ETH Merge: History of Supply-Demand Dynamics About to Be Rewritten

TechFlow Selected TechFlow Selected

ETH Merge: History of Supply-Demand Dynamics About to Be Rewritten

Why did ETH completely transform after the Merge?

Author: @korpi

Translation: TechFlow intern

The Merge — This is the most important upgrade in Ethereum's history. Major events like this are often dismissed as short-lived "hype," and some say $ETH will be no different — but I disagree. This article explains why $ETH will undergo a transformation after The Merge.

The Merge involves replacing Ethereum’s Proof-of-Work (PoW) consensus mechanism with Proof-of-Stake (PoS). But here, we’ll skip the technical details and focus solely on the price of $ETH. The price of any asset is determined by supply and demand. What factors will change the supply-demand dynamics of $ETH after The Merge?

-

Triple halving effect;

-

ETH staking annual percentage rate (APR);

-

ETH (unlocks) lockups;

-

Institutional demand;

1. Triple Halving Effect

Under PoS, $ETH issuance will drop by 90% — equivalent to what would take three Bitcoin halvings to achieve. What Bitcoin takes 12 years to accomplish, Ethereum achieves in one year. But this isn’t just about reducing selling pressure by 90%; it signifies much more.

-

Under PoW, newly issued $ETH goes to miners running high-cost operations. They are forced to sell large amounts of ETH to cover expensive electricity bills.

-

Under PoS, new ETH flows to validators who face minimal power and hardware costs and are not compelled to sell.

Moreover, Bitcoin miners don't need to be bullish on BTC — they invest in hardware and electricity for mining, not necessarily in Bitcoin itself. In contrast, Ethereum validators must stake $ETH, making them typically long-term holders. If they see ETH prices rising, why would they sell their staking rewards?

2. ETH Staking Annual Percentage Rate (APR)

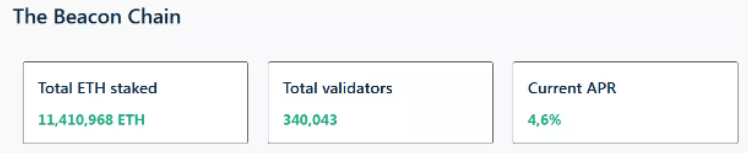

Currently, 11.4 million ETH is staked at an APR of 4.6%. This ETH-denominated return comes purely from staking rewards. Under PoS, stakers will also receive gas fees currently earned by miners, potentially increasing APR by 2x or more.

The staking APR can be seen as a near-risk-free yield on $ETH. As it rises, more ETH will be staked, making it an attractive alternative to other DeFi earning opportunities. Increased staking reduces market supply and may even trigger buying pressure.

3. ETH (Un)locking

Currently, staking $ETH is a one-way process because stakers cannot withdraw their ETH or rewards. Many believe that The Merge will enable withdrawals and that “when 12 million staked ETH unlock, massive selling will occur.” I’ve noticed some view The Merge as a negative price catalyst — ETH flooding the market upon unlocking — but this view is entirely incorrect.

(1) Staked ETH Will Not Unlock at The Merge

The Merge will not enable withdrawals. That functionality depends on another Ethereum upgrade planned 6–12 months after The Merge. Therefore, neither staked $ETH nor staking rewards will enter circulation for a long time. Even when withdrawals are enabled, only 30k ETH per day can be withdrawn — far from a large-scale unlock.

(2) Unlocked ETH Will Be Released Gradually

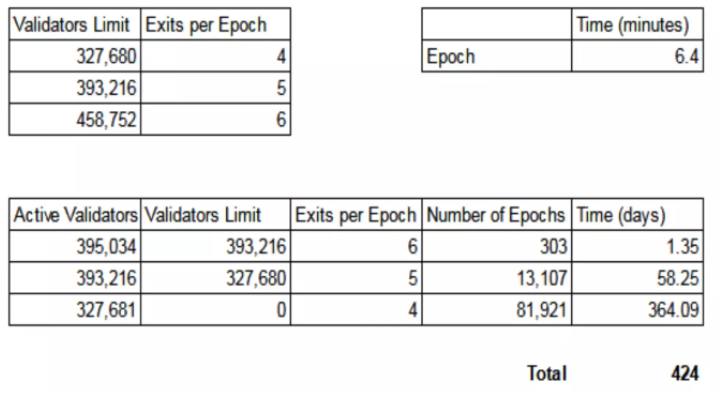

Even if withdrawals are enabled, all staked $ETH won’t become immediately available. A queue mechanism will be implemented, potentially taking over a year in worst-case scenarios and several months under normal conditions. To withdraw $ETH, validators must exit the active validator set, but the number of validators exiting each period is capped. With 395k validators (active + pending), and assuming no new ones are added (highly unlikely), it would take 424 days for all to exit.

(3) Staked ETH Is Usually a Never-Sell Stack

Who voluntarily locks up $ETH for months without knowing when they can withdraw? Undoubtedly, those most bullish on ETH. Most ETH stakers are long-term investors uninterested in selling, especially not at current prices. Short-term stakers prefer liquid staking options (e.g., @LidoFinance), allowing them to sell tokenized shares anytime.

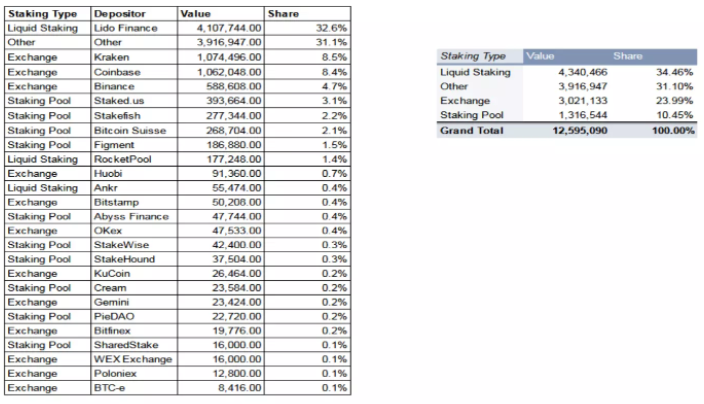

Using Nansen and Etherscan, I analyzed the distribution of staked ETH by type: liquid staking accounts for only 35%.

Additionally, 30% of staked $ETH comes from addresses not labeled as exchanges or staking pools — likely representing individually operated validators. Running a validator is non-trivial, usually done only by true ETH believers. And they won’t sell, right?

In summary, I don’t believe there will be exaggerated selling due to $ETH unlocks. Withdrawals will begin months later and release slowly, and many stakers won’t sell anyway.

4. Institutional Demand

Why does the shift to PoS spark institutional interest?

-

DCF models (Discounted Cash Flow) will apply to valuing $ETH, suggesting ETH is undervalued;

-

$ETH as an "internet bond" becomes an alternative to U.S. Treasuries;

-

ETH becomes environmentally friendly — a compelling narrative;

-

EIP-1559 burns $ETH in every transaction;

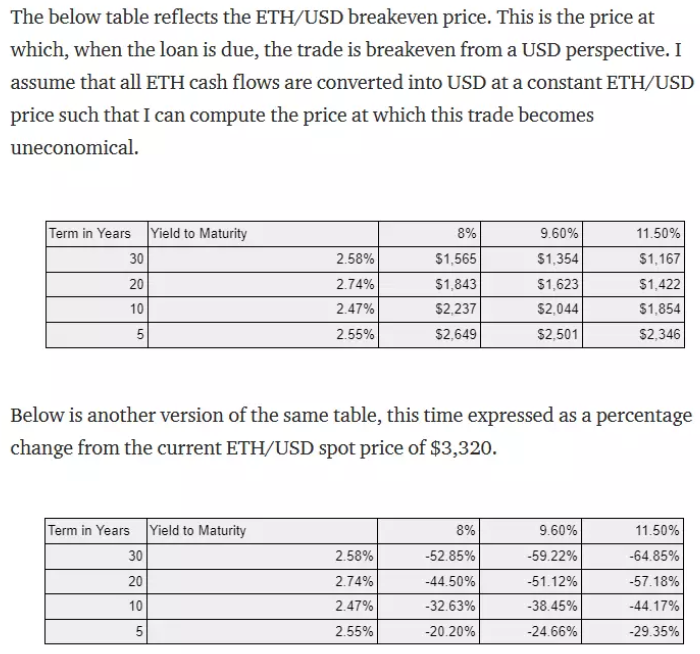

(1) Valuing $ETH Using DCF Models

DCF modeling is a popular valuation method in TradFi. Institutions managing trillions in global wealth have used it for decades. PoS enables DCF-based valuation, finally making $ETH analyzable through traditional frameworks. Why is this significant?

By forecasting future cash flows, we can estimate $ETH’s fair value — a requirement for institutions approving multi-million-dollar investments. And you’ve probably guessed it: ETH is severely undervalued. Based on DCF and P/E valuation techniques, $ETH’s fair value is clearly above $10,000. After a successful PoS transition, institutional investors will take notice. Right now, we can get ahead by purchasing ETH before these mechanisms fully activate.

(2) $ETH Transformed into an Internet Bond

Staking yields transform $ETH into an internet bond — a viable alternative to U.S. Treasuries. While ETH is more volatile than bonds, it offers higher yields, resulting in better real returns unless ETH crashes.

(3) ETH Environmental Narrative

Transitioning to PoS reduces Ethereum’s energy consumption by 99.98%. Amid growing climate concerns, energy-intensive PoW faces heavy criticism. Whether justified or not, the narrative matters. While $BTC supporters must constantly defend PoW and justify Bitcoin’s energy use, $ETH holders embrace the new narrative of an eco-friendly blockchain. Changing the narrative is easier than winning arguments.

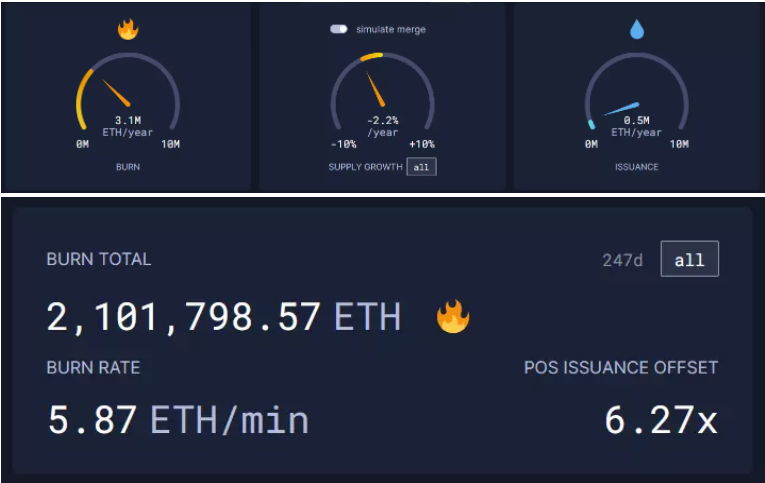

(4) EIP-1559 Burns $ETH

In short, institutional demand will surge. And if that weren’t enough, we have EIP-1559 burning $ETH in every transaction! In just eight months, over 2 million ETH have been burned — roughly 6 ETH per minute! At this burn rate, ETH supply decreases by 2.2% annually. ETH = money that continuously appreciates!

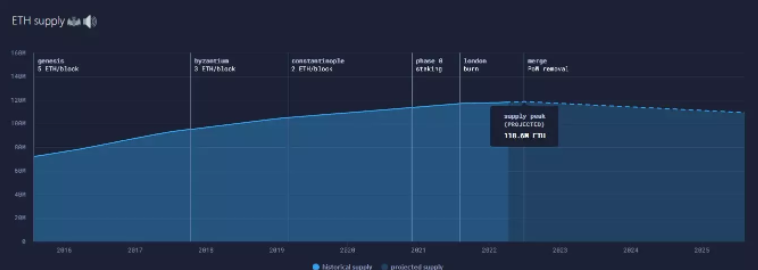

Everyone talks about $ETH being burned — yes, it’s exciting. Is ETH already deflationary? No, it’s low-inflationary. Will it turn deflationary? I’m confident it will. Let me share useful resources to track ETH becoming sound money. After The Merge, we won’t even need a bull market for ETH to become deflationary. Even during recent bear markets with very low gas prices, EIP-1559 kept burning ETH — and post-Merge, it will burn even more. The Merge will mark the peak of ETH supply.

You don’t need an economics degree to grasp one principle: if asset supply decreases while demand increases, what happens to the price? Yes, it goes up. I believe this is exactly what will happen to $ETH’s price after The Merge — along its long-term trajectory. Maybe you’ll say, “But it’s already priced in!” Is it? Crypto markets are extremely inefficient. I’d argue “very few people truly understand” all these dynamics. Remember how surprised everyone was when EIP-1559 started burning massive amounts of $ETH? They’ll be surprised again after The Merge.

Furthermore, institutional demand has not yet reached full strength. Many corporate risk committees won’t approve investing in an asset perceived to have “significant execution risk” — a common description of the PoS transition. Only after The Merge will $ETH become a genuinely investable asset. Currently, bears control the market, and price action completely ignores fundamentals.

Summary:

-

The Merge is not yet priced in;

-

We can get ahead of institutions by buying $ETH now to participate in PoS;

-

You don’t have enough ETH, and neither do I;

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News