Tenderize: Web3 infrastructure for liquid staking and yield generation

TechFlow Selected TechFlow Selected

Tenderize: Web3 infrastructure for liquid staking and yield generation

The market size for Web3 infrastructure serving the decentralized internet stack is so large that it is often underestimated.

Author: Mason Nystrom

Compiled by: TechFlow intern

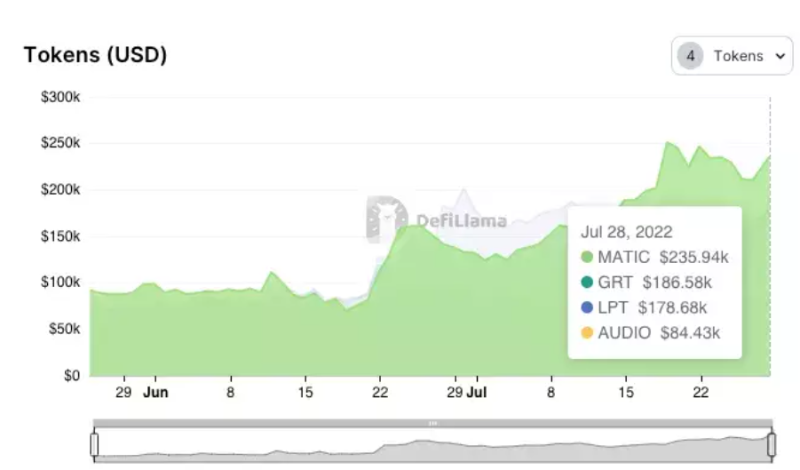

While liquid staking exists for Ethereum and other Layer 1 assets, it is largely unavailable for other Web3 infrastructure assets. Tenderize addresses this gap by providing a non-custodial, liquid staking protocol for Web3 assets and launched its mainnet in May, offering liquid staking for Livepeer (LPT), The Graph (GRT), Polygon (MATIC), and Audius (AUDIO).

To date, Tenderize has nearly $700,000 in TVL, fairly evenly distributed across the first four assets.

How Does Tenderize Work?

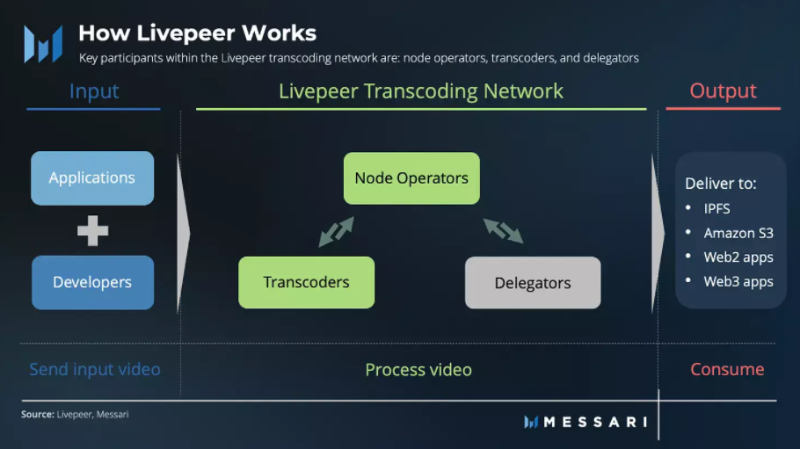

Let’s use Livepeer, one of the largest staked assets on Tenderize, as an example. Livepeer requires a node to stake LPT in order to perform transcoding work on the Livepeer network. Additionally, Livepeer allows users to delegate their LPT to node operators in exchange for a portion of the LPT rewards.

Staking via Livepeer

Typically, you (or an institution) would go directly to the Livepeer network and choose a node to delegate to. As a delegator, you might want to switch nodes when:

-

You want to delegate to a node that shares more rewards (more rewards = more money);

-

You prefer a node with higher uptime (higher uptime = more rewards = more money);

-

You wish to undelegate from a node whose values you no longer align with—for instance, if a node is attacking the network or taking controversial positions on governance proposals (less stake = less power).

However, LPT has a 7-day undelegation period, during which you earn no rewards—meaning you lose 7 days of potential profits. For other infrastructure protocols like The Graph, the undelegation period is even longer (28 days). Moreover, because your LPT is locked within the Livepeer protocol, your staked assets cannot be used as collateral in other protocols or applications.

These examples illustrate how delegators—or potential node operators—must leave capital idle for a period when choosing to undelegate, potentially incurring losses.

Staking via Tenderize

In contrast, using Tenderize, after you (or any delegator) stake LPT, you receive tLPT (tender LPT). The LPT staked through Tenderize is delegated to high-yield nodes, with staking rewards automatically compounded and additional tLPT sent to holders over time. A tLPT holder can redeem back into LPT at any time, use tLPT in other DeFi protocols to earn additional yield, or immediately sell tLPT. Over time, due to its instant liquidity and potential yield-bearing nature, Tender tokens may trade at a premium relative to their native counterparts (e.g., tLPT vs. LPT).

The benefits of liquid staking essentially boil down to Finance 101—time value of money: a dollar today is worth more than a dollar tomorrow. In the case of Tenderize, a dollar you can use today is more valuable than one available seven to twenty-eight days later. Investors unwilling to wait out the unstaking period—or those wishing to efficiently deploy their assets for additional yield—will pay a premium, while others willing to accept lower prices for the underlying LPT tokens will make a time-based trade-off.

Liquidity Moats and Protocol-Controlled Value

Web3 infrastructure is also complex. Protocols like The Graph and Livepeer have diverse long-term holders, and delegation helps drive their growth. Tenderize encourages this by creating greater alignment between capital allocators and node operators, automatically compounding rewards over time and managing delegation based on node profitability and reliability. This simplifies the process for investors and incentivizes competition among hardware providers.

Perhaps most importantly, as Tenderize scales, it naturally accumulates significant protocol-controlled value (liquidity), which can be leveraged to generate yield across the broader DeFi ecosystem.

The market size for Web3 infrastructure powering the decentralized internet stack is so large that it is often underestimated. In 2022, global revenue from network infrastructure was estimated to exceed $200 billion, with Amazon Web Services alone generating $62 billion last year. Imagine a world where many of the services provided by today’s tech giants are unbundled—giving us separate protocols for computing, storage, bandwidth, indexing, and other data management functions. Tenderize offers a mechanism to further financialize future Web3 infrastructure.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News

![Axe Compute [NASDAQ: AGPU] completes corporate restructuring (formerly POAI), enterprise-grade decentralized GPU computing power Aethir officially enters the mainstream market](https://upload.techflowpost.com//upload/images/20251212/2025121221124297058230.png)