10 Reasons Why Stablecoins Will Eventually Reach a $10 Trillion Market Cap

TechFlow Selected TechFlow Selected

10 Reasons Why Stablecoins Will Eventually Reach a $10 Trillion Market Cap

Economic and social reasons, along with use cases, for significant adoption growth of stablecoins over the next 5–10 years.

Author: rektdiomedes

Translation: TechFlow intern

I am highly bullish on the market prospects of stablecoins and believe they will see massive adoption growth over the next 5–10 years. This article outlines the economic and social reasons behind my argument, along with key use cases.

One: They Are a Far Superior Technology Compared to Traditional Finance (Tradfi) Banks

As someone who uses both traditional finance platforms and on-chain stablecoins for online business operations, I can confirm that the latter is unquestionably better.

If you want to conduct international transactions using U.S. Bank, Wells Fargo, or similar institutions, you'll face high currency conversion fees. While platforms like PayPal, Payoneer, or Wise technically allow you to avoid such charges, you still cannot escape endless interactions with their support teams when your transfers get frozen, lost, etc.—wasting countless hours of human effort.

This isn't necessarily their fault—it's due to outdated legacy financial systems.

With stablecoins, however, you can send USDC or DAI across various blockchains for less than a penny and instantly verify via Etherscan or DeBank/DeFi that your transfer has arrived. You can also make any number and combination of transactions with 100% accounting transparency, and much more.

Two: Their Value Is Obvious to People in Places Like Argentina

Imagine living in a country where your local currency is rapidly depreciating, and your only access to U.S. dollars is through expensive gray-market exchanges—yet holding large amounts of physical cash remains risky.

In such circumstances, the utility of permissionless, self-custodied stablecoins denominated in more stable currencies or assets becomes immediately apparent.

Three: Remittances and Reliable Transfer Channels in Emerging Markets

For many migrant workers worldwide, remittance fees are exorbitant, and in numerous emerging markets, remittance channels are inefficient and prone to corruption.

Four: Hyper-Efficiency of On-Chain Foreign Exchange Markets

The technology underpinning on-chain stablecoins vastly outperforms traditional finance across every dimension. Although still in its early stages, stablecoins will inevitably capture a significant share of Tradfi’s market.

Five: Currency Hedging for Ordinary People

Similarly, if you live in a region experiencing currency depreciation, having access to stablecoins pegged to the U.S. dollar, gold, or Swiss francs is extremely valuable. Young people in Europe earning income in USD are a perfect example of this trend.

Six: Ability to Provide Yield to Holders

As mentioned above, you can earn (real, organic) yield from stablecoins. So far, this has primarily taken the form of liquidity provision—you earn returns by supplying liquidity to decentralized exchanges or foreign exchange markets.

This “yield” comes not only from direct incentives but also from the fact that on-chain DeFi efficiency is roughly 100x that of Tradfi. On-chain protocols can accomplish tasks requiring thousands of employees at traditional institutions with just a few developers. As a result, these cost savings can be passed directly to liquidity providers and token holders as yield. Additionally, certain stablecoins like USDC can distribute treasury bill yields to holders, opening up various other interesting possibilities.

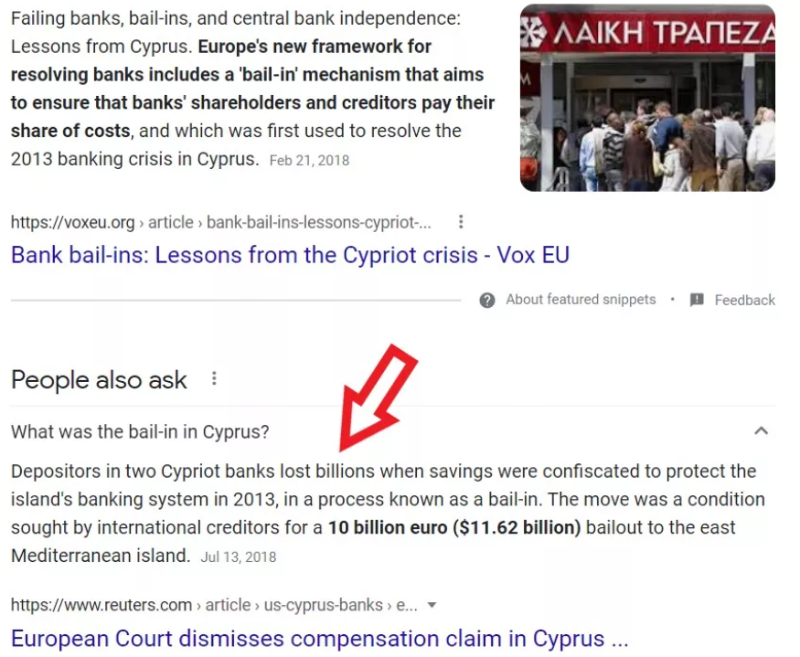

Seven: Defense Against Government/Bank Black Swans

If you've studied history, you know events like the Cyprus bailout and similar incidents tend to happen repeatedly to ordinary citizens. More recently, the Canadian trucker protests reignited concerns around financial censorship.

While topics like Tornado Cash are complex, the value of keeping some liquid capital in a wallet accessible only to you should be obvious.

Eight: Protection Against Personal-Level Black Swans

For many people globally, the threat of wrongful arrest, prosecution, extortion, or frozen bank accounts represents a real personal-level black swan event.

This highlights the core value proposition of cryptocurrency—and stablecoins in particular: rather than entrusting your money to a bank, you hold your own funds and private keys in a personal wallet.

Nine: Monetary Tools for Institutions

Just as online businesses and young individuals are increasingly adopting on-chain stablecoins, traditional institutions will follow suit. We’re already seeing institution-focused complex protocols like Maple Finance, as well as MakerDAO incorporating real-world assets as collateral for its stablecoin $DAI.

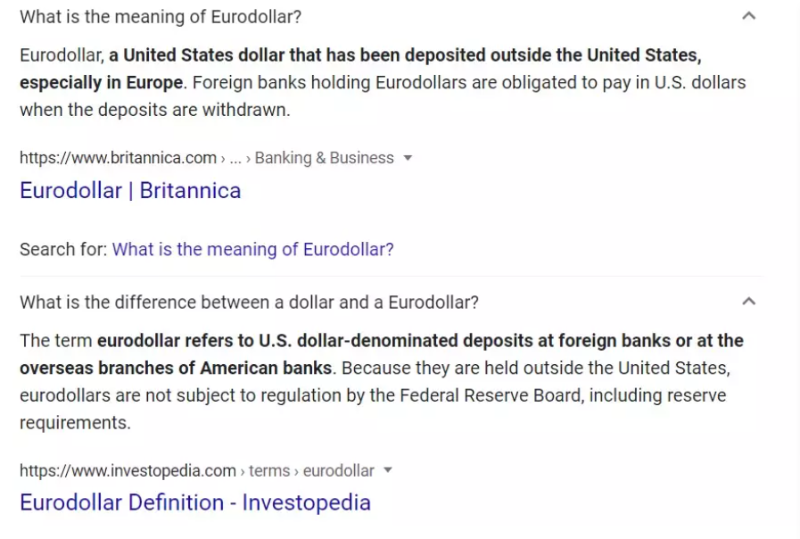

Ten: A Logical Evolution of the Existing Eurodollar System

To clarify, “Eurodollar” has nothing to do with the euro. The term refers broadly to U.S. dollars existing entirely outside the U.S. financial system.

CDP-based stablecoins like $DAI, $FRAX, and $MAI are essentially digital equivalents of Eurodollars—dollar-denominated loans, collateral, and units of account operating outside the official U.S. financial framework.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News