Will derivative DEXs be the protagonist of Web3's next narrative?

TechFlow Selected TechFlow Selected

Will derivative DEXs be the protagonist of Web3's next narrative?

The narrative around decentralized derivatives exchanges is heating up.

Written by: Gains Goblin

Compiled by: TechFlow intern

The narrative around decentralized derivatives exchanges is heating up. Pay attention to sectors that have shown relative strength during the bear market, as they stand to gain significantly in the next bull run. In this article, I analyze the DEX derivatives market and highlight some projects worth watching.

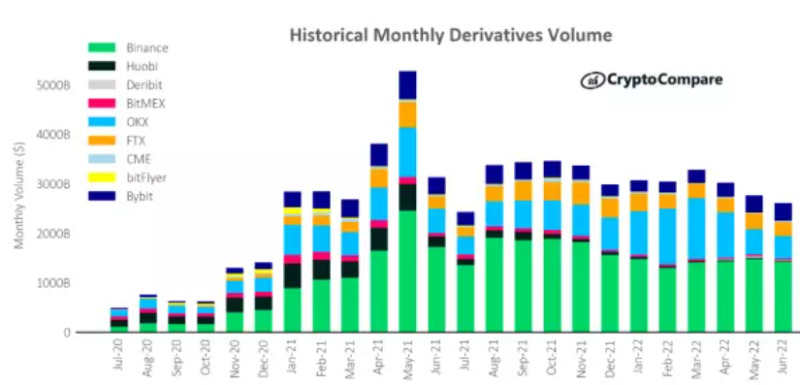

First, derivatives currently account for 66% of all cryptocurrency trading volume. This is significant because while trades like $UNI are major for the DEX market, they operate in a segment that represents only a small fraction of the total market.

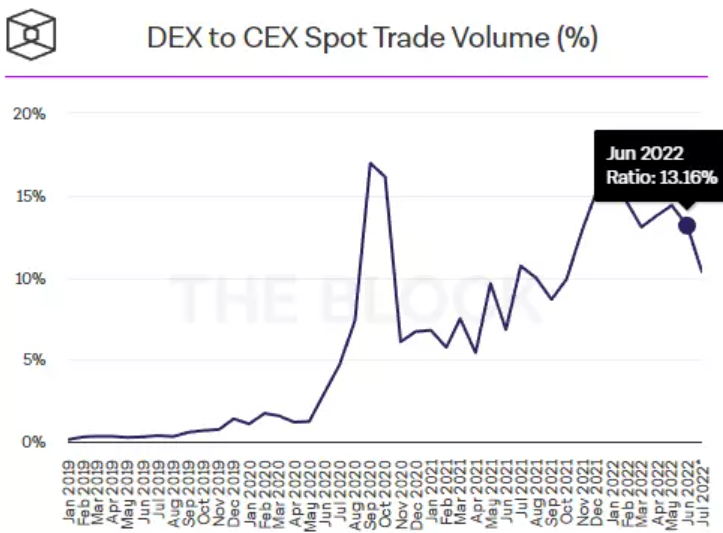

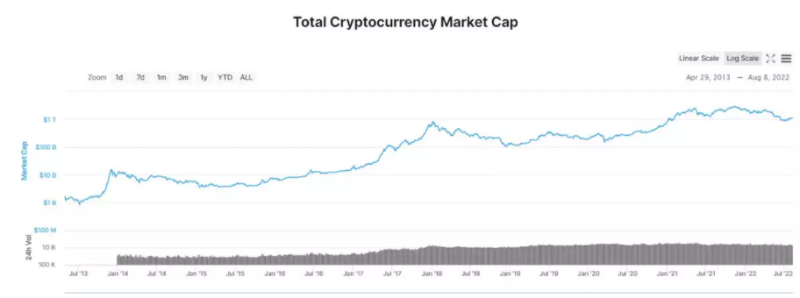

Spot DEXs are rapidly gaining market share from their centralized counterparts. Currently, spot DEXs account for about 13% of total trading volume and are on a solid growth trajectory. I expect this figure to reach at least 25% over the next few years.

And here lies the opportunity: the derivatives DEX market currently holds just 2% market share—similar to where spot DEXs were at the end of 2019.

My prediction is that in the coming years, derivatives DEX trading volume will follow a growth pattern similar to that of spot DEXs. What would that look like?

If derivatives DEX growth mirrors that of spot DEXs, capturing 13% market share would equate to $4.7 trillion in annual trading volume.

According to market analysis, the average fee for derivatives products is 0.075%. Assuming the current market's 13% share, the annual revenue for derivatives DEXs would be: $4.7 trillion * 0.075% = $35.3 billion. The current market caps of top derivatives protocols are:

-

SNX = $1.2 billion

-

GMX = $470 million

-

DIDX = $360 million

-

PERP = $98 million

-

DPX = $111 million

-

GNS = $83 million

-

TCR = $46 million

-

LYRA = $30 million

Totaling approximately $2.4 billion. So with $35 billion in potential annual revenue up for grabs and the combined market cap of leading derivatives DEX protocols standing at just $2.4 billion, isn’t this an incredible opportunity?

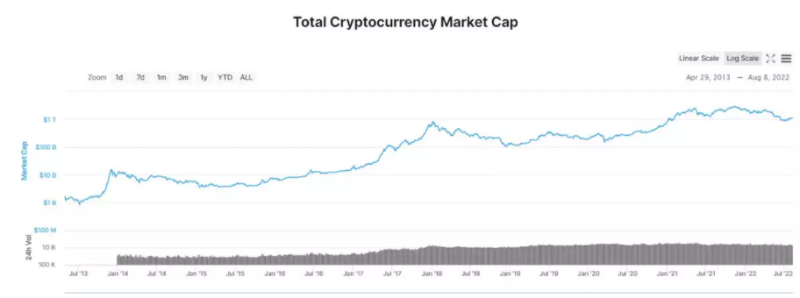

While this outlook is based on current figures, we can reasonably project that both the total crypto market cap and trading volume could maintain their current growth trends and increase tenfold over the next five years.

Add to that the possibility of DEXs growing to capture 25% of total market share, and the numbers become even more compelling.

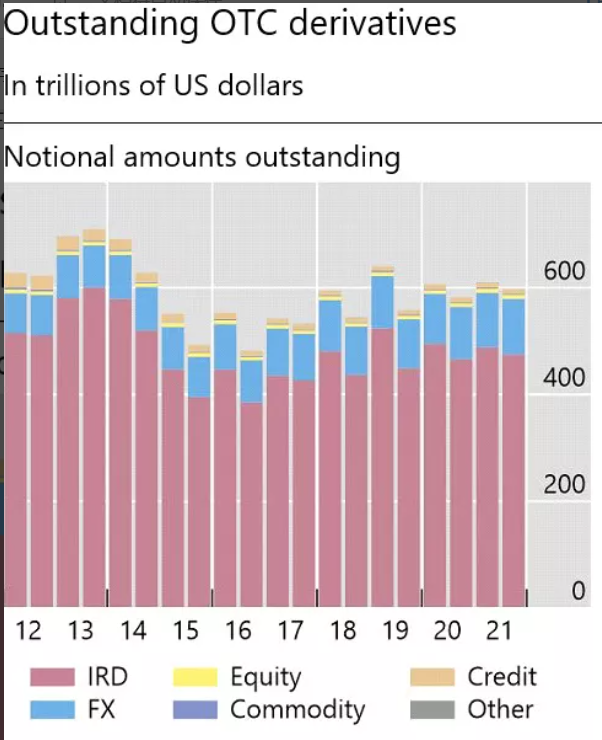

Protocols like GainsNetwork already offer stocks and forex, and plan to expand into commodities, indices, and more—similar to what GMX is doing. The traditional finance (TradFi) derivatives markets for these assets see nearly $600 trillion in annual trading volume.

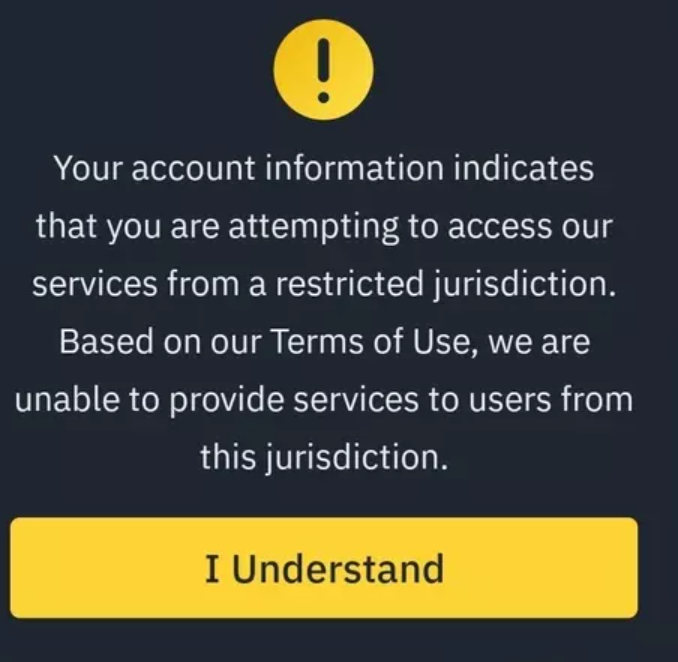

Even capturing a tiny fraction of this volume would represent massive growth potential for DEXs—especially since most developing countries and non-Western populations currently lack access to these markets through traditional banking systems. Another key factor is increasing global regulatory pressure, which is already restricting users in many jurisdictions from trading derivatives on centralized exchanges, as seen with Binance and other platforms.

Users excluded from centralized exchanges will need alternative venues to trade, making DEXs a natural solution to capture this demand. All these factors make me extremely bullish on the future growth of this sector. Below is my list of projects to watch in this space, listed in no particular order:

-

$SNX

-

$GNS

-

$GMX

-

$DPX

-

$TCR

-

$DYDX

-

$LYRA

These also fall under the RealYield narrative.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News