Understanding USDD: Looking Beyond the Decoupling Illusion to Find the Real Stablecoin

TechFlow Selected TechFlow Selected

Understanding USDD: Looking Beyond the Decoupling Illusion to Find the Real Stablecoin

"One cannot step into the same river twice."

Author: Crypto_David

"You cannot step into the same river twice."

First came the collapse of UST, and last month USDD experienced a certain degree of price deviation.

Will USDD repeat history? This question naturally arises. In response to market concerns, the USDD team released an open letter systematically addressing external skepticism.

Rather than reacting emotionally—seeking drama, hoping for failure, or spreading FUD—it’s more valuable to analyze the content of this open letter.

Stablecoins are vital to the entire crypto ecosystem. Understanding basic facts and forming sound judgments help us avoid being swayed by noise, quickly grasp new stablecoin narratives and strategies, and capture returns within our circle of competence.

Given the length of the open letter, I’ll offer an interpretation here to help you quickly understand USDD's design mechanics and its mechanisms for handling price deviations.

Depegging: A Familiar Illusion

Before anything else, when discussing USDD, one naturally thinks of TRX. Due to preconceived notions, many assume the relationship between TRX and USDD is similar to that of LUNA and UST.

On the surface, there are indeed some similarities:

● Both have an underlying native token as backing;

● Both employ a two-way mint-and-burn mechanism, relying on market arbitrage to keep UST/USDD floating around $1;

And both have faced "depegging." Everyone knows what happened with UST—the collapse triggered widespread tremors in the crypto space. USDD also experienced partial depegging (as low as $0.94 according to CoinGecko), but its price soon returned close to $1.

Data source: CoinGecko

Without deeper thought, it’s easy to fall into a chain of suspicion and illusion:

Both stablecoins are strongly tied to their respective base tokens--->the base tokens themselves lack intrinsic value--->both have depegged before--->they’re inherently unstable--->history will inevitably repeat itself.

But is this really true? Now that the narrative of algorithmic stability embodied by LUNA/UST has collapsed, what purpose does it serve for USDD to simply copy UST’s model? If you don’t examine USDD’s design details, it’s easy to develop cognitive bias due to the depegging illusion.

The key to breaking this illusion lies in understanding what “stability” means within USDD’s design, why it is considered stable, and how instability is addressed.

Beyond the Illusion: Analyzing USDD’s Stability Mechanism

● What Does “Stability” Mean?

Every aspect of a stablecoin’s design ultimately serves the goal of “stability.”

But first, we must clarify what stability actually means. According to the official USDD open letter, stability allows USDD to fluctuate slightly above and below $1, rather than requiring strict 1:1 parity at all times.

This makes clear that stability does not mean a fixed price. When USDD trades within a safe range (e.g., ±3%), such fluctuations are seen as normal market behavior—not depegging—and do not require immediate corrective action. Market supply and demand can self-correct minor price movements.

Therefore, we can accept that price fluctuations in USDT, UST, and USDD are normal—you cannot expect them to be exactly equivalent to $1 at every moment. Only when prices move significantly (i.e., depeg), such as during coordinated short attacks or mass sell-offs, should intervention occur to maintain value stability.

What interventions exist? Most people immediately think of algorithmic stablecoins’ two-way mint/burn mechanism—using arbitrage to naturally restore equilibrium. But this mechanism inevitably evokes memories of LUNA/UST, leading to narrow debates about whether TRX truly backs USDD.

It is only when you frame USDD’s stability as dependent on TRX’s price that the aforementioned illusion takes hold.

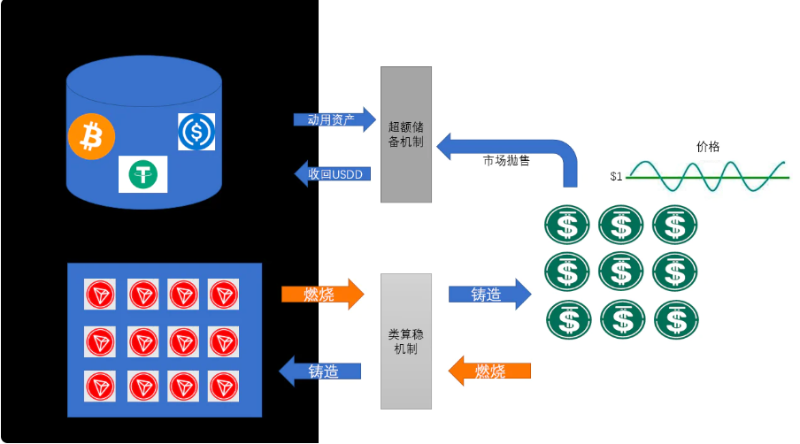

● Two-Way Minting Between TRX/USDD Is Just One Tool, Not the Core

Looking deeper, although TRX/USDD does involve a two-way minting mechanism aimed at maintaining USDD stability, there are crucial operational differences from UST—particularly regarding control over stablecoin supply and openness of minting rights.

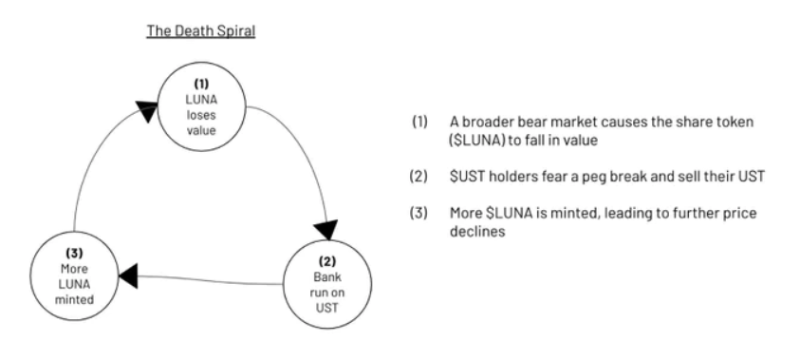

First, consider the LUNA-UST two-way minting design. Since both tokens could be freely minted and burned on the market, negative sentiment could easily trigger a death spiral:

1. During bearish markets, LUNA falls in price;

2. Because UST is backed by LUNA, users fear UST may depeg as LUNA loses value, so they begin selling UST;

3. The free two-way minting mechanism allows arbitrageurs to buy UST below $1 and exchange it for $1 worth of LUNA, increasing LUNA supply;

4. Excess LUNA further drives down its price, initiating a death spiral that repeats step 1.

Interpretation via Twitter @WestieCapital

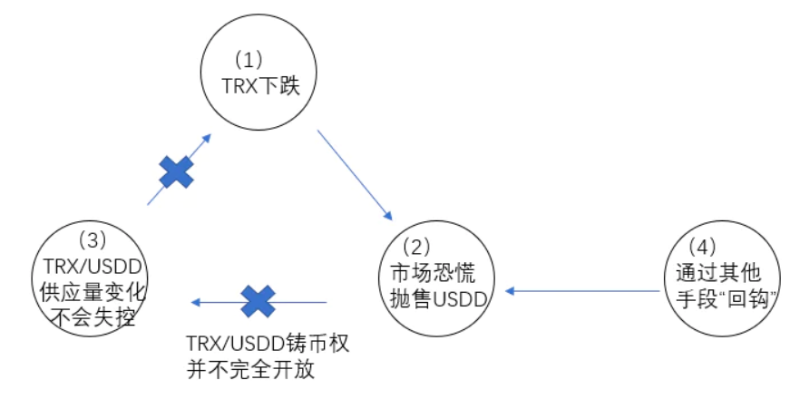

Now let’s examine how things differ under the current TRX/USDD two-way minting setup:

1. During a bear market, assume TRX declines;

2. Spillover panic assumes a strong correlation between TRX price and USDD stability, prompting sales of USDD;

3. When selling pressure increases, the broader market currently cannot freely arbitrage—only whitelisted institutions approved by the BitTorrent Foundation Reserve (BTFD) can burn sub-$1 USDD to mint $1 worth of TRX for profit.

4. Since step 3 isn't universally accessible, the cascading death spiral effect likely won't occur. This means uncontrolled market actions cannot currently affect the circulating supply of USDD or TRX. Control over USDD adjustments remains largely in the hands of BTFD.

USDD clearly learned from past mistakes. Before UST depegged on May 9, UST had a market cap of $18.7 billion and LUNA $20.4 billion—roughly comparable. After depegging, under the public dual-token mint/burn mechanism, LUNA was massively inflated: supply increased 18,000-fold between May 9 and May 14, while its price crashed to 0.00018% of its peak, reducing total market cap to just 3%.

At that point, even a fool would realize that LUNA, now infinitely inflatable, had lost all value—and thus so did UST.

Tying a stablecoin’s value to a freely mintable native token has been proven flawed.

USDD does not follow this model. Instead, BTFD may choose to use—or not use—the two-way mint/burn mechanism (TRX/USDD). It is merely one tool among many. The intelligent BTFD holds other cards and doesn’t need to play an obvious hand with known vulnerabilities for the market to exploit.

Twitter @peanutduck

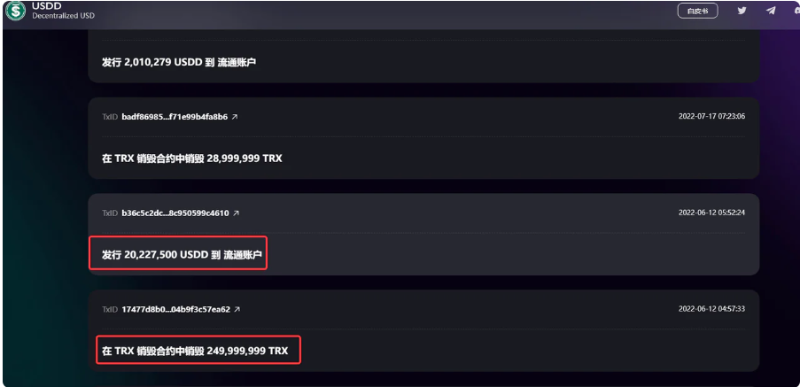

Historical data partially supports this analysis: around mid-June during USDD’s depeg event, BTFD’s official records show no instances of burning USDD to mint TRX. Instead, TRX was sent to a burn contract to issue new USDD.

Source: BTFD official website

● Overcollateralization Is Key to Price Stability

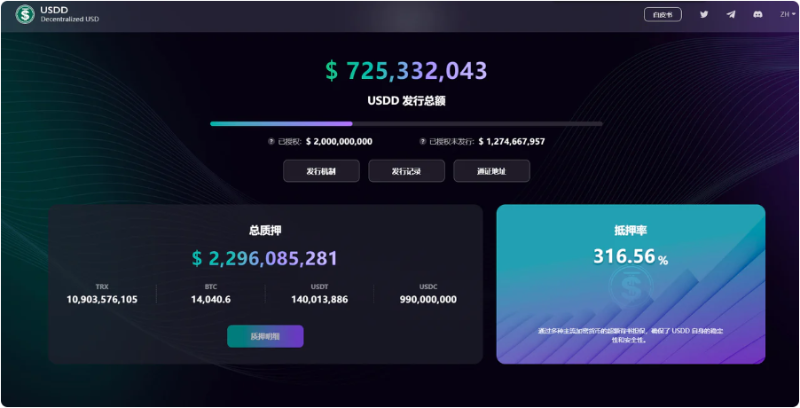

Currently, USDD has a total issuance of approximately $730 million, backed by reserves including BTC, USDT, USDC, and TRX valued at $2.29 billion—about three times the issued amount.

Source: BTFD official website

Let’s consider an extreme scenario: what if TRX were completely worthless—like LUNA crashing to zero—what then?

In reality, excluding TRX, the combined reserves of BTC, USDT, and USDC still amount to around $1.4 billion—more than sufficient to cover the $730 million in issued USDD. If large-scale selling causes oversupply and depegging, BTFD can simply deploy its reserve holdings—far exceeding USDD’s circulation—to buy back USDD and re-anchor the price.

Having capital is power.

Thus, unlike LUNA/UST, TRX accounts for only about one-third of USDD’s total reserves. The price of USDD is no longer closely tied to TRX. Furthermore, as previously noted, the authority to mint/burn TRX/USDD remains firmly controlled by BTFD. Markets cannot freely alter the circulating supply through arbitrage. This means controllable supply plus ample reserves form a layered stabilization mechanism. USDD is not a mere clone of UST’s algorithmic model, but a hybrid stablecoin backed by multiple synthetic assets through overcollateralization.

Image reference: Twitter @danku_r on USDD’s design rationale for adding BTC reserves

The only vulnerability in this system is if BTFD’s collateral—BTC, USDT, USDC, TRX—all experience sharp simultaneous price drops, causing the total reserve value to shrink below the issued USDD value.

Other Stabilization Tools Beyond Two-Way Minting

As discussed earlier, BTFD has multiple tools beyond two-way minting to maintain USDD stability. If we liken BTFD to a central bank in traditional finance, these tools resemble monetary policy instruments.

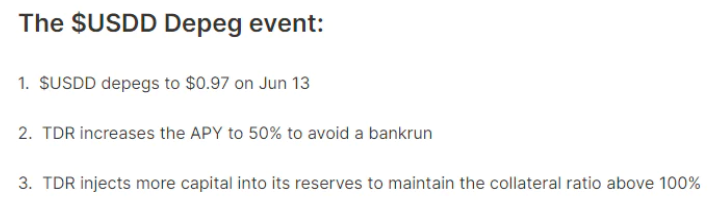

According to the open letter, stabilization policies include interest rate adjustments, open market operations, and window guidance. Setting aside these technical terms, reviewing last month’s brief USDD depegging incident offers intuitive insight into each policy.

1. Adjusting USDD Interest Rates

On June 13, USDD dipped to $0.97. In response to this minor fluctuation, BTFD raised the staking yield for USDD, incentivizing users to stake USDD back into the protocol. By leveraging participants’ profit-seeking behavior, circulating supply decreased, allowing the price to recover organically.

Image source: https://0xilluminati.com,回顾 USDD depeg event

2. Open Market Operations

When USDD experiences significant price swings—say, depegging 10% to ~$0.9—BTFD could theoretically burn USDD to mint TRX, reducing USDD supply to restore parity. However, this would also impact TRX’s price. Aware of this, BTFD instead chose to publicly purchase $100 million worth of TRX using USDC, countering market shorting pressure on TRX while simultaneously strengthening its reserve assets to better withstand future risks.

3. Window Guidance

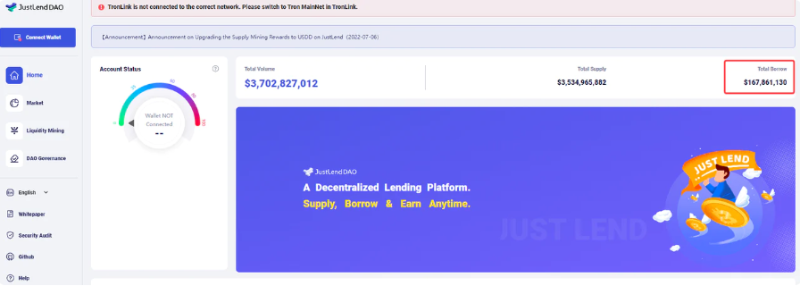

As explained in the open letter, under extreme conditions, BTFD collaborates with select market entities (e.g., JustLend, CEXs) to control borrowing limits for USDD and TRX—or even suspend lending entirely—to prevent malicious short attacks.

Source: BTFD public materials

Last month’s USDD depegging was triggered by massive borrowing. From May 31 to June 1, wallet address TFehYK6usvtxWqDMQ3rXxGXmrA9LiFKJau borrowed 170 million USDD via JustLend and dumped it heavily on KuCoin. After this incident, we speculate BTFD and Sun’s team became more vigilant against massive borrowings. Currently, most circulating USDD on DEXs is concentrated in JustLend, sun.io pools 2/3, and Curve. If abnormal borrowing activity is detected on affiliated platforms, functions may be disabled preemptively to prevent escalation.

JustLend homepage

Bluff and Reality: Does USDD Play With Hidden Cards?

Looking back at last month’s brief USDD depegging, it resembled a game of bluff and counter-bluff between BTFD and the market.

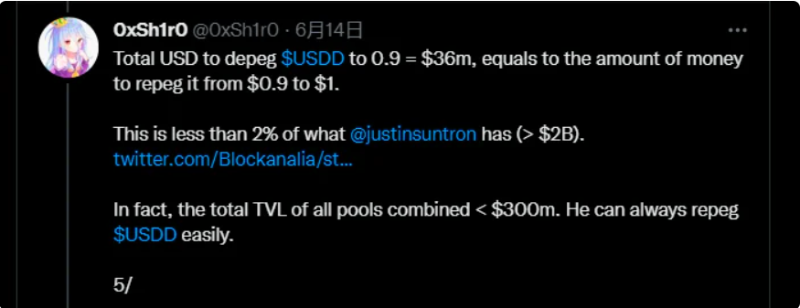

Calculations suggest that given market conditions at the time, roughly $3.6 million would have been needed to push USDD back from $0.9 to $1. Yet BTFD’s total reserve assets exceed $2 billion—meaning Sun could have easily restored parity with a finger snap.

Image source: Twitter @0xSh1r0

Yet he didn’t act immediately. USDD remained below $1 for some time. According to the above calculation, failing to execute a simple fix suggests either negligence or intentional delay.

I lean toward the latter. While USDD stayed depegged, market reactions largely echoed fears of a UST-style collapse. But the savvy Sun went as far as tweeting openly: "No panic, stay calm—we’re deploying additional funds."

As previously analyzed, the link between TRX and USDD is not nearly as tight as LUNA and UST, especially since minting rights remain centralized with BTFD. Publicly declaring intentions, avoiding immediate mint/burn actions—these were all bluffs.

Especially given Sun’s controversial persona and the polarizing nature of USDD, his methods for defending price stability are unlikely to align neatly with market expectations. Between real and feigned moves, I believe that if USDD aims to grow into a major stablecoin, none of these tactics should be dismissed as mere “conspiracies” or “rug pulls.”

In the case of USDD, Sun appears more like a master strategist, orchestrating various resources to collectively sustain USDD’s growth.

Considering that top-tier market makers sit within BTFD, maintaining USDD stability is undoubtedly their shared objective and core interest. The influence and resources gained from scaling USDD far outweigh petty, short-sighted schemes to “harvest韭菜” (reap retail investors).

From the USDD open letter: “The guiding principle of BTFD’s monetary policy is to provide the market with reasonably limited information to ensure confidence in USDD’s price stability—but also to limit disclosure so that neither longs nor shorts can predict BTFD’s next move, minimizing unnecessary volatility and market shocks.”

The letter even quotes former Fed Chair Alan Greenspan: “If I seem unduly clear to you, you must have misunderstood what I said.” If you think you’ve correctly interpreted the strategy, you’ve probably misunderstood it.

This multi-layered game of strategy might just be getting started.

Note: Insights from the following Twitter figures greatly informed this piece:

1.@peanutduck

2.@TheImmutable

3.@0xSh1r0

4.@danku_r

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News