Analyzing DCG's asset structure: in urgent need of a white knight or forced to cut losses

TechFlow Selected TechFlow Selected

Analyzing DCG's asset structure: in urgent need of a white knight or forced to cut losses

What should DCG do about the $1 billion hole they're now facing?

Written by: Adam Cochran

Translated by: TechFlow

Genesis is the only full-service major broker in the crypto space and has played a critical role in enabling large institutions to access and manage cryptocurrency risk. Genesis is one of the most important pieces within DCG's portfolio, yet today no one knows what will become of it.

DCG now faces a $1 billion shortfall—what should they do? I decided to break down their assets from the outside as thoroughly as possible.

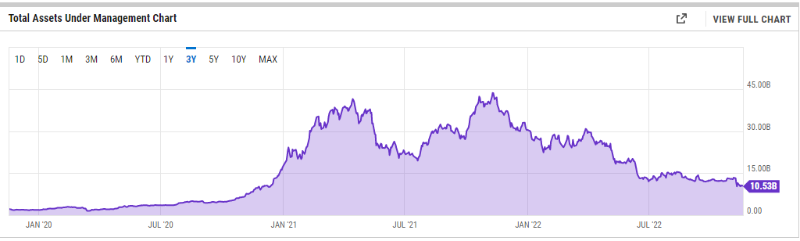

We know that during its 2021 sale to SoftBank, DCG was valued at $10 billion, with GBTC generating roughly $500 million to $750 million in fees that year and managing approximately $38 billion in assets under management.

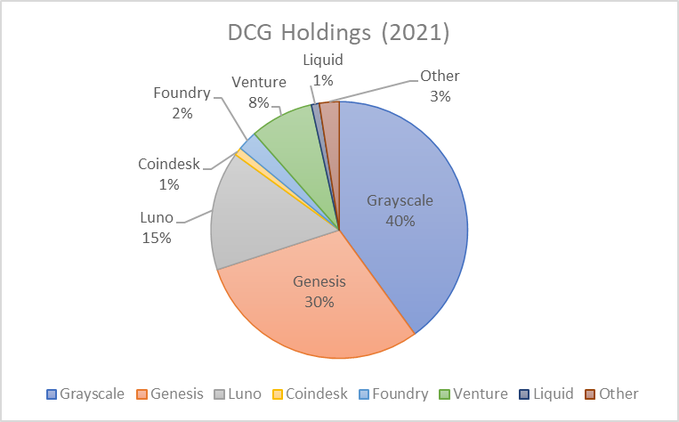

This allows us to roughly estimate the value of each component within the empire.

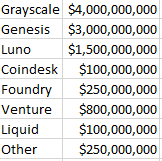

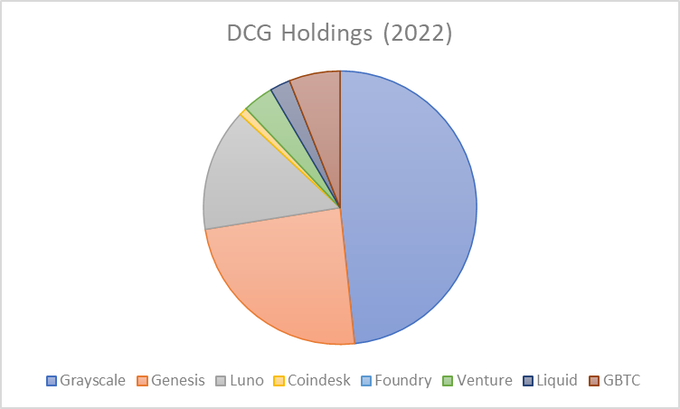

Assuming DCG’s favorable terms generate $500 million annually in fees, applying an 8x multiple to each segment would place Grayscale’s valuation at around $4 billion. We might also assume Genesis’ other major businesses are worth about $3 billion.

We can further speculate that their Luno acquisition was booked at a minimum of $1 billion in value.

Their historical investments likely amount to $200 million in cash deployed, with an $800 million book value at the time of investment due to bullish market conditions.

So, this is roughly what we’re looking at in terms of segmentation.

These are approximate figures from an external perspective, but they help us gauge what their venture portfolio might look like.

Now we know several things:

-

Liquidity has declined by over 70%;

-

Venture valuations have been severely marked down, and the process is slow;

-

They appear to be in a hurry;

-

Advertising revenue in this sector has also dropped significantly.

Therefore, let’s reassess:

-

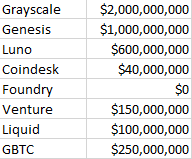

Grayscale’s AUM has declined, so annual revenue is more like $200 million, with a lower multiple—possibly worth $2 billion.

-

Looking at changes in private markets, Luno could also decline by 50%.

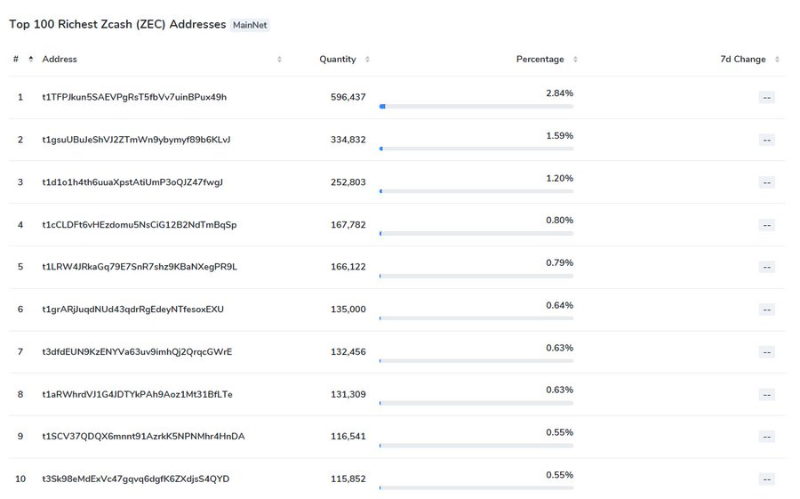

If we examine the largest holders of each currency (excluding BTC/ETH) where they hold liquidity, assuming they are among the top 10 holders, this amounts to roughly $50 million, plus another $50 million potentially in ETH/BTC.

We know they hold at least $250 million in GBTC, so let’s assume fees have accrued to that level.

We know CMC sold to Binance for $400 million during the bull market—CoinDesk’s traffic and added value may be only 1/10 of that, so unless someone buys it purely for brand value, we might reduce its worth to $40 million.

And frankly, it's unclear whether Foundry is currently profitable or even still operational; conservatively, I’ll assign it a $0 value.

This external analysis gives us an overall valuation of $4.4 billion:

Given the current market collapse, this still seems optimistic—no wonder they can’t raise $1 billion on these terms. So let’s suppose they want to prioritize saving Grayscale, Genesis, and Luno.

But they may not be able to, because they need to address a $500 million book-value issue.

Due to thin markets for GBTC, ZEC, ETC, ZEN, and all other liquid positions, I’d be surprised if they received more than 75% of the book value on many of these assets—their sales would exert massive selling pressure on an already fragile market.

Their venture portfolio is so weak because many of their best investments were exited in the previous cycle—the current portfolio is somewhat lackluster.

Thus, to raise $1 billion, they seemingly must:

-

Sell some equity;

-

Sell all venture investments;

-

Sell all liquid holdings;

-

Sell Luno, CoinDesk, and Foundry (if they have any value).

And hope their value holds up well.

Perhaps they get lucky and someone pays a premium, or they manage to sell part of Grayscale or Genesis to a major firm like Fidelity. But they may have to give up everything else to save themselves.

My guess is: if they don’t close a funding round this week, most of their assets will be sold off. If they fail to secure financing in time, they may have to consider spinning out Grayscale itself.

This is an interesting risk model, as it remains unclear whether they are insolvent or simply underfinanced.

But we know that failure to raise funds would have massive ripple effects, making it worthwhile to build out this risk model as thoroughly as possible.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News