Sino Global: Why We’re Betting on LayerZero’s Future?

TechFlow Selected TechFlow Selected

Sino Global: Why We’re Betting on LayerZero’s Future?

As we steadily move toward a multi-chain, multi-layer world, we believe LayerZero's cross-chain architecture will become central to this space, serving as the key infrastructure layer catalyzing a truly permissionless and trustless omnichain future.

Author: Sino Global Capital

Translation: TechFlow intern

A Multi-Chain, Multi-Layer Future

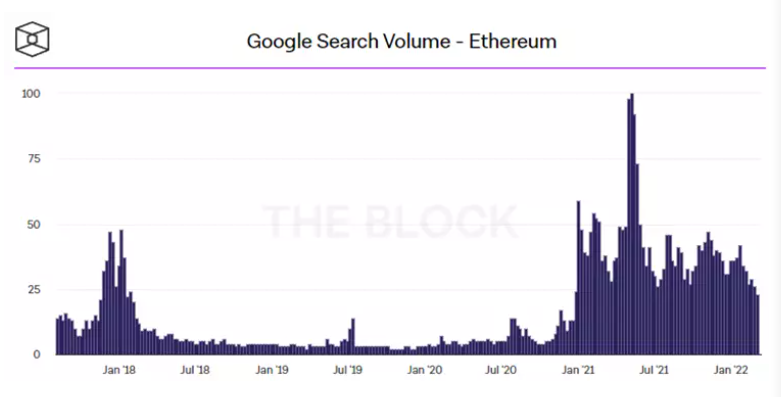

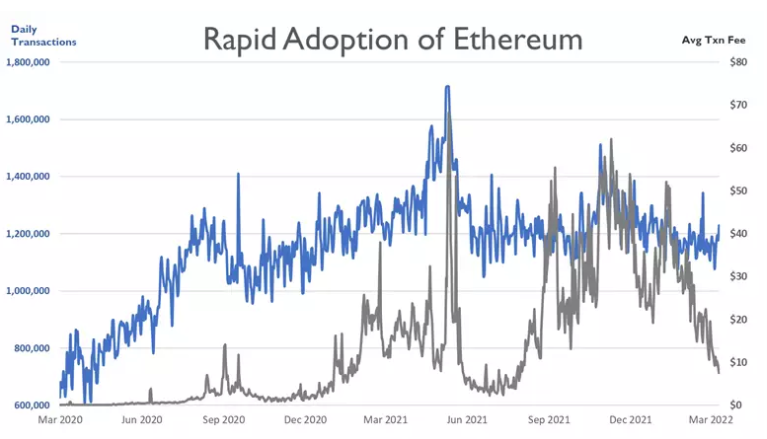

Over the past few years, blockchain adoption has grown steadily. Take Ethereum—the most widely adopted blockchain—as an example. Google search volume for the term "Ethereum" peaked in May 2021, coinciding with a record high of 1.65 million daily transactions on the Ethereum network at that time.

Meanwhile, due to competition among participants for limited block space, average transaction fees on Ethereum surged to nearly $70 per transaction. This is because Ethereum, in its current state, can only support 15–45 transactions per second (TPS), and users must pay higher fees to incentivize miners to prioritize their transactions. As a result, the vast majority of retail investors are priced out, unable to afford the exorbitant costs just to execute a single transaction. Moreover, for many low-value, high-throughput use cases, using Ethereum becomes impractical.

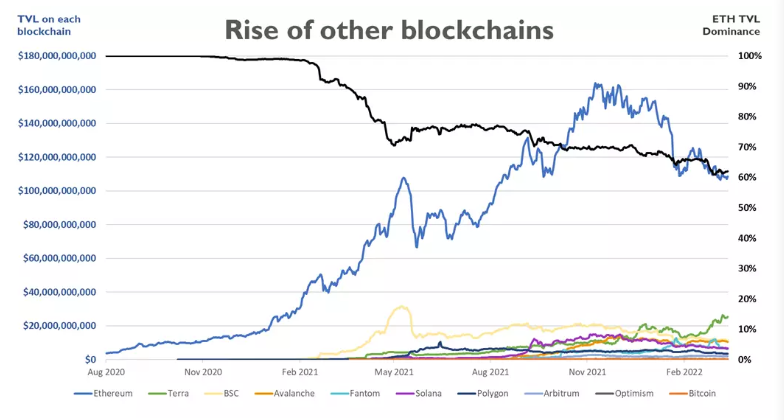

Unsurprisingly, this has created significant market opportunities for various Layer 1 (L1) blockchains and Layer 2 (L2) scaling solutions to serve the retail investors and users excluded from Ethereum. Since early 2021, Ethereum’s dominance—measured by total value locked (TVL)—has declined from 90% to 65%. This shift began with the emergence of Binance Smart Chain (BSC) in April 2021, which offered retail users low transaction fees of approximately $1–$2.

Since then, numerous other L1s and L2s have emerged to challenge Ethereum’s dominance, often offering generous incentives such as liquidity mining or airdrops to users who bridge assets.

These L1s and L2s aim to differentiate themselves primarily by promising lower fees, higher TPS, or better user experiences for retail participants. They may also explore niches where they are better suited—for instance, allowing protocols to exist on parallel chains, or offering high-fidelity data and high-performance blockchains capable of competing with real-world incumbents like Visa, which handles over 15,000 TPS.

Currently, a multi-chain, multi-layer future appears highly probable. Ethereum is likely to maintain its position as the “king of chains” due to its battle-tested security, especially with Ethereum 2.0 addressing scalability. Other chains such as Polygon, Solana, and Polkadot have gained substantial traction within developer communities and may coexist without conflict, each serving different use cases.

Furthermore, many protocols have already begun modularizing different aspects of their applications across multiple blockchains. For example, a game might require a high-TPS blockchain to handle in-game actions while leveraging a high-security, low-throughput chain for trading valuable in-game assets.

Introduction to Cross-Chain Architecture and Bridges

This vision of a multi-chain, multi-layer future creates strong demand for cross-chain infrastructure to bridge the gaps between various blockchains and scaling solutions. However, this introduces a series of unique challenges that undermine—or even negate—the core purpose of decentralized public blockchains.

Existing Problems

1. Centralization: Using Centralized Exchanges as Asset Bridges

When users transfer assets from one chain to another, they often rely on centralized exchanges (CEXs) as intermediaries to move assets to their target chain. While this may seem convenient for some users, it comes at a significant cost:

-

Lack of Privacy and Anonymity – CEXs require KYC, making this option unfeasible for many users seeking privacy.

-

Regulatory Risk – There are multiple instances where CEXs have restricted access or blocked withdrawals/trading of certain assets in specific jurisdictions due to regulatory pressure.

-

Counterparty Risk – Users must trust the CEX to custody their assets. As the saying goes, “Not your keys, not your tokens.”

Use of Centralized Cross-Chain Bridges

Currently, there are multiple bridging methods available for users to choose from when transferring assets. Some rely on a semi-centralized intermediate consensus layer—either through permissioned validators, a small validator set, or a multisig-controlled bridge. This is highly insecure because the destination chain implicitly trusts the intermediate chain, which holds full signing authority over the destination chain. A hack on the intermediate chain could therefore drain all liquidity locked in the destination chain’s pools. Additionally, using an intermediate consensus layer incurs unnecessary resource usage and costs, adding redundant overhead.

2. Lack of Composability: Use of Synthetic Intermediate Tokens

Some bridges use intermediate tokens to solve fragmented liquidity or achieve trustlessness. These intermediate tokens add unnecessary complexity and friction. When errors occur or liquidity on the destination chain is insufficient, users end up holding these intermediary tokens. This leads to poor user experience, as users may be stuck with a useless token—such as abcUSD—that few protocols accept. They must wait for liquidity in the abcUSD–USD pool to recover before proceeding with further trades.

Another inefficiency arises because liquidity in the abcUSD–USD pool remains locked—a completely avoidable issue if native tokens were used from the start. Furthermore, many bridges maintain separate liquidity pools for each supported chain, inherently replicating inefficient liquidity requirements across every additional chain.

Limited Composability

Currently, when protocols consider integrating with others, they typically limit their scope to dApps within the same blockchain or ecosystem. However, there is no reason for protocols to restrict themselves to a single ecosystem if they can compose seamlessly with decentralized applications and smart contracts across all blockchains.

3. Inefficiency and High Cost: Use of On-Chain Nodes

A solution to overcome the above issues involves using on-chain nodes that receive and validate every block header from the source chain to the destination chain, verifying transaction proofs for each forwarded transaction. However, this approach is infeasible for most blockchains due to the massive computational resources and capital required to operate such a system.

Inefficient Current User Flow

Currently, when users want to leverage different protocols across blockchains, they must go through a cumbersome process involving multiple token approvals, swaps, and bridge transactions for each new chain their assets are transferred to. This process involves navigating various confusing token addresses, web apps, and bridges, increasing the risk of errors at every step. Such inefficiencies raise barriers to entry for new users and create a confusing experience.

Having examined all these challenges plaguing today’s cross-chain architectures, we can now turn to LayerZero and how it addresses them.

LayerZero Labs

At its core, LayerZero is an omnichain interoperability protocol. Think of it as a foundational infrastructure layer connecting any specific contract on any given chain. It enables essential message passing, unlocking a new dimension of cross-chain composability and functionality.

Solution

First, we must examine the design that allows LayerZero to achieve this. To verify a block on-chain, two pieces of information are needed:

1. Block header, which contains the Receipts Root;

2. Transaction proof, i.e., the Merkle-Patricia proof on EVM.

LayerZero separates these two components as follows:

1. Oracle forwards the block header—any chosen oracle (e.g., Chainlink, Pyth).

2. Relayer forwards the transaction proof.

Both the Oracle and Relayer are 100% open and permissionless—anyone can fulfill either role.

Since these two entities are independent, and the combination of block headers and corresponding transaction proofs is verified on the destination chain, the forwarded messages are guaranteed to be valid and committed on the source chain.

Two critical security properties must be noted here. First, the worst-case security of this system equals the security of the chosen Oracle. This occurs when the Oracle and Relayer are the same entity—in which case, the system inherits the base security of the Oracle (e.g., Chainlink’s decentralized oracle network and its consensus mechanism). Second, protocols can choose—or even run—their own Relayer to obtain transaction proofs. This means protocols can ensure the Oracle and Relayer are independent entities.

This constitutes the design for trustless, valid delivery—completely eliminating the need for any potentially centralized intermediary or intermediary tokens.

Power to the Protocol

Another core feature of LayerZero is that applications themselves have full control over all security parameters. Each protocol can precisely specify the Oracle and Relayer it wants to use. This design is also modular enough that a protocol could select an Oracle composed of multiple price queries, or even leverage consensus across multiple Oracles. Additionally, protocols can choose the number of confirmations required from the source chain.

Key Advantages of LayerZero

Isolated Risk Infrastructure

Existing cross-chain infrastructures rely on designated entities to validate transactions or relay cross-chain information. In recent vulnerabilities discovered, a common failure point has been compromised or malicious Relayers. Some cross-chain designs implicitly trust any message from the Relayer network as valid. Attackers can exploit this to drain entire liquidity pools, resulting in catastrophic financial losses. This introduces significant “systemic risk” into the ecosystem, where every protocol adding liquidity increases capital exposure across all potential consensus failures or exploits.

With LayerZero’s design, the permissionless use of Oracles and Relayers allows protocols to independently select these components. This isolates risks borne by protocols and users. Since an attack requires collusion between a specific Oracle and a specific Relayer, any protocol not using the exact same Oracle-Relayer pair remains unaffected. This effectively partitions ecosystem-wide risk into narrow “application-specific risk” zones. This is a major security advancement—because any attacker can only target a small fraction of vulnerable liquidity, leaving the rest of the honeypot secure. This design significantly increases the cost of attacks while reducing potential rewards.

Efficiency of LayerZero

As mentioned earlier, cross-chain designs with intermediate layers often introduce extra computation, consensus mechanisms, and/or intermediary tokens. These are inefficient, unnecessary, and introduce additional security concerns and throughput limitations. LayerZero aims to minimize added complexity while maintaining trust-minimized communication security.

In LayerZero’s simple design, neither the Relayer nor the Oracle performs consensus or validation—they merely transmit information. Since all verification occurs on the respective source and destination chains, speed and throughput are solely limited by the characteristics of the two chains involved. This also abstracts away any centralized validation or consensus layer.

True Cross-Chain Composability (Beyond Asset Bridging)

Most existing cross-chain implementations focus primarily on asset bridging. This is understandable, as token bridging is arguably the most common use case. However, cross-chain messaging opens up many more possibilities.

LayerZero is a universal message-passing primitive, meaning any application can connect any contract on blockchain A to any contract on blockchain B. This unlocks a new design space for developers, expanding their vision of composability and compatibility beyond native blockchains to any other blockchain. Below, we expand on two examples that fundamentally change how users and protocols experience composability.

User Perspective: Multi-Chain Lending Market Aggregation

Currently, when users deposit collateral to borrow assets, they are confined to the blockchain where their assets reside. If better interest rates exist on another chain, or if they wish to deposit borrowed assets into a yield farm on a different chain, they must use a bridge and incur transaction fees in the process.

With LayerZero, users deposit collateral into their desired application on chain A. A message is sent to chain B to verify the collateral, after which users can directly borrow native assets on chain B and deposit those tokens into a farm on chain B.

Protocol Perspective: Cross-Chain Governance

We’ve seen multiple blue-chip DeFi applications deployed across multiple chains. This raises an interesting governance challenge. With users and token holders scattered across as many as 9–10 different chains, governance becomes extremely cumbersome. Should governance be hosted on the largest chain? Should proposals or votes happen separately on each chain? Or perhaps off-chain?

LayerZero enables unified governance, allowing users and token holders on any chain to cast their votes via a simple message from their current chain.

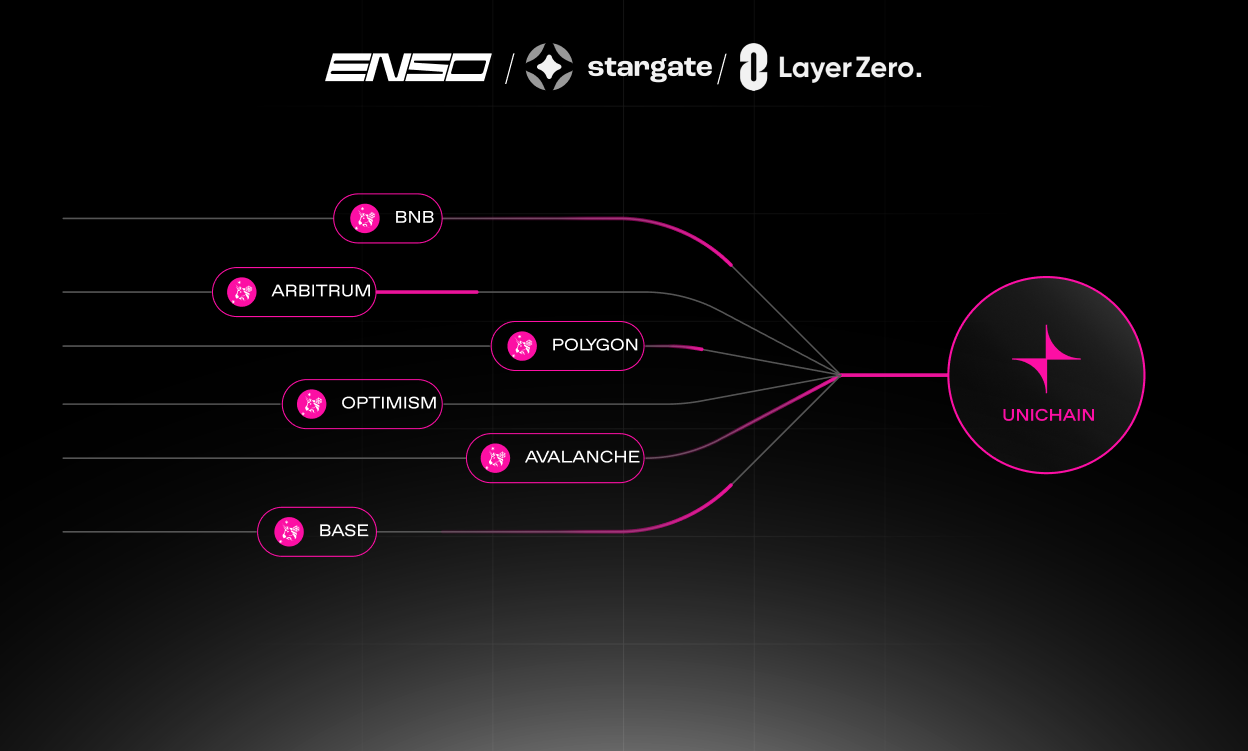

First Application: Stargate (Asset Bridge)

With LayerZero’s mainnet launch, they have introduced their first application—Stargate—which leverages LayerZero’s cross-chain architecture to demonstrate the newly unlocked design space.

Currently, every DEX/AMM deploys identical, duplicated liquidity pools across each new chain they enter. Multiply this by the large number of different AMMs on each chain, and the result is an incredibly inefficient and fragmented system.

Stargate is a truly composable asset bridge that solves this problem. It has three key features:

1. Native Assets – No synthetic or intermediary tokens are needed. Stargate delivers only the native tokens users want, eliminating unnecessary intermediaries and swaps.

2. Unified Liquidity – Provides a single liquidity pool shared simultaneously across all supported chains. These are also single-sided pools with no impermanent loss, greatly improving capital efficiency for all locked liquidity.

3. Instant Guaranteed Finality – Applications on the destination chain are guaranteed that submitted transactions will be resolved on the source chain. This eliminates the critical issue of transaction delays caused by insufficient liquidity on the destination chain.

Implementing cross-chain integration can be extremely time-consuming and technically complex. Moreover, the biggest risk for any application is that fraudulent cross-chain messages could drain their entire liquidity. These factors deter many protocols from pursuing cross-chain integrations. LayerZero resolves these issues by simplifying integration—requiring no changes to existing protocols and posing no risk to the protocol’s own liquidity pool. All risk is fully borne by Stargate itself.

You can think of Stargate as what asset bridges should have been from the beginning.

Conclusion

In conclusion, as we steadily move toward a multi-chain, multi-layer world, we believe LayerZero’s cross-chain architecture will become foundational—an essential infrastructure layer catalyzing a truly permissionless and trustless omnichain future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News