STEPN "die-hard fan": Why I still believe in STEPN?

TechFlow Selected TechFlow Selected

STEPN "die-hard fan": Why I still believe in STEPN?

Stay vigilant, be patient, and hold onto hope.

Author: Fiona @nft_hu

At the end of 2021, a friend introduced me to Sweatcoin, which became the starting point for my renewed interest in Web3 fitness projects. Two months later, during a casual conversation, another friend mentioned he had bought StepN. Funny enough, my first thought was that it was a new sportswear brand—only after his reminder did I realize it was actually a blockchain-based fitness project. In the early days, I studied the English whitepaper while jogging; later, after posting about it on social media, a friend invited me into StepN’s community, where I began to understand its initial user demographics and community culture.

Today, StepN has dominated discussions for quite some time. Whether it's the wealth effect of GMT rising from $0.1 to $4, or the endless debates and predictions about its potential Ponzi collapse, this project remains the most talked-about and capital-favored project of 2022 so far.

So today, as a "senior" user, I’d like to offer a rational and objective analysis of what StepN really is.

(Disclosure: I own 9 sneakers; emotionally speaking, I'm a loyal user.)

Project Background and Sector Analysis:

First of all, StepN belongs to the category of Web3 application projects. Ever since Axie Infinity sparked the craze of the GameFi season, there have been countless discussions around Web3 applications (here focusing only on projects targeting end consumers).

Let’s first revisit what Web3 is.

https://ethereum.org/en/developers/docs/web2-vs-web3/

Web2 refers to the version of the internet most people know today—an internet dominated by companies offering services in exchange for your personal data. In the context of Ethereum, Web3 refers to decentralized applications running on blockchains. These applications allow anyone to participate without monetizing their personal data.

Key characteristics of Web3 include:

● Anyone on the network has the right to use the service—or in other words, no permission required.

● No one can block or deny you access to the service.

● Payments are built-in via native tokens.

This is Sam Richards’ definition of Web3. However, today’s Web3 applications do not fully align with the original concept of Web3.

First, these apps are built on decentralized networks (e.g., Ethereum, Solana, Avalanche). Second, all payments are made using native tokens. Finally, most applications still feature relatively centralized teams and management structures—ranging from oversight and rule-making to revenue distribution models, and whether user data is stored centrally or decentralized. (We might call these Web 2.5 apps for now.)

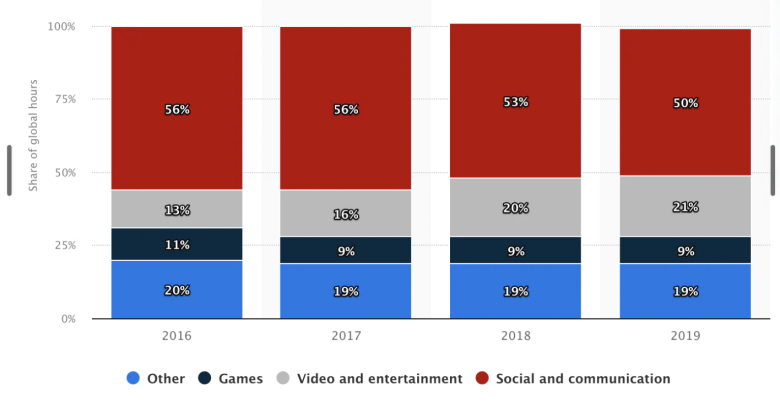

What areas might the application layer of Web3 cover? As shown in the chart below, people spend the most time on social, gaming, video, and other leisure activities. From project developments and funding announcements, we can see these three sectors are also the most active.

Figure 1: Global Mobile Usage Time Distribution from 2016 to 2019 (Source: Statista)

Now stepping back: As an ordinary user, what would drive you to migrate from Web2 apps to Web3? And further, if existing Web2 apps evolve internally to embrace Web3 features, would we still need standalone Web3 dApps?

These questions are highly open-ended. Here’s my personal take on the first one: Data privacy and rewards will be the main reasons driving me to use Web3 applications.

Data privacy is straightforward—today, our WeChat chat logs can be monitored and managed by Tencent, and browsing behavior on Instagram is collected and used to recommend products algorithmically. As awareness of data ownership and personal information protection grows, more people will migrate to Web3 to protect their digital rights.

Rewards are equally clear: If spending time and money on Web2 yields nothing tangible, but doing so on Web3 earns rewards—whether FTs or NFTs—it becomes highly attractive.

On these two points, most current projects have focused primarily on the second—reward mechanisms.

StepN exemplifies this perfectly.

Why Has StepN Been So Successful?

There are many Web2 fitness apps such as Keep and FitTime. Among Web3 Move-to-Earn dApps, examples include Stepapp, Genopets, Walken, Sweatcoin, Aglet, etc.

https://twitter.com/SnapFingersDAO/status/1528028764172537862?s=20&t=6TU3wodbEXw1pcmqZYSMqQ

Among so many apps, why has StepN stood out? Let’s analyze several key design factors behind its success:

“Simple and usable product, strong authentic community, and anti-cheating measures” (my summary, open to discussion)

Product:

StepN’s product is extremely simple and focused. Every aspect revolves around Sneakers. To play the game, after registering your account and wallet, you must first purchase at least one pair of shoes—the gateway to the entire experience.

The game has three core elements: Shoes, Energy, and Gems

● Shoes are your earning tools. However, even if you own multiple pairs, you can only use one pair at a time to earn through walking.

● Energy: Determined by the number and rarity of shoes you own.

● Gems: Shoes have four different attributes; gems can be used to upgrade them.

Authentic and Strong Community:

To clarify, this applies more specifically to StepN on Solana. In fact, StepN initially had almost no media partnerships. Instead, they focused heavily on community operations and collaborations—regular AMAs, sneaker giveaways for quiz winners, co-hosting events with other communities. From my observation, many local communities in Korea, Japan, and Taipei were organically started by fans, both online and offline.

This is critical because GameFi projects require continuous user growth to maintain system stability, token prices, and sneaker values.

Here, users exclude bot operators. While studios may cause short-term price spikes, they shorten the project lifecycle dramatically. BSC’s experience reflects exactly this pattern.

Anti-Cheating Measures:

This is foundational to the game. Without robust anti-cheat systems, turning GameFi into a sustainable lifestyle becomes impossible. AI detection accuracy continues to improve. Recent updates by the team emphasize anti-cheat systems repeatedly. Although false positives (users wrongly flagged as bots) have occurred, the importance of anti-cheating remains paramount to the team.

This reminds me of anti-cheating measures during China’s national college entrance exam (Gaokao). While they don’t affect individual scores directly, they uphold the fundamental integrity of Gaokao as a fair talent selection system.

Where Is StepN Headed Next?

Recently, StepN has faced various issues, with FUD and community disappointment rising. So where should StepN go from here?

From both the project team’s and investors’ perspectives, StepN has already achieved significant success. The current problems stem precisely from its growth speed exceeding initial expectations and the rapidly expanding user base shrinking room for error.

In my view, StepN has successfully completed phase one—user acquisition. The next major challenge is user retention.

I strongly agree with Po Yin (Twitter@poyincom)’s perspective (slightly modified below):

“Players fall into two groups: one focused on ROI and price, but such high returns can’t last forever—once earnings drop, they’ll leave immediately. The other group consists of loyal users—I’ve seen many on WeChat. Some dream of owning a green shoe; others say ‘just let me keep walking on July 15.’ They feel positive feedback from StepN in real life—that’s the true value. They care less about economic models than speculative users.

The priority should be retaining loyal users and educating others. The prerequisite is smooth app operation (many players lose patience due to downtime), followed by fixing the economic model.

User retention is paramount. We need diverse consumption scenarios: impulsive, emotional,炫耀消费 (show-off spending), and health-related spending. For example, the recent feature allowing text engraving on shoes is excellent. Without consumption outlets, the economic model faces immense pressure. Increasing loyal users while reducing speculative ones will achieve ecological balance.”

My thoughts align closely—besides segmenting users, listening to community feedback, and ensuring stable app performance:

1. Short-term: Create more consumption scenarios—pure Play-to-Earn isn’t sustainable long-term, as even the longest-running Axie shows. Users need opportunities to spend GST earnings within the ecosystem.

2. Long-term: Explore broader possibilities. Leveraging fitness and health, StepN could expand into social and consumer domains.

An ideal state I envision:

If GameFi players resemble Shenzhen blue-collar workers—earning income spent on living expenses (food, housing, transport) and investments (property, stocks)—and ultimately stay within Shenzhen (the game ecosystem). Also, consider player dynamics—not everyone profits (just like not everyone succeeds in Shenzhen)—to maintain long-term balance and sustainability.

This requires the team to continuously introduce utilities for spending and investing, keeping funds circulating within the system. Social and personalization features should emerge at this stage.

Key In-Game Mechanisms

Shoe Minting:

This functions similarly to breeding in games. It expands the total shoe supply and allows holders to earn under certain conditions.

This brings us to the recent cost adjustment post-update (June 8, 2022), which exposed flaws behind BSC’s sneaker price surge. If minting profits are too high, studios rush in to breed excessively, disrupting normal ecosystem cycles.

Shoe-Minting Costs Before

GST price determines the amount of GST and GMT required for minting. See below:

e.g. Common M0/7 x Common M0/7. When GMT price < GST price:

1. If GST < $2, Minting cost is 200 (200 GST);

2. If $2 < GST < $3, Minting costs are 200 (160 GST & 40 GMT);

3. If $3 < GST < $4, Minting costs are 200 (120 GST & 80 GMT);

4. If $4 < GST < $8, Minting costs are 200 (100 GST & 100 GMT);

5. If $8 < GST < $10, Minting costs are 200 (80 GST & 120 GMT);

6. If GST > $10, Minting costs are 200 (40 GST & 160 GMT).

Updated rules: As GST price rises, additional GMT (addGMT) is consumed beyond GST and baseGMT. New mint cost formula: A GST + B baseGMT + (A+B)*x% addGMT. Below is how x changes with GST price:

2.1 When GST < $4, x = 0

2.2 When GST between $4–$8, x = 50%

2.3 When GST between $8–$12, x = 100%

2.4 When GST between $12–$16, x = 200%

2.5 When GST between $16–$20, x = 400%

2.6 When GST between $20–$30, x = 800%

2.7 When GST between $30–$40, x = 1600%

2.8 When GST between $40–$50, x = 3200%

2.9 When GST > $50, x = 6400%

Comparing old and new formulas reveals: The new dynamic mint cost aims to curb pure arbitrage-driven minting and redirect users toward the original mission—walking for health.

StepN’s Token Model

StepN uses a dual-token model. GMT is the governance token, while GST is the in-game utility token. Unlike GMT, GST has infinite supply and can be minted through basic physical activity.

This token model raises several important considerations—not just for StepN, but for the entire GameFi space (though I personally believe categorizing StepN strictly as GameFi is debatable).

1. GST / in-game token inflation and perpetual issuance

2. GST price vs. mint payback period (key reason behind BSC chain’s rapid rise and fall)

3. GMT use cases and utility

4. Ponzi scheme accusations

1. GST / In-Game Token Inflation and Perpetual Issuance

One of the biggest challenges facing StepN—and indeed all GameFi projects—is how to sustainably manage selling pressure caused by perpetual GST issuance?

And as shoe supply grows, how can supply-demand equilibrium be achieved? Currently, slow user growth combined with constant GST production creates sustained downward market pressure. Falling GST prices prolong payback periods, fueling criticism of StepN entering a death spiral.

I see parallels with national fiat currencies—our purchasing power erodes over time due to monetary expansion (compare $100 in 1990 vs. today). But balancing inflation rates against spending and income growth demands great wisdom and design from the project team.

2. GST Price and Mint Payback Period

Yesterday’s update offered partial solutions: extending cooldown times and dynamically adjusting mint costs.

Recall the recent BNB realm incident, where b-GST and s-GST prices diverged sharply—b-GST reached $40 while s-GST stayed around $5. This huge gap, combined with high minting profits and the energy-sharing mechanism, created arbitrage opportunities. Numerous studios and speculators flooded StepN’s BSC chain, causing a sharp price spike followed by rapid collapse.

3. GMT Use Cases and Utility

Currently, GMT lacks substantial utility, making GST the true backbone of the game. GST can only be earned by walking, but can be spent on upgrades, minting, opening treasure boxes, gem synthesis, transfers, etc.

We await further clarification from the team.

4. Is It a Ponzi Scheme?

Criticism about Ponzi schemes applies not only to StepN, but to the entire GameFi ecosystem. Most GameFi projects combine gaming with finance. Finance includes many forms—lending, deposits, insurance—but current GameFi focuses narrowly on Play-to-Earn. Early investment (buying NFTs, items, or tokens) generates returns later via in-game earnings.

But what gives these newly created tokens meaning? What is their issuance basis? Their utility? Their externalities?

We know Bitcoin had negligible value at inception—remember the story of buying pizza with thousands of BTC?

Token value lies in consensus, and consensus can be built in many ways.

In StepN’s case, I view GMT (governance token) as a tokenized form of company equity. Token holders act like shareholders, participating in governance. We can explore how token holders might better share in the project’s growth. Meanwhile, StepN is actively building externalities—like branded co-branded sneakers—as attempts to connect with the outside world.

Contrary to external criticism, I personally love StepN precisely because of its external impact. Thanks to StepN, my parents and family created their first self-custody wallets, performed their first on-chain transfers, and used DEXs to swap tokens. I even see StepN as a missionary, introducing Web2 users to Web3.

Finally, stay attentive, patient, and hopeful :)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News