Arbitrum Overview: Ecosystem, Airdrop Strategies, and DeFi Alpha

TechFlow Selected TechFlow Selected

Arbitrum Overview: Ecosystem, Airdrop Strategies, and DeFi Alpha

It can be said that Arbitrum is currently the most promising blockchain.

Author: Viktor DeFi

Translation: TechFlow

Arbitrum can be said to be the most promising blockchain today, impossible to ignore. This article will share some of my views on Arbitrum, airdrop opportunities, and Alpha opportunities.

Overview

Arbitrum is an L2 scaling solution created by Offchain Labs, designed to address congestion and high fees on Ethereum. Arbitrum aims to achieve high throughput and low costs while maintaining trustless security.

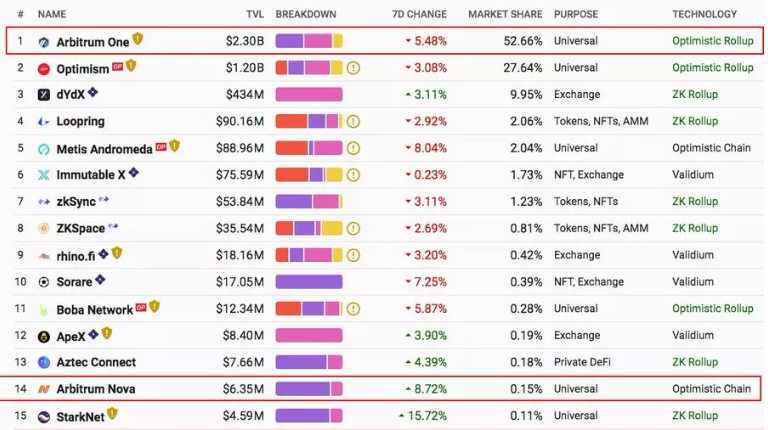

According to DefiLlama, it is the fifth-largest chain in DeFi. According to L2Beat, Arbitrum is the largest L2 in terms of activity and TVL. Additionally, Offchain Labs has raised a total of $123.7 million across three funding rounds.

Arbitrum ranks fourth in Chainlink price feeds, and its ecosystem already hosts over 300 projects. Although Arbitrum currently does not have its own token, there are many speculations about potential airdrops.

How Does Arbitrum Work?

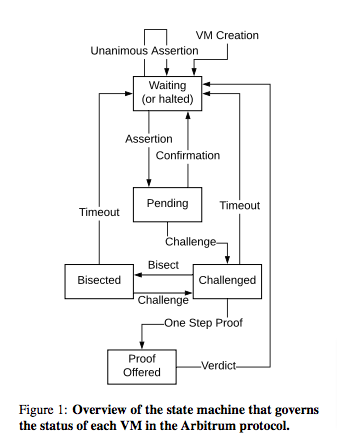

Arbitrum uses a simple cryptocurrency design, enhanced with functionality allowing the creation and use of virtual machines (VMs) that can host arbitrary functions.

Moreover, Arbitrum recognizes two main actors: keys and virtual machines.

Keys are identified by public keys; an action is considered taken by a participant if it is signed by the corresponding private key.

Similarly, virtual machines take actions by executing code. Also, any actor can hold currency.

In simple terms, users and smart contracts instruct the Arbitrum blockchain to act by placing transactions into the chain’s inbox. Arbitrum then processes them and outputs transaction receipts.

Developer Activity

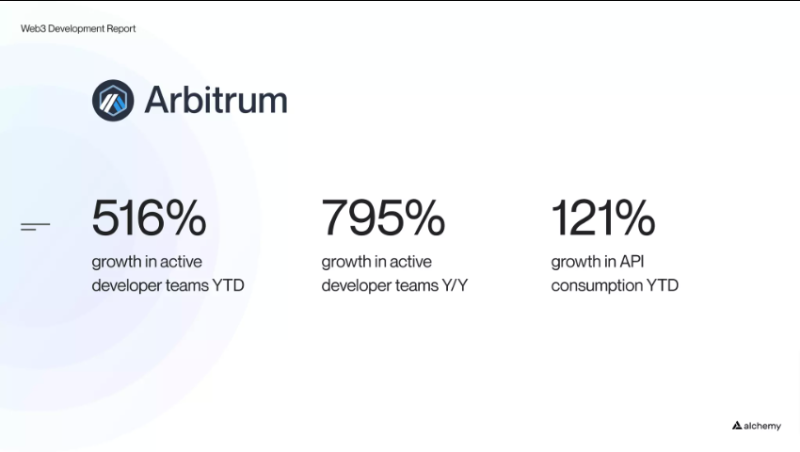

Alchemy's Web3 Developer Report (Q3 2022) shows a 516% increase in active developer teams on Arbitrum. Year-to-date, API consumption has grown by 121%.

Developer activity is one way to assess the health of an ecosystem.

Airdrop

As I mentioned earlier, Arbitrum does not have its own token yet. Therefore, there is much speculation around a potential $ARBI airdrop. Below is everything you need to know about airdrop eligibility.

Arbitrum Nova

Recently, Arbitrum launched a new general-purpose rollup called Arbitrum Nova, built on their AnyTrust technology.

Arbitrum Nova focuses on social projects, gaming, and blockchain dApps. We can participate and engage with Arbitrum Nova to increase our chances of receiving the $ARBI airdrop.

Alpha

Tokens with solid potential on my watchlist:

1. Dopex

Dopex is a decentralized options exchange. Their goal is to maximize liquidity, reduce losses, and deliver maximum returns for options buyers.

2. Rage Trade

Rage Trade is launching its Delta Neutral GLP Vault.

By hedging ETH and BTC exposure, it turns GMX’s GLP into a stablecoin farm, catering to two types of users: risk-seeking and risk-averse investors.

3. 3xcaliSwap

3xcaliSwap is a DeFi protocol with three components: DEX, borrowing and lending, and bribeable LP pools. They recently announced MultiSwap as well.

4. Umami

Umami performs well in real yield. They offer competitive returns while hedging positions. Stakers receive 50% of all protocol rewards. Users can also compound WETH for UMAMI.

5. DAO Jones

DAO Jones is a protocol aiming to make options investing simpler and more liquid. They have a new Metavaults product that allows users to provide liquidity while hedging the underlying assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News