Hayes: Understanding the Impact of the Ethereum Merge through Soros's Theory of Reflexivity

TechFlow Selected TechFlow Selected

Hayes: Understanding the Impact of the Ethereum Merge through Soros's Theory of Reflexivity

For those who believe the merger will succeed as scheduled, the question becomes: how should you express your bullish view?

Author: Arthur Hayes, Founder of Bitmex

Translation: TechFlow

(The views expressed below are solely those of the author and should not constitute the basis for investment decisions, nor should they be construed as advice or recommendations regarding investment trading.)

I am currently reading George Soros’s *The Alchemy of Finance*, which inspired this stream-of-consciousness article on my macro thesis about the ETH merge. When it comes to macro investing, Soros is a giant. His followers—such as Paul Tudor Jones and Stan Druckenmiller—are superstars in their own right, but much of their success stems from the strategies and principles Soros has articulated over the years. *The Alchemy of Finance* offers a deep philosophical discussion on what drives markets—if you're serious about mastering the craft of managing your own or others’ capital, it's a must-read.

Soros’s core theory—what he calls the "theory of reflexivity"—is that there exists a feedback loop between market participants and market prices. The basic idea is that market participants' perceptions of a particular market situation will influence and shape how that situation unfolds. Market expectations affect market facts (or so-called "fundamentals"), and those facts in turn influence participants’ expectations—an ongoing cycle. More simply, participants—intentionally or unintentionally—play a critical role in shaping market expectations. Their biases can amplify upward or downward price trends, turning the future into a self-fulfilling prophecy.

This is a very brief and incomplete explanation of reflexivity, but I will elaborate further as the article progresses. For now, let’s bring this back to cryptocurrency and its relation to the merge.

Inputs

Event

The merge either happens or it doesn’t—that’s the future event we’re trading. The merge itself is unaffected by the price of ETH; its success or failure depends entirely on the capabilities of Ethereum’s core developers.

Structure

The merge will do two things:

-

It will eliminate PoW ETH emissions per block (i.e., ETH paid to miners in exchange for the computational power they provide to secure the network). Currently, these emissions total approximately 13,000 ETH per day. After the merge, these daily miner rewards of ~13,000 ETH are expected to be replaced with new emissions of about 1,000 to 2,000 ETH per day, which will go to network validators (i.e., those who stake ETH and earn more ETH by helping determine which transactions are valid and which are not). These new emissions will occur at a fixed rate regardless of ETH’s price or usage of the Ethereum network.

-

A certain amount of gas fees will be burned with each block (meaning the ETH used to pay these fees will permanently exit circulation). This variable depends on network usage. Network utilization is a reflexive variable, which I’ll explain in detail later.

Total ETH Inflation = Block Emissions - Burned Gas Fees

Under current local conditions, I treat block emissions as a constant. These local conditions may eventually be violated, but only over an extremely long time horizon (i.e., hundreds of years). Therefore, we can safely consider this variable a constant.

Burned gas depends on network usage:

Inflation = Block Emissions > Burned Gas

Deflation = Block Emissions < Burned Gas

Those who believe ETH must inevitably become deflationary must also believe that network usage (the amount of ETH burned in user-paid fees) will be sufficient to offset the amount of ETH emitted per block as rewards to validators. However, to assess whether they might be correct, we must first ask: what determines the level of usage for a specific cryptocurrency network like Ethereum?

Users have many choices when selecting an L1 smart contract platform. Other Layer 1s include Solana, Cardano, Near, etc. Here are the factors I believe influence users’ choice of one chain over another:

-

Information Sharing: Which chain is more widely known? Social media and blog posts are the primary mediums for spreading information about various L1s.

-

Applications: Which network has the strongest decentralized applications (DApps)? Which apps lead their sectors? Which have the most trading liquidity? Etc.

Information Sharing

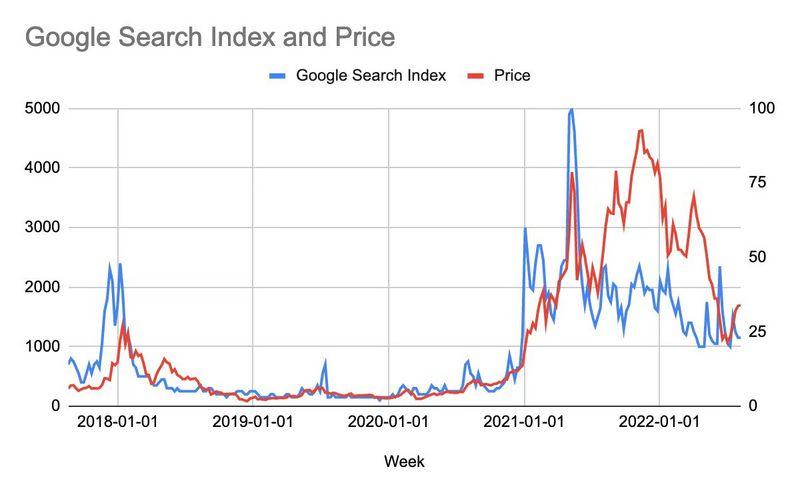

There is a reflexive relationship between information sharing and the price of ETH. The chart above shows Google search trends for “Ethereum” alongside ETH’s price. As you can see, they are highly correlated. Conceptually, this makes perfect sense—interest in the Ethereum network rises and falls with the price of its native token. As the price increases, more people hear about ETH and want to buy and use the network, further driving up the price.

Applications

The quality of applications on a network begins with the quality and quantity of its engineers. As a developer, you build things for people to use. If no one uses the network, there’s no point building on it. Clearly, a developer prefers coding in a familiar language, but if a large number of users can interact on a decentralized network, that preference becomes secondary.

The number of developers is directly related to the number of users their products can serve. As we established earlier, the number of users on any given network is directly linked to the price of its native token. Since user count and price have a reflexive relationship, the number of developers and price must also have a reflexive relationship. As the price rises, more people hear about Ethereum, more people use the network, and more developers are drawn to build applications chasing this growing user base. The better the applications, the more users join the network.

Outputs

-

The degree of ETH deflation depends on the amount of gas fees burned.

-

Burned gas fees depend on network usage.

-

Network usage depends on the number of users and the quality of applications.

-

Both user count and application quality have a reflexive relationship with the price of ETH.

Therefore, by transitivity, the degree of deflation has a reflexive relationship with the price of ETH. Given this, two potential future states may unfold.

Merge occurs:

If the merge succeeds, there is a positive reflexive relationship between price and monetary deflation. Traders will therefore buy ETH today because they know higher prices lead to greater network usage, which leads to stronger deflation, pushing prices higher, increasing network usage further, and so on. It’s a bullish virtuous cycle—the upper limit being when every human has an Ethereum wallet address.

Merge does not occur:

If the merge fails, there will be a negative reflexive relationship between price and monetary deflation—or put differently, a positive reflexive relationship between price and monetary inflation. In this case, I believe traders will either short ETH or choose not to hold it.

There is a floor here, however: Ethereum is the longest-operating decentralized network. ETH achieved a substantial market cap even without the merge narrative. The most popular dApps are built on Ethereum, and it hosts the largest number of developers among all L1s. Given this, as I mentioned in previous articles, I believe ETH won’t fall below the $800–$1,000 range it experienced during the TerraUSD / Three Arrows crypto credit collapse.

Market Sentiment

We now need to determine what we think the market believes about the likelihood of the merge succeeding or failing.

In my view, this is best determined from the chart below, which shows the ETH/BTC exchange rate. The higher it goes, the better ETH performs relative to Bitcoin. Since Bitcoin is the reserve asset of the crypto capital markets, if ETH outperforms BTC at this stage, to me it means the market increasingly believes the merge will succeed.

Since the end of the crypto credit crisis, ETH has outperformed BTC by roughly 50%. Thus, it can be argued that market confidence in a successful merge is growing. The currently expected merge date—as suggested by Ethereum core developers—is September 15, 2022.

But this reflects only spot market sentiment—what about the derivatives market?

The chart above illustrates Ethereum’s futures term structure, which plots current prices against the expiration dates of futures contracts. It allows us to forecast supply and demand across different maturities by calculating the premium or discount of futures contracts relative to the underlying spot price.

Discount = Futures Price < Current Spot Price; Futures trade at a discount

Premium = Futures Price > Current Spot Price; Futures trade at a premium

Given that the entire curve through June 2023 is trading at a discount—implying the derivatives market expects ETH’s price at expiry to be lower than the current spot price—there is greater selling pressure than buying pressure on margin.

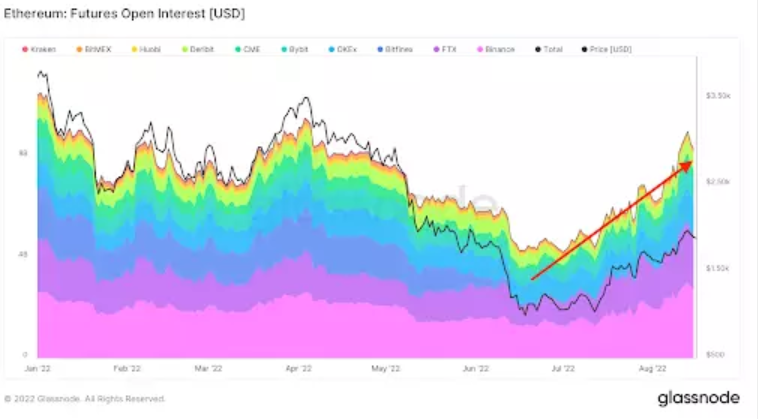

This chart shows open interest in ETH futures. Open interest refers to the total number of outstanding futures contracts held by market participants at a given point in time. As you can see, it is rising from the lows seen during the mid-June crypto credit crash. While open interest increases, the curve remains in backwardation. To me, this indicates high and rising selling pressure on margin. Conversely, if the curve were in contango (futures price > spot price) and open interest were rising, it would indicate strong and rising buying pressure on margin.

There are two potential reasons for the current selling pressure:

-

You buy ETH spot but are uncertain whether or when the merge will happen—so you fully or partially hedge your ETH risk by selling futures contracts at prices above the current spot price.

-

You expect the merge to happen and hope to receive free forked token airdrops—so you buy ETH spot, but also sell futures contracts to hedge your ETH risk. If the discount on the futures sold is less than the value of the forked tokens received on-chain, you profit.

On the other side of these directional futures flows are market makers. They run delta-neutral portfolios, meaning they have no direct exposure to ETH. When they buy futures from sellers, they must sell ETH in the spot market to hedge themselves, adding further selling pressure to the spot or cash market.

But remember—I just showed you that ETH has outperformed BTC by 50%. The market makers’ spot selling cannot match the inflow of bullish capital, which is encouraging. This suggests market confidence in a successful merge is underestimated and masked by short-term hedging flows from market makers.

If the market increasingly believes the merge will happen, what happens to all those who hedged via futures contracts if the merge succeeds?

-

If the merge succeeds, those holding spot ETH will buy back their hedges, making them net long ETH and allowing them to benefit from the positive reflexivity I described earlier.

-

If the merge succeeds and forked tokens are distributed, they will sell them at whatever value, and those who hedged will immediately unwind their positions. Now, they may decide to sell spot ETH to close entirely—but I bet these traders will be in the minority. ETH will be freed up and able to benefit from positive reflexivity.

I believe a successful merge will trigger significant buying pressure on margin, flipping market makers’ futures positioning. They will shift from being long futures / short spot to flat futures or short futures / long spot. Their short spot positions must be covered (i.e., buying spot), and if they take on net short futures, they will now need to enter the market and buy additional spot. The unwinding of pre-merge discounted derivative flows will lead to post-merge premiums.

Trading Decisions

For those who believe the merge will succeed as scheduled, the question becomes: how should you express your bullish view?

Spot/Physical ETH

The most straightforward trade is to sell fiat for ETH, or overweight ETH in your crypto portfolio.

Lido Finance

Lido Finance is the largest Ethereum beacon chain validator. Lido allows you to stake ETH with them to earn validator rewards. In return, Lido takes a 10% cut from the earned ETH rewards. Lido operates a DAO and issues a token called LDO.

If you want to take on more merge-related risk, this is an attractive option. It’s riskier than holding spot ETH because Lido’s value proposition entirely depends on the merge succeeding—for spot ETH, it could still succeed without the merge due to other value propositions.

This is higher-beta exposure within the merge narrative, which is why LDO has risen over sixfold since the mid-June crypto credit crash.

Long ETH Futures

For those seeking greater leverage and returns, going long ETH futures is a solid choice. With negative funding rates, long futures holders are paid to take on ETH exposure.

Basis = Futures - Spot

From the term structure, the December 2023 futures contract is the cheapest. If the merge succeeds, due to remaining time value, the basis will swing sharply into positive territory as shorts cover. The September 2023 futures contract will have only 1–2 weeks of time value post-merge, so you won’t get the same basis effect as going long the December contract.

ETH Call Options

For those who prefer leverage but don’t want the risk of liquidation like with futures, buying call options is a good strategy. Currently, implied volatility for September and December futures is below realized volatility. This is expected, as hedgers use both futures and options.

When I entered the market to buy my December 2022 $3,000 strike ETH calls, I was able to trade near the quoted price with volume far larger than shown on screen. I was told this was because dealers were heavily long calls, as hedgers were using calls to hedge their long ETH positions. Traders were happy to reduce their long call risk, freeing up margin, and thus displayed tight pricing on the bid side.

Similar to the futures term structure, the December calls are trading at cheaper implied volatility than the September calls. But another reason I prefer December calls is that I don’t need to be as precise about the timing of the merge. Although developers say September 15 is the date, tech delivery timelines are notoriously uncertain. I don’t want to worry about being off by a few weeks on the completion date.

Long December Futures vs Short September Futures

This is a steepening curve trade, requiring careful margin management. While you have no direct ETH price exposure, one leg will show unrealized losses while the other shows unrealized gains. If the exchange doesn’t allow offsetting, you may face margin calls on the losing leg—or face liquidation.

You’re short the September futures at a discount, meaning you pay theta (time decay). You’re long the December futures at a discount, meaning you receive theta. Netting out theta exposure, you’re earning money daily (assuming no spot movement) due to net positive theta. If we believe heavy short covering follows the merge, December futures will rise more than September futures. Thus, the curve will steepen, and gains on the December long will exceed losses on the September short.

Buy the rumor, sell the news?

Suppose you’re long via some ETH-linked instrument—should you reduce or fully exit your long position before the merge?

Due to positive reflexivity, ETH’s price will likely rally ahead of the merge. Textbook trading suggests you should at least reduce your position before then. But reality rarely matches textbook outcomes.

However…

The structural reduction in inflation only begins after the merge. I expect a similar dynamic to Bitcoin halvings—we know the date in advance, yet Bitcoin always rebounds after the event.

That said, ETH’s price could dip slightly before and shortly after the merge. Those who partially or fully exit will initially feel good about their decision. Yet, as deflation begins and the reflexive loop between high ETH prices and network usage re-engages, prices may gradually climb. At that point, you’ll have to decide when to re-enter. This is typically a psychologically challenging trade—you believe in the long-term trend but tried to trade around it. Now, you must pay a higher price to rebuild your position. It hurts because you keep waiting for a pullback that rarely comes. You either rebuild at the same size or miss a large portion of the upside.

Considering this thought experiment and my reflections on reflexivity in this scenario, I will not reduce my position at or immediately after the merge. If anything, I will add to my position during market sell-offs, because I believe today’s market does not—and cannot—know the optimal price.

How to Short

To remain balanced, we must also consider the best shorting strategy if the merge event fails. Given current market sentiment and price action, anyone shorting ETH before the merge is fighting positive reflexivity—a very dangerous position, making timing absolutely critical.

The best time to short is just before the merge is supposed to happen. That’s when expected value is highest, and the window from entry to outcome is shortest. If the merge fails, given the market’s high expectations versus objective reality, the sell-off will be swift and vicious. This allows you to exit quickly and lock in profits.

I recommend using put options for this strategy. Looking back at the futures curve, the March 2023 futures have the lowest discount. As a short, this means you pay the least. It also implies March 2023 puts will be the most attractive. If I were shorting, I’d buy 1,000 March 2023 $1,000 strike ETH puts on September 14. Your maximum loss is known upfront—the premium paid for the puts—giving you defined risk if the merge succeeds. If it fails, your goal is to see price rapidly drop below your $1,000 strike.

Conclusion

Writing these articles is a great way for me to truly think through my trades and ultimately strengthen my confidence in my portfolio positioning. If I cannot logically explain the ideas behind my portfolio construction, then I need to reevaluate my trading decisions.

Applying Soros’s theory of reflexivity to the ETH merge has increased my confidence. I wasn’t sure what to do before the merge, but after putting these thoughts on paper, I now know.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News