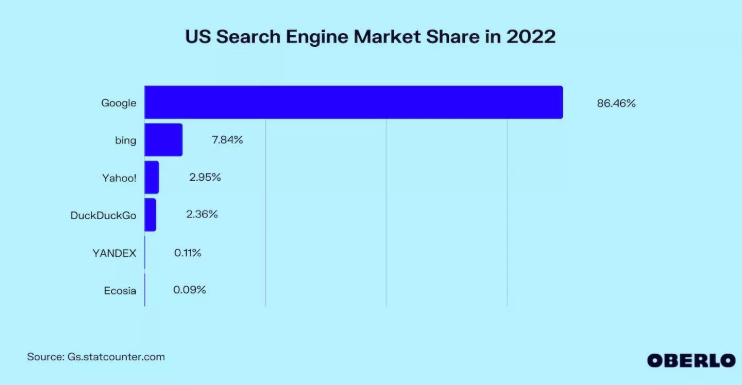

Finding examples of product-market fit is easy—we just need to look at successful companies and fast-growing startups. Coca-Cola on a hot summer day; Netflix's online video, which destroyed traditional television; Blockbuster and DVDs; Google dominating search—almost everyone looking for information online uses their product:

However, despite the significant rise in popularity and prices of cryptocurrencies, product-market fit appears relatively scarce in crypto. In fact, I believe only a handful of products in the cryptocurrency industry have genuine PMF.

During the frenzy of a bull market, it’s easy to make two mistakes when evaluating PMF:

-

Completely ignoring the necessity of PMF, assuming strong funding and a solid team will solve everything along the way,

-

Mistakenly assuming that because token prices are rising, the project has already achieved PMF.

So why do most cryptocurrency projects fail to find product-market fit?

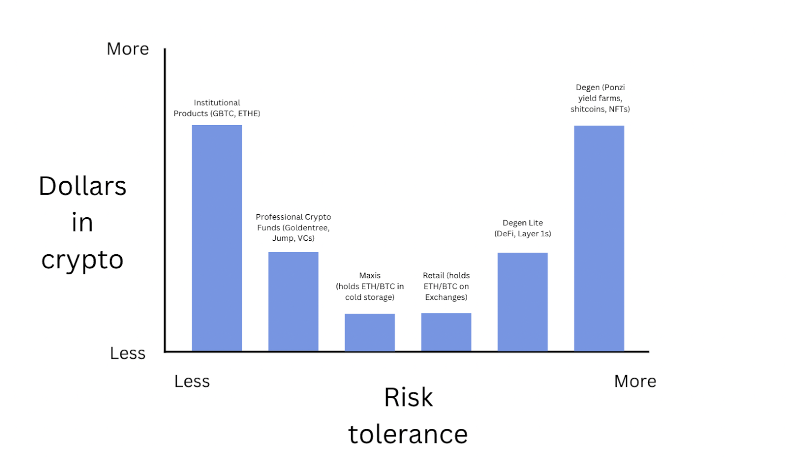

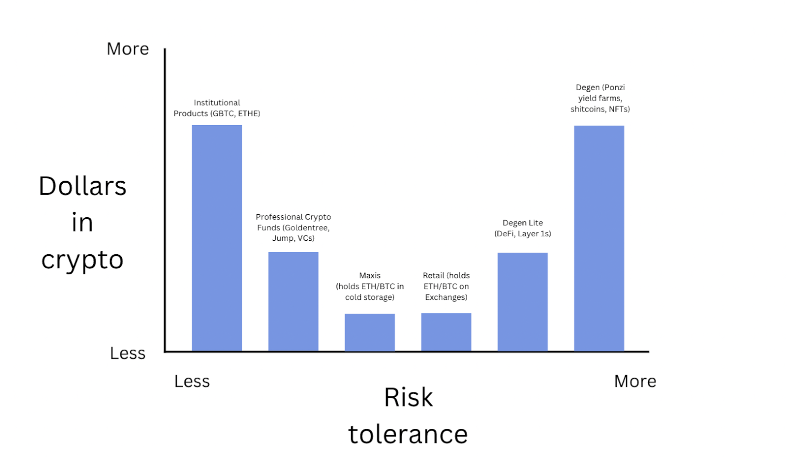

To understand product-market fit, we must first understand the market. What does the spectrum of crypto investors and users look like?

What stands out first about this chart?

Capital flows toward opposite ends of the risk spectrum: On one end, we have large amounts of capital from non-risk-tolerant participants. Here sit sophisticated investors, often traders from traditional markets who have now entered crypto. These are what we call "professional investors," holding the majority of capital in the space.

On the other end, we have the most vocal group on Crypto Twitter: anonymous whales, "Degen" traders, Memecoin enthusiasts. While this group holds less capital than institutions, there are more of them, and they allocate a much higher proportion of their net worth to crypto.

Broadly speaking, each of these two investor groups represents a distinct market. Failing to understand this range is a key reason behind most PMF failures:

- Designing products for markets that don’t exist;

- Serving mature markets with poor products.

Almost all crypto projects struggle with PMF, but I’ll outline two types of PMF failure below:

1. Y2K

Y2K is a very cool product—and an essential one. Some depegging events we saw in spring 2022 proved its necessity, with the UST/LUNA collapse being the most prominent example.

Primary function: Y2K allows users to hedge against stablecoin depeg risk. You effectively buy insurance by depositing funds into a vault. If I want to hedge against Tether/USDT depegging, I can insure (hedge) my position. If it doesn’t devalue, the premium goes to another vault—the risk vault, i.e., the insurer. If it does depeg, money deposited into the “risk” vault is paid out to me proportionally based on how much I deposited into the hedge vault.

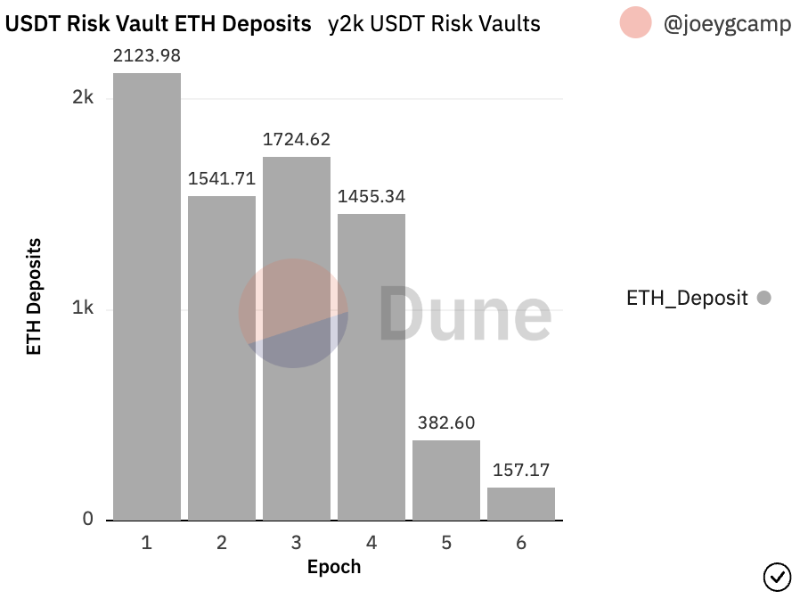

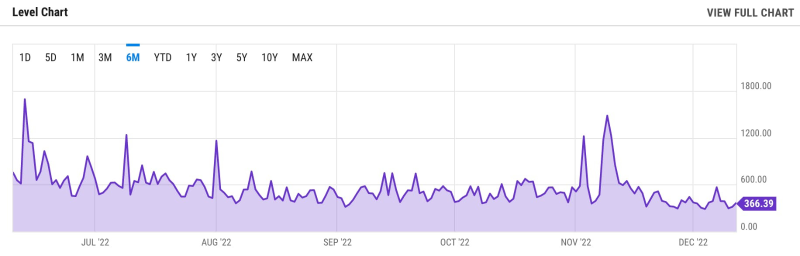

A great product: insurance against depeg risk, transparent market pricing, and simple protection against black swan depeg events. Sounds good, right? Well, let’s look at deposits into the USDT vault over the past five weeks:

Strong performance during the first four weeks, followed by a sharp decline. Note that Y2K was distributing tokens to early protocol users, hoping to incentivize deposits. This reward period lasted one month.

So why did deposits drop so significantly in week five?

I believe it’s due to lack of product-market fit. Let’s revisit our crypto capital/risk spectrum:

How do institutions hedge stablecoin risk? Several ways:

- They hold USD and only enter stablecoins when opportunity outweighs risk;

- They short stablecoins on centralized exchanges;

How do Degens hedge stablecoin risk? Well, they don’t—Degens have high risk tolerance and generally don’t bother hedging tail risks of most stablecoins.

Y2K is a great product: stablecoin risk is real, hedging matters—but it lacks a sufficiently large addressable market: who actually uses this thing? Institutions already have effective off-chain hedging mechanisms, while retail simply doesn’t care about hedging.

In summary: a good product, a bad market—unable to achieve true product-market fit.

2. Metaverse and GameFi Projects

What about a good market with a poor product?

Look no further than some of the GameFi and metaverse projects launched in 2021 and 2022.

Over the past few years, gamblers have been searching for a breakout GameFi or metaverse success, but nothing produced by crypto compares to games made by major studios: think Activision Blizzard, EA, Epic Games.

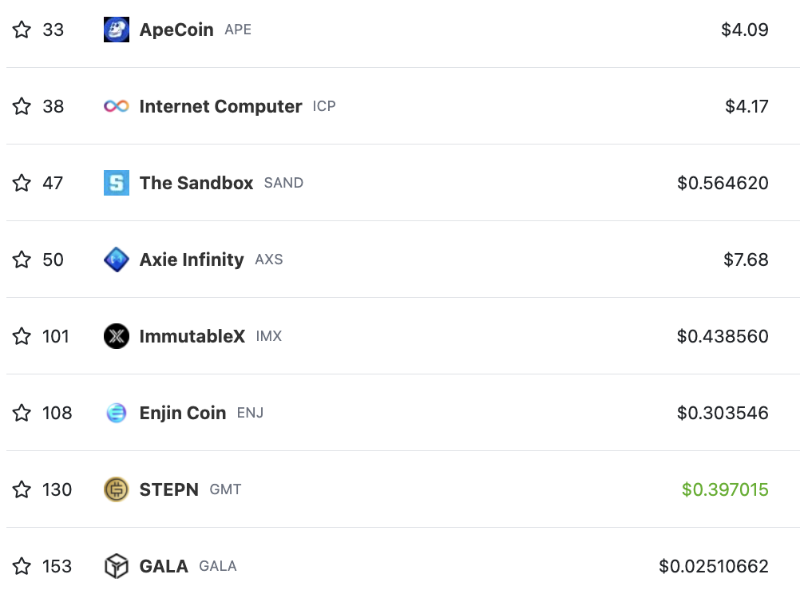

There are an estimated 200 million+ gamers in the U.S. alone—but crypto gaming metrics are dismal:

-

Decentraland, one of the largest metaverse projects, has around 8,000 daily active users. Compare that to 4 million people currently playing Fortnite. Minecraft has 3 million DAU; even Runescape, released in 2001, has nearly 500,000 DAU.

-

Axie Infinity does better, with around 700,000 monthly active users—about the same as Skyrim (note: Skyrim is already 12 years old).

What’s the problem?

Most people don’t play crypto games for the gameplay—they play for the crypto.

Check CoinGecko’s ranking of games and tell me if you’ve played any of them purely for entertainment, or stepped into the metaverse just to hang out with friends.

I bet you haven’t. If you did participate, it was likely to earn some money.

Most people have used Facebook Messenger, played LOL, GTA, or Minecraft—do these products require cryptocurrency to function?

No.

So what does the crypto gaming and metaverse space need?

Better products. Over 200 million gamers are waiting for someone to crack the code. The market is there—but the product is missing.

Is there any good news in this article?

Yes—specifically, one famous project has successfully achieved product-market fit.

Ethereum

While Ethereum doesn’t have any consumer-facing applications per se, it’s the crypto L1 with the highest observed demand. You can actually quantify this demand by looking at gas costs—sometimes even a simple token swap exceeds $100. Why are people willing to pay this when Solana and Arbitrum are nearly free? Product-market fit.

Ethereum has built an unparalleled brand of decentralization and utility across its ecosystem:

-

People are willing to pay more for NFTs held on Ethereum.

-

Users have greater confidence in assets stored on-chain.

-

The most innovative and trusted DeFi blue-chips operate on Ethereum.

For these reasons, on-chain transaction costs are higher—this itself proves product-market fit: the cost demonstrates that Ethereum’s PMF is far stronger than newer L1s, despite their lower fees.

In my view, DEXs like Uniswap, perpetual exchanges like GMX and dYdX, and online, non-KYC crypto gambling platforms have also found product-market fit—but these are speculative use cases. All these platforms effectively pay for blockspace on Ethereum, and those profits are ultimately passed on to ETH holders.

Closing: Build What People Want

Real demand in crypto comes from users—those who derive utility from specific products. The product may relate to DeFi, GameFi, Metaverse, gambling, speculation—but fundamentally, it must deliver value to many people willing to pay for it; otherwise, the business model simply doesn’t work.

As crypto strives toward a new and better future, the industry should wisely reflect on creating real value for users and people. We can no longer ignore product-market fit just because we’re building in crypto.

Now we must take the necessary steps, just like any other startup: diligently pursue product-market fit.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News