The Rise and Fall of Voyager Digital: Why You Shouldn't Lend Money to "Acquaintances"

TechFlow Selected TechFlow Selected

The Rise and Fall of Voyager Digital: Why You Shouldn't Lend Money to "Acquaintances"

In financial markets, those who survive the longest often become the ultimate winners.

By Morty, TechFlow

According to CoinDesk, cryptocurrency investment platform Voyager Digital filed for Chapter 11 bankruptcy protection on Tuesday evening in the Southern District of New York, with an estimated number of creditors exceeding 100,000.

As a Canadian publicly traded company, Voyager Digital was one of the primary channels for investors in the U.S. and Canada to access cryptocurrencies. In addition to offering trading in over 100 cryptocurrencies, users could earn up to 12% APY on 39 different locked crypto assets provided by Voyager Digital. Furthermore, Voyager Digital launched a Mastercard debit card that offered rewards of up to 9% APY and could be used for spending anywhere.

Under the impact of LUNA/UST's collapse, Voyager Digital—a CeFi institution that rose during the bull market—has ultimately met its end amid liquidity drying up in the bear market: filing for bankruptcy protection. Let's take a look back at Voyager Digital’s journey and the warning signs leading up to its downfall.

Founded in 2018, Voyager Digital saw massive growth in total assets under management during the 2020–2021 bull run, rising sharply from $5 million in December 2019 to $150 million by November 2020. In October 2020, Voyager Digital successfully acquired European cryptocurrency exchange LGO and merged the tokens of both companies.

In 2021, Voyager Digital received a strategic investment of $75 million from Alameda Research. That same year, it became the first crypto brokerage and international partner of the NBA’s Dallas Mavericks through a five-year sponsorship deal. As its influence grew, in November 2021, Coinbase announced it would list Voyager Digital’s native token, VGX.

On May 16 this year, Voyager Digital completed a $60 million private placement at $2.34 per share, led by Alameda Research and joined by Galaxy Digital, Blockdaemon, and Digital Currency Group. After full issuance, Voyager Digital was estimated to hold more than $225 million in liquidity, including approximately $175 million in cash and $50 million in cryptocurrencies.

But the good times didn’t last. Under the ripple effects of the LUNA/UST crash, Three Arrows Capital (3AC) became insolvent, and risks cascaded down the chain—Voyager was the unlucky borrower caught in the trap.

As announced by Voyager Digital on June 22, its subsidiary Voyager Digital, LLC might issue a default notice to Three Arrows Capital due to their failure to repay loans. Voyager’s exposure to 3AC included 15,250 BTC and $350 million in USDC, totaling approximately $660 million in value, with non-payment before June 27 constituting a default.

Inexplicably, Voyager Digital had extended unsecured loans to Three Arrows Capital—essentially walking into a trap empty-handed. Its risk control wasn't just poor; it was virtually nonexistent.

Blinded by the reputation of Three Arrows Capital, like an innocent girl deceived by a bad boyfriend.

Only then did investors and the crypto market realize what was happening—which explains why on June 18, Voyager Digital signed terms with Alameda Research for a $200 million credit facility in cash/USDC and a revolving credit line of 15,000 BTC.

Despite stating on June 23 that it held $137 million worth of crypto assets and had secured credit funding from Alameda Research, Voyager Digital still announced a reduction in daily withdrawal limits to $10,000 after disclosing 3AC’s impending default.

After the June 27 default notice to Three Arrows Capital yielded no results, on July 2, Voyager Digital announced a suspension of all customer trading, deposits, withdrawals, and loyalty rewards. According to CNBC, CEO Stephen Ehrlich said: "This was a very difficult decision, but we believe it is the right one given current market conditions. The goal is to give the company more time to continue exploring strategic options with stakeholders, and we will provide further updates at the appropriate time."

On July 4, Voyager Digital stated it held approximately $1.3 billion in crypto assets and over $350 million in cash at Metropolitan Commercial Bank.

On July 6, Voyager Digital filed for bankruptcy protection and officially initiated its restructuring process. The proposed reorganization plan ("the Plan") aims to restore account access and return value to customers upon implementation. Once agreed upon by multiple parties and approved by the court, Voyager Digital’s creditors will receive compensation consisting of recoveries from Three Arrows Capital ($660 million), shares in the restructured company, and VGX tokens. CEO Stephen Ehrlich stated: "This comprehensive restructuring is the best way to protect platform assets and maximize value for all stakeholders, including our customers."

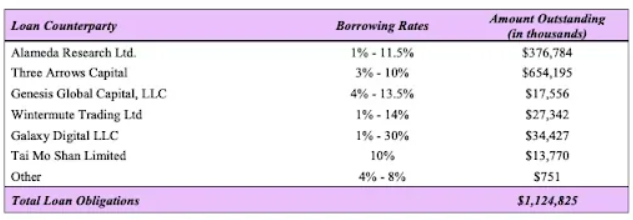

According to bankruptcy filings, aside from Three Arrows Capital, Voyager Digital’s largest debtor is now Alameda Research, which owes Voyager $370 million, including a $75 million unsecured loan with interest rates ranging from 1% to 11.5%.

The CeFi meltdown is far from over—BABEL, Voyager Digital, BlockFi, Celsius… once winners of the bull market, now all paying the price in the bear market.

In financial markets, risk management is always the most neglected aspect. Buffett’s greatness doesn’t lie in his annual returns, but in his ability to keep earning, survive, and stay in the game long enough—those who endure are often the ultimate winners.

Be the indestructible old turtle.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News