The stablecoin war continues to intensify: How has the stablecoin market landscape evolved?

TechFlow Selected TechFlow Selected

The stablecoin war continues to intensify: How has the stablecoin market landscape evolved?

A gentleman does not stand beneath a dangerous wall. At present, BUSD may be the stablecoin with the lowest risk factor.

Author: Ignas | DeFi Research, TechFlow

Translation: TechFlow

The stablecoin war is quietly heating up, especially in the aftermath of recent crises. First, let's examine the collapse of Near’s $USN and Huobi’s $HUSD.

USN, an algorithmic stablecoin, was launched just seven months ago. However, after the UST crash, USN v2 began being minted using USDT. Due to dual minting, a "40 million dollar collateral shortfall" emerged, ultimately leading to the project's failure.

Since the shutdown of USN, Near’s TVL has dropped from $297 million to its current $164 million—a decline of 44.7%. The USN V2 roadmap included plans to back USN with both stable and non-stable assets (such as NEAR).

Returns for USN holders would have come from NEAR staking rewards.

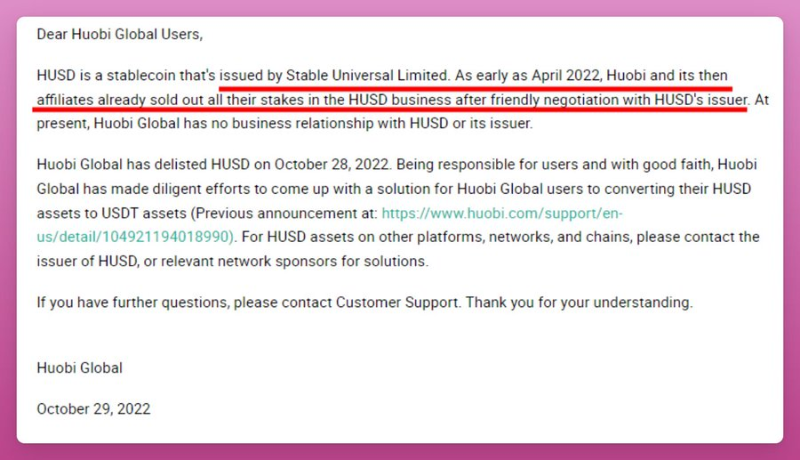

Huobi’s HUSD is currently trading at $0.28. This occurred after Huobi was acquired by Justin Sun (who denies it was an acquisition) and after Huobi delisted HUSD. HUSD was the backbone of the Huobi ECO Chain, but HECO will now "merge" with the Tron and BitTorrent chains.

Interestingly, following friendly negotiations with the HUSD issuer, Huobi announced in 2022 that it had sold its HUSD business. Huobi converted all HUSD into USDT, so if you want to exchange HUSD for USD at a 1:1 ratio, you need to contact the issuer directly. Is there an arbitrage opportunity here?

The story doesn’t end here.

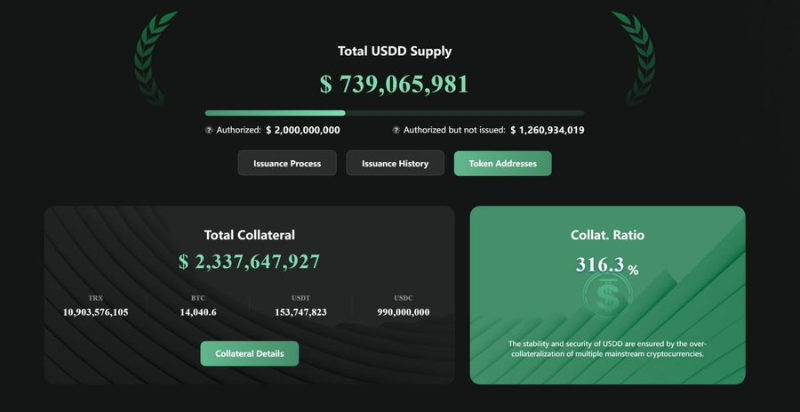

The deposed $HUSD is being replaced by Tron’s $USDD, although $USDD currently only has 10 markets open. Justin Sun is clearly pushing for higher adoption of $USDD and Tron.

USDD is one of the few algorithmic stablecoins still standing.

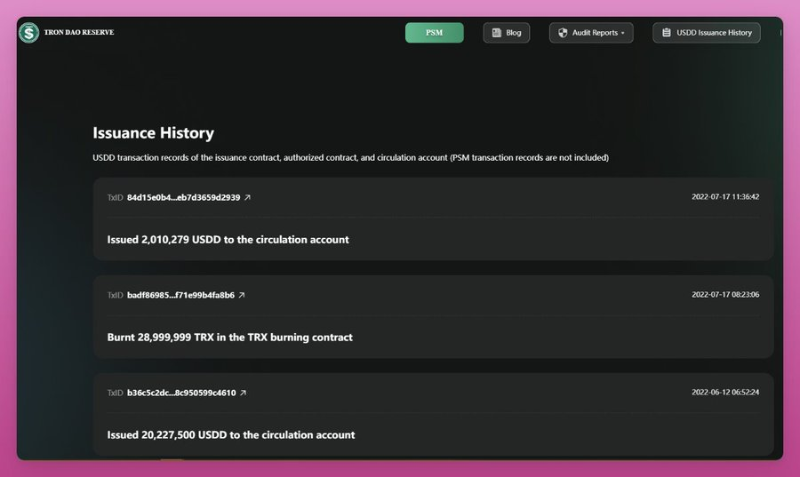

USDD is minted 1:1 solely with $TRX and only by whitelisted members. However, the Tron DAO Reserve claims that USDD is backed by other crypto assets at a collateralization ratio of 293%.

The last minting or issuance of USDD was on July 17. Since then, USDD’s market cap has remained unchanged at $700 million. Regardless, listing USDD on Huobi has created a new use case for the stablecoin beyond single-token staking.

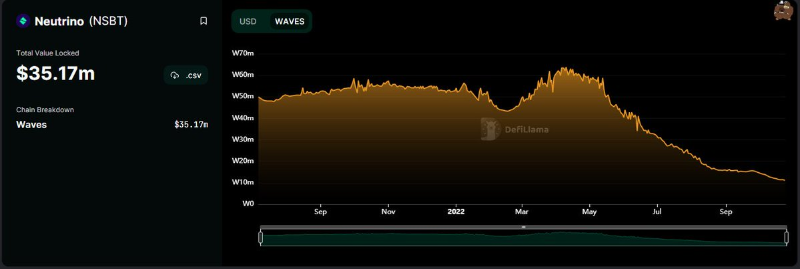

Another algorithmic stablecoin fighting for survival is USDN. USDN has suffered three major de-pegging events, the worst occurring in April.

Since then, USDN has struggled to maintain its $1 peg, as it is no longer 100% backed by WAVES collateral.

Like $UST or USDD, Neutrino’s $USDN is supported by its native token $WAVES.

Since the liquidity crunch at Vires Finance in April, the backing ratio (BR) has fallen far below 100%. Due to various market interventions, BR is currently at 25%.

Are there any positive cases?

Yes—LUSD’s market cap successfully grew by 13%.

Liquity introduced an innovative bond mechanism with dynamic NFTs—Chicken Bonds.

But at its core, it has proven more resilient against insolvency threats.

As more $LUSD is bonded into $bUSD, LUSD is deposited into the stability pool. Given the low liquidation threshold for LUSD Troves (collateralized debt positions) at 110%, this stability pool acts as the first line of defense in maintaining solvency.

The leader among decentralized stablecoins is $DAI, with a market cap of $5.8 billion, followed by $FRAX ($1.2 billion).

Surprisingly, given its significance, this vote drew little attention. I suspect this is due to the complexity of the proposal.

The Endgame Plan aims to defend against regulatory crackdowns on real-world asset-backed collateral, including $USDC.

Abracadabra’s $MIM, once DAI’s biggest competitor, has now declined by 96.6% in market cap.

$FTT was MIM’s largest collateral asset, so... Abracadabra is now in even worse shape.

While the DAI proposal and plan may not pass soon, we can look forward to two other upcoming DeFi stablecoins: $GHO and $crvUSD:

-

Details about $crvUSD remain scarce

-

Aave’s $GHO may feature a revenue-sharing model based on $AAVE staking

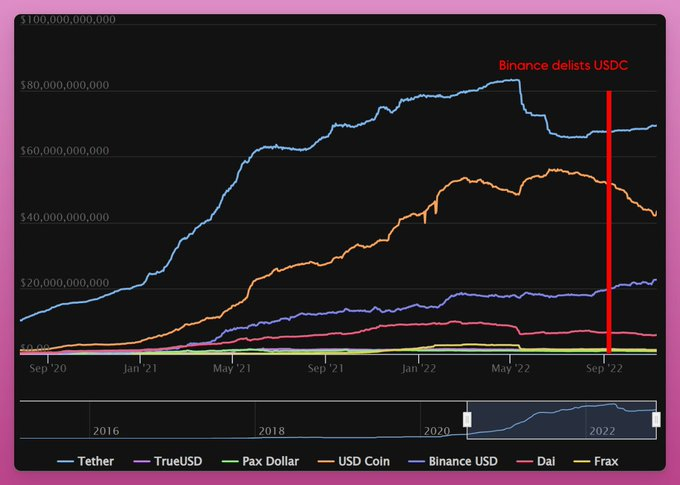

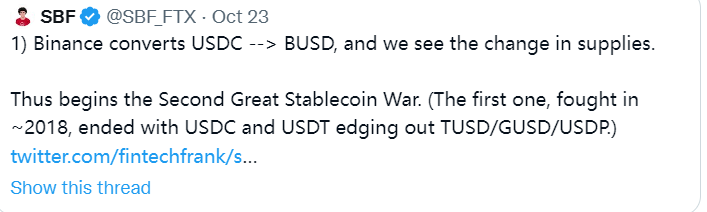

However, in terms of stablecoin market cap, the biggest change has been in $USDC.

It has been two months since Binance “delisted” USDC. Since then, USDC’s market cap has dropped by 15.9%, while BUSD grew by 14.3%. USDC’s market cap has shrunk by $8.2 billion—more than DAI’s entire market cap!

For USDC, another potential risk lies in its numerous partnerships with FTX. SBF once tweeted about wanting to join the stablecoin war, but it remains unclear whether he pursued cooperation with USDC or entered into any contractual agreements for this purpose.

Finally, let’s look at USDT. Last month, Tether reduced its commercial paper holdings to zero and increased exposure to U.S. Treasury bonds.

Tether previously refuted rumors that its commercial paper was "85% backed by Chinese or Asian commercial paper traded at a 30% discount." Clearly, Tether has mature operations in this area.

Given the current situation, the liquidations triggered by FTX are not yet fully over, and there is still a significant amount of USDC circulating on FTX and Solana, which poses certain risks to USDC.

Although the panic around USDT stemmed from CoinGecko reading incorrect USDT data.

But in today’s environment, even a small dose of FUD could trigger a massive avalanche.

A wise man does not stand under a crumbling wall. For now, BUSD may be the stablecoin with the lowest risk factor.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News