Oil and gas, stablecoins, NFTs become infrastructure... Ten trends to watch in the future

TechFlow Selected TechFlow Selected

Oil and gas, stablecoins, NFTs become infrastructure... Ten trends to watch in the future

This article lists ten things I'm highly optimistic about over the next decade, both in terms of investments and overall outlook. (Not all are related to cryptocurrency.)

Written by: Rektdiomedes

Translated by: TechFlow intern

Disclaimer: The views expressed in this article are solely those of the author and do not constitute financial advice.

Here are ten things I'm bullish on over the next decade—both from an investment and general perspective. (Not all crypto-related.)

1: Oil and Gas Prices

For the past 5-8 years, we've severely underinvested in oil and gas—and now we're starting to feel the consequences. Billions of people in emerging markets aspire to the same standard of living we enjoy, which means demand will continue rising.

I don't have strong romantic feelings about one energy source versus another, but it seems unlikely we'll move away from oil and gas anytime soon. In the West, there's little policy focus on increasing oil and gas production.

2: Stablecoins

I believe stablecoins represent the first sticky use case for on-chain crypto and DeFi. For more, check out ChainLinkGod’s excellent thread.

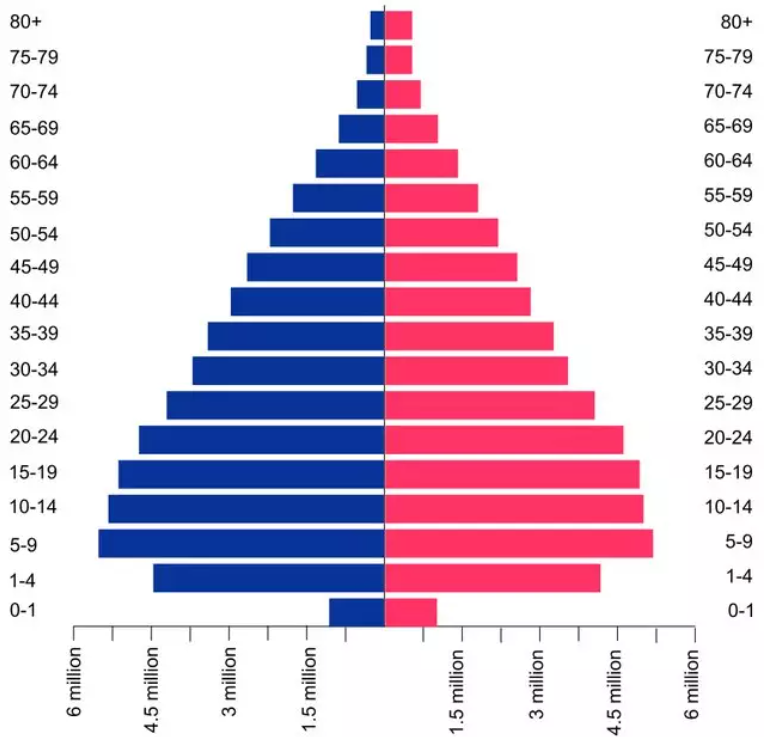

3: The Philippines

The Philippines is currently at a demographic stage similar to where the U.S. was in 1980 and China in 2000. In other words, their 40-year "demographic dividend" period has begun.

It also has millions of young people working as virtual assistants (VAs) for some of the world's best-run online businesses, learning valuable skills in business development and organization. As they mature, they’ll bring these skills back home and become leaders.

I’ve hired several Filipino VAs, and their professionalism and fluent English have impressed me deeply. I believe the Philippines is on a steep upward trajectory and that within 20 years, its median income could surpass countries like Greece or Italy.

4: NFTs as Online Infrastructure

Right now, most people associate NFTs with ape pictures and wealth... But I believe NFTs as a technology are likely to become foundational infrastructure for the internet.

We’re already seeing this with things like LensProtocol; NFT-based membership sites; NFT-based e-books, etc. It seems wallet/NFT technology is destined to become a core part of how we navigate the digital world.

5: Crypto Youth Movement

Some younger readers may not realize just how unique crypto truly is. The fact that older generations are lamenting its cultural impact speaks volumes.

Crypto is the first youth-driven cultural phenomenon in at least 60 years—one that's fundamentally positive for society, hopeful rather than overly utopian. Sure, crypto faces many valid criticisms, but overall, it's profoundly constructive.

Interestingly, unlike the early internet—which was mocked and associated with geeks, nerds, or perverts—public perception of young people in crypto tends to be “smart,” “forward-thinking,” etc.

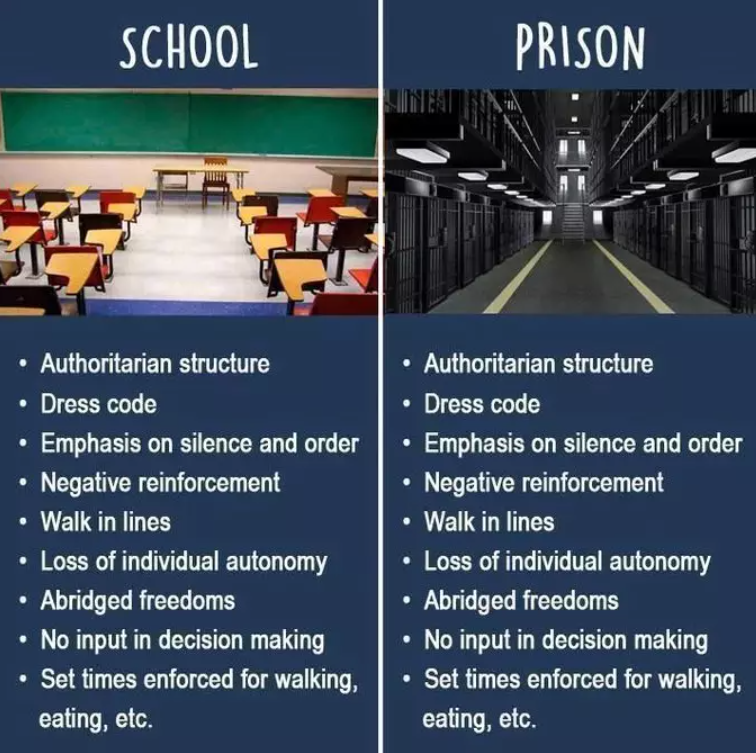

6: Alternative Education & Homeschooling

People are beginning to realize that making kids wake up at 6–7 AM and sit all day in prison-like buildings, studying at narrow desks under fluorescent lights, isn’t healthy.

With the rise of remote work, careers, and businesses, many parents now have more time to focus on homeschooling and alternative education models. As a result, I believe we’re already witnessing a massive shift in education—at least in the U.S.

7: Personalized Health

While modern medicine excels at acute care (ER, surgery, etc.), many people now realize that traditional primary care doctors know surprisingly little about everyday health, nutrition, and fitness—and many patients remain chronically unhealthy.

Therefore, I’m very bullish on niche online health experts (e.g., @BowTiedOx, @AJA_Cortes), the rise of “health tech,” and private-pay health services (e.g., blood labs).

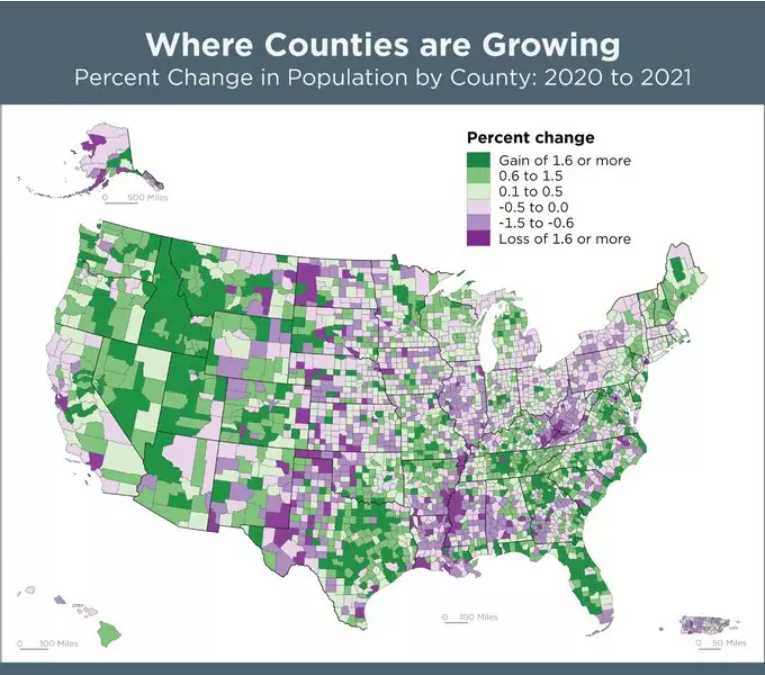

8: U.S. Real Estate

Everyone’s predicting a real estate crash—and sure, housing *should* crash—but I don’t think it will (except in places everyone is fleeing). Major metropolitan areas should continue to grow.

Homeownership is baby boomers’ cocaine. I don’t believe 80 million boomer voters will willingly allow home prices to fall while they’re still alive—they’ll vote to keep home values inflated.

9: Blue-Collar Workers

I believe blue-collar workers, skilled tradespeople, and hands-on professionals will see absolutely vertical wage growth over the next decade. In aging nations—like most Western countries are becoming—all manual labor will command huge premiums, and there are vanishingly few young people willing to do this work.

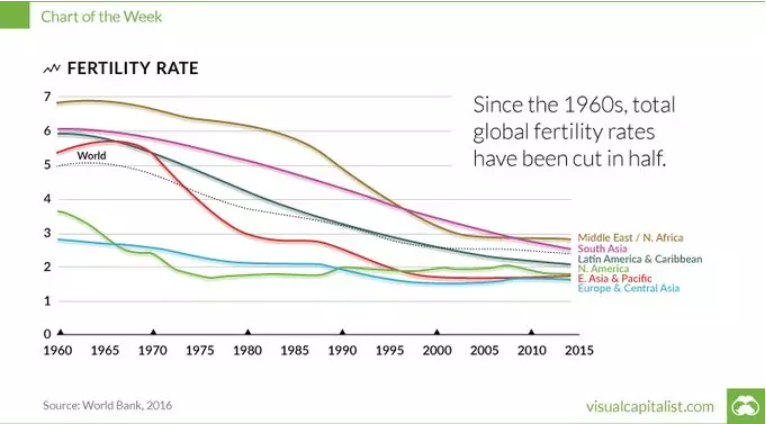

Finally, as low fertility spreads globally, the cheap labor force we had 30 years ago will disappear.

10: Gold

I believe gold should revalue higher regardless of how the sovereign debt bubble plays out. In fact, given the U.S. still holds large gold reserves, revaluing gold upward might be the least harmful way for the U.S. government to reduce its debt burden.

I also believe geopolitical competition between Russia, China, the U.S., etc., is bullish for gold. It's a political play—but gold may drift sideways for another 5–10 years before suddenly capturing global attention.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News