Web2 VCs Talk Web3: Why Are Traditional VCs Changing Course?

TechFlow Selected TechFlow Selected

Web2 VCs Talk Web3: Why Are Traditional VCs Changing Course?

For an investor with extensive experience in traditional investments, what is the logic and thought process when transitioning to Web3 investing?

-

When did you start believing in Web3?

-

What is the most exciting thing about Web3?

-

What are the biggest obstacles on the path to realizing Web3?

-

What changes do Web2 companies need to make if they want to transition to Web3?

-

How should we view the monopoly issues in Web2 from a Web3 perspective?

-

How do crypto VCs view anonymous projects?

-

What are your thoughts on the current inversion between primary and secondary markets?

-

Which areas in the primary market are you most bullish on this year?

-

How do you view the user-ownership philosophy of Web3 versus the capital-driven model of Web2?

-

How do you value token investments versus equity investments?

-

How do you think about cyclical trends in investment sectors?

-

How do you evaluate project valuations?

-

Compared to recruiting founders from traditional Web2 tech giants, how can Web3 efficiently identify strong project founders?

-

How do you view open-source Web3 projects, and how can such projects maintain competitiveness?

Main Content

Below is a transcript of a recent in-depth conversation between A&T team members and two industry peers. We invited two seasoned investors from traditional institutions who have transitioned into Web3 investing—referred to here as Peter and David (pseudonyms)—to share their logic and reflections on moving from traditional investment into Web3.

Legal Disclaimer:

The content above represents only the personal academic opinions of the speakers, intended for industry learning and exchange. It does not represent the positions or views of the speakers’ affiliated institutions or this publication.

Q: When did you start believing in Web3?

Peter:

It started back in 2016 when I attended a Hackathon. At that time, Ethereum had just suffered the well-known DAO hack. But what struck me was that despite ETH taking a major hit, many developers remained focused on building interesting things—not obsessing over price fluctuations.

Todd:

I began believing in Web3 in January 2021. Although I entered the crypto space in 2018, I didn't equate crypto with Web3—it was more about blockchain as a new technology. It wasn't until I saw Mirror.xyz that I realized something truly different and valuable had emerged. Compared to Web2 platforms like Zhihu or Medium, Mirror gave content creators an option to raise funds directly during their creative process—something extremely difficult to achieve in Web2.

Peter:

From a user experience standpoint, I agree with your take on Mirror. For me, DeFi is also part of Web3, even though they're not exactly Web3 applications. Before Uniswap, there was a famous DEX called DDEX—I was an active user because it didn’t monopolize your data rights. I could fully control my assets and move them freely across applications.

Liam:

I started believing in Web3 through my immersion in the cryptocurrency market. To me, Web3 means fewer permissions, ownership, transferable economic value, and so on. In March 2020, while still at Deutsche Bank, I first learned about Bitcoin as an alternative asset class. I believe Web3 will begin with money—a paradigm shift in the financial system.

Q: What excites you most about Web3? It could be a model, product, or mindset.

Peter:

From a user experience perspective, ownership is key. Ownership is something we simply don’t have in the Web2 internet world. That’s why I felt so excited when the NFT bull run happened. Starting from NFTs, we can build a Metaverse where people spend more time and derive entertainment. Long-term, as everything becomes digitized and data multiplies, we’ll be able to own more diverse digital assets.

Todd:

I completely agree with the idea of ownership, but there are still many barriers to achieving it. Right now, the only things we truly own are NFTs and FTs—we likely don’t yet own our data. That part remains to be discussed.

David:

An open financial market is what I’m most excited about. Many friends ask me: if they don’t have overseas bank accounts, how can they buy Chinese stocks listed in the U.S.? Synthetic asset platforms can offer a solution—replicating stock price movements on-chain.

Q: What are the biggest obstacles on the path to realizing Web3?

Peter:

First is usability. To enter the real Web3 world, you need a wallet to manage your private keys—this creates a high barrier for many people. I know many projects are working to lower this barrier, but progress has been insufficient so far.

Second is privacy. On-chain data today is highly transparent—essentially, every transaction is visible to everyone. As a result, we see all kinds of applications entering public spaces, harvesting this data to offer products that show users what others are doing on-chain. This provides functionality, but leaves us with zero privacy. I’ve seen many projects trying to solve this, like Tornado Cash. These tools let users manage their own privacy—choose to disclose some transactions publicly, or keep others private. Breakthroughs in this area are coming soon.

The last piece is decentralized storage. Most things in the crypto world today are still stored on centralized cloud services. When we talk about ownership, we don’t really own anything unless it's stored decentrally—only then can true data ownership exist.

Todd:

Between lowering barriers and being competitive in use cases—which matters more for Web3 expansion? You mentioned many projects are improving UX.

Peter:

There are two scenarios. One serves crypto-savvy or crypto-native users. The other focuses on bringing the mainstream into crypto. From an investor’s view, both paths can succeed. Serving core users first to build an initial community—rather than aggressively scaling from day one—is probably more practical.

That said, I admire other projects bold enough to innovate—for example, Flow is doing significant work adapting to non-crypto users. Another example is Stepn—very interesting, “move-to-earn”—they created a super simple UX right from the start for non-crypto users.

David:

I fully agree with what’s been said. For me, it’s crypto education. Most Web2 users have no idea about Web3—they don’t know how to use wallets, buy crypto, or join communities. We need simple, intuitive ways to help these people onboard faster.

Liam:

Many people aren’t interested in DeFi, but if they want to get into Web3, the first hurdle might be learning how to use MetaMask. But I think starting with hardware wallets is better—they’re more secure and closer to Web2 user experience.

Q: Can Web2 companies successfully transition to Web3?

Peter:

Web2 companies need to change their mindset. They must try openness and collaboration instead of seeing everyone as future competitors. They should also use token incentives to attract users, rather than buying users outright.

David:

It’s very hard for most Web2 companies. We’re entering a new era—building isn’t about companies anymore, but more like digital nations. We’re building open-source protocols. The entire mentality behind building has shifted between Web2 and Web3.

From a community perspective, launching a Web3 or crypto project requires a community-building mindset—establishing consensus among users. While this resembles how some great companies were built in the past, the overall mindset is quite different.

Q: How should we view the monopoly problem in Web2 from a Web3 perspective?

David:

For Web3 startups, finding new application scenarios is essential. Trying to compete with AAVE and Compound in lending and borrowing offers little opportunity—it’s too hard.

Peter:

We often face questions like “what if Tencent or Alibaba enters?” But even for B2B use cases, AAVE and Compound can do those—and they have stronger credibility with certain B-side users.

Todd:

Big players can do many things, but every team has limited expertise. Also, many teams don’t deeply embrace new directions—even if they recognize innovation, they may not fully commit.

New teams can still innovate in crowded fields. For example, last year we invested in Staking Rewards. Our thesis was that it could become the CoinMarketCap of staking—but CoinMarketCap never pursued that. Staking Rewards has since深耕'd deeply in this niche and built a loyal user base.

AAVE itself has contributed many innovations to the market over the past year, so it makes sense for them to explore new areas. You need to step outside a circle to discover new opportunities.

Peter:

We’re not yet at peak saturation. Platforms like OpenSea and Uniswap aren’t present on every chain—there’s still plenty of room. There are countless directions to explore. For example, Uniswap dominates DEX traffic on Ethereum, but MetaMask didn’t build its own swap out of user dominance. Instead, it aggregates Uniswap—but charges high fees on swaps, generating substantial revenue. Similarly, there are many forms of NFT marketplaces and aggregators. At the project level, there’s still much to build.

Liam:

In Web3, institutional monopolies don’t exist—users vote with their feet. Are leading projects perfect? Far from it. Beyond UniV2 and V3, there can be many other models—like orderbook-based designs. First-movers have advantages, but continuous innovation is needed to retain users.

Q: How do VCs view anonymous projects?

Peter:

VCs, like companies, are historical constructs—they evolve too. From an investment standpoint, VCs put in capital early at low prices for equity or tokens. This is fundamentally similar to traditional VC. The differences lie in fundraising formats and valuation methods. For example, early token allocations often avoid further dilution—unlike equity, which gets diluted over multiple rounds down to 1% or even 0.x%. Tokens don’t dilute, so some VCs enjoy extremely low costs.

Also, due diligence differs. For traditional projects, you conduct financial and legal audits. But in today’s digital environment, you don’t need to visit the company—you can chat remotely with founders. Crypto brings many benefits: once a project launches, much becomes transparent and visible.

For anonymous projects, it doesn’t matter much who the person is or where they’re from—what matters is how trust is established. Personally, I’ve participated in fair launch projects that avoided institutional funding—this works well for application-focused projects. But for ecosystem-level public chains, early large-scale institutional support is usually necessary—pure fair launch is very difficult.

Peter:

If investing in a fund, we’re betting on the fund’s taste. But for fair launches, it’s more about aligning with broader market sentiment—which is highly volatile. However, if a fund operates transparently—say as a DAO, publishing its investment history—I’d prefer that model.

Todd:

Some crypto funds recognize that VC models are changing. For instance, Polychain’s founder tweeted that our industry’s VCs will soon be disrupted—most traditional VC structures will be overturned.

David:

Compared to fair launches, VC funding still offers many advantages. Connections between projects, investors, and institutions remain valuable. Institutions can provide post-investment support—helping recruit talent, PR, connecting resources like KOLs and exchanges.

Q: What are your thoughts on the current inversion between primary and secondary markets? And what sectors in the primary market are you bullish on this year?

Todd:

Internally, we’ve actually been looking forward to a bear market. In our view, the best time for funds to invest is during bear markets—because in bull markets, competition and valuations become less favorable. Institutions typically do deeper research than individuals—it’s about monetizing knowledge. So we prefer to deploy capital in bear markets and count profits in bull markets.

Many traditional funds are recently deploying more aggressively, unafraid of high valuations. But we maintain a steady pace specifically during bear markets. To answer your question: each team member focuses on specific sectors. Personally, I’m bullish on completing Web3 middleware—core components are already visible, but gaps remain to be filled.

David:

We prefer overseas companies. We divide Web3 into four layers: application, tooling, middleware, and infrastructure—with protocol layer (e.g., L1) at the base. Our focus is mainly on middleware and tooling—DAO tools, data analytics platforms, NFT analytics platforms (we call this tooling layer). We also look at middleware and infrastructure—DID, data middleware, nodes, storage—which we internally refer to as “meddleware.” These areas are familiar from Web2, so risks are more manageable. Applications like gaming and NFTs carry higher risk for us, so we dedicate less effort.

As for protocol layer, we pay less attention to L1 and scaling solutions due to limited exposure to strong projects. Cross-chain is another key focus.

On bull vs. bear markets: many traditional Web2 funds are FOMO-ing into Web3. We stay calm and rationally assess high valuations.

Peter:

For us, we tend to invest in L1/L2 scaling or privacy protocols—we believe richer protocol ecosystems enable more economic activity. We look less at applications, but have invested significantly in middleware and tooling, which we continue monitoring. On valuation: most prefer bear markets, avoiding inflated valuations. When competition intensifies, valuations get bid up, reducing returns for everyone—it’s a game. Everyone votes with their feet. If prices seem unreasonable, or better pricing exists on secondary markets, participants will price projects accordingly. Everyone has their own valuation logic.

Q: How do you view the user-ownership philosophy of Web3 versus the capital-driven model of Web2? How do you value token investments versus equity?

Peter:

First, on philosophy: compared to traditional equity markets, Web3 has much stronger individual and community elements—hence practices like fair launches. On the other hand, while ideals lean toward full decentralization and transparency, many still rely on institutional or KOL judgment. So institutions will retain influence for a long time.

On valuation: broadly speaking, we assess how a project might exit—e.g., Coinbase’s IPO, CoinMarketCap acquired by Binance. These are relatively traditional paths. We’re flexible on exit mechanisms.

David:

It depends on whether the project’s value lies in its token or in equity.

Q: How do you view cyclical trends in investment sectors?

Peter:

The ideal scenario is accurately predicting cycles and directions—like funds that early-birded into NFTs or previous DeFi waves. That’s optimal. Less ideally, sometimes it’s unclear what will take off. But we must ask: is this a passing trend or something lasting? If you believe it’s long-term—say 5–10 years—then consistent investment makes sense, even if short-term bubbles exist. If you think it’s just hype, you won’t chase it. Sustained conviction leads to sustained allocation.

Todd:

One addition: for short-lived projects, secondary-focused funds can capture short-term gains. We consider whether a project genuinely solves market problems. It may face downturns, but long-term, the fund can still realize value.

David:

There’s broad consensus: the crypto industry oscillates between bull and bear markets. When investing, we hope projects survive into the next bull cycle and can exit then. Application-layer projects like NFTs or gaming may deliver huge short-term returns, but often fade quickly.

Q: How do you evaluate project valuations?

Todd:

Each sector has its own valuation methods. The simplest is using comparable companies—if a similar project exists, benchmark against it. Alternatively, if we believe a project will occupy a solid position long-term, valuation becomes easier. Take “staking-as-a-service”: if crypto goes mainstream, such a service could become a giant like AWS or Alibaba Cloud. Looking at traditional equity companies, their market valuations offer reference points. For example, a project you invest in today might grow into such a giant within five years.

Regarding current DeFi valuations: since market interest isn’t focused there now, capital flows elsewhere, pushing secondary valuations down. But for blue-chip DeFi projects, you can calculate their revenues. Compared to traditional finance, 20x–30x P/E ratios seem reasonable. So for core DeFi players, price is just secondary market volatility.

David:

OpenSea’s Web2 counterpart follows a model somewhat like Taobao, but because its product differs, it’s also closer to Xianyu. Just adding context to this point.

Peter:

On timing: Todd’s point about comparables is probably most useful—find similar projects and see where they stand. Also consider product traits. Traditional valuation works better for DeFi, less so for Layer 1 projects. Also, user subsidies are common now, leading to inflated metrics. In summary, to value properly, believe the industry will eventually return to rationality and average levels. The space is still early—no formulaic valuation method exists yet.

Q: Compared to recruiting founders from traditional Web2 tech giants, how can Web3 efficiently find project founders?

David:

Simply put, most deals come through word-of-mouth from insiders. Occasionally, we find good projects on Twitter or Discord.

Peter:

Word-of-mouth needs no elaboration. Finding projects via Twitter or Discord is still effective. Friends from big domestic firms often face regulatory concerns, so mindset shifts take time. Long-term, once they认同 the industry, more will transition in—it just takes patience.

Todd:

I’ll add two things we often do. First, we invest in portfolios—because we believe in those sectors, we engage founders to understand emerging trends and top new teams, sourcing deals through this channel.

Second, many of us use bots to crawl new projects—everyone has their own approach, with custom parameters for scraping.

Q: How do you view Web3 open-source projects maintaining competitiveness?

David:

When I first entered crypto, I wondered: if code is open-source, how do you maintain competitive advantage? After getting involved in Web3, I realized teams need strong marketing and operational capabilities, plus access to networks—exchanges, blockchains, KOLs, influential investors.

Also, since Web3 projects are global, managing international teams—global operations, execution strength—is crucial. Additionally, having team members deeply understand tokenomics and drive innovation helps—while DeFi tokenomics haven’t seen major breakthroughs, GameFi and SocialFi have introduced novel token designs, which are pluses.

Todd:

Take Uniswap, Sushi, Pancake. Uniswap still holds the largest capital volume and attention. Innovation matters—Uniswap delivered V2 and V3, which Sushi and Pancake couldn’t replicate. Code can be copied, but insight and innovation cannot. Pancake also benefited from strong Binance support and the BSC ecosystem—so robust backing is vital. Sushi, meanwhile, excels in community operations. So these three aspects—innovation, resource strength, and community management—cover our investment thinking.

Peter:

In the primary market, people matter immensely—can the team sustain innovation? Also, open-source doesn’t necessarily increase competition. Competition is multidimensional. For example, Uniswap V3 initially used a time-locked license—delaying full open-sourcing before gradually releasing it. So open-source isn’t black-and-white.

Todd:

Thank you all for joining our Space. Today’s Twitter Space ends here. Goodbye.

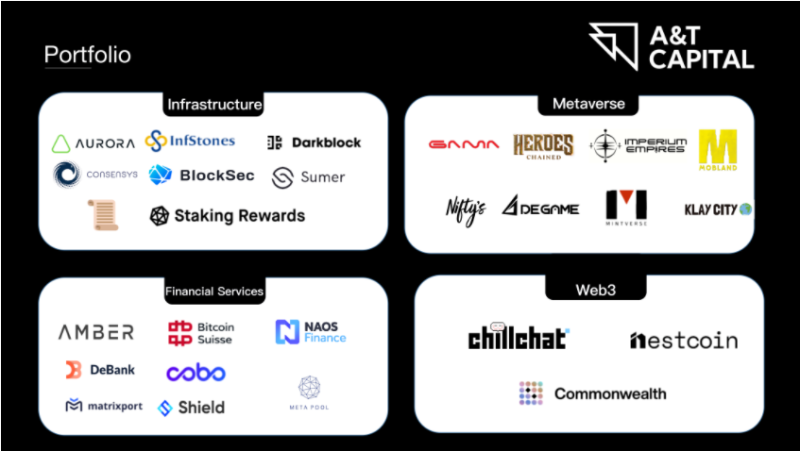

About A&T Capital

A&T Capital is a venture capital fund focused on emerging disruptive technologies. The fund specializes in supporting startups from early to growth stages. Backed by five financial technology decacorns (valued over $10 billion), early supporters of distributed ledger technology, and a group of experienced product leaders, A&T Capital holds unique advantages in advancing the large-scale adoption of next-generation decentralized digital startups.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News