Nansen Data Reveals: Crypto VCs, Who Are the Diamond Hands and Who Are the Paper Hands?

TechFlow Selected TechFlow Selected

Nansen Data Reveals: Crypto VCs, Who Are the Diamond Hands and Who Are the Paper Hands?

Are you diamond hands or paper hands?

Written by: Andrew T, Nansen

Translated by: TechFlow intern

Are you diamond hands or paper hands?

The same question applies to VCs—some VCs firmly hold onto the projects they invest in without selling early, while others dump tokens immediately upon listing to quickly realize financial gains.

A notable example recently emerged when Jason Choi, former partner at Spartan Group, tweeted that some VCs are selling their SAFTs just weeks after investing to secure quick profits. For instance, shortly after the first round, numerous StepN SAFTs appeared on the market for sale. Larry from The Block noted he saw a seed investor publicly shilling StepN on Twitter, then later spotted the same person offering them at a 90% discount via an OTC channel.

So which VCs sell immediately at listing? Nansen’s data analysts examined a recent token unlock event to uncover the truth. Here's what they found:

Markets are tough, and as early investor allocations unlock, major funds may dump millions of these already struggling assets, making conditions even worse. Let’s look at a recent case and analyze how to protect yourself.

Last week, $BETA caught my attention at the top of the Smart Money Inflows dashboard.

This is a lending protocol—I pay close attention to young, experimental lending projects—I believe there’s still room for innovation in this vertical, and Smart Money inflows during a bear market can help signal potential strength.

Investigation revealed that the inflow stemmed from unlocked shares. Checking the Top Transactions dashboard, a multisig sent nearly 35 million tokens (worth $4.2M) to the deployer, who then distributed them among a dozen investors—the names match those in the 2021 fundraising press release.

This doesn’t rule out $BETA entirely—although TVL is declining, prices are stabilizing, so it might still be worth watching—if key holders remain committed.

So who are the diamond hands? And who are the paper hands?

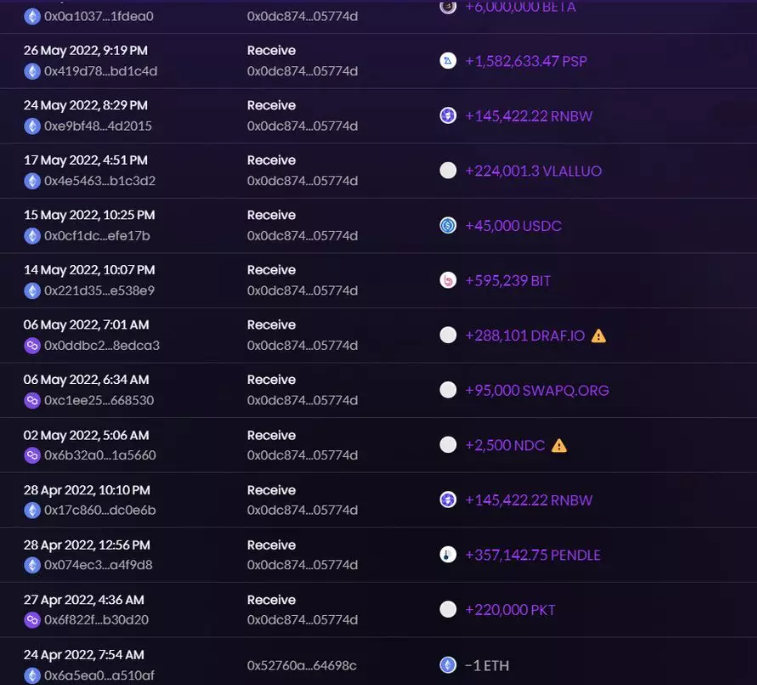

First up: Spartan Group. They received six million tokens on Tuesday—and have been holding!

This is an interesting wallet—according to Apeboard.Finance, recently acquired by Nansen, it hasn't been active since April, despite receiving large token unlocks.

Conclusion: Hats off to them!

Next: Parafi. Within six hours of receiving six million tokens, they transferred them to another labeled address, then batched about 700,000 into several unlabeled wallets before ultimately routing them to Binance deposit addresses—likely for cashing out.

Conclusion: Partial sell-off.

Next is Sequoia India. Another hardcore HODL wallet—completely inactive since October 2021. A true diamond hand role model!

Conclusion: Hodlers!

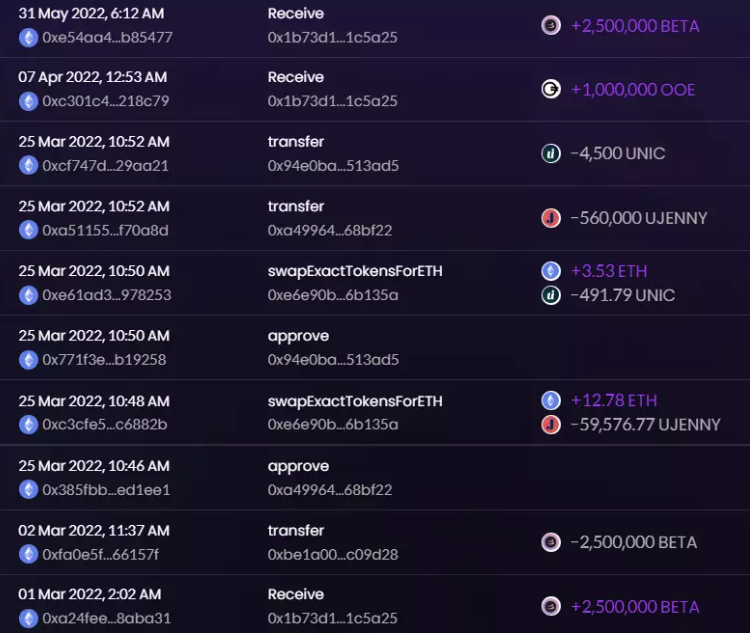

Next is Delphi Digital. They haven’t sold this month’s 2.5 million tokens yet, but last month they did sell December and March unlocks—first transferring to an unlabeled wallet, then sending to Binance.

Conclusion: Slow dumping.

Then comes Multicoin. Like Delphi, they haven’t moved May’s unlocked tokens to exchanges yet—but December and March unlocks were sent to Binance within days.

Conclusion: Slow dumping.

However, Defiance was one of the main culprits behind the dump. In this latest allocation, they transferred tokens to Binance in just 15 minutes. Back in March, they sold out in under an hour.

Conclusion: Top-tier paper hands!

Finally, Three Arrows Capital. While not completed within minutes, they similarly sent tokens to Binance and dumped everything within a day.

Conclusion: Paper hands.

TL;DR: Out of seven funds analyzed, five are either actively selling or poised to sell. It seems many more funds may be rushing to do the same.

Based on this, I’ve personally decided not to conduct further due diligence on $BETA. Going forward, I’ll monitor unlock-related selling as a key indicator—especially for projects I’m bullish on, like LDO.

In certain ecosystems, ongoing dumps could be especially brutal—for example, Avalanche. Pay attention to how low their circulating supply is, with massive amounts of tokens still locked and yet to be dumped. Prices could fall much further.

What’s particularly wild is that some paper hands openly admit this! They claim such misaligned incentives mask zombie projects whose primary purpose is enabling them to offload ERC-20 tokens.

Despite the harsh reality, you can protect yourself. Last month, a Nansen Alpha member used Smart Alerts to monitor $UST withdrawals from Curve—and ultimately exited before depegging, saving millions of dollars.

You can also set up Smart Alerts to monitor token movements from deployer addresses. Moving forward, I’ll be watching dump patterns more closely, especially in high-FDV, low-circulating-supply ecosystems.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News