SBF responds to CZ's skepticism: "If you don't understand bankruptcy law, feel free to ask."

TechFlow Selected TechFlow Selected

SBF responds to CZ's skepticism: "If you don't understand bankruptcy law, feel free to ask."

"If you decide to save a company that's already about to declare bankruptcy, you might not be considering your own company."

Cryptocurrency broker Voyager Digital has officially filed for bankruptcy, and according to the bankruptcy filing, Alameda had lent money to Voyager Digital—second only in amount to 3AC—drawing criticism from Binance CEO Changpeng Zhao. However, SBF later clarified the matter with The Wall Street Journal and fired back: "If you don't understand bankruptcy law, feel free to ask me."

The Lehman-style moment in the crypto market continues to devastate the community. Cryptocurrency brokerage Voyager Digital recently filed for bankruptcy. According to bankruptcy documents, Alameda borrowed $376 million from Voyager, second only to Three Arrows Capital (3AC) in outstanding debt. This attracted attention because shortly before its collapse, Alameda had provided Voyager with a credit facility to ease its liquidity crisis.

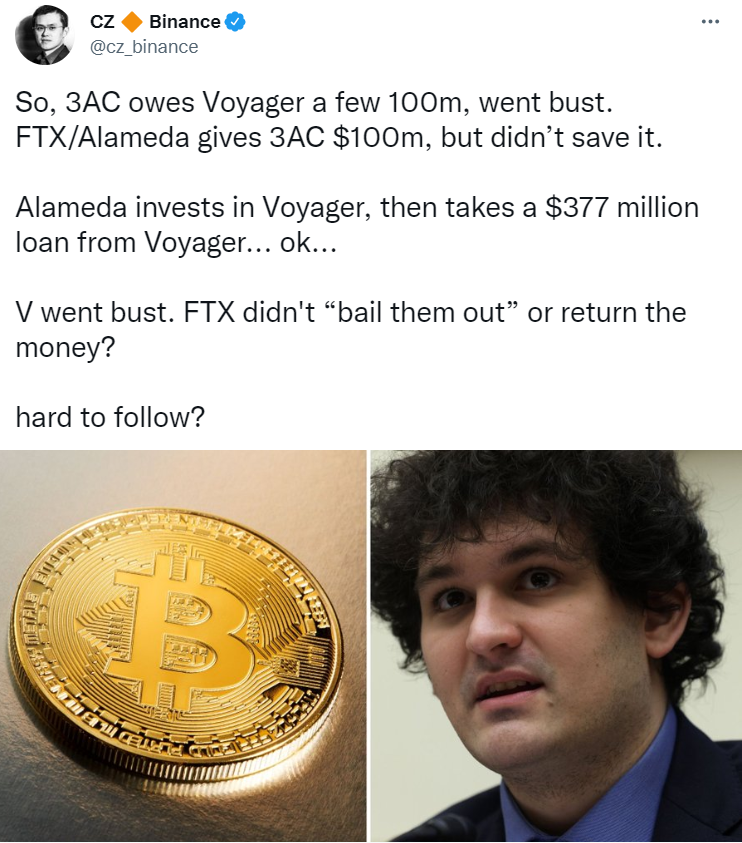

Binance’s founder went further, directly commenting that others couldn’t keep up. In short, CZ questioned why FTX/Alameda had funds to lend to 3AC but didn’t step in to rescue or repay Voyager when it faced bankruptcy.

CZ tweeted:

"So 3AC owed hundreds of millions to Voyager, then went bankrupt. FTX/Alameda gave 3AC $100 million, but 3AC still went under.

Alameda invested in Voyager, yet also borrowed from them... okay...

In the end, Voyager went bankrupt. During this process, did FTX not lend money to Voyager or repay them?

Hard to understand."

In response, SBF stated: Lending to Alameda was merely part of Voyager's regular business operations, entirely separate from the emergency credit line Alameda extended to Voyager during its liquidity crisis, and he hit back on Twitter: If you don’t understand bankruptcy law, feel free to ask me.

According to the documents, aside from Alameda, Voyager also issued loans to other major firms including Genesis, Galaxy Digital, and Jump Trading.

SBF’s Explanation

In an interview with The Washington Journal, SBF explained that Voyager’s core business model involved offering high-interest loans to borrowers, collecting repayment with interest upon maturity, returning those proceeds to users, and profiting from the spread. These routine lending activities are entirely distinct from the emergency credit Alameda provided at the time of Voyager’s collapse.

In fact, every loan has a maturity date, and before these loans mature, alternative arrangements may exist.

For example, the $376 million lent to Alameda might have been deployed elsewhere—such as purchasing short-term corporate bonds or re-lending to third parties. Therefore, Alameda would need to wait until those instruments matured to recoup the funds.

Thus, the emergency credit Alameda provided near the time of Voyager’s bankruptcy—including $200 million in cash and 15,000 BTC—was sourced separately and not drawn from the funds previously borrowed from Voyager.

Notably, while Alameda’s total loan book amounted to nearly $500 million on paper, its available liquidity within 30 days was only $75 million. This implies Alameda expected another inflow of funds after 30 days to replenish the $75 million already committed.

In the interview, SBF said:

"Voyager’s normal business is making high-interest loans—that’s completely separate from the emergency credit Alameda provided during its bankruptcy.

Alameda will eventually repay, and that money could go toward repaying Voyager’s users."

Corporate balance sheets are complex and deeply interconnected. The money Company A owes to Company B this week may depend on Company C fulfilling its obligations first. Once short-term liquidity dries up, bankruptcy can quickly follow.

The reason Voyager filed for bankruptcy wasn’t because it had absolutely no funds left.

According to the filings, its “assets” range between $1 billion and $10 billion, with liabilities in the same range. However, not all these assets are liquid—they may consist of bonds or outstanding loans that only convert into spendable dollars upon maturity.

A lack of immediate liquidity to meet maturing obligations was likely the key factor leading to bankruptcy.

SBF Fires Back: Ask Us If You Don’t Understand

SBF acknowledged in the interview that Voyager’s bankruptcy was unfortunate news for Alameda—implying potential losses—but added that such outcomes are common in investing.

Regarding CZ’s question about why FTX didn’t save Voyager, SBF responded:

"If you choose to rescue a company that's already announcing bankruptcy, you're probably not thinking clearly about your own firm."

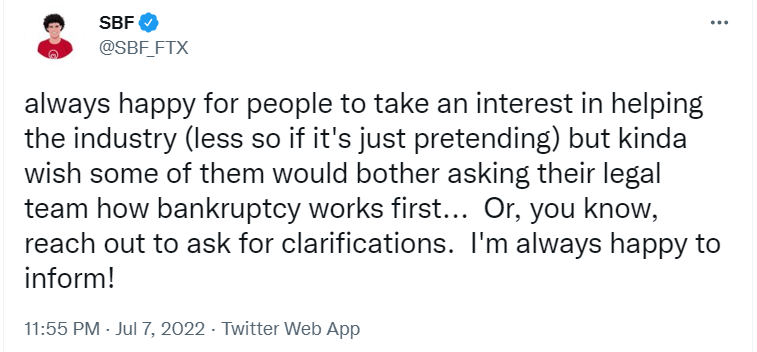

Finally, SBF tweeted:

"I'm glad there are people willing to help this industry—even though once you exclude those pretending to help, the list gets very short. But I’d prefer some of them first consult their legal teams to understand how bankruptcy actually works... Or just ask us directly for clarification. I’m always happy to clarify!"

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News