Nansen Research: Ethereum Merge Report

TechFlow Selected TechFlow Selected

Nansen Research: Ethereum Merge Report

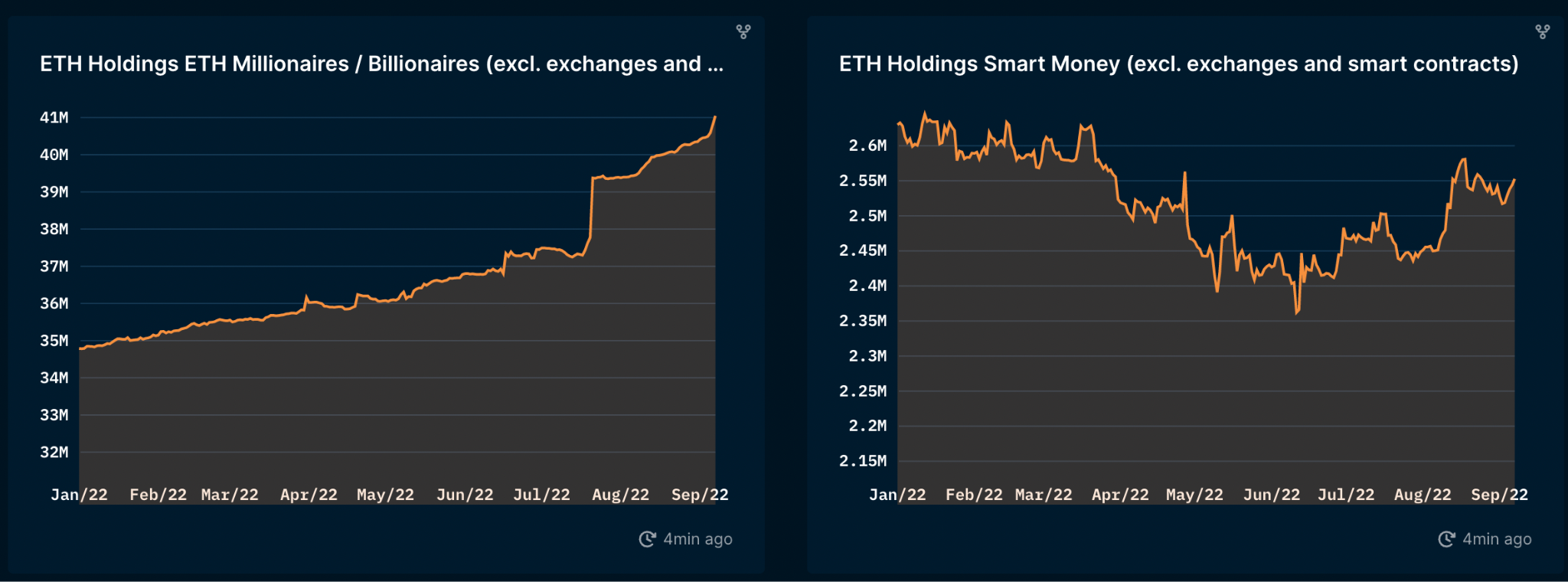

ETH whales have been accumulating ETH tokens consistently this year. Smart money began expanding their ETH positions starting from the mid-June lows.

In short TLDR

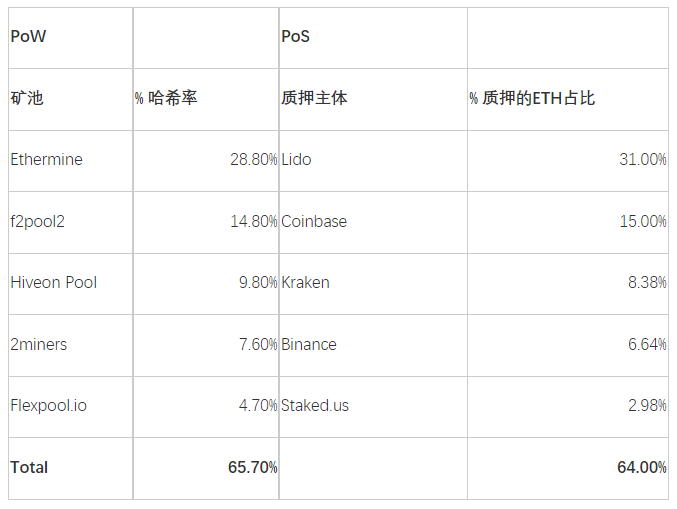

- Currently, a relatively small proportion of ETH is staked (about 11.3%), with 65% being liquid staking and 35% non-liquid staking. Despite a large number of validator addresses (426k) and unique deposit addresses (~80k), approximately 64% of staked ETH tokens come from just five entities.

- Lido holds the largest amount of staked ETH (31%), followed by Coinbase, Kraken, and Binance, collectively accounting for about 30%. Liquid staking services like Lido were created to prevent centralized exchanges (CEXs) from gaining control over most staked ETH. It is crucial that liquid staking providers such as Lido become decentralized enough to resist censorship.

- Ownership of Lido's governance token LDO is relatively concentrated, with the largest holders being identifiable funds and team members, indicating potential vulnerability to censorship. For instance, the top nine addresses (excluding treasury) hold around 46% of voting power, and a few addresses typically dominate proposals. For entities holding potentially dominant shares of staked ETH, the risks associated with inadequate decentralization are extremely high.

- The majority of staked ETH tokens (approximately 71%) are currently underwater. About 18% of all staked ETH belongs to non-liquid stakers who are in profit—these individuals are most likely to sell for gains once free withdrawals are enabled after Ethereum’s Shanghai upgrade.

- ETH whales have been accumulating ETH tokens throughout this year.

- Smart Money began increasing their ETH holdings from mid-June lows.

Nansen has launched its Nansen Research Center where you can browse the latest and most comprehensive重磅 research in the crypto industry at this link. Users are welcome to register MetaMask wallets to experience Nansen via this link.

Is everyone bullish on Ethereum's Merge?

The upcoming Ethereum Merge could be one of the biggest events in the cryptocurrency space since Bitcoin's genesis block. The Merge refers to Ethereum transitioning consensus from Proof-of-Work (PoW) to Proof-of-Stake (PoS). As the crypto market remains bearish, The Merge has remained a hot topic over recent months—but does it live up to the hype?

While everyone agrees that The Merge reduces Ethereum’s energy consumption by about 99.95%, which is a positive development for an industry criticized for excessive energy use, other implications of PoS have divided the community.

In the report below, we aim to discuss and offer insights into two key questions:

- Will PoS introduce more censorship risk at the validator level?

- Will the shift to PoS increase medium-term selling pressure on ETH for non-stakers?

Will transitioning to PoS lead to greater centralization?

With Ethereum moving to PoS after the Merge, a critical concern is the concentration and centralization of staked ETH.

One of blockchain's original ideas was achieving decentralization. However, high energy costs and economies of scale in mining equipment eventually led to large centralized mining farms and pools. Among other arguments, this drove discussions toward alternative technical solutions such as PoS.

On the other hand, some argue that PoS itself may also lead to centralization. Many users prefer convenience and opt for liquid staking or third-party staking, and staking service providers benefit from economies of scale.

- Larger entities may have advantages in MEV revenue distribution.

- Additionally, the most liquid staking derivatives, integrated with CEXs and DeFi, enjoy strong first-mover advantages, reinforcing liquidity dominance.

The actual number of unique depositing addresses is very high (~80k). However, when examining intermediary staking service providers representing users' staked ETH, the situation becomes more nuanced. Thus, although stakers (i.e., ETH contributors) may be highly diverse, most staked ETH and validators might (indirectly) be controlled by a few entities or governing bodies.

Given recent events involving Tornado Cash, concerns have emerged regarding the transition to PoS and the impact of concentrated holdings among a few participants. Any major validator engaging in malicious behavior or directly targeted by regulators could threaten Ethereum’s value proposition as a secure, decentralized, and censorship-resistant infrastructure.

Although technically different, comparing centralization between Ethereum’s PoS and PoW can be roughly assessed by contrasting hash rate concentrations among top mining pools versus stake concentrations among top staking entities or intermediaries. At first glance, both appear nearly identical in terms of entity-level centralization—the top three control over half, while the top five each control roughly two-thirds of either hash rate or stake share.

Source: https://etherchain.org/miner, Nansen, September 9, 2022

Recently, there has been heated online discussion following the U.S. government’s approval on August 8, 2022, to sanction the Tornado Cash protocol through OFAC, raising increased concerns about censorship possibilities. This caused many protocols to block addresses interacting with Tornado Cash, sparking legitimate concerns about assumptions of permissionless participation on Ethereum. While many frontend addresses were blocked, access remains possible via direct interaction with on-chain smart contracts. However, concerns remain that if Ethereum itself becomes centralized, certain users might face censorship, undermining its core value proposition as a decentralized and open infrastructure. This makes evaluating the impact of The Merge and gaining deeper insight into the top staking entities important.

How much ETH has been staked, and when was it staked?

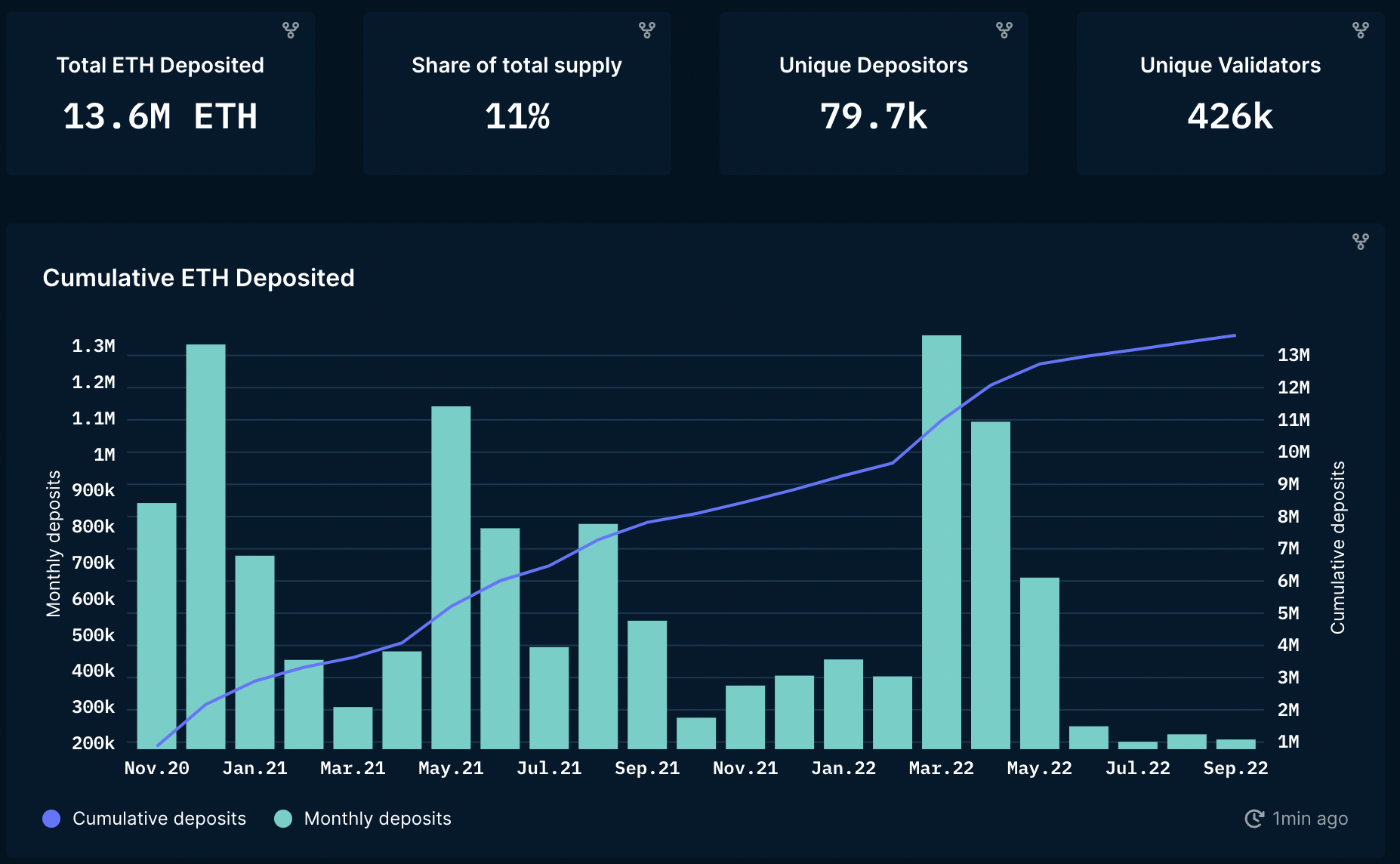

Source: Nansen Query

Nansen data shows significant volatility in monthly ETH deposits, with a notable decline recently. Note that due to withdrawal functionality not yet being enabled, total staked ETH only increases. The sharp drop after May can be attributed to the LUNA collapse, subsequent FUD, and the “depegging” effect between ETH and stETH. In total, 11.3% of the ETH supply is staked.

By comparison, about 41% of MATIC is staked (Polygon) and 77% of SOL (Solana). The relatively low percentage of staked ETH may be due to:

- High barrier to running your own validator node (32 ETH).

- Lack of liquidity: After the Merge, staked ETH will remain locked until withdrawals are enabled during the Shanghai upgrade, expected sometime in 2023.

○ Liquid staking providers like Lido and Binance address this liquidity issue by allowing users to receive fungible derivative tokens representing their staked ETH positions.

○ A total of 65% of ETH is staked through liquid staking providers.

○ Liquid staking providers also allow users to stake amounts less than 32 ETH.

■ However, using solutions like Lido and Binance to solve liquidity issues introduces new risks—counterparty and smart contract risks.

Technical Risks

○ Uncertainty exists regarding when the Merge will occur.

○ Uncertainty whether the Merge executes properly and whether the PoS chain will be adopted.

Validators face slashing or even confiscation risks if they misbehave

○ Minor penalties apply for unintentional actions hindering consensus (e.g., going offline for days).

○ Major penalties apply for malicious acts (e.g., attesting invalid or conflicting blocks)—direct confiscation occurs.

● To minimize slashing risks for stakers, Lido stakes ETH across multiple node operators (with heterogeneous setups). If your chosen operator goes offline, you cannot redelegate or switch to another until transactions resume on the new chain (meaning your ETH earns no rewards). Additionally, as noted above, node downtime incurs slashing penalties, though Lido charges a 10% fee on staking rewards shared among node operators, DAO, and insurance fund to help mitigate such incidents.

● Lower returns compared to other DeFi protocols: Many DeFi protocols offer higher yields than Ethereum staking, potentially reducing incentives to stake ETH.

If the Merge proceeds as planned, reduced execution risks may encourage increased monthly ETH staking. Given the current relatively low amount of staked ETH, liquid staking derivative solutions should benefit from this increased confidence. However, this also depends on market conditions—if crypto sentiment worsens further, positive effects could be offset. Concerns exist about risks stemming from concentrating staked ETH among a few entities—a trend already partially underway.

Can Lido be censored?

Lido is a decentralized DAO governed by LDO tokens, structured to support multiple validator nodes. While this setup makes it clearly harder for regulators to target, some express concerns about concentrated token ownership. This could make Lido vulnerable and expose it to centralization risks.

Who controls the Lido DAO?

LDO is the governance token of the Lido DAO. The Lido DAO is responsible for setting protocol fees and parameters, selecting approved node operators, designing incentives to improve/accelerate project development, implementing protocol upgrades, and managing DAO funds. The figure below details assets held in the treasury. As shown, the DAO controls approximately $330 million in liquid assets, about 3.3% of total dollar value controlled by DAOs in the sector. Key managed assets include LDO, ETH, DAI, and stETH. However, note that 81%, or about $265 million, of its funds are in LDO tokens, which remain highly volatile, and deployment for productive uses adds additional sell-side pressure on the token. Nonetheless, the DAO holds over $20.6 million in stablecoins and over $9 million in stETH, ensuring sufficient capital reserves.

The Lido DAO treasury wallet (representing 14% of total supply) is excluded because these tokens are neither circulating nor used for governance. As previously mentioned, the Lido DAO treasury is used for liquidity incentives, consulting services, and further token sales. These allocations can create further concentration effects. As illustrated, overall LDO ownership is relatively concentrated, which could pose centralization risks to Ethereum if Lido dominates staked ETH. The top nine addresses hold about 46% of governance power and could theoretically exert significant influence over validators (assuming they pass DAO scrutiny and can be removed via governance).

If Lido’s market share continues rising, the Lido DAO could end up controlling most Ethereum validator nodes. This would enable Lido to capture more MEV opportunities, conduct profitable block reorganizations, and worst-case, censor certain transactions by forcing or incentivizing validators to act according to Lido’s wishes (via governance). This could pose problems for the Ethereum network. On the other hand, if Lido self-limits, there’s a risk of centralized exchanges dominating the staking derivatives market—an environment potentially easier to censor than attempting to capture Lido governance. As an example of LDO concentration risk, 50% of voting power on a proposal to sell tokens to Dragonfly came from just two wallets, while the top five wallets exercised nearly 80% of voting power. This indicates signs of governance centralization, which could become problematic if Lido maintains its market share of staked ETH.

Behind Lido DAO, who operates these nodes?

Lido currently has 29 different node operators, which some see as evidence of decentralization, with the protocol aiming to grow this number over time. However, one might question whether validator nodes essentially function as a single entity, unified by the LDO token. Becoming a Lido node operator requires approval, as decisions lie within the Lido DAO. This could lead to collusion between node operators and LDO holders. Moreover, Lido’s node operators are primarily concentrated in Europe and the U.S. Lido has acknowledged this and is actively working to reduce dependency by establishing compliant and physically distributed validators.

How to reduce Lido's centralization risks?

Lido's dual governance process

Lido is considering adopting a dual governance model using both LDO and stETH. While LDO will remain Lido’s primary governance token, stETH holders will gain the ability to veto proposals directly affecting them. Rather than making stETH a full governance token, it would serve as a safety mechanism against potentially harmful Lido proposals. This aims to better align interests between LDO and stETH holders while ensuring overall governance remains under LDO holder control.

It is proposed that LDO holders must stake their LDO to gain governance rights. If LDO voters approve a proposal later vetoed by stETH holders, their staked LDO would be slashed. While this better aligns interests, it could also cause governance deadlock driven by stETH holders. To prevent abuse of veto power, another option suggests imposing a significant timelock instead of immediate slashing. If stETH holders fail to resolve the vetoed situation, the timelock lifts. In such cases, the stETH used to veto would also be penalized.

There are many variations in how this dual governance model could be implemented, and nuances exceed the scope of this article. For example, slashing mechanisms for vetoed transactions might deter ordinary community members from participating in governance. Note that the final solution has not yet been decided by the community.

Another consideration is that most stETH is used within DeFi protocols and may not be eligible to vote, reducing its governance capacity. Nansen data shows that 21.2% of LDO holders also hold one or more of stETH, astETH, crvstETH, and wstETH.

Given that these LDO holders collectively own about 33% of total LDO supply, it will be interesting to observe how this affects potential veto outcomes. One might assume what benefits Lido (and thus LDO) also benefits Ethereum (and thus ETH), and both groups should consider this in Lido governance. However, scenarios could arise where the value and upside potential of their LDO holdings outweigh their ETH, incentivizing them to protect their portfolio (LDO) at Ethereum’s expense. Lido is not exclusive to Ethereum; if other blockchains become primary growth areas, these holders might vote in ways contrary to Ethereum community interests.

Ultimately, a well-designed dual governance system helping align LDO holder interests with stETH could be vital, especially if Lido retains its leading market position. Also worth noting: if Lido successfully establishes a market-recognized secure dual governance system, it could further solidify its leadership. Should this happen, it will be critically important for Lido to remain secure and satisfactorily decentralized to resist censorship.

Permissionless Withdrawals

Another measure to reduce risks of liquid staking derivative platforms is enabling permissionless withdrawals (after the Shanghai upgrade). Lido prefers exit mechanisms triggered at the protocol level (Ethereum) rather than pre-signed exit messages, due to potential centralization tendencies and security concerns. The risk lies in node operators potentially fleeing during this exit period.

Lido's moat

It will also be interesting to see whether Lido depositors decide to withdraw their ETH and restake it with competitors like Rocket Pool. Over the past three months, Rocket Pool’s staked ETH growth has nearly matched Lido’s. Perhaps many wallets want to avoid Lido monopoly and will re-stake their ETH with other platforms once withdrawals are enabled.

Lido currently holds about 91% of the liquid staking derivatives market share (excluding CEXs) and about 30% of total staked ETH. Lido’s economies of scale may give it an edge in capturing additional MEV-related gains, making it difficult for others to gain market share. This leads users to choose Lido for staking due to superior returns—even if it doesn’t align with Ethereum’s best interests. This underscores the importance of Lido DAO ensuring Lido achieves satisfactory decentralization quickly.

Why use Lido and other liquid staking platforms?

Many users seek yield from their ETH, driving rapid growth in staking services offered by centralized exchanges. Without Lido and other liquid staking providers, CEX influence could pose serious problems for Ethereum. Liquid staking platforms provide alternatives and can be designed to limit censorship risks. Protocols like Lido are still early-stage, including many community members who value decentralization and censorship resistance. If they achieve satisfactory decentralization, they can play a pivotal role in ensuring Ethereum remains secure, decentralized, and censorship-resistant. While PoS may inherently favor "winner-takes-most" dynamics, if that winner proves resilient, satisfactorily decentralized, and censorship-resistant, Ethereum should retain those same attributes.

Insisting on limiting Lido may be rash. Nansen data shows that over the past three months, ETH staked on Lido amounted to 41k, compared to Coinbase (116k), Binance (59k), and Kraken (43.5k). From this perspective, the top three CEXs added 218.5k staked ETH over the same period, roughly 5.3 times Lido’s addition. Additionally, Rocket Pool grew by approximately 35k ETH during this time, almost matching Lido.

This indicates that centralized exchanges have received far more deposits recently than Lido. Restricting Lido—which has become the most popular liquid staking provider—could result in CEXs increasing their share of staked ETH.

How will the Merge affect staking behavior?

Will more people stake ETH?

Although only a relatively small portion of circulating ETH is staked, this will increase if/when the Merge succeeds (as noted earlier, total staked ETH can only rise until withdrawals are enabled post-Shanghai upgrade).

In addition to rewards from ETH issuance, stakers will also receive transaction fees currently collected by miners, which depending on market conditions could be substantial. Post-Merge, transaction fees are paid in liquid ETH, and some estimate staking APR could increase by about 50%. However, the exact APR increase cannot be determined, as it heavily depends on the amount of staked ETH and transaction activity. This is unlikely to create additional sell-side pressure, as these fees merely transfer from miners rather than represent new issuance. Conversely, this could make ETH a more attractive asset.

Moreover, many believe stakers, who own the underlying asset themselves, are less likely to sell in the medium term compared to previous Ethereum miners. However, note that gas fees vary significantly and depend on network activity on Ethereum. As shown in the Nansen data below, this figure has been declining over the year.

Will those staking Ethereum sell after the Merge?

After the Merge, staked ETH cannot be withdrawn and sold. Only after the Shanghai upgrade, scheduled 6–12 months post-Merge, can ETH be withdrawn.

Will stakers sell after the Shanghai upgrade?

Even then, not everyone can immediately withdraw, as the validator exit queue resembles the activation queue—around six validators (typically 32 ETH each) per epoch (approximately 6.4 minutes). With over 13 million ETH staked, full withdrawal and exit currently take about 300 days. However, validators can withdraw rewards earned beyond their initial 32 ETH stake without fully exiting.

Regarding staking rewards

Using Polygon as a comparison, most earned rewards are withdrawn. However, this tends to occur more among institutions than anonymous or private stakers, possibly due to internal processes for reallocating staking rewards or liquidity needs (completely unstaking on Polygon takes about 3–4 days).

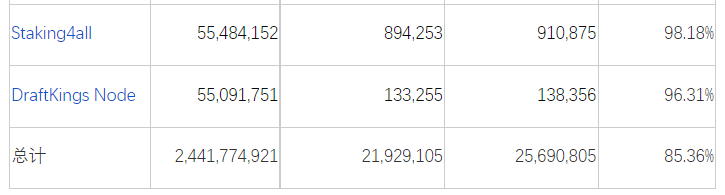

Based on data from 15 top validators, representing about 80% of all staked MATIC, 85% of earned staking rewards have been withdrawn:

If stakers can retrieve their staked ETH, will they sell?

To answer this question, let us set several assumptions:

- Most selling stems from profit-taking

a. Overall crypto market stability, no depeg risk

b. Successful Shanghai upgrade, Ethereum in an uptrend, neutral-to-bullish sentiment toward ETH as an asset

- Most non-liquid stakers will unstake and sell, as liquid stakers may have already exited their positions

- Liquid stakers wishing to sell don’t mind minor discounts or penalties for selling liquid tokens (e.g., stETH currently trades at ~0.97 ETH)

- Assume "unlabeled" addresses are non-liquid (not part of public projects/entities, nor offering liquid staking)

Under these assumptions, analyzing at which prices ETH was staked and whether stakes are liquid or non-liquid provides insights and helps identify the group most likely to sell—profitable non-liquid stakers.

First, the obvious part: data shows large amounts of ETH were staked around $600, with earliest stakers active in November and early December 2020 (the only period when ETH could be staked at these prices). This group likely includes early adopters and supporters of ETH 2.0 (as it was known then), who staked immediately after Beacon Chain launch.

Unsurprisingly, most of these early staked ETH positions lack liquidity, as established liquid staking providers were largely unknown at the time, and many early stakers preferred self-staking. Furthermore, users may have hesitated to stake via major CEXs then, as most didn’t introduce liquid staking until much later, meaning staking implied locking tokens indefinitely before an impending bull run.

Thus, when withdrawals are enabled post-Shanghai upgrade, ETH staked around $600 will be profitable (assuming prices stay above that level). Unlocking via the exit queue could bring approximately 1 million locked ETH to market at this price level. However, note that many early stakers are strong Ethereum believers and diamond-handed (e.g., Vitalik), who may not wish to sell their holdings.

However, from a broader view, most staked ETH (about 71%) is currently unprofitable.

Currently, only 18% of staked ETH belongs to profitable non-liquid stakers, who are most likely to sell once able to unstake.

Considering this figure and the validator exit queue, even the Shanghai upgrade is unlikely to trigger mass sell-offs by stakers. However, note this analysis is based on current price levels and must be adjusted closer to the actual Shanghai upgrade date.

How much Smart Money participated in the Merge?

How are ETH millionaires/billionaires and Smart Money wallets handling their ETH holdings?

Examining Nansen’s labeled addresses not marked as exchanges or smart contracts offers some insight.

Source: Nansen Query

Looking at ETH millionaires and billionaires’ holdings reveals a clear trajectory: continuous accumulation.

● Overall, ETH millionaires and billionaire whales have been accumulating ETH since the beginning of this year, seemingly unaffected by market volatility.

On the other hand, Smart Money appears more flexible, clearly entering and exiting the market partially based on macro trends.

● Interestingly, Smart Money seems to have resumed expanding positions after the early/mid-June lows.

Conclusion

● The proportion of staked ETH is currently relatively low. If the Merge is implemented as expected, reducing staking risks could encourage further ETH staking. Redemptions won't be possible until the Shanghai upgrade in 2023, meaning staked ETH will only increase until then, potentially generating additional hype once execution risks dissipate post-Merge, depending on market conditions.

● Contrary to some beliefs, the Shanghai upgrade may not trigger massive ETH sell-offs. First, most staked ETH is unprofitable. Second, about 65% of staked ETH already has liquidity (via liquid staking derivatives), providing little incentive to redeem and sell ETH. Third, profitable non-liquid staked ETH (most likely to sell) accounts for only 18% of total staked ETH. Additionally, withdrawals won’t happen all at once, with exit queues lasting weeks. Note that all figures and corresponding assumptions may change as the Shanghai upgrade approaches.

● Decentralized liquid staking providers like Lido and Rocket Pool may play a critical role in ensuring Ethereum remains decentralized, censorship-resistant, and open. They were partly designed to prevent most staked ETH from being controlled by centralized entities like CEXs (top three CEXs hold about 30% of staked ETH). These entities must become sufficiently decentralized to resist censorship and preserve Ethereum’s network integrity.

● The liquid staking market appears headed toward a "winner-takes-most" scenario. However, if existing players gradually decentralize and properly align with the Ethereum community, this outcome should not harm Ethereum’s core value propositions.

● Lido governance is relatively centralized at the time of writing. However, the community recognizes these risks and is actively seeking solutions. Initiatives include dual governance (to better align LDO and stETH holders) and regulatory-compliant, physically distributed validators.

● ETH whales have been steadily increasing holdings over recent months. This makes sense, as these addresses likely maintain high ETH balances due to strong belief in the project.

● Smart Money has been actively trading ETH but has been consistently accumulating since June. This suggests expectations of positive price movements surrounding The Merge.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News