Old Fashion Research: Why We Invested in DUX, Brazil's Largest Gaming Guild?

TechFlow Selected TechFlow Selected

Old Fashion Research: Why We Invested in DUX, Brazil's Largest Gaming Guild?

Sustained and stable user growth, streamlined core technology and operational processes, user Web3 education, and transparent financial management have enabled Dux to develop into a reliable "employer of last resort."

Author: Gui, Investment Lead at OFR

Dux Blockchain Games launched in Q4 2021 during the peak of the GameFi boom. It was Old Fashion Research’s (OFR) first lead investment in the Latin American market and a co-investment with Animoca Brands. Dux followed Bit2Me, another successful investment by OFR and Spain's first regulated cryptocurrency exchange. This milestone marks a breakthrough where retail users can participate in IEOs to invest in crypto companies listed since 2022, with every step fully compliant with European regulatory standards.

Six months ago, investing in GameFi projects seemed like a poor decision—at least from a venture capital perspective—given that there were over 10,000 gaming guilds in the market, with new games launching weekly. However, based on OFR’s conviction in the Web3 and crypto potential across Latin America, we believed investing in Dux was the right move. This aligns with OFR’s global "Global South" investment thesis, which includes emerging markets such as Africa, India, and Southeast Asia.

High inflation, wealth disparity, and unequal income distribution are common issues across all 33 countries in Latin America, although significant differences exist between nations. For example, Brazil’s minimum wage is around $250, while Venezuela’s official monthly minimum wage is only $28—even after President Nicolas Maduro increased it by 18x last April (from a previous rate of ~$2). When you factor in 28 million unemployed individuals, it becomes clear how Web3 and its value-sharing model could profoundly impact local economies—where any additional income can drastically improve quality of life.

GameFi—the fusion of “gaming” and “finance”—has triggered a paradigm shift by introducing financial models into traditional game economies, turning “in-game assets” into what are now seen as “real economic assets.” This transformation, primarily enabled by NFTs, fosters a culture of lifelong learning and virtual world-building, attracting new users exploring digital currency possibilities and income-generating opportunities within decentralized economies. In this context, play-to-earn (P2E) gaming guilds are not just places where users “play,” but also fulfill an urgent and previously unmet need: Web3 education.

Background

During the pandemic, deteriorating labor market conditions pushed millions to seek alternative sources of income, driving a massive influx of potential players into the GameFi space. Reports indicated top Axie Infinity players earned up to $800 per month—over three times Brazil’s minimum wage—making remote earning a reality. This quickly spread across developing markets, positioning gaming guilds as the “employers of last resort.” While we recognize that such high earnings for skilled players are unsustainable, the mere possibility resonated deeply with populations desperate for employment.

Given Dux’s strong focus on community education and data-driven growth even before becoming a full-fledged guild, during our due diligence period, Dux’s MVP player base grew from around 50 in March 2021 to over 12,000 by January 2022—an indication that guilds have become foundational “onboarding” infrastructure for Web3.

Therefore, from a venture capital standpoint, evaluating guilds solely based on their earning power becomes increasingly tenuous, as this logic is subjective and dependent on the success of individual game ecosystems. As gold-farming guilds flooded the GameFi market, no sustainable game economies with critical mass emerged. Expecting scholarships (player funding programs) to generate returns via revenue sharing became unrealistic. It was at this point that the shift occurred—from “work-to-earn” to “play-to-earn.”

Sustaining a game economy centered purely on income generation became unviable. History shows that maintaining a game without actual gameplay is a failed strategy. Crucially, user rewards must be sustainable, as token appreciation cannot rely solely on user acquisition. In other words, when new users stop coming, token prices will fall—without question.

When analyzing GameFi cases, overly broad claims are often red flags. Just as launching numerous indie games in traditional gaming markets initially attracts large user bases that quickly decline post-launch, this mechanism mirrors DeFi’s reliance on high yield mining to attract liquidity.

In this context, we at OFR gained clearer insight: the strongest guilds serve as hubs for user education, GameFi research, and NFT lending, consistently acquiring new users across all market cycles—particularly those drawn to GameFi income opportunities regardless of market conditions, such as players in Latin America.

In short, all these activities function as effective user acquisition mechanisms in emerging markets, where people actively seek new ways to boost income and rely on side hustles to support their families.

As we engaged with more guilds, regional disparities in user acquisition became evident. While some regions showed slowing or declining user growth during bear markets, Dux continued to grow steadily among Latin American audiences. Indeed, in this region, Dux has increasingly become the “employer of last resort” for those willing to enter the GameFi economy.

User Growth

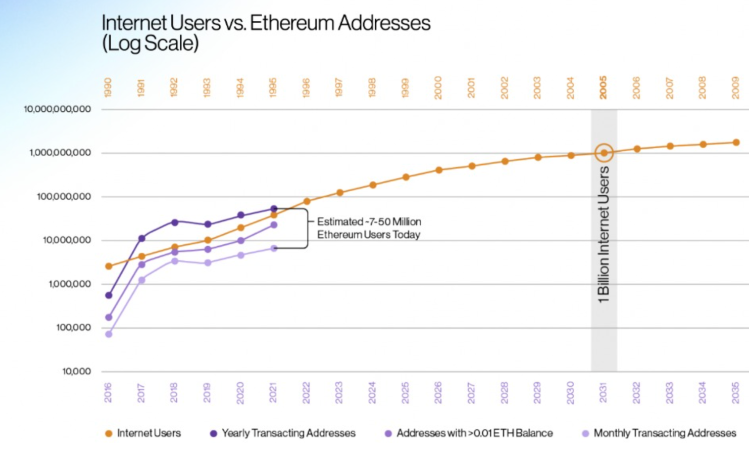

The image below illustrates that Web3 is still in its early stages regarding user acquisition—supporting the investment thesis of “guilds as user acquisition tools” and creating ideal conditions for geographically focused investments centered on GameFi and education in Latin America.

Figure 1: Active Ethereum wallet addresses

According to a16z analysis, if we compare Web3 growth to that of the internet, we are currently at the same stage the internet was in 1995. We know that Web2 growth led to fierce competition for user acquisition—a race that often occurred between organizations pursuing unnatural growth through venture capital tactics rather than organic strategies.

Among MetaMask’s 10 million monthly active users, 2 million are from the Philippines—an undeniable sign of organic growth driven by GameFi, particularly thanks to the Axie Infinity revolution, which provided a new livelihood for those who lost jobs during the pandemic and laid the early foundation for GameFi to break into the mainstream of Web3.

Operations

In this environment, our investment in Dux met several notable criteria. We believe any guild committed to its roots and dedicated to bringing users into Web3 should meet the following fundamentals:

1. Robust Backend & Settlement Infrastructure

Since beginning our search for promising gaming guilds in Q2 2021, our team has spoken with hundreds of founders. It became clear that once a guild reaches around 2,000 players, manual payment processing becomes extremely challenging.

Specifically, Dux typically required about 50 hardware wallets and six collaborators dedicating a full week’s work to process all payments. Previously, only Binance offered Ronin bridge solutions, which suffered from long downtime. The situation has improved as other exchanges like Coins.ph now offer similar services, helping reduce processing time.

Thus, streamlining Dux’s settlement and payment processes is critical for operational automation and improving player retention. As Dux’s lead investor and advisor, we helped establish a fully automated player payment and clearing system prior to their next fundraising round.

2. Game Asset Performance Management

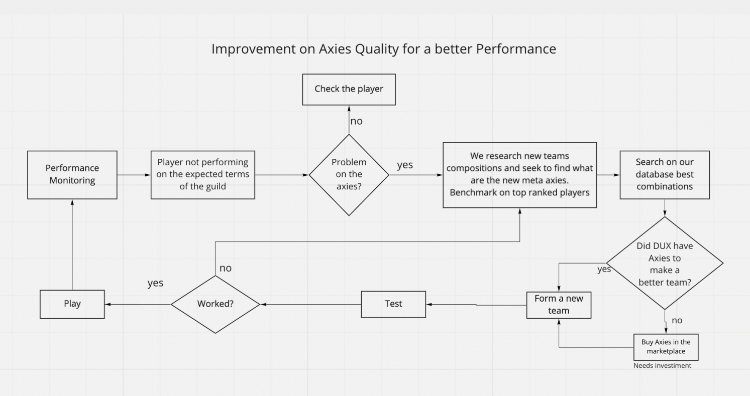

Another major red flag we identified when evaluating gaming guilds is that most founders lack clarity on standardized operational workflows. While some games like Pegaxy have begun automating parts of NFT management, substantial behind-the-scenes work remains. For instance, the team managing NFT inventory should be deeply familiar with daily NFT performance data across each game. Take, for example, the Axie optimization farming workflow established by Dux managers for Axie Infinity.

Figure 2: Axie Farming Workflow

Defining standardized operating procedures: operations, execution, and assigning the right people to continuously optimize NFT performance day and night—this is how we expect a serious, high-quality gaming guild to operate. This level of documented process maturity was one of the decisive factors in our decision to partner with Dux in Latin America.

3. Institutional-Grade Research

Dux’s internal research process closely aligns with OFR’s investment philosophy in GameFi, enabling efficient synergies and shared knowledge across our portfolio. To date, Dux’s research team has reviewed over 300 games and made modest allocations in more than 50 projects. Their core scholarship model focuses heavily on Genopets and MetaDerby—both of which are also OFR-backed investments.

By fostering open collaboration, we encourage our portfolio companies to jointly shape the future of GameFi, creating a symbiotic relationship that enhances user experience, drives community growth, and enables early detection of flaws in game economies. Notably, Dux improves localization by offering native-language support, effectively promoting these games within local communities.

This virtuous cycle allows our investment team to gain firsthand insights from practitioners on novel game economics, industry evolution, and emerging blockchain projects.

Through this collaboration, we’ve developed an investment principle: invest in games seeking value appreciation through NFTs themselves, rather than those chasing token price gains. Given that NFTs are non-fungible and drive sustained community vitality, they capture protocol value more effectively than tokens. Users are far more likely to leave games focused on tokens than those centered on NFTs.

4. Transparent Treasury Management

Treasury management within guilds remains one of the least discussed topics in crypto. In our investment framework, treating financial management as an afterthought is unacceptable. We believe a DAO must maintain openness and transparency in financial reporting and strategic decisions for all participants. With this in mind, we served as full-time advisors to help Dux build a treasury management system that allows DAO members and the public to clearly track NFT inventory and transaction history at any time—verified continuously through audits by reputable third parties.

Conclusion

Reflecting on our current GameFi investments, we conclude that venture capital in this space must adopt broader macro-level theories. Thus, OFR refers to this geographically driven approach as the “Southern Hemisphere Strategy,” targeting specific high-potential guilds in defined regions (like Latin America) and unique use cases. While individual guilds don’t guarantee success, building interconnected ecosystems—where projects coexist and mutually reinforce each other—creates resilience against adverse market conditions.

Furthermore, we recognize that the rise of “mega-guilds” contributed to the GameFi sector cooling down in Q1 2022, as vast amounts of capital chased a limited number of players. These guilds transitioned from doing the heavy lifting of user onboarding to acting as inexperienced, check-writing venture investors across multiple game projects. Mimicking Web2 giants, these guilds extracted far more value than they contributed back to the GameFi ecosystem, often driven by founder self-interest under the guise of DAO principles. In contrast, guilds functioning as genuine Web3 user acquisition infrastructure—built through deliberate planning and long-term vision—are far more sustainable.

In summary, Dux’s consistent user growth, streamlined technical and operational workflows, commitment to Web3 education, and transparent financial management have solidified its role as a reliable “employer of last resort,” generating positive social impact and establishing itself as a key player in the GameFi landscape. Dux stands out as an exemplary investment target and infrastructure project within the GameFi ecosystem—one we strongly believe in and have backed.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News