Web3 Cold Start: How to Make Your Project Known and Reach the Market?

TechFlow Selected TechFlow Selected

Web3 Cold Start: How to Make Your Project Known and Reach the Market?

Compared to Web2, Web3 currently lacks a systematic GTM methodology and remains in a relatively blind growth phase.

Background

As someone responsible for growth at a Web3 project, one question I often hear is how to cold start a project—essentially, how to GTM (go-to-market), meaning how to get your project noticed and into the market.

Compared to Web2, Web3 currently lacks a systematic GTM methodology and remains in a relatively chaotic growth phase. Managing community expectations through tokens and NFTs differs significantly from traditional Web2 growth hacking techniques, making many Web2 marketing strategies ineffective or even incompatible in Web3.

However, the underlying logic and processes are similar—both require user acquisition, activation, retention, and referrals. In Web3, there are already widely used tactics for acquisition such as AMAs, giveaways, and collaborations.

Therefore, by leveraging these common scenarios and utilizing native Web3 growth platforms effectively, early-stage projects can significantly improve user acquisition efficiency, reduce costs, and—with proper community management—accurately retain loyal seed users. Simply put: amazing!

AARRR Model

With the growing number of Web3 projects (it feels like there are more project teams than users during this bear market), the Web3 Growth space has seen an explosion of new products, each carving out niche domains. There are now numerous DApps available across dimensions like user acquisition, community management, notifications, reward distribution, and data analytics [see figure below].

Source: Twitter@Safaryclub

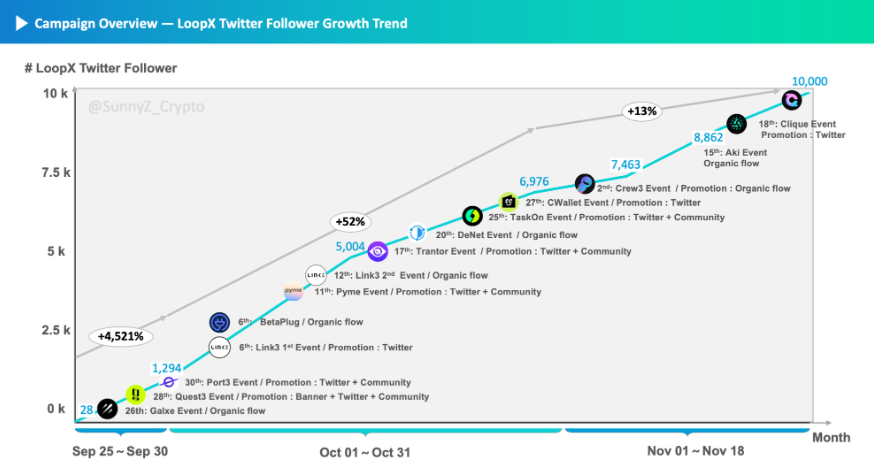

The most relevant category for project cold starts is user acquisition. Recently, my own project LoopX went through this cold-start journey, so I’m sharing a recap of how I leveraged native Web3 growth methods to grow from 0 to 10k Twitter followers, hoping it can offer inspiration and practical insights to others building in this space.

Growth Path

Over the past six weeks, I deeply engaged with 13 platforms in the sequence shown below, launching multiple campaigns while tracking Twitter follower growth. The overall trend showed steady, stage-by-stage growth. September and October saw higher activity and faster growth, while November slowed down due to personal bandwidth constraints—mainly relying on partnerships and giveaways.

If you're unsure about the optimal order for platform collaboration, feel free to use the diagram below as a reference.

Although these 13 platforms differ in focus, their core functionalities are quite similar—especially the all-in-one platforms, which aren't vastly different from each other. You can clearly see trends of mutual "inspiration," with competition primarily centered on product iteration speed and business development pace—it's intensely competitive.

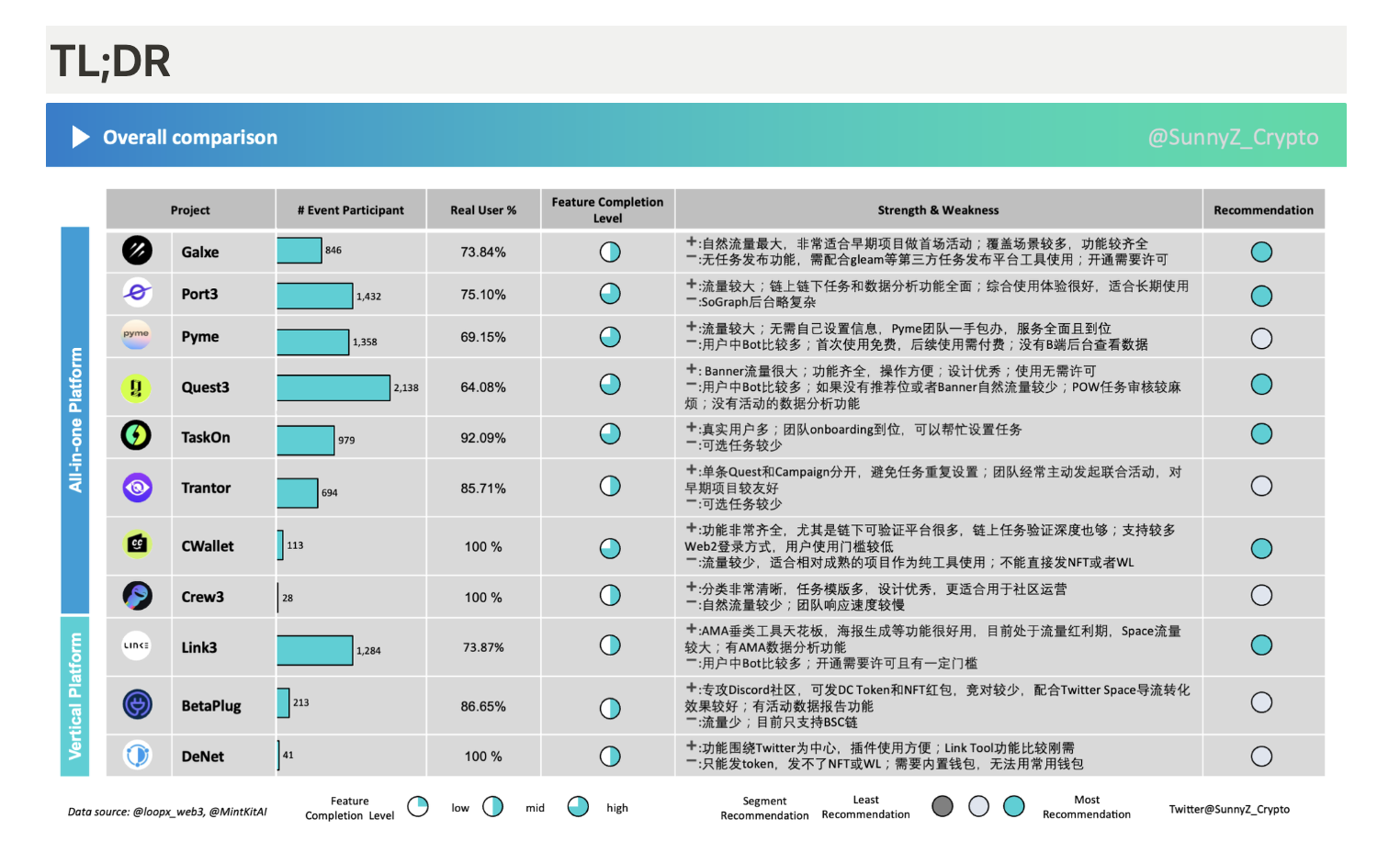

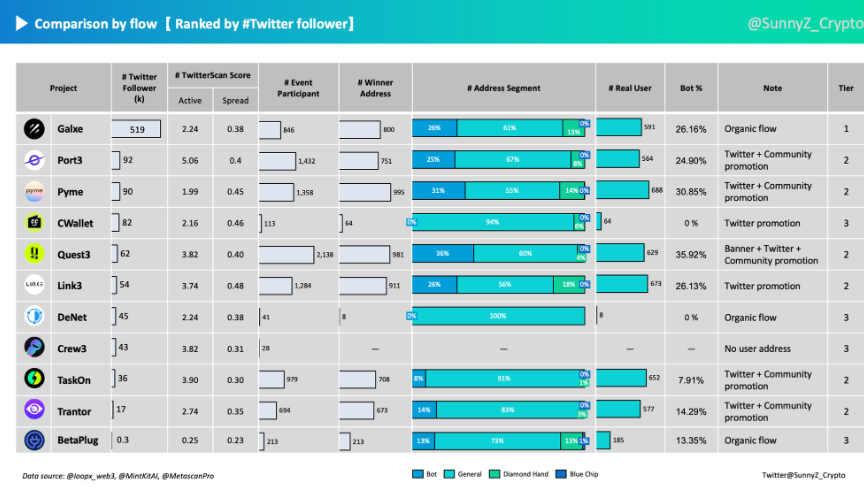

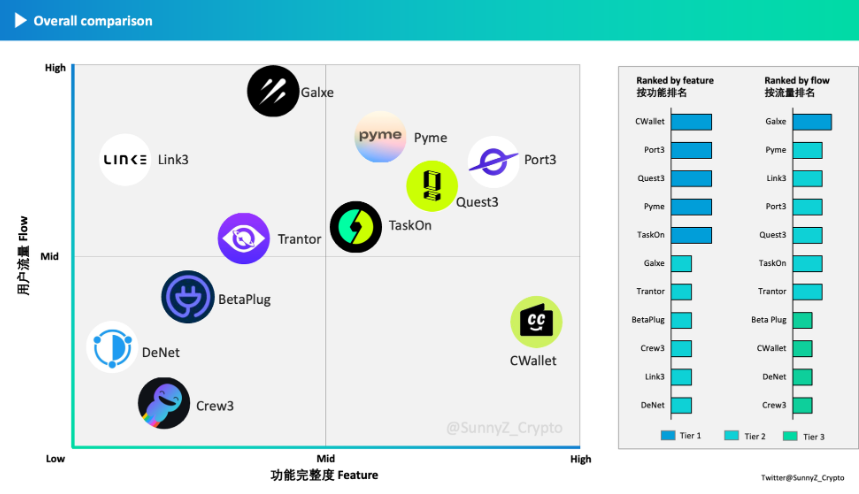

To better understand each platform’s strengths and weaknesses and optimize campaign details, I analyzed performance data from these 13 platforms based on real-world results (Aki and Clique campaigns are still ongoing; updated data will be shared upon completion). Among various factors, I focused particularly on two key modules: Functionality and Traffic, corresponding to solving user needs and delivering value (i.e., driving traffic)—the two biggest pain points. Below is an overview and comparison of each platform:

(Disclosure: This is not advertising or sponsored content, nor do I have any vested interest.)

Hands-on Review of Web3 Growth Tools

Platform Overview

There’s plenty of information online about these platforms, so here I’ll keep introductions brief and include links for further exploration.

There are also strong players outside this list—such as Layer3 and Dappback—but since they charge fees for campaign hosting, I didn’t include them in this review. After all, I’m a habitual free-user, and only used free tools.

From a platform growth perspective, staying free and accessible helps expand B2B adoption in today’s Web3 landscape. User switching costs are low, and product substitutability is high—users go where the tools are affordable, robust, and easy to use. Healthy competition benefits everyone.

Testing Methodology

Before presenting the data, let’s clarify the testing logic. The approach was based on controlled variables and repeated trials, aiming for comparable and relatively accurate results.

-

Task Setup: Tasks were consistent across platforms—follow social media accounts and complete a Google Form feedback survey (some platforms don’t support form redirects, so only social tasks applied). Each platform had identical form content but unique URLs.

-

User Screening: Real users were manually filtered using responses from the Google Form backend before distributing rewards.

-

Data Analysis: Wallet addresses were analyzed via mintkit.ai, classifying users into five categories based on NFT holdings, wallet balance, address connections, etc.: Bot (automated), General (average), Diamond Hand (loyal), Blue Chip (high-value), and Whale (large holder).

-

Multiple Tests: Where possible, the same platform was tested with different features—for example, Galxe, Link3, Quest3, and DeNet were each tested at least twice.

-

Scenario Segmentation: For specific use cases like AMAs, the same Twitter Space was used to compare data across multiple platforms; same for giveaways (GA).

(Note 1: All data comes from real growth metrics of @loopx_web3. Single-test data may contain some variance; actual results may differ.)

(Note 2: For brevity, some abbreviations are used: TW = Twitter, DC = Discord, TG = Telegram, TS = TwitterScan, WL = Whitelist, GA = Giveaway, Txn = Transaction)

Traffic Comparison

-

Traffic levels show clear disparities, falling roughly into three tiers. Galxe stands alone in Tier 1—their organic traffic matches the combined output of second-tier platforms like Port3, Pyme, Quest3, Link3, TaskOn, and Trantor. Notably, Quest3 Banner offers significant traffic advantages.

-

Judging by activity and reach metrics on TS, Port3, Quest3, Link3, Crew3, and TaskOn actively promote their Twitter presence, resulting in broader campaign visibility (by the way, why are so many projects named xx3? 👀). Galxe, having launched its token earlier, appears less active now—but due to its established user base, reach remains strong despite lower engagement.

-

High-traffic platforms attract more bots. Nearly all platforms see 15–30% bot participation, with Quest3 hitting 36%—almost half. Clearly, DID-based identity systems still have a long way to go. Among these, Port3 and Clique allow reward distribution conditioned on multiple data filters. Kudos to Clique—their monitoring depth is best-in-class, greatly reducing the risk of bots claiming rewards.

-

Surprisingly, Trantor performed well despite modest TW follower count. They attracted solid participation with quality user data. Upon follow-up, I learned Trantor frequently initiates multi-project joint marketing campaigns, which significantly boosts B2B user stickiness.

-

Crew3’s domain issues impacted data reliability this time. Web3 projects remain fragile—one misstep with domains or accounts can severely hinder progress.

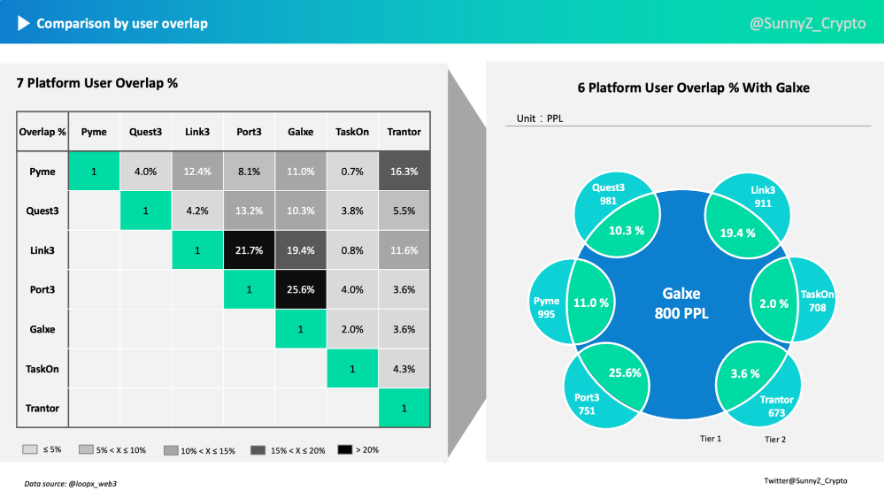

User Overlap Comparison

-

All platforms show high user overlap with Galxe. This suggests that “sheep farmers” (reward chasers) don’t favor any single platform—it’s normal to farm across multiple sites. It also highlights Galxe’s massive user base and first-mover advantage.

-

Port3, Link3, and Galxe share highly overlapping user bases. This could be because earlier versions of Port3 required integration with Galxe for reward distribution, pulling users from Galxe. Additionally, Galxe was the first to launch AMA badges, and Link3 focuses heavily on AMA-centric markets—so shared origins explain the high overlap.

-

Pyme and Trantor also show significant user overlap. Pyme excels in Indian and Southeast Asian markets, and Trantor originated from StarryNift—indicating that GamFi-originated users are concentrated in these regions.

-

Among all platforms, TaskOn stands out with unusual data patterns—distinct in both bot volume and overlap rates. Given TaskOn is incubated by OntoWallet, this suggests DeFi users and NFT badge collectors are likely different demographics.

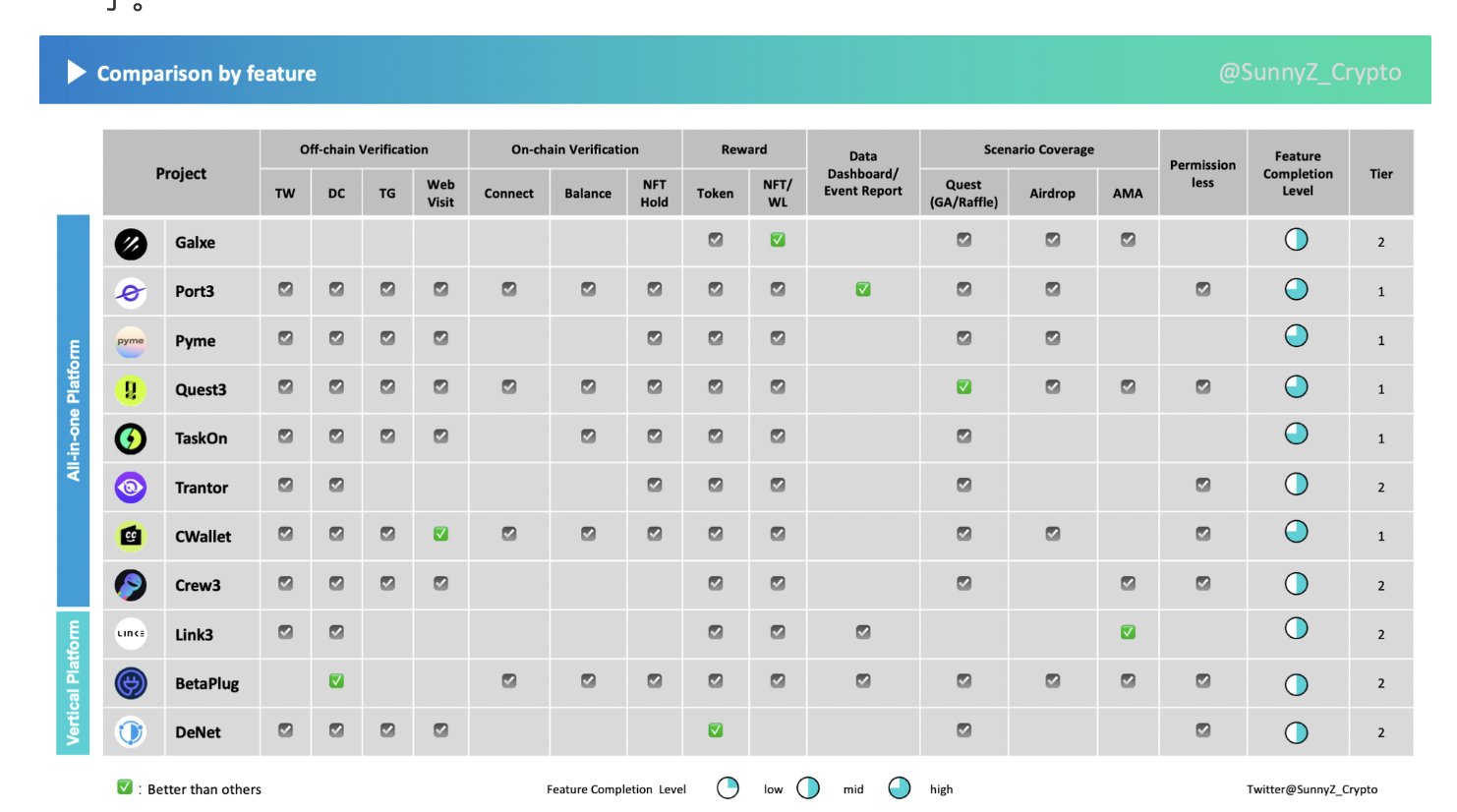

Feature Comparison

It's impossible to cover every feature when comparing horizontally. Here, I focus on functions that are most essential and frequently used by project teams, broken down into five modules: on-chain tasks, off-chain tasks, reward distribution, data analytics, and scenario coverage. Gray indicates basic functionality; green means superior capability compared to others.

Vertical-focused platforms and all-in-one platforms operate on different levels, so comparisons are split by type for clarity.

-

Overall, feature sets are quite similar—dominated by off-chain verification with supplementary on-chain checks, covering multiple scenarios. This confirms earlier observations about intense feature competition and high product substitutability.

-

Data analytics is crucial, yet few platforms offer it—only Port3, Link3, BetaPlug, and Clique do. Integrating analytics requires deep data monitoring capabilities, which isn’t cost-effective for most platforms. Especially for retention metrics, implementation demands are high. This reflects that Web3 growth isn’t yet data-driven.

-

Feature completeness doesn’t always correlate with traffic. This depends on each platform’s market strategy—specifically whether they aim to grow To C via To B. Pure tooling platforms like CWallet, Genki, and Gleam focus solely on B2B without funneling traffic back to themselves. In short, they lack launchpad qualities, making them less ideal for early-stage cold starts.

-

Differences in product design stem largely from differing long-term missions. For example, Galxe aims to build a decentralized credential system, so they specialize deeply in issuing badges. Early-stage workflows can still rely on tools like Gleam, giving Galxe strong extensibility—though their task creation interface feels generic. Crew3, aiming to become the “Web3 Discord,” offers rich in-community activity templates—daily check-ins, content creation, referral tasks—more focused than others.

-

While all-in-one platforms offer full feature sets, they lack depth in specific scenarios. Gaps in functionality led to specialized tools emerging around frequent use cases like giveaways and AMAs. Bottom line: the Web3 incentive economy is huge, full of opportunities—just dive in.

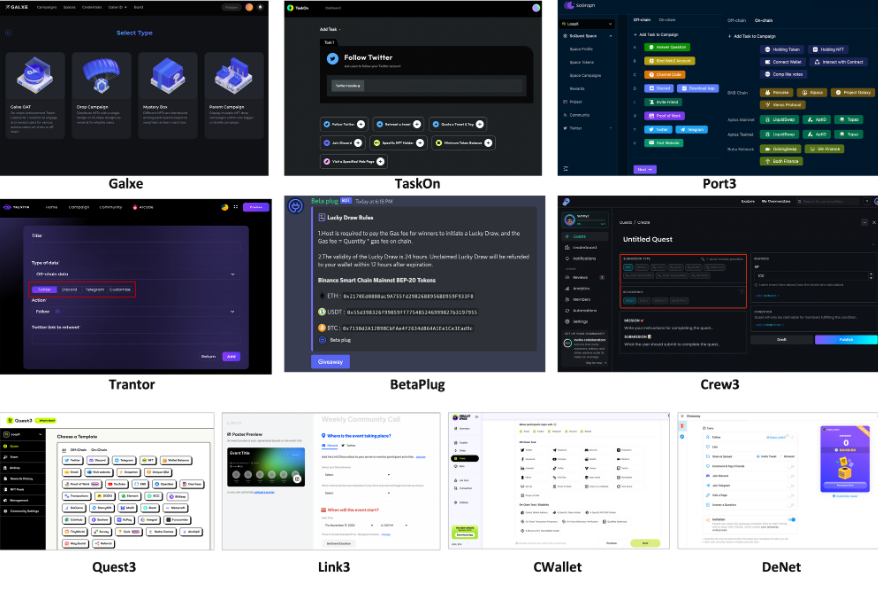

Below are screenshots from each platform’s admin dashboard, offering a visual sense of differences and functional nuances ⬇️

Combining the two hard metrics—functionality and traffic—the approximate positioning of these platforms looks like this:

(Again, single-test data has inherent variance—actual outcomes may vary.)

We can see there’s no clear dominant leader in this space—many players coexist, constantly innovating. New entrants emerge regularly, signaling a healthy market where every DApp can find its niche and thrive.

Other Comparative Factors

Beyond the two main metrics, during product usage and team coordination, the following projects stood out in terms of design, development, and BD [in no particular order]. Quest3’s UX, Link3’s iteration speed, and Clique’s BD efforts were especially impressive 🆙

-

Fast BD response: Clique, Port3, DeNet, Pyme, TaskOn, CWallet;

-

Excellent product design: Quest3, Link3, Crew3, Aki Network;

-

Rapid feature iteration: Link3, Quest3, Beta Plug, Clique.

Often, differences in BD responsiveness directly impact partnership speed. These soft factors ultimately shape a project’s trajectory—especially for DApps. Since user needs are largely shared, the breadth and depth of frontline team insights—and how quickly they feed back into product development—directly influence product evolution. When choosing long-term tools, consider checking the team’s TW activity and release velocity first.

Usage Recommendations

-

Unless you have deep integrations with another platform, your first campaign should be on Galxe. Their organic traffic is strong, and their large user base allows rapid early user acquisition.

-

Strive for co-PR and cross-community promotion with partners. If you can secure banners or featured placements, definitely pursue them. Quest3’s banner ads are effective. Galxe banners work best once your project reaches a certain scale and launches a major update.

-

Don’t over-rely on a single platform. Distribute your efforts. Repeated use of one platform yields diminishing returns—similar to running campaigns only within your own community. Long-term, 2–3 all-in-one platforms are sufficient. For vertical platforms, segment by use case—1–2 per scenario is ideal.

-

More mature projects should run more activation and retention campaigns. Currently, few platforms support such activities well. Port3, Trantor, Crew3, and BetaPlug are decent options. Others haven’t caught up yet. If you know any great ones, please recommend!

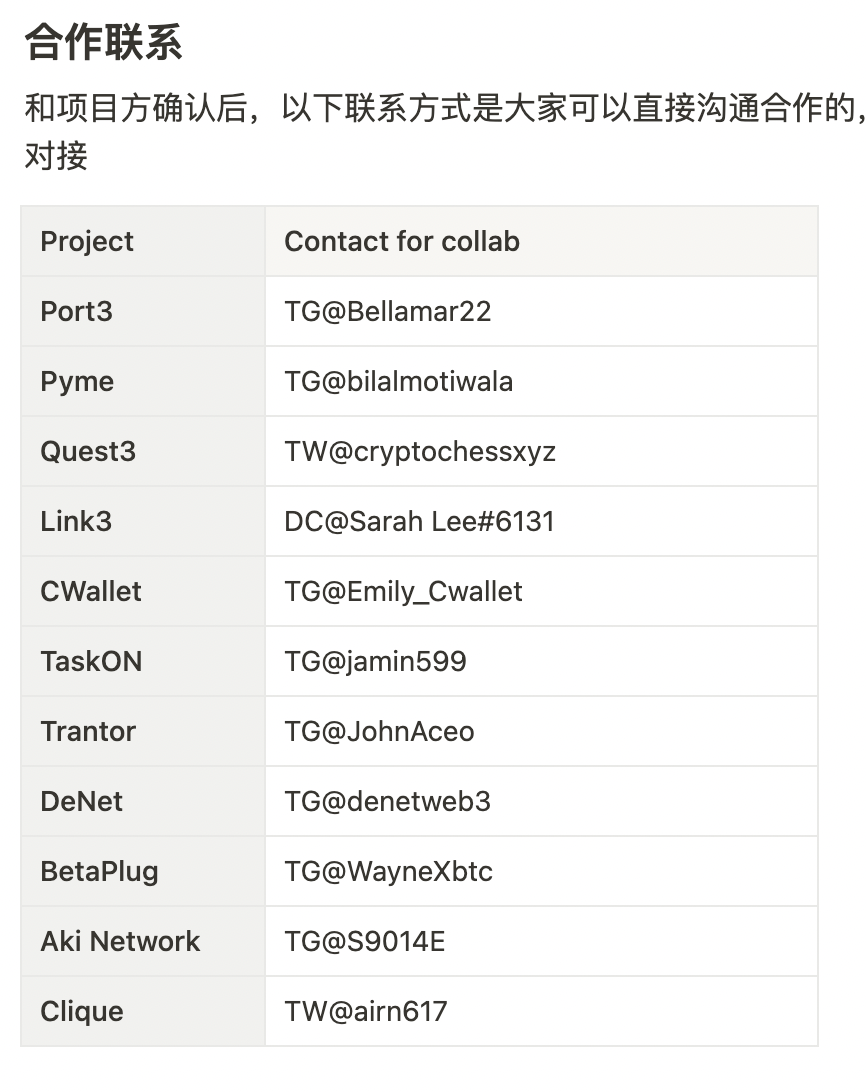

Contact for Collaboration

After confirming with the teams, the contacts below are open for direct collaboration inquiries. For any questions, feel free to reach out directly.

About Me

A Web3 BUIDLer. Open to chat.

- Twitter / Telegram: @SunnyZ_Crypto

- Link3: awesomesunny.eth

Finally, big thanks to Grace from TwitterScan and Messy from Minkit for their help, and to all the project teams who patiently answered my endless questions. Wishing everyone continued success—WAGMI! Original link

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News