A Comprehensive Guide to Ethereum's Upgrade Path

TechFlow Selected TechFlow Selected

A Comprehensive Guide to Ethereum's Upgrade Path

The roadmap for Ethereum 2.0 upgrades. The Ethereum merge is drawing near. Although the upgrade plan has undergone several iterations, progress so far has been largely smooth.

By Mushrooms

Ethereum is positioned as a "world computer." To achieve this goal, developers laid out an upgrade roadmap from the beginning, consisting of four stages: Frontier (frontier), Homestead (homestead), Metropolis (metropolis), and Serenity (serenity).

The network has currently progressed to the third stage. The first three stages belong to Ethereum 1.0, while the final stage—Serenity—is what we often refer to as Ethereum 2.0. (To avoid confusion, the Ethereum Foundation has officially deprecated the term "Ethereum 2.0," but for consistency, this article will continue using the familiar terminology.)

The Ethereum 2.0 upgrade primarily aims to address several limitations that have hindered the network's growth. These include the following three key issues:

-

First, high energy consumption caused by mining. Since Ethereum uses PoW (Proof of Work) as its consensus mechanism, nodes must provide computational power to mine blocks. The intensive calculations performed by mining hardware consume vast amounts of electricity, leading to frequent criticism about the network’s environmental sustainability.

-

Second, performance bottlenecks. Currently, Ethereum produces a new block approximately every 12–15 seconds, with a TPS (Transactions Per Second) of around 15. This throughput is insufficient even for basic commercial applications. Periodic network congestion further constrains Ethereum’s scalability and adoption.

-

Third, high usage fees. Using the Ethereum network requires paying gas fees to miners who maintain it. These fees typically range from several to dozens of dollars depending on network congestion, and at peak times can reach hundreds of dollars. Such high costs have driven some protocols to migrate to competing public chains like Solana and Near.

To tackle these challenges, the developer community has outlined a phased plan for the Ethereum 2.0 upgrade. Below, we introduce the roadmap of Ethereum 2.0.

Ethereum 2.0 Roadmap

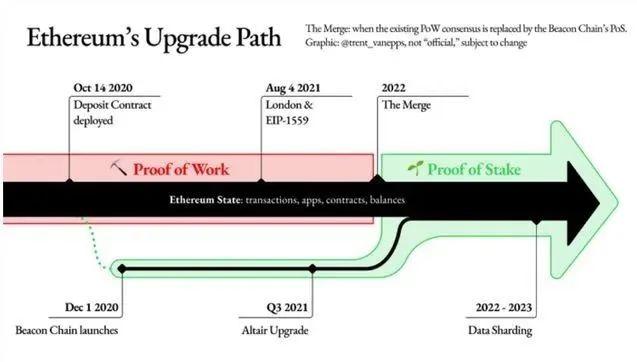

The Ethereum 2.0 roadmap mainly consists of three steps: the parallel chain—Beacon Chain, The Merge, and Sharding. The first two steps aim to transition the network’s consensus mechanism from PoW to PoS (Proof of Stake), while the last step focuses on improving overall performance and scalability.

1. Parallel Chain – Beacon Chain

To ensure a smooth transition in consensus mechanisms, on December 1, 2020, Ethereum launched a parallel-running chain called the Beacon Chain, alongside the existing PoW mainnet. The Beacon Chain operates independently using PoS as its consensus mechanism. Participants must stake 32 ETH into a smart contract as proof of stake. After verification, they are added to the validator list and become validators on the Beacon Chain, replacing miners as block producers.

Under PoW, nodes generate the next block through computational work. In contrast, under the PoS-based Beacon Chain, validators are randomly selected to propose the next block. This selection process is decentralized and not controlled by any single validator. Validators receive rewards for honest behavior, but if they act maliciously, part of their staked 32 ETH will be slashed. If their staked balance falls below 16 ETH, they are removed from the validator set.

Before The Merge—which is the current phase—Ethereum runs both PoW and PoS in parallel. Launching the PoS chain early serves two purposes: minimizing disruption to the ongoing PoW chain and allowing sufficient time for the new PoS network to accumulate staked ETH to ensure security.

2. The Merge

The much-discussed “Merge” refers to combining the PoW mainnet (known as the execution layer, responsible for transaction processing) with the PoS Beacon Chain (officially termed the consensus layer). Before implementation on the mainnet, the merge must first be tested on testnets. Any issues discovered during testing will be addressed accordingly by node operators.

So far, Ethereum’s Ropsten and Sepolia testnets completed their merges on June 9 and July 6, respectively. The remaining Goerli testnet is scheduled to undergo merging soon. If all goes smoothly, the Ethereum mainnet is expected to complete the merge in mid-to-late September. Afterward, the PoW mechanism will be retired, and all new blocks will be produced via PoS.

To ensure a successful consensus switch, Ethereum developers proposed activating the “difficulty bomb,” which increases the difficulty of PoW mining. Originally introduced into Ethereum’s codebase in 2015, the difficulty bomb gradually increases the complexity of PoW puzzles at predetermined block heights, making block production slower and mining less profitable. Once activated, mining becomes economically unviable, effectively halting the original PoW chain.

3. Sharding

Changing the consensus mechanism alone does not improve Ethereum’s performance—scalability improvements require sharding.

Sharding is a database partitioning technique used to optimize storage and enable fast processing. By dividing the network into smaller segments (shards), the database is horizontally split, distributing the load. Each shard maintains independent data, and multiple shards can process transactions in parallel, reducing congestion and increasing TPS, thereby enhancing network scalability.

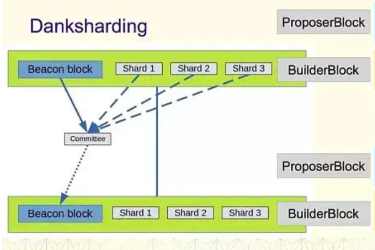

Ethereum’s early sharding plan involved splitting the mainnet into 64 shards, each with its own block proposers and committees. Proposers and committee members would be randomly selected and assigned. A proposer selects transactions from the mempool, and once approved by two-thirds of the committee, the block is finalized on-chain.

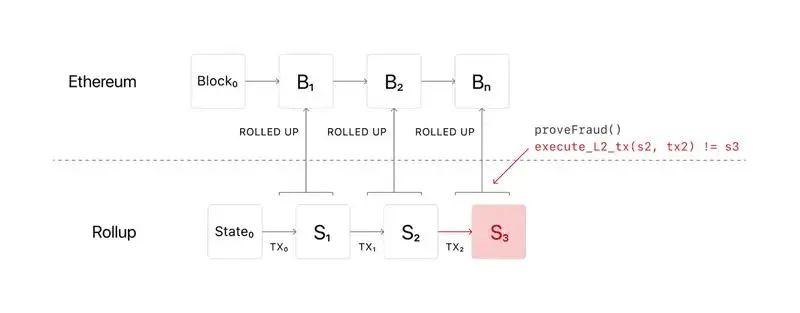

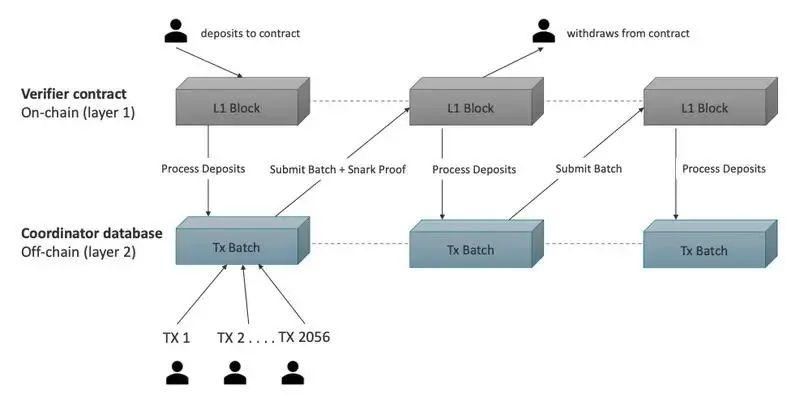

This initial sharding design aimed to scale Ethereum’s main chain directly. However, due to its complexity and the rapid advancement of Layer 2 solutions—especially the proliferation of Rollups—the Ethereum development team led by Vitalik Buterin gradually abandoned this approach. Instead, they shifted toward a new technical direction: moving away from direct sharding of the mainnet to handle more transactions, and instead adopting a Rollup-centric model where Rollups handle transaction scaling, while the main chain serves only as a base layer providing data availability.

In this new paradigm, Ethereum’s role is to serve as a scalable data availability layer—essentially acting as the final settlement and accounting layer. Main chain scaling will focus on increasing data capacity rather than on-chain computation efficiency. Specifically, Ethereum sharding aims to provide more space for data blobs (binary large objects) to support Rollups. The main chain does not interpret this data; instead, it collects computation results and validity proofs from Rollups, ensuring data availability. Meanwhile, most transaction execution and validation are handled off-chain by Layer 2 Rollups. More concretely, Rollups perform transaction computation and verification, bundling multiple validated transactions along with their proofs into a single package, which is then recorded within main chain blocks.

Since a single block can include packages from multiple Rollups, various types of Rollups may coexist on Ethereum in the future to collectively scale the network. Currently, the dominant types are zkRollup and Optimistic Rollup, corresponding to validity proofs and fraud proofs, respectively.

Impact of the Ethereum 2.0 Upgrade

Reduced Energy Consumption

After transitioning to PoS, the network no longer relies on energy-intensive mining nodes, making it significantly more environmentally friendly. Node energy efficiency under PoS is over 99% higher than under PoW, resulting in a dramatic improvement in network-wide energy efficiency. Under PoW, miners require powerful, high-energy-consumption hardware to solve complex mathematical problems—the first to complete the calculation earns the right to build a block and claim the reward. As a result, miners run their equipment at full capacity 24/7 to maximize profits, creating enormous demand for electricity.

In a PoS network, block proposers are selected randomly, eliminating the need for massive mining farms and drastically reducing electricity consumption.

ETH Issuance Rate

After switching from PoW to PoS, block rewards for miners are replaced with staking rewards. Consequently, the issuance rate of ETH will drop by approximately 90%. This phenomenon has been dubbed the “Triple Halvening,” equivalent to three simultaneous Bitcoin halvings. Ethereum will experience a sharp decline in new supply, and combined with the fact that staked ETH cannot enter circulation immediately, the network could enter a deflationary period.

ETH Staking

After the merge, more users are expected to stake their ETH to earn nearly risk-free staking rewards. Estimates suggest an annual yield of around 4%. Kraken’s report “Staking Landscape Q1 2022” projected that after the merge, stakers could see annual returns between 8.5% and 11.5%.

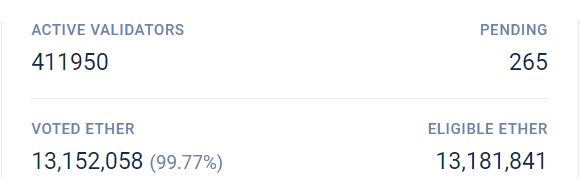

Additionally, increased demand for staking is likely to drive growth in staking service providers. Currently, over 13 million ETH are staked on the Beacon Chain—more than 10% of the total supply—with around 410,000 active validators.

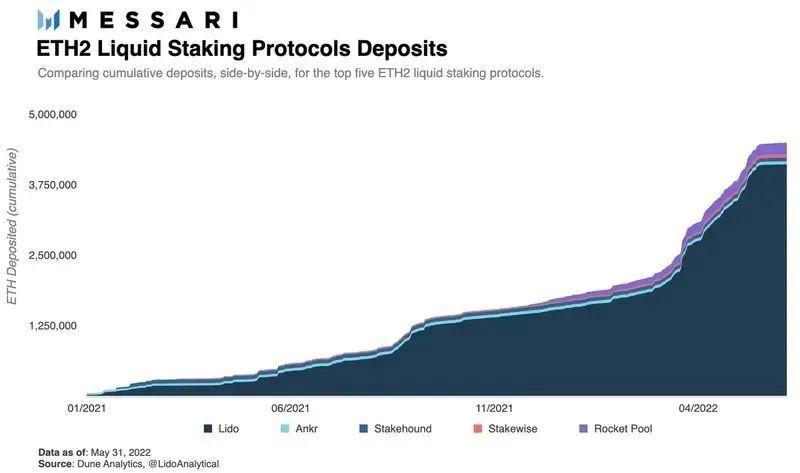

Given the requirement of staking at least 32 ETH and the technical and financial barriers to running a node, using staking services becomes far more attractive than solo staking. Lido, the current market leader in the staking sector (see previous article Understanding stETH Discount – Pricing, Liquidity, and Risks of stETH), already controls over 90% of the liquid staking market.

Miners

After the merge, the original PoW chain will gradually be phased out, raising questions about the future of existing miners. As the second-largest mining ecosystem in crypto, what choices will these miners make? Will they fork the original chain or shift to mining ETC? Ethereum Classic (ETC) supports Ethereum mining hardware, but its capacity to absorb hash power is limited. ETC’s lower price makes mining profitability inherently challenging. With a potential influx of hash power post-merge, competition would intensify, further reducing miner revenues. Additionally, forking the original chain may prove difficult due to the built-in difficulty bomb mechanism.

Conclusion

The Ethereum merge is now imminent. Although the upgrade plan has evolved over time, progress so far has been largely smooth. As the most influential public blockchain with the largest developer community, Ethereum’s upgrade will undoubtedly have profound implications. With the arrival of Ethereum 2.0, the blockchain industry enters a new era. Long-standing issues—low performance, high fees, and excessive energy use—may finally be resolved through a series of upgrades. We look forward with great anticipation to what lies ahead.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News