Forbes: The Dilemma and Redemption of Cryptocurrency Empire DCG

TechFlow Selected TechFlow Selected

Forbes: The Dilemma and Redemption of Cryptocurrency Empire DCG

Time and the gradually recovering crypto market could be DCG's savior.

By Nina Bambysheva, Forbes

Translated by Luffy, Foresight News

Barry Silbert, founder of Digital Currency Group

In May 2022, the domino effect following Terra’s collapse rapidly devastated the entire crypto industry. Within a year, Celsius Network, BlockFi, Voyager Digital, and FTX had all filed for bankruptcy. Once-celebrated crypto CEOs found themselves either in court or behind bars. Now, with Bitcoin surpassing $40,000, the crypto sector appears to have finally emerged from its winter.

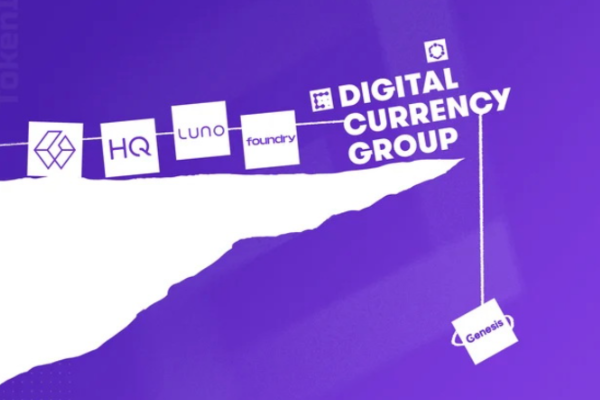

For Barry Silbert and his Connecticut-based Digital Currency Group (DCG), the fallout from Terra’s collapse has been like quicksand. His Genesis Global Capital lending arm filed for bankruptcy protection this January, but the group still holds a vast portfolio of over 200 companies, including cryptocurrency miner Foundry, digital asset exchange Luno, and the crown jewel—Grayscale Investments, the world’s largest Bitcoin fund managing $27 billion in assets with a 2% fee rate. Despite rising Bitcoin prices, Grayscale’s flagship product, GBTC, continues to trade at an 11% discount to Bitcoin’s spot price. Last month, DCG sold its news outlet CoinDesk to Bullish, a crypto exchange led by former New York Stock Exchange president Tom Farley, in a deal whose financial terms were not disclosed.

Silbert’s crypto winter is far from over. The former billionaire now faces a cascade of serious challenges:

-

New York Attorney General Letitia James is seeking to bar DCG and Genesis from operating in New York as punishment for allegedly deceiving investors by attempting to conceal over $1.1 billion in losses tied to the collapse of Singapore-based crypto hedge fund Three Arrows Capital—one of Genesis’s largest borrowers.

-

Cameron Winklevoss, president of crypto exchange Gemini, has also accused Silbert and DCG of defrauding Gemini Earn depositors. Bloomberg, citing informed sources, reported that the FBI, SEC, and state officials are investigating these allegations.

-

Genesis claims its parent company treated it as a de facto treasury without proper corporate controls. It demands that DCG repay more than $320 million in loans that came due in May 2023. According to a proposed bankruptcy plan filed on November 28, DCG has agreed to new repayment terms.

-

Many Genesis creditors rejected DCG’s latest recovery proposal in August. The new plan allows Genesis to sue DCG on multiple grounds. DCG insists these claims are baseless, while Genesis says it would prefer a settlement rather than pursue legal action against its former parent.

The fraud allegations cited in the New York civil suit include a questionable $1.1 billion 10-year note from DCG appearing on Genesis’s balance sheet, which Genesis classified as a liquid asset.

“FTX was more like Bernie Madoff,” said Austin Campbell, adjunct professor at Columbia Business School and managing partner at blockchain-focused Zero Knowledge Consulting, “but if these allegations are true, DCG might resemble Enron.”

DCG denies all fraud allegations. “The note represents DCG stepping in to support Genesis after Three Arrows Capital defaulted in June 2022,” a company spokesperson told Forbes via email, requesting anonymity. “DCG agreed to assume Genesis’s unsecured $1.1 billion loan to Three Arrows Capital, the recovery prospects of which were and remain highly uncertain. DCG received no cash, cryptocurrency, or other payment for this note and took on the risk of Genesis’s losses on Three Arrows Capital voluntarily, with no obligation to do so.”

The spokesperson added that the promissory note mechanism used to assist Genesis was developed with input from DCG’s “financial and legal advisors, as well as our accountants.”

Silbert and DCG maintain they are cooperating with the New York Attorney General’s investigation and were “taken aback” by the allegations, which they call “baseless,” describing Genesis’s claims as “misleading.” Nevertheless, numerous lawsuits and claims remain unresolved, and time may be on Silbert’s side.

Regarding Gemini’s claim that DCG defrauded depositors, DCG stated in a January statement: “This is Cameron Winklevoss deflecting responsibility—he was fully in charge of Gemini Earn’s operations and personally promoted the product to customers.”

Bitcoin surged 157% last year, and the value of many digital assets underpinning Silbert’s vast empire may have increased by billions. For example, shares of Bitcoin miners have soared recently—Marathon Digital is up 356% year-to-date. DCG’s mining firm Foundry is now valued at around $3 billion. Given its rich asset base, DCG has fared significantly better than other victims of the Terra collapse.

Ram Ahluwalia, CEO of investment advisory firm Lumida Wealth Management, which has closely followed the case, said the biggest current threat to DCG appears to be the New York lawsuit, which could force Silbert to relinquish control of Grayscale. “The New York Attorney General is trying to ban DCG from conducting securities and commodities business in the state,” Ahluwalia said. “Legally, they would be required to cease various operations.”

Ahluwalia added that if James prevails, DCG would be barred from operating in New York—a restriction that could soon spread: other states might follow suit.

According to an investor letter recently reviewed by Forbes, Grayscale manages over a dozen crypto funds, including the massive Grayscale Bitcoin Trust (GBTC), which accounts for nearly two-thirds of DCG’s revenue. In DCG’s third-quarter report, Grayscale contributed 67% of the $188 million in revenue—$126 million—more than double that of its second-largest subsidiary, Foundry.

Worse still, the potential approval of a spot Bitcoin ETF could erode Grayscale’s appeal to future investors. Ironically, Grayscale has been fighting to convert GBTC into a more investor-friendly ETF and recently won a major court victory advancing the case—but the result could be a flood of powerful new competitors, including giants like BlackRock and Fidelity, offering similar funds at a fraction of Grayscale’s current fees.

Losing Grayscale, Ahluwalia said, would leave a downsized DCG “mired in endless settlements and litigation.” He added that what remains of Silbert’s empire would effectively become “an insolvent zombie company.” Yet the crypto rally could yet prove its savior. In November 2021, at the peak of the crypto boom, DCG raised $700 million in a private placement led by SoftBank, valuing the company at $10 billion.

“If DCG ultimately fails to recover and reach a settlement with Genesis creditors, they may be forced into bankruptcy,” said advisor Campbell.

DCG’s recovery plan initially gained support from Genesis and the unsecured creditors committee, but not from Gemini or the ad hoc committee of Genesis lenders, who argue it offers the “best feasible recovery outcome.”

One of the most complex aspects of Genesis’s bankruptcy resolution is the legal dispute between Genesis and Gemini. In 2021, Gemini Earn offered depositors yields of up to 8% per year for holding crypto with the exchange. Under the program, Genesis borrowed crypto assets from Gemini Earn customers, reinvested them at higher rates, and pocketed most of the spread after paying interest. Winklevoss’s Gemini acted as an agent, handling deposits and withdrawals, and collected a small commission on payments flowing from Silbert’s Genesis to Earn investors. Genesis halted withdrawals on November 16, 2022, to protect its assets.

Shortly before that, as market conditions deteriorated due to a series of bankruptcies, Genesis agreed to provide collateral to ensure Earn customers wouldn’t lose their assets if borrowers defaulted. It pledged shares of the Grayscale Bitcoin Trust (GBTC) as collateral, committing to deliver 30.9 million shares on August 15, 2022, and another 31.2 million on November 10. When Genesis stopped withdrawals six days later, Gemini foreclosed on the first batch of collateral, but the second tranche was never transferred. At the time of foreclosure, GBTC was trading at $9.20 per share.

Last month, Gemini sued Genesis to claim the remaining collateral. Allegedly, DCG had sent GBTC shares to Genesis, but the unit refused to transfer them. Today, the value of this collateral has soared—it now trades above $30 per share. The total package is worth $1.6 billion, enough to cover all Earn customer claims.

Genesis sees it differently. On November 21, it countersued Gemini, seeking to claw back $689.3 million withdrawn by Earn users within 90 days of Genesis filing for bankruptcy. Genesis also wants to reallocate the collateral to benefit all its creditors and disputes Gemini’s right to foreclosure and the additional GBTC shares. Gemini insists that due to the collateral agreement, Earn customers have priority in repayment.

There’s another twist: when Gemini foreclosed, the first batch of GBTC collateral was worth $284 million; today, it exceeds $800 million. Gemini still controls these shares and says it holds them solely for the benefit of Earn depositors.

A Genesis lender who requested anonymity told Forbes that many creditors believe both Silbert’s DCG and Winklevoss’s Gemini have acted in bad faith. “I think creditors are incredibly frustrated because this bankruptcy process has taken so long, and DCG has been unwilling to propose reasonable solutions. They’ve repeatedly delayed, only to offer terms that are deeply unfavorable.”

“I think the best outcome for creditors, DCG, and all Genesis stakeholders would be a fair settlement with DCG,” said another Genesis creditor, identifying himself as BJ on Telegram. “Creditors’ lives have been severely disrupted by this bankruptcy, while DCG benefits from delays. I believe it’s in DCG’s best interest to find a way to avoid protracted litigation involving fraud claims from thousands of creditors.”

Undoubtedly, the crypto market’s recovery is helping DCG. “Either DCG buys enough time to generate sufficient profits from Grayscale to rebuild its balance sheet and eventually pay Genesis, or some other legal pressure forces DCG into bankruptcy,” said Jeff Dorman, chief investment officer at crypto hedge fund Arca. “Right now, is there anyone with a big enough stick to force DCG to pay and push it into bankruptcy? So far, we haven’t seen it.”

Another anonymous creditor said Silbert and DCG may also benefit financially from delaying Genesis’s bankruptcy: “Millions in loans to Genesis were due in May, but he hasn’t repaid them—and that’s capital he can profit from. With risk-free rates at 5%, just imagine—he’s earning $30 million annually thanks to the delay.” According to filings submitted on November 27, DCG has reduced over $600 million in debt owed by its subsidiaries to approximately $324.5 million.

“The recent deal Genesis struck with DCG over the DCG loan is absolutely absurd,” scoffed creditor BJ. “Those loans were due in May. They sued DCG to get paid, then immediately gave them a stay. That stay ended, DCG still hasn’t paid, and now they’re preparing to grant another stay. That’s unfair to creditors.”

Meanwhile, the clock is ticking. Grayscale and other asset managers—including BlackRock, Ark, WisdomTree, VanEck, Invesco, and Fidelity—appear close to receiving SEC approval for spot Bitcoin ETFs. Approval timing remains uncertain, according to Bloomberg analysts, but could come by January 10.

If Grayscale secures SEC approval and converts GBTC into an ETF, the fund’s share price discount could narrow or disappear entirely, increasing value for shareholders—one of whom is Genesis itself. However, DCG’s cash flow could suffer under pressure to align management fees with ETF competitors. Morningstar reports that the average expense ratio for U.S.-listed ETFs and mutual funds is below 0.4% of assets. Still, given its $27 billion in assets as a closed-end fund, Grayscale would instantly become the largest ETF in the market. New inflows into a GBTC ETF could offset any decline in fee income.

“If GBTC becomes an ETF and management fees are halved, that will affect the recoveries we might receive,” explained Genesis creditor BJ. But he added that while ETF approval would hurt DCG, the actual situation is complicated: “They’d still remain the biggest player.”

Regardless of Grayscale’s next move, Ahluwalia believes DCG faces brand “annihilation”—a process that could unfold over two to three years.

“We keep seeing how damaging this is for sentiment,” said Arca’s Dorman. “To a casual observer, it looks terrible—they see nothing but negative headlines every day. But these businesses will find a way forward.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News