A Comprehensive Look at the Current State and Opportunities in the Arbitrum Ecosystem

TechFlow Selected TechFlow Selected

A Comprehensive Look at the Current State and Opportunities in the Arbitrum Ecosystem

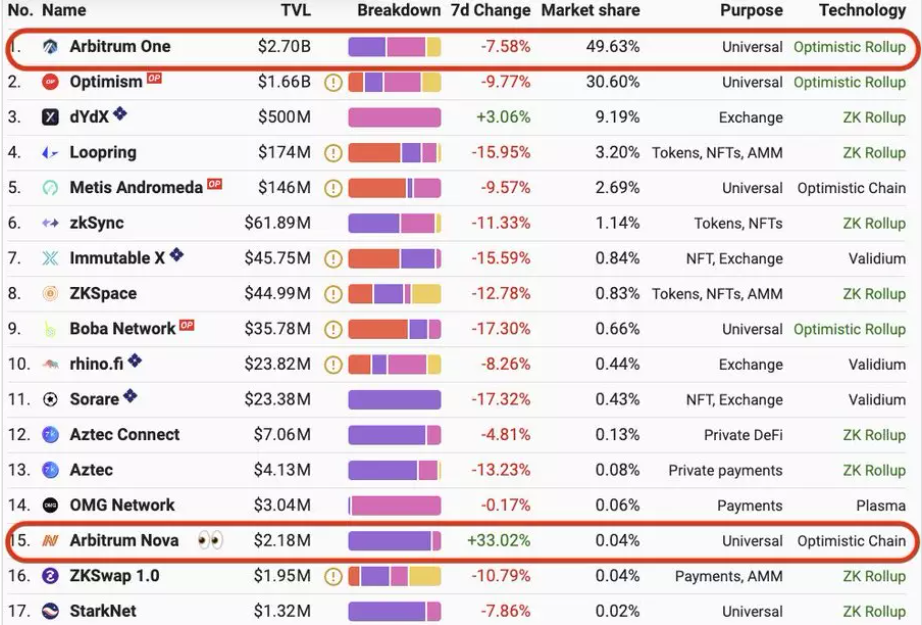

Arbitrum is an Optimistic Roll-up, Layer 2 scaling solution built on top of Ethereum. Known for ultra-fast speed, low latency, and low fees, it is the largest L2 by TVL and on-chain activity.

Written by: blocmates

Translated by: TechFlow

Arbitrum TLDR: Arbitrum is an Optimistic Roll-up, Layer 2 scaling solution built on Ethereum. Known for ultra-fast speed, low latency, and low fees, it is currently the largest L2 in terms of TVL and on-chain activity.

Haven't started exploring Arbitrum yet? Now is a great time—the ecosystem is rapidly improving, and protocols building (or about to build) here stand to gain significantly. Of course, participants will also benefit. The opportunities are endless.

So, it seems everyone is here for high APYs and potential airdrops... But who will emerge as the future leaders of this ecosystem? Let's take a look at some projects you may have heard of—and some you haven't.

GMX, a project that's clearly impossible to miss. It remains undervalued today—an on-chain decentralized exchange that distributes protocol revenue directly to users.

Dopex, an on-chain options vault. The team continues to innovate (Atlantic options, SSOVs, Diamond Pepes, dpxUSD), backed by an incredibly strong community. $DPX has a market cap of $90 million, and $rDPX stands at $43 million—both appear undervalued.

DAOJonesOptions: Confused by options strategies? Many are. Jones allows users to deposit assets into their vaults, which then manages the capital on your behalf. Deposit collateral and receive a yield-bearing jAsset, usable across other protocols. $JONES has a market cap of $5.7 million.

PlutusDAO: Feels a bit like Arbitrum’s Convex. They’re accumulating large amounts of $DPX and $JONES. 26K (52%) of DPX has been converted to plsDPX, and 9K JONES to plsJONE. Which token will they accumulate next? $PLS has a market cap of $5.2 million.

VestaFinance: A lending protocol where the CDP issues the stablecoin $VST. Deposit assets such as $ETH, $renBTC, $GMX, or $DPX, and borrow $VST against them. CDPs are now very popular—I believe with increased liquidity, a native Arbitrum stablecoin could receive official backing. $VSTA has a market cap of $4.5 million.

SperaxUSD: An auto-yielding, fully collateralized stablecoin project. $USDs is the minted stablecoin, and user collateral is deployed into yield-generating projects within the Arbitrum ecosystem. $SPA has a market cap of $22 million.

TreasureDAO: The $MAGIC ecosystem hosts many promising developments, including Magic Swap based on $MAGIC and expansions in NFT markets. $MAGIC has a market cap of $32 million.

Y2KFinance: A very interesting native Arbitrum project—we’ll get more details once their official documentation is released.

UmamiFinance: Offers users a simple way to earn yield across various assets. $UMAMI has a market cap of $19 million.

GMOTrust: A fully collateralized stablecoin preparing to enter the L2 space.

RDNTCapital: A cross-chain lending protocol. $RDNT launched trading on Arbitrum but uses StargateFinance / LayerZero Labs technology to enable cross-chain lending. Market cap: $2.7 million.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News