The hardest lesson in the crypto market: Don't treat a moment as forever

TechFlow Selected TechFlow Selected

The hardest lesson in the crypto market: Don't treat a moment as forever

Stop believing in any "too big to fail," stop treating a moment as forever.

Written by: @0xTodd, Partner at Nothing Research

No Other Way

The shadow of inflation looms over every major nation in the world.

The Russia-Ukraine war, the pandemic, and disruptions to global supply chains—undeniably, in the past two decades of globalization, no country can comfortably survive in isolation. The abundant oil and gas from Russia, affordable industrial goods from China, grain produced by Ukraine, the "breadbasket of Europe"—these essential commodities, once easily accessible, have now abruptly disappeared.

Whether it's the U.S., Europe, or other developed regions, concerns about rising inflation have surpassed desires for economic stimulus. Inflation at 8-10% is enough to push many households into hardship. But with insufficient supply, there is simply no alternative.

U.S. inflation hits a 40-year high

For central banks around the world, there seems to be only one path forward: raising interest rates—even though everyone knows it brings recession. But only by hiking rates and cooling down asset prices can inflation be contained.

Nowhere is this more evident than in the United States, which has always been the most sensitive to such shifts. The U.S. raises rates first, forcing Europe and the rest of the world to follow suit. It’s like the final round of a poker game—when the player before you raises, even if your hand is weak, you’re forced to call.

In this inevitable rate-hiking environment, all risk assets could best be described as “standing alone on a single log.” Unfortunately, Bitcoin, Ethereum, and crypto assets are currently classified precisely as “risk assets.”

Cycle Theory

I remain bullish long-term on Bitcoin, Ethereum, and crypto—but capital outflows do not depend on any individual’s wishes.

Do you believe in the "super cycle" theory? The so-called super cycle suggests that crypto assets go through a bull-bear cycle roughly every four years. This theory draws direct support from Bitcoin’s halving event every four years (and its resulting shift in selling pressure). Indeed, since 2011, it has played out three times already.

Bitcoin super cycle

I am not a proponent of the super cycle theory. To attribute everything to fate would be to erase the relentless efforts of countless builders across the entire crypto industry—and that would be wrong.

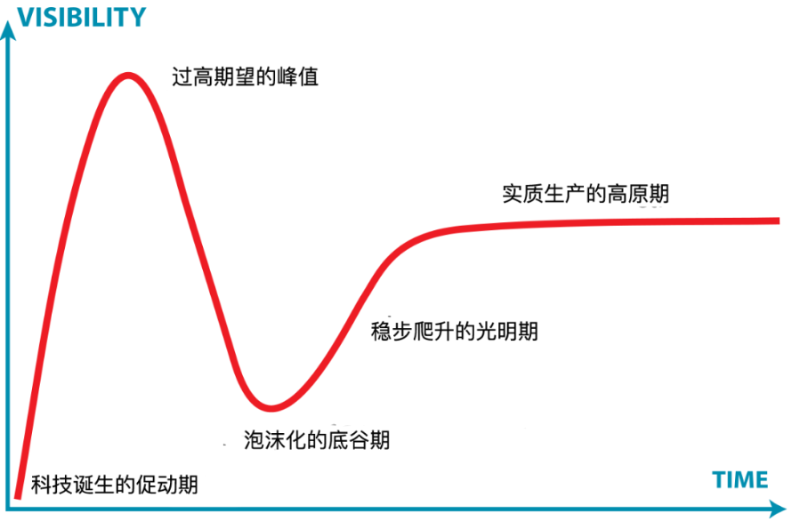

However, if asked what model I do believe in, I’d point to the Gartner Hype Cycle.

Gartner Hype Cycle

You’ve likely seen this curve before. It reflects the natural evolution of things, especially technologies.

Initially, people tend to inflate bubbles because something hasn’t yet been proven false. When development moves too fast, a few blowups become inevitable. Then, those who never hyped the bubble will rush to mock it (just like now!). Only afterward does the slow, real building begin—the time for genuine progress.

Round and round, each phase linked to the next.

It resembles the super cycle, but isn’t quite the same:

-

The 2013 Bitcoin bull run introduced blockchain technology to the masses, paving the way for Ethereum in 2015.

-

The 2017 bull market revealed the power of smart contracts, leading to DeFi in 2019.

-

The 2021 bull run showed us how much DeFi and NFTs could achieve—ensuring we’ll inevitably plant new seeds for the future.

But these new seeds need more time to sprout.

So yes, I still firmly believe in the long-term future of Bitcoin and Ethereum. That said, in the medium to short term, they cannot fully decouple from traditional markets and the global economy to chart an independent course. Bitcoin, crypto—these are still technologies barely over a decade old. They can’t fight off multiple adversaries at once. So this may be a very difficult period ahead.

The Most Expensive Lesson

As the saying goes: history is the best teacher. If we are to prepare for the next bull market, we must understand what lessons we can draw from this collapse—which is exactly the title of this article.

To me, there’s only one essential lesson: don’t mistake a moment for forever.

What does it mean not to mistake a moment for forever?

Starting with 'Passive Income'

Before DeFi Summer, we invested in a token. Later, it was listed on Pancake’s farm with an APR exceeding 300%—very comfortable. Then, the pool was added to Alpaca Finance, allowing leveraged yield farming. With leverage, we no longer needed to put up additional cash—we could borrow against the token itself to mine, pushing returns beyond 10,000%.

Think about it: deposit $200,000, and a year later, theoretically own $20 million.

At that moment, our office erupted. Even just CAKE alone could generate thousands of dollars daily in passive income—never mind the extra leverage and incentives from Alpaca. It seemed we’d never need to work again.

Was this permanent? Obviously not (laughs). Anyone who farmed second-order pools knows how the story ended.

DeFi Is No Exception—Nor Is NFT

Let’s talk about another illusion.

Suppose you buy an animal as your profile picture—you don’t just get an avatar. Soon after, you receive a dog, then a mutated creature, tokens used by these animals, and maybe even two plots of land where they’ll live in the future…

Even better, each of these items can be sold. Do the math: within less than a year, you could recoup your initial investment plus profits.

Would you buy in?

I clearly remember, the night before the ApeCoin airdrop, my friend and I hesitated, FOMO creeping in—should we buy some monkeys? Then, when APE was finally airdropped, BAYC’s price surged, APE soared—like sunset and lone wild goose flying together. At that moment, the entire metaverse was on fire.

Of course, today we know—this wasn’t permanent either.

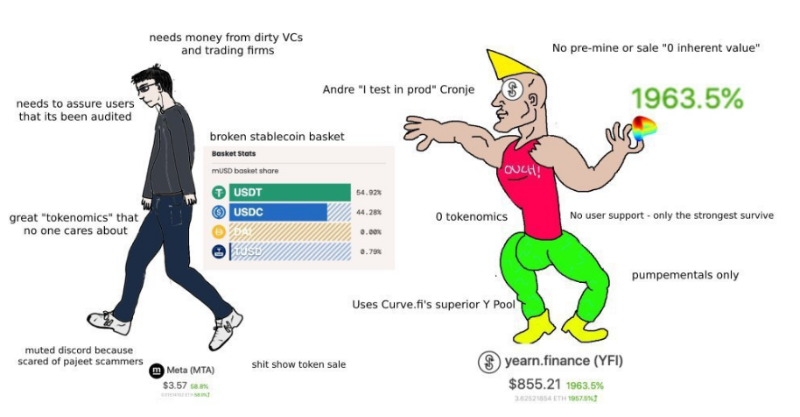

Even 'Stablecoins' Are Included

The peak of UST’s momentum came the moment its market cap surpassed DAI. At that instant, farmers worldwide were ecstatic.

Back then, even MakerDAO executives had to tweet somewhat bitterly about their superior product—only to be attacked by Luna fanatics.

UST—a “stablecoin” with a market cap of tens of billions of dollars—operated seamlessly across over ten blockchains, boasting hundreds of millions in liquidity on Curve and Terraswap. Orders worth tens of millions barely caused slippage. Even more impressively, it offered a rock-solid 20% annual yield.

For some Korean businesses, working hard all year wouldn’t earn 20%. Why not just park money here—safe and sound?

The most common argument I heard was that although UST might have issues, it was “too big to fail.”

But was it permanent?

When Luna crashed from $120 to $0.00012, some still gambled on it re-pegging. But it was already over. Countless investors lost everything, realizing the “peg” had never truly existed.

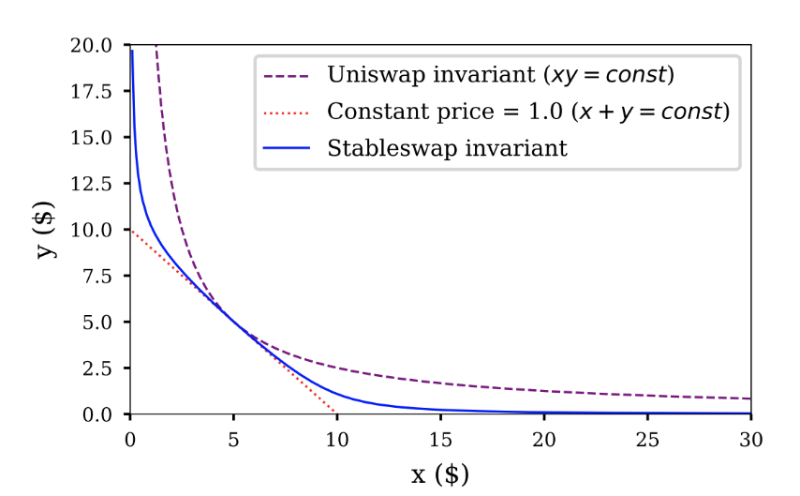

As I’ve mentioned before, Curve is a completely neutral tool. Within its core range, even if two assets are utterly unrelated, its AMM algorithm can keep them pegged, enabling near-zero-slippage swaps.

Curve AMM Curve

But once outside the core range, even a small wave of panic-driven withdrawals can break the curve, accelerating the crash.

The same logic applies to: leveraged yield farming offering instant multi-fold returns, magical internet money, club memberships priced at 40 ETH, promissory notes redeemable 1:1 for cash—I won’t list them all.

Domino Effect

If the fallout were limited to removing Luna as a toxic element from crypto, perhaps it would end there. But Luna’s impact on the industry runs much deeper.

As a former top-five cryptocurrency, Luna’s reach extended into every corner. Its collapse has triggered a chain reaction. Two immediate consequences have already occurred:

1. Weakened Liquidity

Several major crypto market makers were severely damaged—entities that previously provided critical liquidity to the crypto markets.

Whether they invested in Luna, lent money to Luna, provided liquidity for UST, or were UST farmers (other than those who borrowed ETH to mint UST)—all suffered heavy losses.

Like in a video game, when your base crystal is about to explode, no one bothers defending outer towers anymore. You can clearly feel it: after Luna’s collapse, overall crypto liquidity dropped significantly.

2. Forced Selling

Top-tier institutions like Celsius and 3AC built strong reputations over time—and also accumulated significant liabilities (to LPs, partners, or users). This was normal business expansion. Given their scale, under normal liquidity conditions, repaying gradually would have been manageable.

I believe both sides were satisfied when these deals were made.

But good times aren’t permanent either.

Now, amid the rate-hiking cycle, crypto prices continue falling. As collateral shrinks, options for these institutions dwindle. Selling remaining holdings to cut losses becomes one of the few choices left. Yet today’s fragile market simply cannot absorb such large-scale sell-offs.

This is another death spiral: the more urgently they sell to repay debts or meet margin calls, the steeper the drop, which triggers even faster debt demands.

Beyond these two direct factors, a third consequence is likely coming soon:

3. New Wave of Regulation

Faced with retail outcry from Celsius users and the tears of Luna investors, it’s hard to imagine regulators staying idle.

At this moment, crypto can no longer distance itself from Luna. The general public won’t make fine distinctions. Just when regulators need case studies, Luna, Celsius, and even 3AC are handed to them on a silver platter. A wave of strict regulation targeting crypto is entirely foreseeable.

Make no mistake: the crowds who once cheered for Luna are not innocent snowflakes in today’s Bitcoin avalanche. The louder they shouted back then, the heavier the chains they’ll bear in return.

At Luna’s peak, its “too big to fail” narrative convinced many institutions. Lies repeated a thousand times become truth. I sincerely hope we stop hyping any Ponzi schemes, stop believing in “too big to fail,” and stop mistaking a moment for forever.

Final Thoughts

A friend recently told me they followed me from Zhihu—that really moved me. Back then, I published all my articles on Zhihu, since Chinese-language internet still allowed open discussion about crypto.

I used to have an “annual update” strategy—publishing one piece each year summarizing my view of the broader market and my portfolio. In 2019, I recommended dollar-cost averaging into BTC; in 2020, switching part of positions into ETH. Haha, those early posts were a bit naive—so I won’t link them here. But if you’re curious, feel free to dig them up on Zhihu.

If I were to share my current strategy, it would mainly revolve around waiting for the right timing.

My main holdings now are BTC, USDC/USDT, and a few minor altcoins and PFPs. At current levels, there’s not much room left to panic-sell major assets, but alts still have significant downside potential.

On bottom-fishing:

On bottom-fishing

I think buying stETH below $800 could be a sound decision for long-term holders.

ETH/USD

$800 was one starting point of the last bull run, and stETH should indeed carry a discount. Long-term believers will surely see the day when stETH redeems fully into actual ETH.

I’m highly optimistic about Ethereum’s future tech roadmap: PoS ETH + Rollups. On this path, true Web3 applications can run atop Ethereum at ultra-low cost, benefiting from Ethereum’s security without worrying about high fees. Ethereum’s environmental and inflation issues will also be resolved by PoS.

Also, BTC remains my favorite—worth considering for regular dollar-cost averaging. Over the past six months, its liquidity has been outstanding, and as we know, liquidity is king. Besides, rate hikes will eventually end—easy money is the eternal era.

Meme of Bitcoin

Finally, if this is your first bear market, don’t be too discouraged. Wars end, pandemics pass, inflation cools—easy money remains the eternal theme. Every second in a bear market is a golden opportunity to build and learn, because this dark moment—just like every extreme—is not forever.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News