Wall Street Hypes Uranium Prices – Will Uranium Digital Use Blockchain to Accelerate Uranium Financialization?

TechFlow Selected TechFlow Selected

Wall Street Hypes Uranium Prices – Will Uranium Digital Use Blockchain to Accelerate Uranium Financialization?

In stark contrast to uranium's importance is the backwardness of its market infrastructure—so how can the uranium market truly enter the modern financial system? This is precisely the problem Uranium Digital aims to solve.

Author: Zen, PANews

Uranium, known as "one of the most important metals in the world," is the heaviest naturally occurring element and the primary fuel for nuclear power generation. As global energy transition accelerates, nuclear power is experiencing a revival—and uranium, as the core resource behind this clean energy source, is seeing steadily rising market demand. Uranium trading has also become one of Wall Street’s hottest commodities, attracting major financial institutions like Goldman Sachs and numerous hedge funds.

Yet, despite its strategic importance, uranium’s market infrastructure remains underdeveloped—lacking efficient spot trading mechanisms, transparent pricing, and sufficient liquidity—falling far behind traditional commodities such as oil and natural gas.

How can the uranium market truly enter the modern financial system? This is exactly the challenge the U.S.-based team Uranium Digital aims to solve. Leveraging blockchain technology, Uranium Digital is building what it claims will be the world’s first 24/7, compliant, spot uranium trading market, offering real-time price discovery, physical and financial settlement options, and derivatives trading—bringing uranium up to par with other major commodities in terms of market infrastructure.

Global Nuclear Renaissance Brings New Opportunities for Uranium

Driven by growth in emerging economies, global demand for electricity and energy is projected to rise significantly. At the same time, constraints on greenhouse gas emissions have further elevated the importance of clean energy sources. With continuous improvements in safety, production efficiency, and reactor capacity in recent years, nuclear energy has become a central topic in international energy policy discussions.

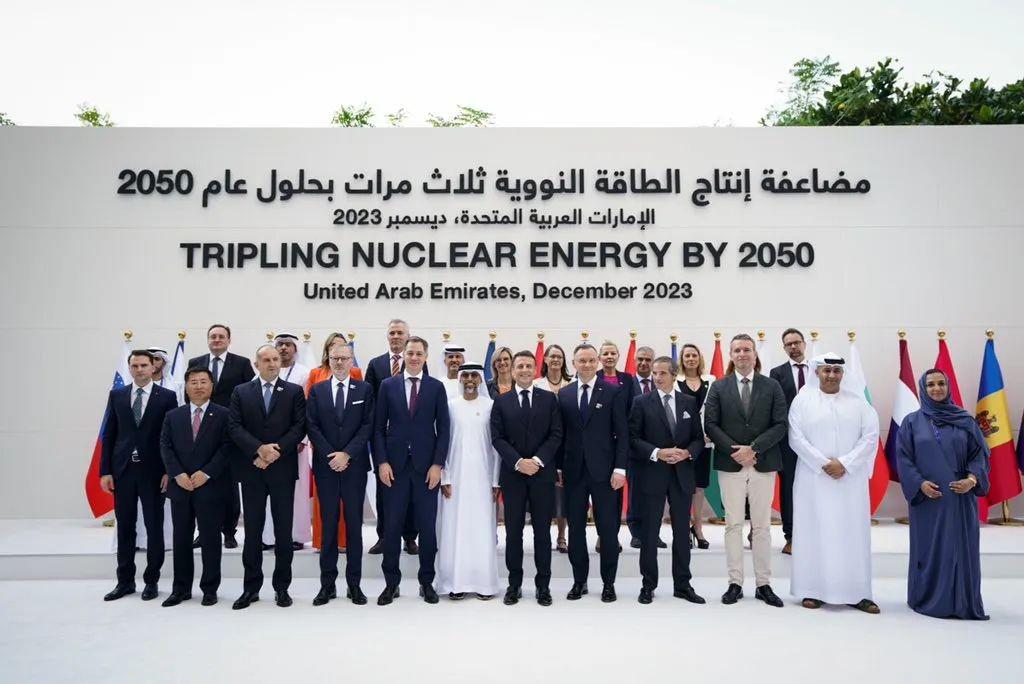

In December 2023, at the COP28 UN Climate Change Conference, 22 countries including the United States, Canada, and the UK jointly issued the “Triple Nuclear Power Declaration,” committing to work toward tripling global nuclear capacity by 2050. At COP29 in 2024, the number of nations supporting this goal increased to 31, joined by 140 nuclear industry companies and 14 major global banks. In March this year, during the CERAWeek global energy forum, major energy consumers such as Amazon, Google, Meta, and Dow signed the “Large Energy Users Pledge” to support the expansion of nuclear power—the first time major non-nuclear corporations have united publicly in support of broad, coordinated nuclear growth.

22 Countries Launch 2050 Triple Nuclear Initiative

Today, global nuclear power capacity is steadily increasing. At an event hosted in early February by the Atlantic Council, a U.S. think tank, International Energy Agency (IEA) Executive Director Fatih Birol stated that global nuclear power generation is expected to reach an all-time high in 2025. Over 40 countries have already developed plans to build or expand their nuclear capabilities. According to the International Atomic Energy Agency (IAEA), as of September 2023, 410 nuclear reactors were operating across 32 countries, with another 57 under construction.

Backed by sustained demand from the global nuclear resurgence, and constrained by years of underinvestment and supply-side rigidity prone to frequent disruptions, uranium prices have gained strong investor confidence over the past few years. From late 2023 to early 2024, uranium prices surged from $59/lb to a peak of $107/lb. As supply shortages persist and prices continue climbing, physical uranium and related securities have drawn significant interest, making uranium trading one of Wall Street’s hottest categories—with investment banks like Goldman Sachs and Macquarie, as well as various hedge funds, actively participating.

Strategic Commodity, Outdated Market Mechanisms

In the midst of the global energy transition, uranium—a critical clean energy commodity—still operates within a highly inefficient market. The current uranium market sees annual trading volume of about 190 million pounds, valued at over $1 billion. However, because long-term contracts dominate uranium transactions, futures prices fail to accurately reflect true supply and demand dynamics. Moreover, the market lacks basic financial infrastructure common to other commodities, such as real-time spot pricing, integrated financial and physical settlement, derivatives trading, and effective open-market price discovery.

The existing uranium trading mechanism is outdated, opaque, and illiquid, lacking essential components of a modern financial market. Key pain points include:

1. Absence of a spot market and high entry barriers. Individuals and institutions seeking direct exposure to uranium must either become licensed traders or brokers and purchase uranium via over-the-counter (OTC) deals. Alternatively, they can invest in uranium-related ETFs or mining company stocks—but these do not offer genuine uranium price exposure;

2. Lack of financial instruments limits speculative activity. Uranium prices are highly volatile, making it theoretically ideal for speculative trading. Yet, due to the absence of futures, forwards, swaps, and options, speculative capital struggles to enter, limiting market depth and liquidity.

3. Opaque price discovery. Current uranium prices are largely determined through private bilateral agreements, resulting in highly opaque pricing information that undermines pricing efficiency across the entire nuclear fuel supply chain. By comparison, financial trading volumes in coal markets are seven times larger than physical volumes, and in natural gas markets, 23 times larger—while uranium has virtually no comparable financial market scale.

Against this backdrop, Uranium Digital is leveraging blockchain technology to build the world’s first 24/7, compliant, institutional-grade uranium spot market, equipping uranium with financial trading infrastructure on par with other commodities. The project has quickly attracted venture capital support—last December, Uranium Digital raised $1.7 million in a pre-seed round led by Portal Ventures, with participation from Framework Ventures, Karatage, and several angel investors. In March this year, the company announced a $6.1 million seed round led by Framework Ventures.

Uranium Digital Raises $6.1 Million in Seed Funding

Redefining the Uranium Spot Market with Crypto Infrastructure

Uranium Digital is building a blockchain-based, modernized uranium trading platform designed to bring uranium in line with other commodities in terms of tradability and liquidity, with an official launch expected later this year. The platform adopts a dual-track model: physically settled trades for licensed institutional traders, facilitated through warehousing and delivery partners; and financially settled trades tailored for institutional and retail investors, allowing direct access to uranium price movements without navigating complex regulatory processes.

On the derivatives front, Uranium Digital plans to launch futures, options, perpetual contracts, and swaps to enhance liquidity and provide institutional investors with broader trading strategies. The company also aims to build the first uranium price oracle, delivering real-time, publicly accessible uranium price data to address today’s opacity.

Given uranium’s unique nature, its trade is strictly regulated, requiring KYC/AML compliance and rigorous tracking of each pound from origin to end-user. Traditional systems struggle to efficiently manage these requirements, whereas blockchain’s traceability, transparency, and decentralized architecture make it inherently suitable for uranium markets.

Blockchain enables full transaction records—from mine to final user—making illicit trade easier to detect and prevent. Smart contracts allow automated settlements, accelerating transaction speed and reducing human intervention. A blockchain-based uranium market can also deliver verifiable, real-time pricing, enhancing market efficiency and fairness.

In this new era of nuclear renaissance, Uranium Digital aims to build the world’s first modern uranium trading market—one that is transparent, efficient, and liquid enough to welcome miners, traders, institutional investors, and retail participants alike, finally integrating this vital clean energy commodity into global capital markets. Yet the path ahead is undoubtedly challenging, involving numerous stakeholders and complex operational hurdles—success is far from guaranteed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News