Web3 VC Rankings Explained: What Competitive Advantages Do the Top 5 VCs Have?

TechFlow Selected TechFlow Selected

Web3 VC Rankings Explained: What Competitive Advantages Do the Top 5 VCs Have?

This article is Global Coin Research's interpretation of the list, discussing the specific scoring criteria and providing an in-depth analysis of the top five ranked venture capital firms.

By: CODY

On September 27, crypto research organization GCR and Clearblock jointly launched the Web3 VC rankings. The top 20 Web3 VCs are Paradigm, a16z Crypto, Pantera Capital, Coinbase Ventures, Polychain Capital, Dragonfly Capital, Sequoia, Variant Fund, Electric Capital, Multicoin Capital, ParaFi Capital, Digital Currency Group, Blockchain Capital, Union Square Ventures, Spartan Group, Alameda Research, Binance Labs, Animoca Brands, and CoinFund.

This ranking has sparked controversy in the crypto community—some approve, others criticize. This article is Global Coin Research’s analysis of the list, discussing the specific scoring criteria and providing detailed insights into each of the top five VCs. Global Coin Research authorizes TechFlow to translate and publish this Chinese version.

Overview

In past cycles, Web3 venture capital has evolved into a complex and differentiated space—encompassing traditionally structured funds, corporate venture capital (CVC), DAO-based ventures, world-class exchanges, and trading firms with thriving venture divisions that invest across every lifecycle stage of equity and token companies.

We recall a list released a year ago that ranked certain crypto VCs based on “diamond hands” to “value-add.” That list showed how, just as the markets these funds invest in dynamically evolve, so too does the VC landscape and its leaders.

This report provides a comprehensive and up-to-date analysis of the top ten Web3 venture capital firms and broader industry activity—measuring performance across multiple dimensions including portfolio, competitive differentiation, platform strategy, community and reputation, and 2022 deal activity.

Methodology

In such a volatile and dynamic market, there is no exact science for ranking—today’s position of a fund could completely change due to their next investment, publication, or strategic move. This is where this ranking differs from most others.

In a world where asset under management (AUM) once ruled all, an interesting dynamic has emerged over the past 24 months: macroeconomic conditions have ushered in an era where capital has become commoditized, forcing top-tier firms to differentiate themselves uniquely to secure spots on competitive cap tables. As a result, in this methodology, the knowledge moats built by funds beyond AUM carry the greatest weight.

Data was extracted from Crunchbase for the following categories:

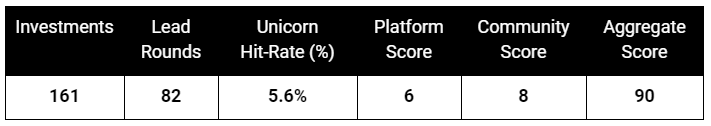

- Total Investments: [Weight: 7/10] Number of investments since the launch of the first fund

- Lead Rounds: [Weight: 8/10] Number of rounds led as primary investor

- Deals in 2022: [Weight: 7.5/10] Number of completed investment deals in 2022

- Unicorns: [Weight: 9/10] Number of unicorns (valued over $1 billion) in the fund’s portfolio

- Diverse Investments: [Weight: 4/10] Number of investments in companies founded or led by women and minorities

- Prestigious Deals: [Weight: 3/10] Investments in well-known Web3 and cryptocurrency companies

- Unicorn Hit Rate: [Weight: 9.5/10] A metric evaluating the percentage of unicorns in the portfolio relative to total investments.

- Unicorns / Total Investments = UHR

- Note: A fund may have invested in the same unicorn multiple times.

- Platform Score: [Weight: 9.5/10] Evaluates the tangible post-investment support provided to portfolio companies through dedicated platform teams or strategies. This includes technical assistance in protocol design, tokenomics, whitepaper crafting, allocating engineering resources, and internal platform teams aiding GTM, talent acquisition, business development, events, and formal operational collaborations beyond capital allocation.

- Community Score: [Weight: 7.5/10] A unique metric measuring Web3 relevance—community—and the fund's ability in designing, nurturing, and scaling it. This includes writing, social media reach, podcasts, conferences, Twitter Spaces, and general community engagement and thought leadership. We assess the quantity, quality, and reach of these community-driven initiatives via social and traditional media sources, as well as fund websites and/or publications to determine the score.

- Reputation Score: [Weight: 6.5/10] Measures the fund’s reputation among media, builders, founders, and the Web3 community as they invest in, interact with, and provide infrastructure for consumer-centric products, platforms, and protocols. This category is based on public sentiment from social and traditional media sources.

- Non-Crypto-Native Funds: [Weight: 5/10] Evaluated solely on their crypto investments, focusing on recent deal activity. This creates a natural bias toward crypto-native funds in terms of deal volume, lead rounds, and number of unicorns. Higher weight is given to funds native to the Web3/crypto space.

- Female Partners: [Weight: 5/10] Data sourced from team pages on individual fund websites.

- Negative News: [Weight: 8/10] Sourced from open web searches and social media. Related to reputation score.

- Dollars Raised: [Weight: 4/10] Sourced from Crunchbase and Messari fundraising databases (formerly Dove Metrics).

- Year Founded: [Weight: 2/10] Highlights fund longevity across multiple cycles.

The final score combines the above weighted metrics to produce a composite score (out of 100).

TOP 5 :

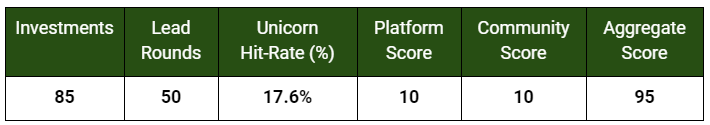

#1 / Paradigm

Overview

Launched in 2018 by Coinbase co-founder Fred Ehrsam and former Sequoia partner Matt Huang, Paradigm is the only Web3 fund on this list whose founders are alumni of two other top-10 firms—both of which rank among the best performers in the field.

Paradigm employs a team of expert researchers, blockchain security specialists, and white hats, leveraging both capital deployment and technical support at every stage of growth for the companies it backs.

Portfolio

Paradigm has consistently focused on accumulating unicorns within its portfolio—making concentrated bets informed by deep technical research and computation. Their investments range from $1 million seed rounds to over $100 million growth rounds. Unlike many top-tier crypto-native funds that focus exclusively on early-stage investing, this stage-agnostic approach is unique.

Their portfolio includes 15 unicorns, covering more than a dozen leading names in both liquid and illiquid sectors: Coinbase, Chainalysis, Uniswap, Compound, Cosmos, Fireblocks, FTX US, Opensea, Magic Eden, Amber, Gauntlet, MoonPay, Phantom, Optimism, Sky Mavis, and Starkware—all contributing to a diversified team.

Competitive Advantage

Paradigm is a fund composed of technical experts who have built one of the industry’s most distinctive moats. While every VC can offer capital and promised post-investment support, Paradigm possesses genuine technical capabilities to build alongside founders—something most players in the space simply cannot match:

- A teenage engineering prodigy who publicly criticized his boss on Twitter;

- An elite team of white hats and blockchain security researchers capable of designing novel token mechanisms;

- Developer competitions like the recent CTP 0xMonaco game, pushing top engineers in the field to compete;

- Technical thinkers actively building with their portfolio companies.

2022 Deals

Before the market downturn, Paradigm timely raised a $2.5 billion fund at the end of 2021. Unlike others, Paradigm did not significantly slow down capital deployment. As of the first week of September, Paradigm had announced 25 deals, on track to surpass 2021’s 29 deals. They doubled down on Opensea, Magic Eden, Phantom, Optimism, and Fractional, while making new seed investments in projects they believe will become household names in the next cycle.

#2 / a16z Crypto

Overview

Andreessen Horowitz, or a16z, is not only a giant in Web3 but also in tech investing broadly. Marc Andreessen, a16z’s co-founder, authored the world’s first internet browser, Mosaic. The firm has shifted much of its focus to crypto—Chris Dixon, head of Web3, topped Forbes’ Midas List in 2022. In May 2022, they raised a $4.5 billion crypto-focused fund, followed by a $5 billion growth fund in January 2022, a $2.5 billion biotech fund, and a $600 million gaming fund.

Notably, many competitors argue that deploying such massive capital could negatively impact fund returns. However, I wouldn’t underestimate Marc, Chris, and a16z’s world-class team. Others, like Chamath Palihapitiya, suggest a16z’s model could become the “Blackstone of tech”—creating a publicly ownable institution tied to technology by absorbing hundreds of billions in industry equity, rather than focusing narrowly on delivering outsized returns to LPs. They’re playing a different game altogether.

Portfolio

The firm has deployed strategic capital to scale some of the most vibrant and defining companies in the industry. We could write a full report on this portfolio (and perhaps we will), but for now, we’ll highlight 14 unicorns—spanning protocol layers, centralized and decentralized infrastructure, consumer apps, and mature NFT projects—including Anchorage, Dapper Labs, Coinbase, Opensea, LayerZero, Yuga Labs, and Phantom.

Competitive Advantage

Beyond a16z’s immense prominence and track record in investing and tech, a key differentiator from native crypto funds is its 200+ member post-investment platform team. They’ve created an internal consultancy of experts in marketing, operations, business development, partnerships, talent, and capital formation, bringing unprecedented operational value to each portfolio company. This elite platform team is unmatched by any crypto-native fund—or indeed, most global VCs.

2022 Deals

With $4.5 billion to deploy over the coming years, a16z’s active 2022 comes as no surprise. According to Crunchbase, their crypto division has already made 14 investments this year, leading nearly every round they participated in. Their scale in Web3 is impossible to ignore: Yuga Labs received a massive $450 million seed round, VeeFriends $50 million, FlowCarbon $70 million, and significant protocol-level investments in NEAR and Morpho Labs.

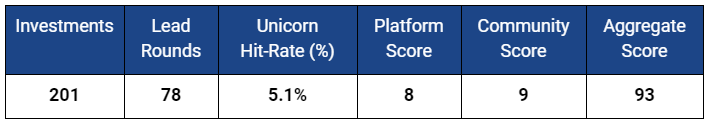

#3 / Pantera Capital

Overview

Founded in 2013, Pantera Capital is considered one of the first institutional-grade crypto asset management firms. With five distinct funds capable of trading liquid assets like a hedge fund and making private investments from seed to growth stages, Pantera has backed many of the industry’s most defining projects. Few have shown greater foresight than founder and CEO Dan Morehead, who famously declared in a summer 2013 investor letter that Bitcoin had bottomed at $65 and urged clients to begin accumulating.

Portfolio

Pantera entered the space during the early cypherpunk days—even before Vitalik’s beloved World of Warcraft character was nerfed, sparking Ethereum’s creation. In 2013, they wrote the first $1.4 million check for Ripple’s seed round, provided seed funding to Polychain Capital—which itself is now an industry giant—and invested across a range of consumer and infrastructure plays, including seed rounds for media outlet The Block, Series A for NEAR and Bakkt, and nearly every growth round for Circle since 2014.

Beyond these impressive marquee investments, the fund has made 22 diverse investments in companies founded by women and minorities—over 10% of total investments since inception. Pantera’s portfolio, track record, and enduring reputation solidify its place among the top VCs.

Competitive Advantage

Already mentioned but possibly Pantera’s most distinguishing trait compared to most funds on this list is its long-term track record of successful investing across nearly every phase of the last decade. On this list, few—if any—can claim to have written a $1.4 million seed check back in 2013.

2022 Deals

Like many top firms, Pantera continued aggressive investing in 2022, making 43 deals—the fourth highest among crypto-native funds this year and one of the few to surpass 200+ total investments since inception. This year, they invested in 18 seed rounds, 9 Series A, and 16 growth rounds, demonstrating commitment to a stage-agnostic strategy. Q1 marked their most active quarter in history, with 24 investments.

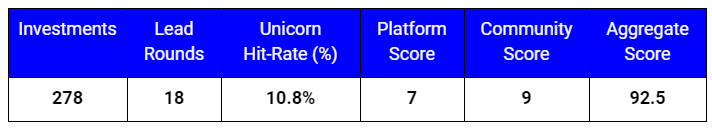

#4 / Coinbase Ventures

Overview

Launched in 2018 during a bear market with just $15 million, Coinbase Ventures now has a footprint across the entire industry—possibly wider than any other investor. To date, it has made over 275 investments and boasts 30 unicorns—a figure that would make Peter Thiel and Bill Gurley blush.

Portfolio

There are many ways to build a strong venture portfolio. One approach is centralized and research-driven, as we’ll see with Variant. Another is Coinbase Ventures’ method—maximizing coverage across every sector and stage. They demonstrate a mission to bring transparency to the industry by providing early funding to nearly every major crypto data provider: CoinMetrics, Messari, Flipside Crypto, Dune, Nansen, CoinTracker, and Moralis. They also show commitment to maximizing value for portfolio companies—after leading the Series A, they directly acquired Bison Trails for over $450 million in cash and stock—while continuing to seed fund startups, protocols, consumer apps, and DeFi infrastructure from Silicon Valley and Miami to Paris and Chennai.

Competitive Advantage

Coinbase has paved the way for exchange-based CVCs to become power players in venture capital, competing with the industry’s most elite funds. With a globally recognized brand, a team of hundreds of engineers, and experts in product, marketing, enterprise, and business development, founders feel they gain access to a unique engine for growth. Coinbase Ventures leads the pack.

2022 Deals

In terms of 2022 activity, Coinbase Ventures ranks second across the industry with 85 deals so far this year—47 seed, 21 Series A, and 17 growth-stage investments. This focus on smaller deals makes sense, as most of their marginal capital was deployed in 2021. Notably, Coinbase Ventures reportedly deployed 90% of its capital in 2021. Many of those investments may be downgraded, giving them better leverage in the 2022 bear market to support builders. Still, this hasn’t slowed their investment pace.

Coinbase Ventures remains highly diversified in influence, investing at the protocol level in notable capital allocators like Valkyrie and AllianceDAO, data providers like CoinTracker and Moralis, and projects such as Aptos, Sei, Euler, and LayerZero.

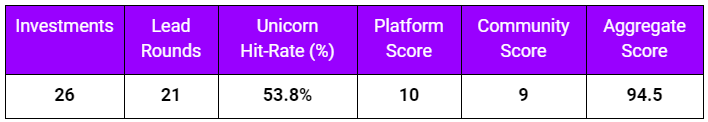

#5 / Polychain Capital

Overview

Founded in 2016 by Coinbase’s first employee, Olaf Carlson-Wee, and seeded by a16z, Pantera, and Union Square Ventures, the fund has weathered a long second cycle since the 2018 bear market. SEC filings show its AUM grew from $591.5 million at the end of 2018 to over $6.6 billion by March 2022 (note: the latest filing predates the market downturn and may be significantly lower today).

Portfolio

Since inception, Polychain has focused on DeFi infrastructure and protocol-layer investments, funding key protocols and platforms at the earliest stages—providing seed funding since 2017 to Polkadot, dYdX, Starkware, Compound, Avalanche, Gauntlet, Acala, Solana, and Maple Finance. Firmly rooted in Bitcoin, they continue to lead in advancing new technologies, investing in next-gen mining and clean energy firms—growth-stage investment in Crusoe Energy (Series C), seed rounds in Vesper Energy and Vespene Energy.

Competitive Advantage

Polychain is another fund that emerged from earlier crypto eras—long before JPEGs dominated our crypto Twitter feeds. By navigating the highs and lows of crypto volatility, growing AUM tenfold, returning capital to investors, and reinvesting in winners throughout its existence, it exemplifies the consistency and conviction founders and LPs seek—even in super-volatile fields.

2022 Deals

A trend visible across this report is that top funds commit to continued capital deployment despite uncertain macro conditions. Polychain has made 26 investments so far this year, 15 of which were early seed rounds. They also demonstrate commitment to doubling down on winners—investing four times in unicorn Gauntlet, from a seed round in October 2018 to the latest Series B in May 2022.

What emerges from this report is that top-tier venture capital firms in crypto and Web3 are not merely capital allocators chasing high multiples. They are driving industry progress through deep technical acumen, resilience across cycles, and innovative frameworks that define the future. This is what separates category-defining VCs from other Tier 1 firms—they are carving their own paths forward.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News