DeFi Liquidity: Current State and Future Outlook

TechFlow Selected TechFlow Selected

DeFi Liquidity: Current State and Future Outlook

The DeFi industry will experience another billion-dollar level growth within the next 1 to 2 years.

Author: iZUMi Research; @0xJamesXXX

Preface – On Liquidity

In traditional finance, liquidity is defined simply as the time scale required to buy or sell an asset at a reasonable market price.Its importance within the broader economic and financial system is self-evident. One could even argue that the modern financial trading system—and indeed the entire monetary system—has continuously evolved and innovated specifically to enhance market liquidity.

"Cash" or fiat currency is generally considered the most liquid asset because it can be converted into other assets fastest and most easily. Other financial products and tangible assets—such as stocks, bonds, art, and real estate—sit at various lower points along the liquidity spectrum.

Thus, we might say highly liquid "money" serves as the value transmission mechanism in today’s financial system and global trade network. The liquidity of a given “currency” in global markets often reflects the international standing of the sovereign government backing it.The U.S. dollar, in this regard, is undoubtedly the most liquid "asset" currently available.

The ability to transact quickly without loss during circulation represents the liquidity of money. However, in today’s digital age, physical cash often lags behind digitized balances in bank accounts in terms of everyday liquidity. Most financial products have significantly improved transactional liquidity thanks to the internet and electronic devices—a phenomenon we might call the “electronic revolution in liquidity.” The emergence and maturation of blockchain technology have elevated this liquidity revolution to a new level.

Blockchain: Revolutionizing Trading Systems + Explosive Liquidity Growth

Blockchain marks value or represents various assets through freely transferable tokens and removes restrictions imposed by sovereign governments on centralized trading platforms. Any individual with an internet-connected device can participate in a permissionless blockchain trading system.

This revolutionary change eliminates the barriers to entry for traders in traditional finance—bank or exchange accounts, trading qualifications, and time constraints—which simply do not exist in on-chain trading systems. (We will not discuss KYC requirements at centralized exchanges here.)

The on-chain trading revolution drastically reduces, if not nearly eliminates, user entry barriers. In microeconomic market mechanisms, this leads to more robust competition and greater market efficiency. In the blockchain space, it results in explosive liquidity growth.

Of course, it's important to note that this broad-based explosion in trading liquidity does not necessarily mean that the depth of liquidity supporting each individual real-world transaction has directly increased. This remains an ongoing challenge that the entire on-chain ecosystem—and particularly the DeFi industry—continues to refine and address.

AMM Automated Market Makers: The Birth of DeFi

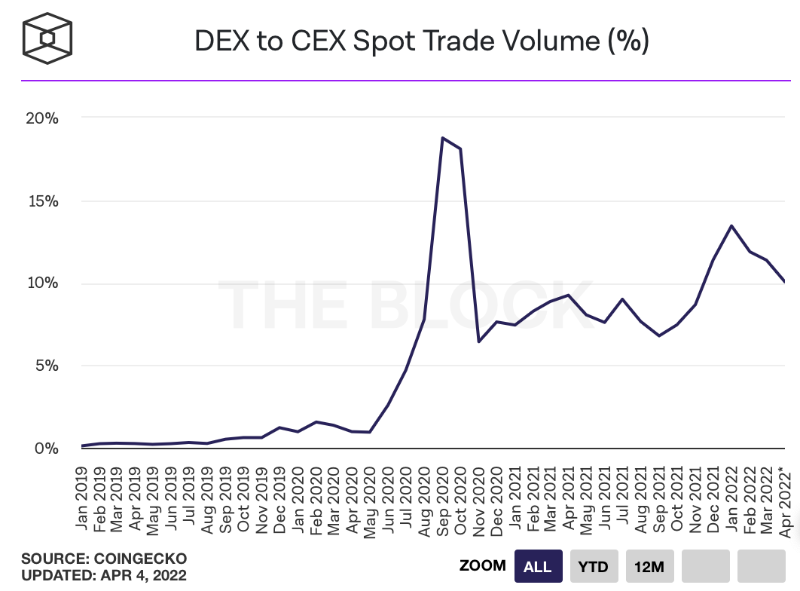

Within the broader blockchain trading system, liquidity serves as the mechanism for transmitting token value. Yet, centralized exchanges (CEXs) still dominate liquidity provision. A major reason is that CEXs, similar to traditional financial markets, rely not only on ordinary users’ order books but also on specialized market makers who play a crucial role.

(https://www.theblockcrypto.com/data/decentralized-finance/dex-non-custodial/dex-to-cex-spot-trade-volume)

(https://www.theblockcrypto.com/data/decentralized-finance/dex-non-custodial/dex-to-cex-spot-trade-volume)

Professional market makers provide deeper liquidity to exchanges, help projects achieve better token liquidity, and improve real users’ trading experience. This appears mutually beneficial. However, in the unregulated and unconstrained cryptocurrency market, the relationship between whales and market makers often hinders effective market price discovery. Projects, investment firms, and large holders may form dedicated market-making teams to stabilize prices, manage market capitalization, and boost liquidity.

On CEXs, however, vast amounts of trading data and counterparty information remain opaque. As a result, regular traders often indirectly bear the profits of market makers and are vulnerable to losses from market manipulation.

The emergence of on-chain AMM (Automated Market Maker) mechanisms, along with decentralized exchanges (DEXs) and "liquidity providers," offers a fresh approach to solving some of these liquidity challenges. Any individual can now act as a "market maker" by supplying liquidity to trading pools. Instead of relying on order book matching, users trade directly with liquidity pools via algorithmic pricing.

The advent of AMMs marked the beginning of the DeFi era and formally split blockchain token liquidity into two categories: 1) off-chain liquidity on centralized exchanges (CEX), and 2) on-chain liquidity.

Note: DeFi enables users to access financial services via decentralized applications (DApps) deployed on blockchain smart contract platforms, without relying on centralized institutions. (Guosheng DeFi1)

On-Chain Liquidity

On-chain liquidity has experienced explosive growth over the past two years. Compared to off-chain liquidity on centralized exchanges, automated market maker (AMM) mechanisms have lowered the barrier to becoming a liquidity provider. Without needing professional market-making teams or centralized platforms, any individual can supply liquidity and earn direct fee income.

For traders, on-chain liquidity information is more transparent. Stronger on-chain liquidity also boosts investor confidence, as they know they can exit positions smoothly when needed, avoiding the extreme price volatility common during CEX liquidity crises.

For projects, achieving strong on-chain liquidity is a key goal. Data suggests a direct correlation between on-chain liquidity size and project market cap.

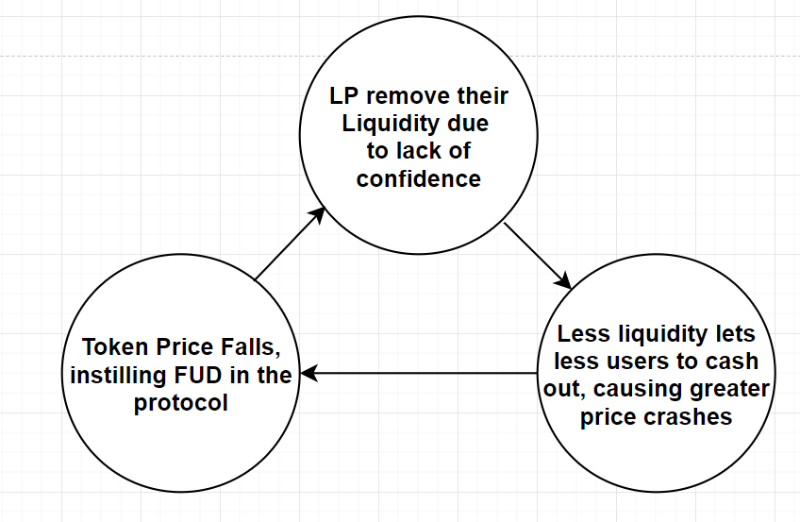

However, the basic AMM logic has a fatal flaw: while liquidity providers earn trading fees by supplying liquidity to mainstream, high-volume tokens, they lack incentives to support emerging tokens. The main reasons are: providing liquidity for new tokens requires holding them first, meaning LPs must typically purchase them upfront. They then face impermanent loss risk, and if the project lacks traction, fee earnings are low. Thus, profit-driven LPs lack sufficient expected returns to justify the risk. But without adequate liquidity, new tokens suffer from high slippage and price instability, deterring users from participating in DeFi or investing. With fewer users, trading volume stays low, fee rewards remain insufficient, and liquidity providers aren’t incentivized—creating a classic “chicken-and-egg” problem.

Yet, the innovative blockchain industry found a solution—liquidity mining.

Mining the DeFi Summer—DeFi 1.0

Yield Farming: Token Incentive Model

Broadly speaking, liquidity mining refers to a token incentive model where users interact with DeFi protocols and receive the protocol’s native tokens as rewards. Pioneered by the DeFi lending protocol Compound, which launched its liquidity mining campaign on June 16, 2020, users borrowing or lending on the platform earned COMP tokens. This innovative model not only boosted lender returns but also subsidized borrowers. Thanks to this mechanism, Compound saw rapid growth in users and lending activity, significantly enhancing platform liquidity. Within just 20 days, total value locked (TVL) surged from $180 million to $650 million, and user numbers quickly rose to 6,000.

(https://defillama.com/protocol/compound)

Uniswap, one of the most mature AMM-based DEX platforms at the time, issued LP Tokens (Liquidity Provider Tokens) to users who supplied pool liquidity. However, under this model, LPs only earned a share of trading fees.

Inspired by Compound’s token incentive model, Sushiswap forked Uniswap’s code and introduced its own SUSHI token, launching a DEX liquidity mining program that successfully executed a “vampire attack” on Uniswap’s liquidity.

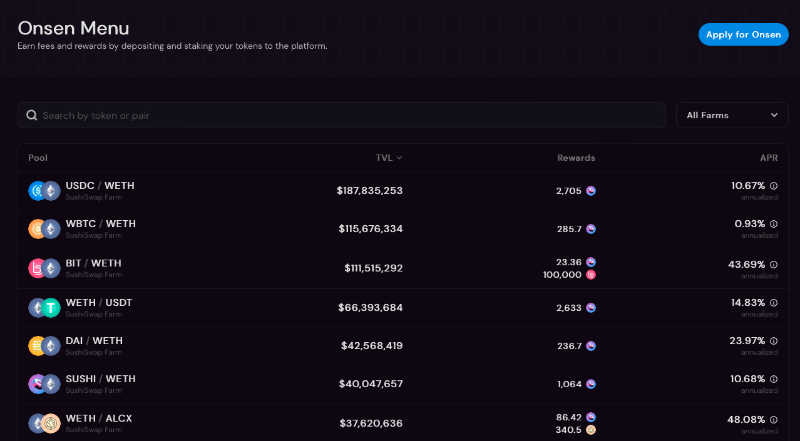

On Sushiswap, users supplying liquidity not only earn a portion of trading fees but also receive SUSHI token rewards. SUSHI tokens grant governance rights and revenue sharing. Even after ceasing liquidity provision, users can continue earning a share of Sushi protocol fees through their SUSHI holdings, better incentivizing early LPs and deeply aligning the interests of "liquidity providers" and the "decentralized exchange platform."

Beyond individual DeFi platforms using liquidity mining to attract liquidity for their own apps, the DEX + LP token model has enabled other blockchain projects to create new ways of incentivizing on-chain liquidity for their token pairs. After providing liquidity for a project token/mainstream token pair on a DEX, users can stake the received LP tokens to earn liquidity mining rewards from the project team.

This model effectively solves the AMM flaw mentioned earlier: low initial trading volumes generate insufficient fees to incentivize LPs, leading to inadequate liquidity, reduced user willingness to trade on-chain, and a vicious cycle. But with liquidity mining, early LPs can earn substantial profits through direct token incentives from projects, attracting more capital to provide liquidity. This improves the trading experience and creates a positive feedback loop.

(https://app.sushi.com/farm)

Off-Chain Exchange Liquidity Mining

Liquidity mining didn't originate with DEXs—it began with FCoin, one of the hottest centralized exchanges in 2018. Shortly after launch, FCoin introduced a “trade-to-mine” model as its primary FC token distribution method. Considered the progenitor of liquidity mining, this model rewarded users with FC tokens (FCoin’s platform token) based on their trading volume, aiming to encourage higher trading activity to signal strong exchange liquidity and attract long-term users. But this outcome never materialized.

Since the main cost of trading on a CEX is transaction fees, numerous “mining teams” joined in. As long as fee costs were lower than the resale value of earned FC tokens, volume farming became a straightforward profit strategy. During FCoin’s liquidity mining campaign, massive wash trading occurred, with daily trading volume peaking at $5.6 billion, briefly making FCoin one of the world’s most liquid exchanges by volume. But everyone knew the actual trading depth behind these inflated figures was shallow. Most users sold their FC tokens immediately for profit, rather than becoming loyal users. Once token rewards no longer covered trading costs, FCoin’s volume rapidly declined.

FCoin’s biggest failure was rewarding solely based on trading volume. It misunderstood the causality between volume and liquidity: in traditional markets, high volume usually indicates strong liquidity. But when volume is artificially inflated for token rewards, it no longer reflects true liquidity. Thus, FCoin’s liquidity mining model ended in failure.

Limits of On-Chain Liquidity Mining 1.0

Just like FCoin’s flawed CEX liquidity mining, on-chain liquidity mining faces several limitations.

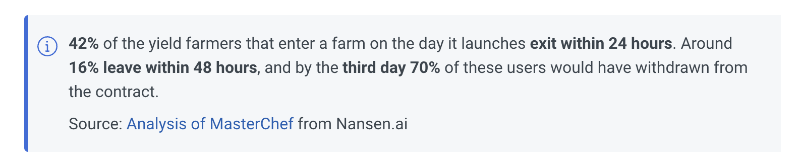

First, any profitable economic activity attracts capital primarily seeking profit. Thus, most participants follow a simple pattern: “mine, withdraw, sell”—mining tokens, withdrawing them, and selling. These “locust miners” cannot provide sustained liquidity or become long-term token holders. Instead, they increase sell-side pressure, distorting fair token pricing.

Another issue is the high cost of token-reward-based liquidity mining, which is unsustainable long-term. Since multiple campaigns compete simultaneously, projects must offer more tokens and higher APRs to attract liquidity, dramatically increasing token issuance costs. Such high incentives cannot last. Once campaigns end, most projects see liquidity drop sharply, failing to achieve lasting, robust liquidity.

(https://www.nansen.ai/research/all-hail-masterchef-analysing-yield-farming-activity)

Meanwhile, distributing large token supplies via liquidity mining exerts significant short-term inflationary pressure on a project’s tokenomics, conflicting with long-term development goals. Since mining rules and reward schedules are typically fixed before launch—but outcomes are unpredictable—projects struggle to define clear liquidity targets and achieve them reliably.

(https://docs.olympusdao.finance/pro)

(https://docs.olympusdao.finance/pro)

Therefore, whether foundational AMM-based DEXs or blockchain projects running liquidity mining campaigns, the core challenge remains: How to improve capital efficiency and better guide and manage liquidity?

DEX Innovations in Liquidity Efficiency—Capital Efficiency of Base-Layer Trading

Building upon the foundational x*y=K constant product AMM mechanism of Uniswap V2, numerous upgraded AMM variants have emerged. In this section, we explore the most representative projects and analyze how they break through the aforementioned liquidity bottlenecks.

Curve: Stable Assets, Ve-Tokenomics, and Convex

Curve Protocol—an Ethereum-based decentralized exchange focused primarily on stablecoins and pegged assets. Compared to other DEXs, Curve offers more concentrated trading pairs with extremely low slippage and fees, meeting the needs of large-scale asset trades.

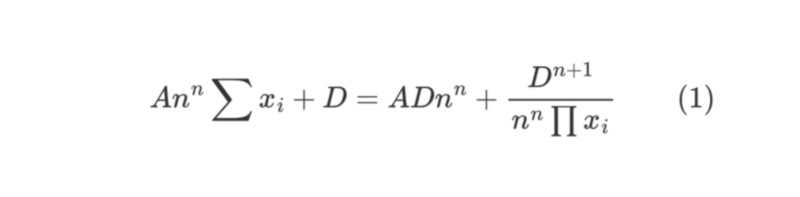

CFMM Algorithm

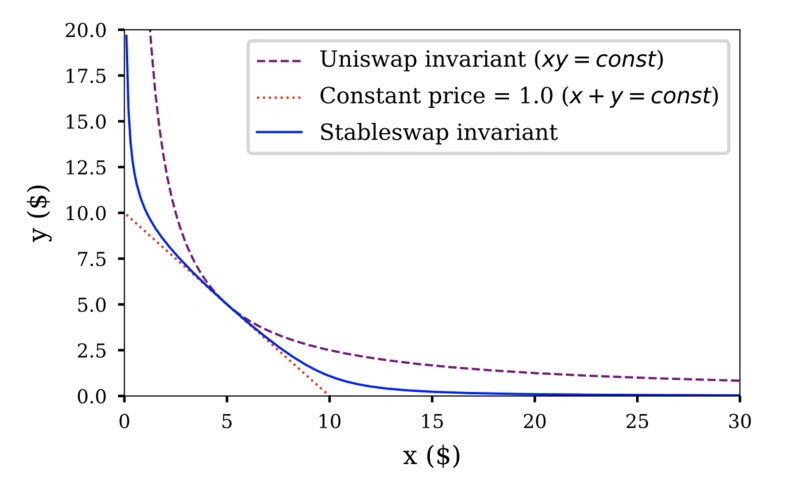

This advantage stems from Curve’s uniquely designed Stable Assets AMM model, which blends constant sum and constant product market-making models, combining the low slippage of the former with the infinite liquidity of the latter.

(https://www.odaily.news/post/5176601)

(https://www.odaily.news/post/5176601)

Compared to Uniswap V2’s constant product algorithm, Curve achieves significantly lower slippage for stablecoin and pegged asset pairs using less liquidity capital, greatly improving capital efficiency for stable asset trading. (https://www.odaily.news/post/5176601)

(https://www.odaily.news/post/5176601)

ve-Tokenomics

Beyond innovations in AMM algorithms, Curve’s other groundbreaking contribution is ve-Tokenomics. In August 2020, Curve launched its "vote-escrowed" (ve) feature, allowing CRV token holders to lock their tokens for up to four years in exchange for veCRV (vote-escrowed CRV). The amount of veCRV is proportional to the remaining lock time, and veCRV is non-transferable. Rights associated with veCRV include voting power to direct CRV rewards to preferred liquidity pools and entitlement to a share of Curve’s protocol revenues. Users can use veCRV to boost their liquidity mining returns and directly earn a portion of Curve’s platform income.

At the time, the optimal strategy for maximizing returns was locking CRV to obtain veCRV, boosting yield farming gains, and voting to allocate CRV rewards to preferred pools to earn even more CRV. This led to more liquidity and capital flowing into those pools, increasing depth, reducing slippage, attracting more traders to Curve, and creating a virtuous cycle.

The breakthrough lies in Curve’s liquidity mining mechanism deeply aligning LPs’ interests with the DEX itself over the long term. Consequently, Curve’s TVL steadily grew, eventually reaching $22.1 billion, securing its position as the largest DeFi protocol by TVL. Curve has thus provided the entire DeFi market with a highly liquid platform for stable asset trading. (https://defillama.com/protocol/curve)

(https://defillama.com/protocol/curve)

Validated by Curve’s success, ve-Tokenomics has become an essential component in many DeFi projects’ token designs, such as Stargate, UDX, Curvance, and Lendflare. Well-known established DeFi protocols like Frax, Ribbon Finance, and Yearn have also launched or announced plans to integrate ve-token models. Some projects have even combined ve models with NFTs, including AC’s Solidly ve(3,3) and iZUMi Finance’s veNFT (veiZi) built on Uniswap V3.

Note: These two projects will be analyzed in greater detail later in this report.

Convex—Creating Liquidity for ve-Tokenomics

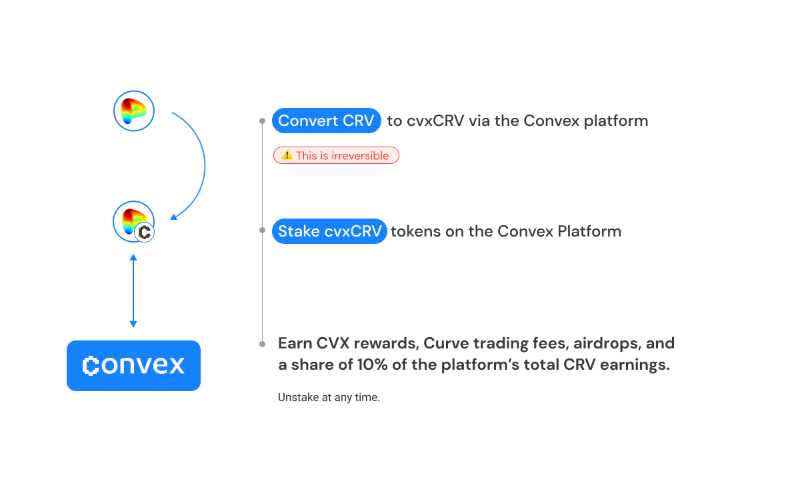

A core aspect of Curve’s ve-Tokenomics is that veCRV tokens obtained through staking cannot be transferred or traded, rendering them nearly illiquid. This has drawn criticism, especially from retail users who cannot afford to lock CRV tokens for four years and thus miss out on veCRV benefits like boosted yields or voting power over CRV incentives in specific pools.

To solve ve token illiquidity, Convex emerged. CRV holders can stake CRV on Convex to receive cvxCRV, a token representing staked CRV. Convex automatically locks deposited CRV on Curve to acquire veCRV, making cvxCRV a tradable, tokenized version of veCRV. By staking cvxCRV, users gain Curve governance rights, 10% of $CRV liquidity mining rewards (from Convex’s total mining rewards), 50% of trading fees ($3CRV), $CVX rewards, and access to Convex’s airdrops.

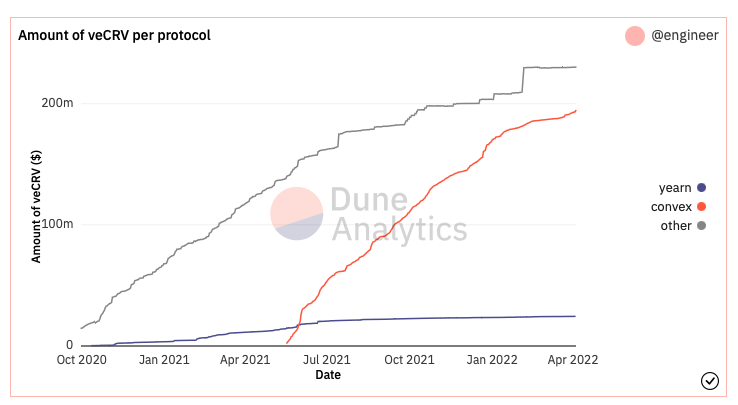

Through liquidity mining incentives for CRV/cvxCRV, Convex maintains a near 1:1 swap ratio, preserving liquidity while enabling users to earn enhanced returns from Curve. Convex has accumulated significant veCRV, gaining substantial voting power over liquidity pool incentives on Curve. The competition among Curve ecosystem projects—including Convex—for veCRV governance is known as the “Curve War.” Based on current data, Convex controls 43% of veCRV, dominating this battle.

(https://dune.xyz/engineer/CRV-and-Convex)

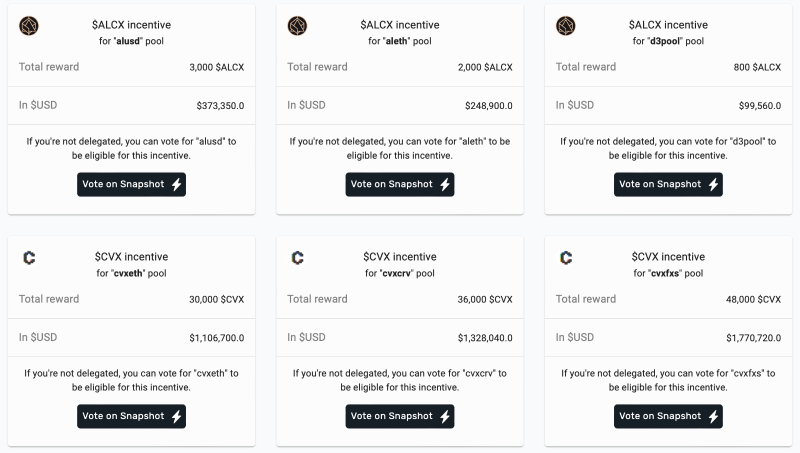

Bribes—Creating Liquidity for Governance Rights

As the Curve War outcome becomes clearer, Convex’s governance rights have attracted intense competition from users and DeFi protocols alike. Users who stake and lock Convex’s CVX token receive vlCVX tokens, representing voting rights over Convex’s veCRV allocation. Under this mechanism, whoever holds more CVX and receives more vlCVX gains greater control over veCRV voting power, influencing metrics like size, slippage, and yield of specific stablecoin pools on Curve. Project teams have increasingly recognized the value of CVX and vlCVX governance. While stockpiling CVX, another efficient mechanism has emerged—bribery for governance rights.

(https://votium.app)

Votium Protocol provides an efficient marketplace for vlCVX vote bribes. vlCVX holders lend their voting power on proposals in exchange for bribes from buyers seeking influence. Buyers set rewards for votes on specific pools. vlCVX holders choose the highest bribe offers or delegate vlCVX to Votium, whose smart contracts automatically vote for the most lucrative bribes, maximizing returns. To date, Votium has generated $157 million in bribe revenue for vlCVX holders, efficiently unlocking governance value and essentially creating a market for previously illiquid governance rights. (https://llama.airforce/#/votium/overview)

(https://llama.airforce/#/votium/overview)

For buyers—or projects wanting to secure more liquidity on Curve via Convex governance—Votium offers a low-cost, efficient alternative. They avoid the expense and volatility risks of accumulating CVX, instead paying controlled bribe costs to directly gain voting power and achieve their liquidity goals. Currently, every $1 spent on bribes generates $1.53 in liquidity mining rewards for LPs. Compared to direct liquidity mining, the bribe mechanism offers projects a cheaper, sustainable way to incentivize liquidity without disrupting their token economy: bribe for governance to capture Curve and Convex liquidity mining rewards, thereby boosting their own pair’s on-chain liquidity.

Uniswap V3’s Concentrated Liquidity Mechanism

High Capital Efficiency of Uniswap V3

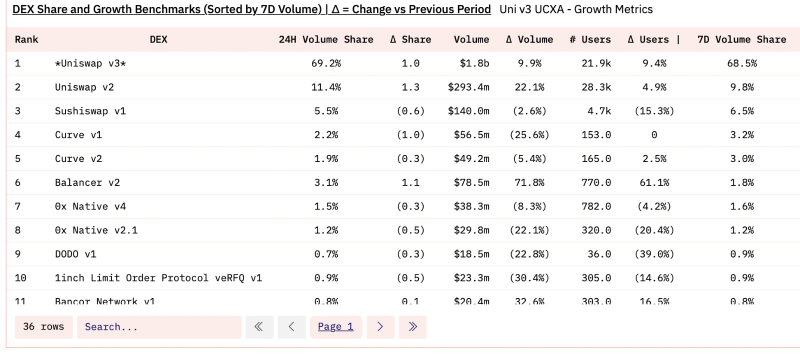

(https://dune.xyz/msilb7/Uniswap-v3-Competitive-Analysis?Time%20Period=24%20hours)

Uniswap V3 currently dominates about 70% of Ethereum’s on-chain trading volume—17 times that of Curve during the same period—yet its TVL is less than one-third of Curve’s. If we measure capital efficiency as the ratio of trading volume to TVL, Uniswap V3 achieves over 50 times the capital efficiency of Curve.

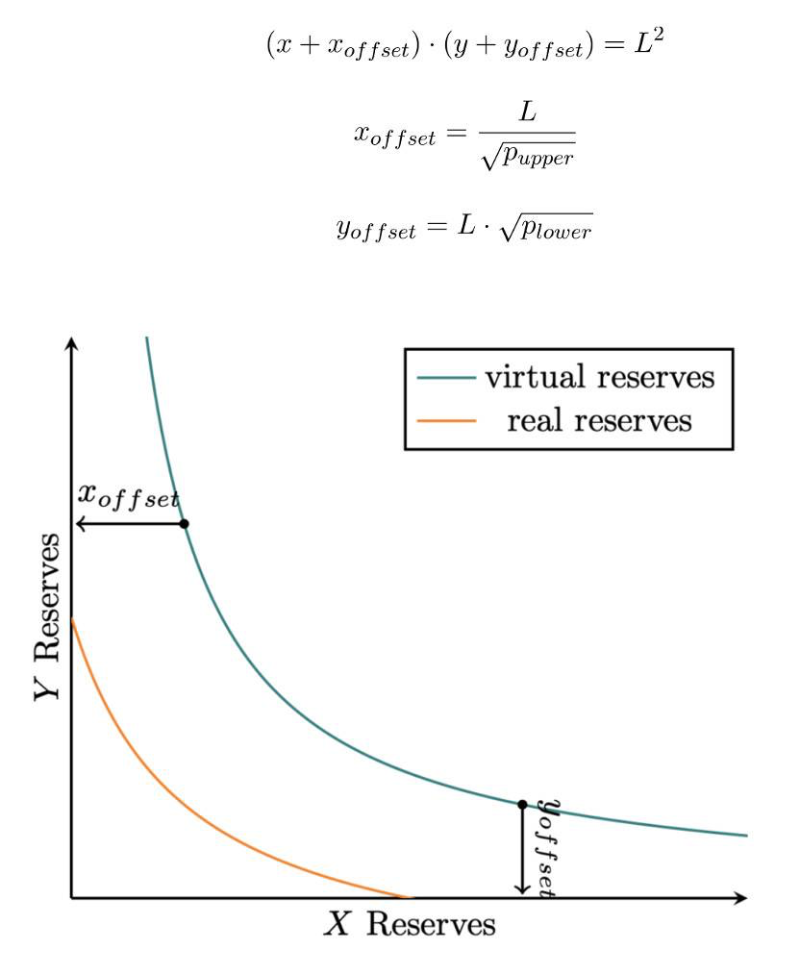

This standout advantage stems from Uniswap V3’s innovative concentrated liquidity mechanism. When providing liquidity, users can select specific price ranges, enabling customized and concentrated liquidity. Within the specified range, the AMM follows the V2 constant product formula. Compared to Uniswap V2’s default full-range liquidity, this “range-based liquidity provision” greatly enhances LP flexibility and capital efficiency. Thus, concentrated liquidity near the market price replaces the concept of “infinite” liquidity.

(https://news.huoxing24.com/20210704171101877495.html)

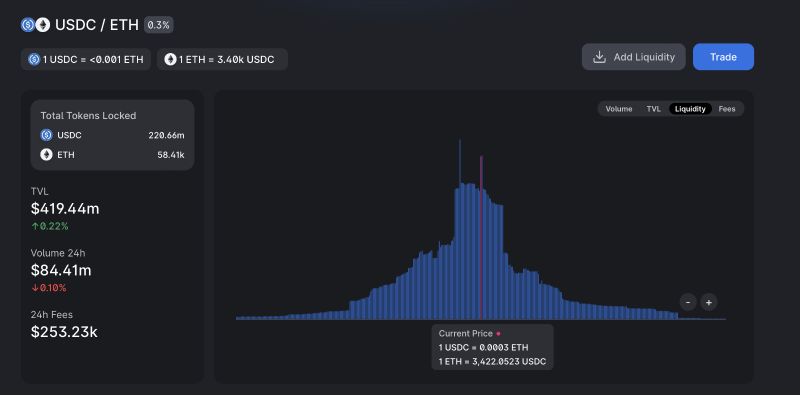

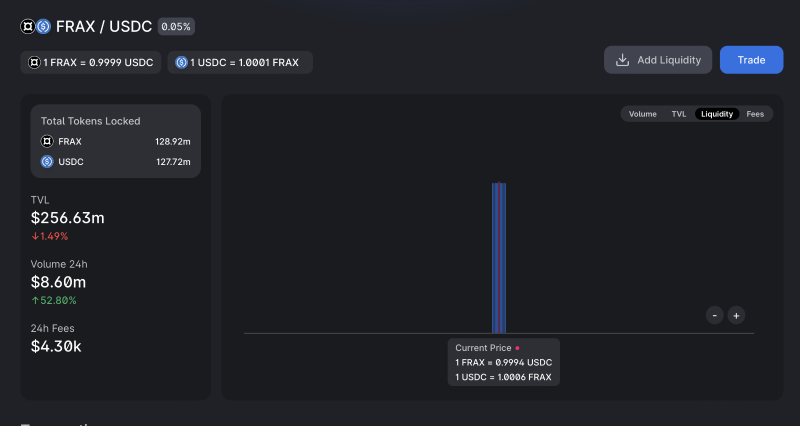

As shown below, the ETH/USDC pair, due to high volatility, sees liquidity concentrated around the current price but relatively dispersed. The FRAX/USDC pair, being both stablecoins, exhibits smaller price fluctuations and liquidity tightly clustered around 1.

(https://info.uniswap.org/#/)

(https://info.uniswap.org/#/)

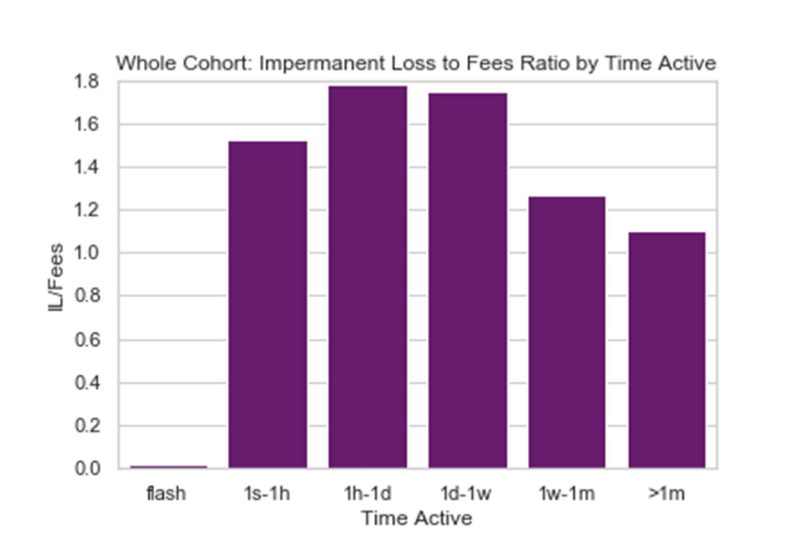

The Flip Side of Concentrated Liquidity—Higher Impermanent Loss

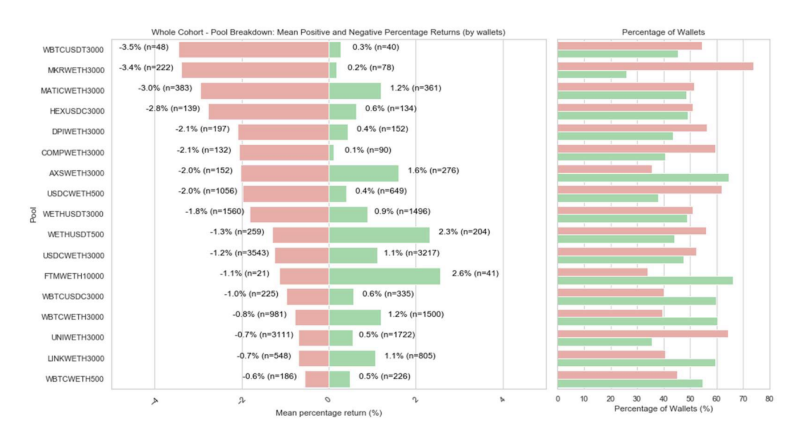

Topaz Blue and Bancor released an in-depth study on Uniswap V3 returns in November 2021. The report presents statistics on fee income and impermanent loss (IL). Surprisingly, nearly half of Uniswap V3 liquidity providers (LPs) incurred negative returns due to IL during the studied period.

(https://arxiv.org/ftp/arxiv/papers/2111/2111.09192.pdf)

According to compiled data, 49.5% of all LPs earned no income and operated at a loss due to IL. Viewed collectively, LPs as a group also lost money due to IL. Therefore, Uniswap V3 is currently not a platform where average LPs can expect high positive returns. (https://arxiv.org/ftp/arxiv/papers/2111/2111.09192.pdf)

(https://arxiv.org/ftp/arxiv/papers/2111/2111.09192.pdf)

Among all LPs, only Flash LPs—those providing liquidity for just one block, later known as “Just-in-Time” (JIT) liquidity—consistently profited. However, due to technical complexity, ordinary investors lack feasible execution methods. Beyond these technically capable JIT LPs, no clear group—based on fund size or rebalancing frequency—can be identified as consistently benefiting from providing liquidity on Uniswap V3.

Balancer—Programmable AMM Pools

Balancer is another DEX based on the AMM protocol, but unlike others, Balancer’s liquidity pools can consist of 2–8 tokens, with customizable initial weights ranging from 2% to 98%. This differs from traditional 50%+50% AMM pools (like Uniswap) based on the x*y=k equation, allowing variable impermanent loss profiles and capital efficiency tailored to specific tokens and use cases.

Balancer pools also allow customizable trading fees, ranging from 0.00001% to 10%, accommodating diverse trading scenarios. Near-zero fee pools, for instance, can support high-frequency trading needs, improving capital efficiency for specific operations.

Another innovation in Balancer’s liquidity mechanism is the Liquidity Bootstrapping Pool (LBP) for guiding liquidity for emerging assets. Traditional AMM pools require 50%+50% token ratios, forcing new projects to deploy large funds (50% in mainstream tokens like ETH or USDT). Insufficient initial liquidity can cause wild price swings and poor price discovery. LBPs let projects create short-term smart pools with dynamic token weights (e.g., shifting from 2%/98% ETH/$Token to 98%/2% ETH/$Token), allowing them to bootstrap liquidity with minimal capital. It can also serve as a token sale tool: users buy tokens from the pool anytime; if no purchases occur, the price gradually drops until demand resumes. Combined with moderate demand, this enables efficient price discovery and prevents bot sniping common in other token sale formats.

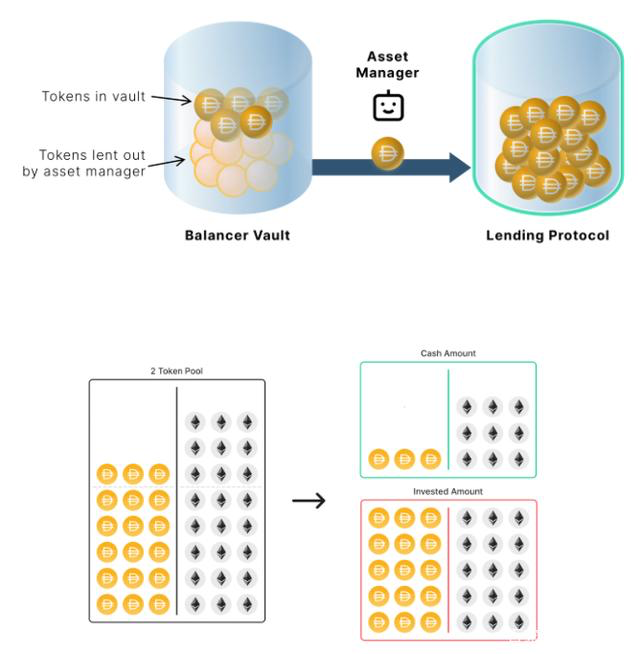

Asset Managers

In its V2 upgrade, Balancer introduced a revolutionary concept—Asset Managers—to address low capital efficiency in AMM pools. Asset Managers use smart contracts to lend idle tokens to partner lending protocols like Aave, generating additional yield and improving overall capital utilization and returns from a new dimension.

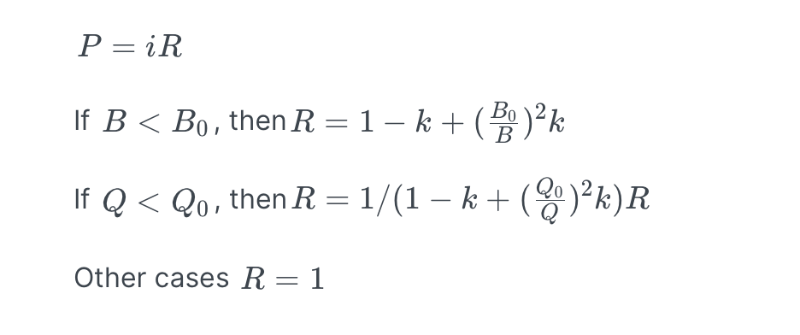

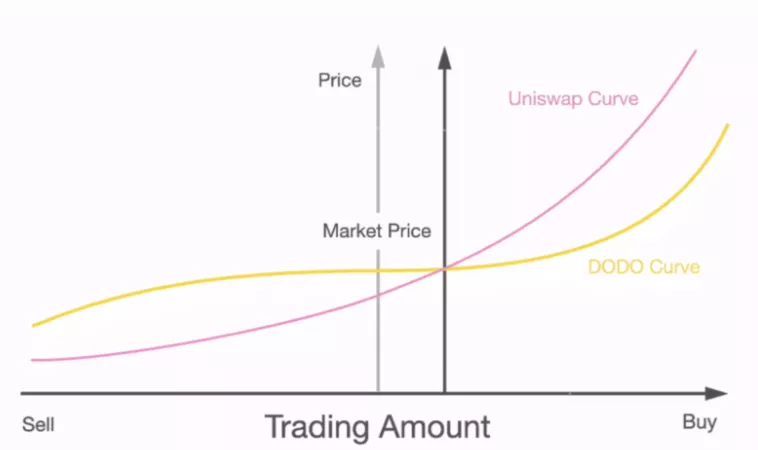

DODO—PMM Proactive Market Maker Mechanism

DODO, as one of the more capital-efficient DEX platforms, relies on its innovative PMM (Proactive Market Maker) algorithm. It uses oracles to obtain a token’s current market price, mimics traditional market maker behavior, and introduces price parameters to adjust the AMM curve.

(https://docs.dodoex.io/english/dodo-academy/pmm-overview/the-mathematical-principle-of-pmm)

(https://docs.dodoex.io/english/dodo-academy/pmm-overview/the-mathematical-principle-of-pmm)

Compared to traditional AMM algorithms, this allows proactive price discovery and concentrates more liquidity capital around the current market price via flatter pricing curves, achieving higher capital efficiency, lower slippage, reduced single-asset exposure, and lower impermanent loss for LPs.

(https://blog.dodoex.io/the-evolution-attack-and-future-of-dex-53392064865d)

Traditional AMM DEXs can be called “passive liquidity,” whereas DODO and Uniswap V3 represent the trend toward “active liquidity” on DEXs. With Uniswap V3, LPs actively adjust liquidity; with DODO, algorithmic design enables automatic adjustments, achieving even higher capital efficiency.

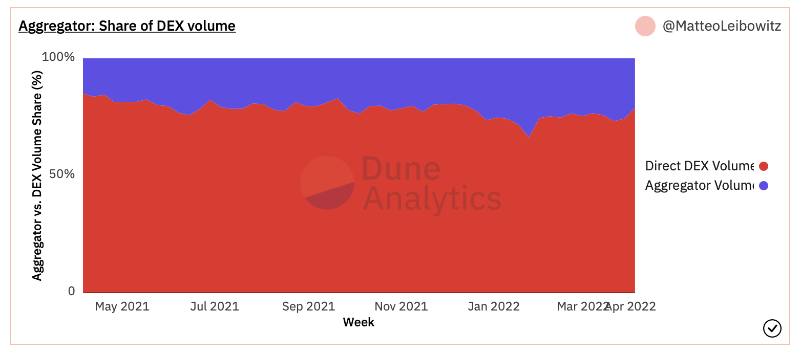

On-Chain Trading Aggregators Built on DeFi’s Lego-Like Composability

(https://dune.xyz/MatteoLeibowitz/Aggregator-Dashboard)

(https://dune.xyz/MatteoLeibowitz/Aggregator-Dashboard)

After discussing various DEX innovations in base-layer liquidity capital efficiency, another hallmark of the DeFi industry—the Lego-like composability—has further enhanced trading-layer liquidity efficiency through on-chain trading aggregators built atop multiple DEXs and liquidity pool APIs.

These aggregators pool liquidity from various sources, enabling traders to execute across multiple DeFi platforms simultaneously. They split user orders and distribute execution across multiple DEXs or liquidity providers, automatically finding optimal trade routes to enhance user experience and reduce trading costs.

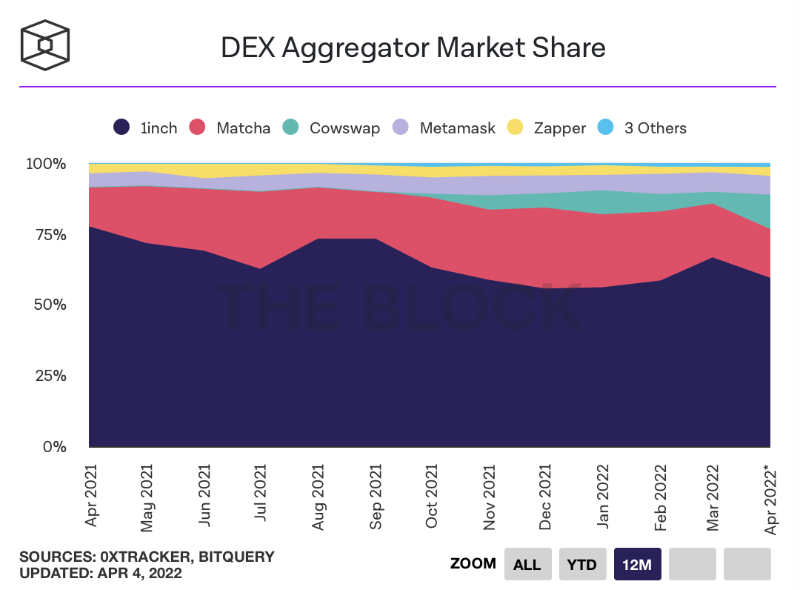

(https://www.theblockcrypto.com/data/decentralized-finance/dex-non-custodial/dex-aggregator-market-share)

(https://www.theblockcrypto.com/data/decentralized-finance/dex-non-custodial/dex-aggregator-market-share)

Major trading aggregators include 1inch, Matcha by the 0x team, Cowswap, and MetaMask’s built-in aggregator. 1inch dominates in trading volume, consistently capturing over 55% of the aggregator market, while MetaMask holds about half the user share due to its large user base.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News