What should you do after ETH's hard fork to profit better?

TechFlow Selected TechFlow Selected

What should you do after ETH's hard fork to profit better?

A network can be technically replicated, but its value cannot be copied.

Author: Korpi

Translation: TechFlow intern

This is a simple explanation of everything you need to know about Ethereum's hard fork and the $ETH after the merge. At the end of this article, I'll mention a few trading strategies you can consider.

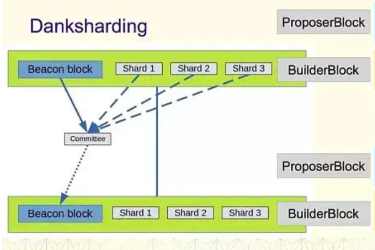

I. The Merge

The Merge refers to Ethereum blockchain switching its consensus mechanism from PoW to PoS. Imagine Ethereum as a spaceship, with PoW being its current engine. PoS is a new, more efficient engine that will replace the old one mid-flight—without any downtime.

PoS offers many advantages over PoW:

-

Much lower energy consumption (reduced by 99%)

-

More decentralized (lower economic barrier to participation via staking)

-

More secure (harder to attack the network)

-

Lower ETH issuance (potentially deflationary)

-

Opens the path for further scalability upgrades

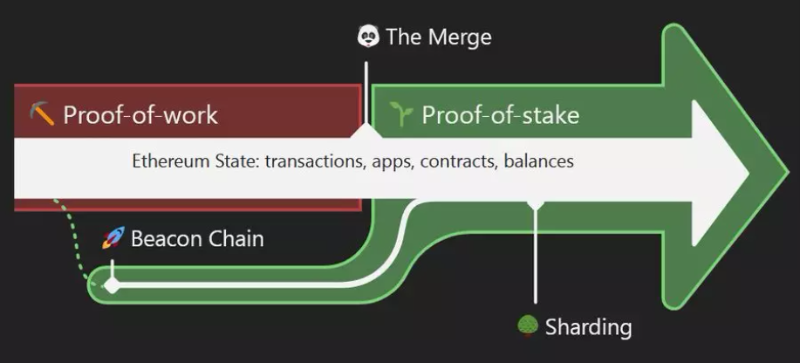

II. Hard Fork

Technically, the Merge is a hard fork—resulting in one chain splitting into two:

-

The old PoW chain

-

The new PoS chain

Initially, both chains are identical—your asset holdings will be duplicated. After the Merge, some assets will exist in two versions:

-

$ETH: $ETHPOS and $ETHPOW

-

NFTs

-

Tokens, including stablecoins

One version will reside on the PoW chain, the other on the PoS chain. If you currently hold 1 ETH and 1,000 USDC on Ethereum, you’ll own them on both chains afterward. If you use certain dApps, your positions will also be duplicated:

-

Your liquidity provision for ETH and USDC on Uniswap will be mirrored on both PoW and PoS chains.

-

Your ETH and USDC loans on Aave will appear identically on both PoW and PoS chains.

But this situation won’t last long...

III. Decision Time

While networks can technically duplicate, value cannot. Stablecoin issuers will have to choose which chain carries real value.

Does this mean Circle or Tether could decide which chain becomes the new Ethereum?

Theoretically, yes. But they won’t act against community consensus—that would damage their business. The Ethereum community has already decided to move to PoS, and stablecoin issuers will simply follow suit.

IV. Chaos

If USDC, USDT, and other centralized stablecoins become worthless on the PoW chain, DeFi dominoes will collapse. All tokens paired with stablecoins in liquidity pools will lose value; all loans backed by stablecoins will become undercollateralized and turn into bad debt. DeFi on the PoW chain will effectively die.

The only potentially valuable asset on the PoW chain might be $ETHPOW. Some exchanges may list it, so speculation could give it a price. As a result, people will rush to extract as much ETHPOW as possible from the dying DeFi ecosystem. But in this race, you stand little chance...

Bots will be ready within seconds. Even if you write your own bot, your transactions can be front-run via MEV—others can collaborate with miners to get priority inclusion in blocks. Unless you're an MEV expert, it's safest to just hold ETH.

V. Trading

How should you handle $ETHPOW? (Whatever you do, this is not financial advice)

I personally plan to sell mine quickly. There’s no real community behind Ethereum PoW—only so-called "gurus" trying to exit liquidity and make a quick profit. Don’t fall for it.

You could maximize exposure to $ETHPOW by borrowing $ETH before the Merge. Your collateral on the PoW chain will likely be worthless, meaning you won't need to repay the loan, while gaining more $ETHPOW to sell. But beware of rising borrowing rates.

Of course, borrowing $ETH could get extremely crowded. Also, if everyone plans to sell $ETHPOW post-Merge, I’m not sure who’ll be buying. You might be better off ignoring $ETHPOW entirely and instead lending ETH in DeFi to earn high yields.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News